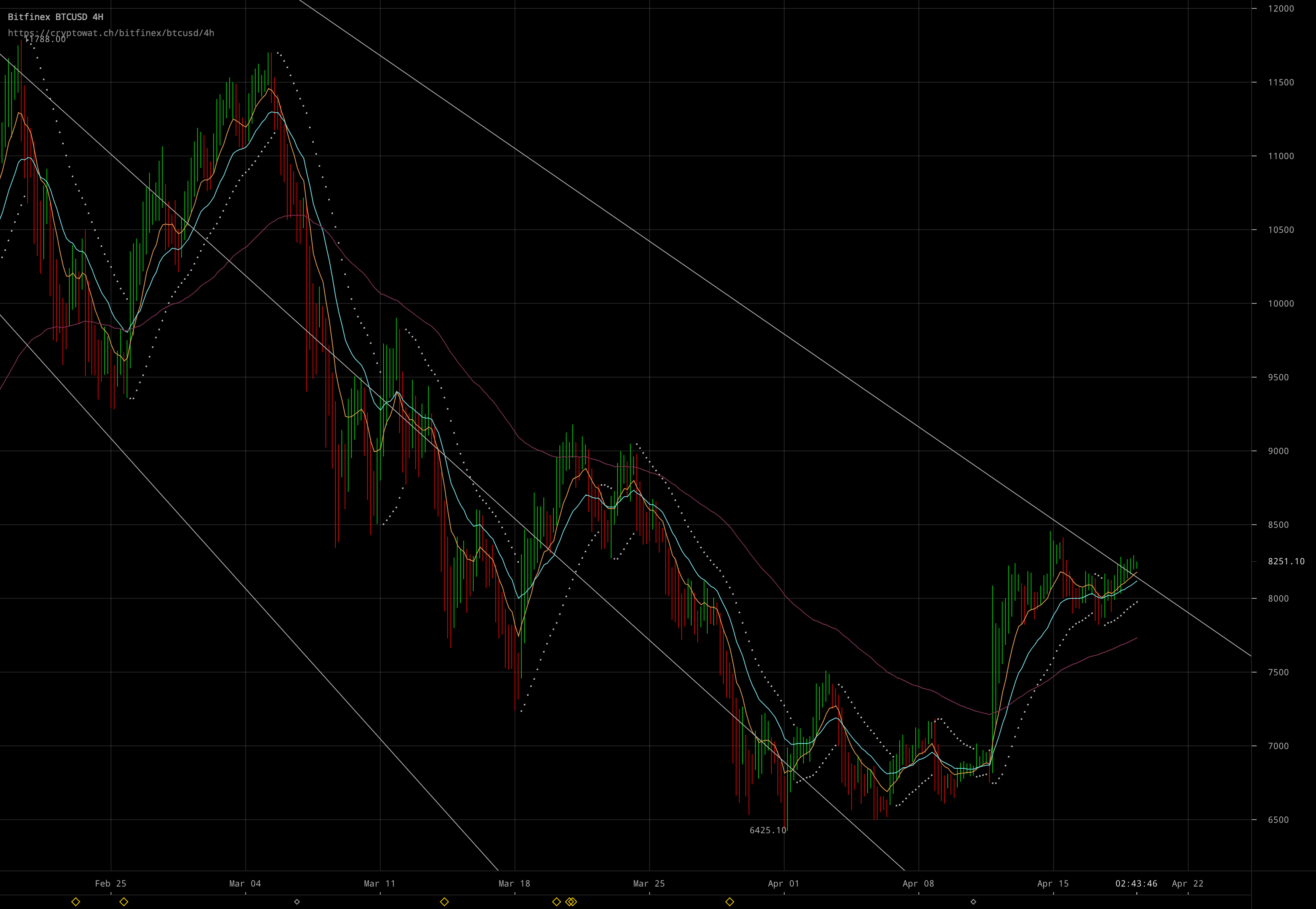

BTC 24% Correction Imminent

Kraken's refusal to comply with NY's basic questionnaire is definitely a bearish signal that suggests a larger 'institutional' sell off is slated before the end of the week.

Hopefully you enjoyed that nice exit pump, as the major players will be short-selling while they can.

Pfff Kraken. It's only one exchange. I don't even use it. BTC might go down, or not. But Kraken will not be the trigger.

You are right. It will not be the trigger, but it is an indicator of the market moving from Q2 to Q3.

The way I see it is that people will just move to Binance, Kucoin, Bibox, etc

Or their bank account to avoid 'shady' transfer fee's.

Or they will use Ethos.

LOL the scammiest of coins. HAHA ok. GL with that.

Also there's no Ethos market on Kraken, according to coinmarketcap so its not clear how this would be possible without doing another expensive conversion.

I must respectfully disagree with your main presumption here. Kraken's refusal to comply with the New York Attorney General's request for information by no means stands out as a bearish signal. I would actually question the existing correlation between these two events without further explanation.

First of all, Kraken is not directly subject to the New York rules as it is incorporated in San-Francisco. Furthermore, the presumption could be viewed as being equally unqualified, if the scenario was the opposite. An example being: because Coinbase and the Winklevoss twins' Gemini Trust complied with the request and co-operated with the AG's office, that is a bullish signal that the markets will rise and the markets will see continual strong performances.

Please refer to this Cnbc article for more details on the points I made in passing.

https://www.cnbc.com/2018/04/19/kraken-cryptocurrency-exchange-says-it-will-not-comply-with-new-york-inquiry.html

I welcome any further comments, opinions, or disagreements, and will try to respond to any replies when I can.

I've read the article, and Kraken's public reply to the request leaves much to be wondered about what it is Kraken is hiding, or what they hope to accomplish by being public about their stance; as for them to say nothing would have had less of an effect on the market as if they were to publicly take a stance.

As someone who has been trading cryptocurrencies for many years across many exchanges (Kraken included) it is in my best interest to seek the exchanges that are transparent about the things NY wishes to learn about. These are, but not limited to:

Transfer and Trading Fees

Planned outages

Insider trading polcies

Margin / Lending market policies

Other related crypto-technology acquisitions

Handling of hard/soft forks of crypto currencies

Hiring of engineering positions meant to support their infastructure (or lack thereof)

While they are under no legal precedent to comply, this is obviously a 'first shot' and will eventually lead to further inquiry by other government sponsored actors that will not be voluntary if they wish to continue operations in the United States.

If cryptocurrencies are to gain mass adoption as a credible way of transferring and crediting wealth; they must be regulated and they must follow a framework to avoid the pitfalls of the current banking system; especially for the institutions that stand to gain per each transaction.

I do not consider CNBC to be a reliable place to go for finance advice. As day traders will tell you, if the sentiment is bull, you must be the bear; and CNBC has a wonderful habit of having a polar stance before each major market movement. Agree to disagree.