Bitcoin BTC - Feb 28 - Detailed Technical Analysis - Morning Update - Neutral - Indecision

General Tone: In consolidation phase.

Indecision and difficult wave count. We see more bearish signs than bullish,

but I remain 100% neutral.

Lower range support is $10,150.

Must break about $11,250+ to be bullish

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Neutral

Short Term Bias (Today) - Neutral

Long Term Target Prediction - Primary Wave 3, $35,000+ by 2019

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Lesson 23 - Fibonacci extension, Fibonacci Retracement, Elliot Wave, Shorting, Playing Downtrend - Summarizing Feb 21 BTC + ETH

Lesson 24 - Customize RSI Alerts & Multiple Charts, Pro Features of Trading View

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If you think I've helped you tremendously, donate crypto to my dog's tequila / vodka problem.

BTC: 3FYAk7kMXP21S2hFvr7GrANAEDwxknCjCS

NEO: ANNmGUDAoFZs52dEkckQoL1vw34sxiV4Ey

EOS: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

Ethereum: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

LTC: LPHXW5WGSSES6RkZ9VXQe76YdLPCUWH1Ev

Bitcoin Cash: 1MaR7nSeVTbu894Xf8gLTNK6xvKZ2hNpbx

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 2640750089

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

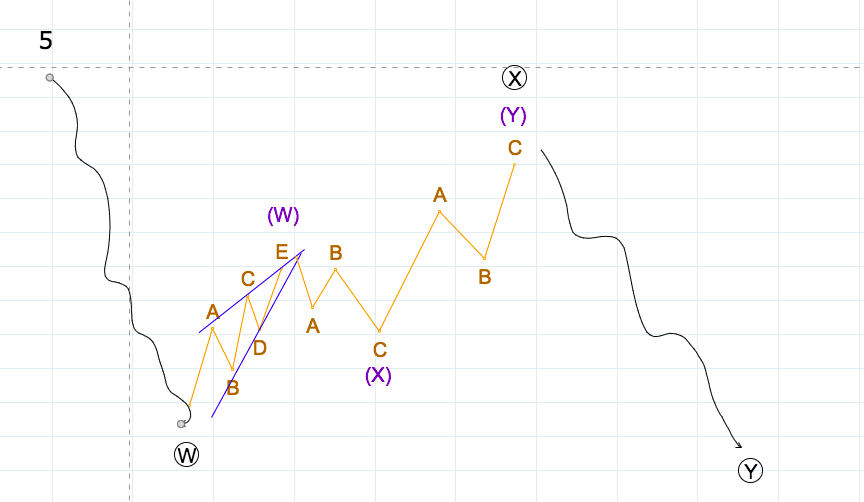

Bearish Scenario

you always say in your videos that W4 can't cross W1 by a wick on a larger time frame (i remember once you said at least 4 hours) in a leveraged market. But here you are letting it extend W1 on a smaller time frame.

Does that mean this is more of a guideline than a rule?

I upvote all your vids, hope you have a chance to reply this time :) Really appreciate all your educational material!

Hi... i still don't get it... please :(

everywhere i read the X waves of double or triple correction are 3 wave ABCs corrections... :(

it is possible for it to be a 5 wave?

If the five waves in the X wave is in the shape of a rising wedge, than it can be considered a abcde corrective structure. Also, wave failures within the X wave can look similar to a five wave.

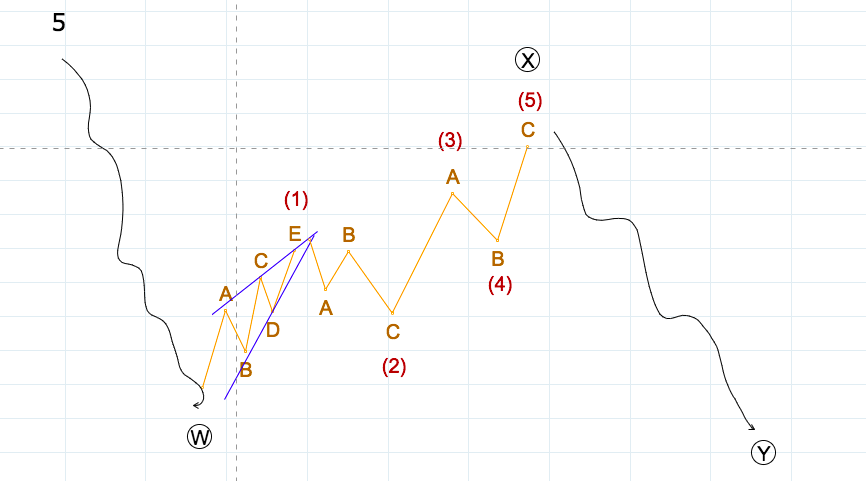

Right count on top, wrong count in red on the bottom.

A 5 waves impulse could actually be a corrective wave in disguise. I don't know if I missed any other combinations, but you're right, wave X can't be a impulse.

I have been wondering the same thing since Phil made his last video before he got hacked. Just to make it clear, X is corrective so it takes any corrective pattern, e.g. ABC, but it can also be an ABCDE triangle. But everywhere I read and it seems that 5 wave impulsive (12345) is not allowed in a X.

Please somebody help us...

I know you like the bears, but I’m cheering for the bulls today!

hello! I saw your reply! My accounts were compromised :) But safe now. HOw are you?

I’m fine. I really meant it that I missed you. You are so cheerful and I listen to your post while cooking or commuting , yes all of them, because I really enjoy listening to your thought process!. And please don’t apologize at the end of a video! You are doing the best you can. I read the Eliot books the pattern books, but damn you just see things sometimes so differently! I got stuck in a stupid position in bitcoin, set the sell price too high, damnit! But yesterday it was my sons birthday and didn’t catch the reversal. It was a splendid day anyway. It doesn’t matter, as I only gamble with what I can afford to loose. I like the game, and enjoy the ups and downs, as it is the only way to get better.

I hope this hack didn’t hurt you too much ( financially and emotionally), there are always bad people thinking they are entitled to something in this life and taking it from others.

So how are you today?

time to pour some coffee and pull up a chair!

I'm like having this big grin on my face when I watch how your WXY pattern materialize which matches my counts exactly!!!

Wow! If you're giving out grades or gold/silver stars stickers to your student's homework, I'll be very happy to get it knowing that I'm improving over the course.

This is what I tweet on Feb 27 below chart... macro count to match all the small ABC in the B waves, and marking out the X as you describe it should be, spotting the Y ending too :)

Yes, you bet I took trades along the way all the way down and up to that impulse wave up from Y, and also shorting it down! Also those lessons on RSI divergences (see the trend lines I drew below) helps me to enter these long and short trades!

This video is amazing. I learned a lot about corrections. Thanks Phil!

So great to see you back mamma whale! During the 'break' I was going through previous tutorials. Thanks!

hiii :) "break" was horrible :)

Do you do ever check your BTC TA on Bitstamp? I've found that finex tends to get some crazy wicks from time to time due to their margin. For example, the wick that makes the 3rd wave of the latest C wave does not exist on stamp. Without that wick, the C wave makes a very nice completed 5 wave structure that terminates at the current local low of 10364.

gg