Is Holding Rational?

A few days ago, I posted a piece on Reddit titled "Don't hold (Story of holder)". It was met with mixed reactions (as I expected). I was accused of not being a holder – or hodler (because I eventually sold 40% of my bitcoins). I was also accused of being emotional in trading. I have to admit: I'm emotional and I think 99.99% people (excluding those with severe disorders) are emotional as well. Holders are just good in suppressing their emotions. Until they break. And I think that they often break at the worst moment.

In this article, I'll try to check whether holding Bitcoin is a good strategy.

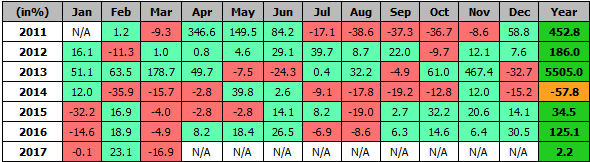

Defining what a good strategy is can be hard. Everyone has some set of expectations and lots of them are common, but people assign different weight to different parameters. Let's start with the most obvious and most important: all of us agree that a good strategy should be profitable. For this article I did a lot of backtests of various strategies. I used data ranging from February 21 2011 to March 26 2017. I have no earlier data, but I think it covers most of the BTC history.

Was holding Bitcoin profitable? Hell yeah! It was unbelievably profitable. Even if March 26 2017 wasn't exactly the highest point in BTC history, price of Bitcoin went from $0.85 to $989.12. That's staggering 116267% return. Average return per year ( CARG ) was 218%.

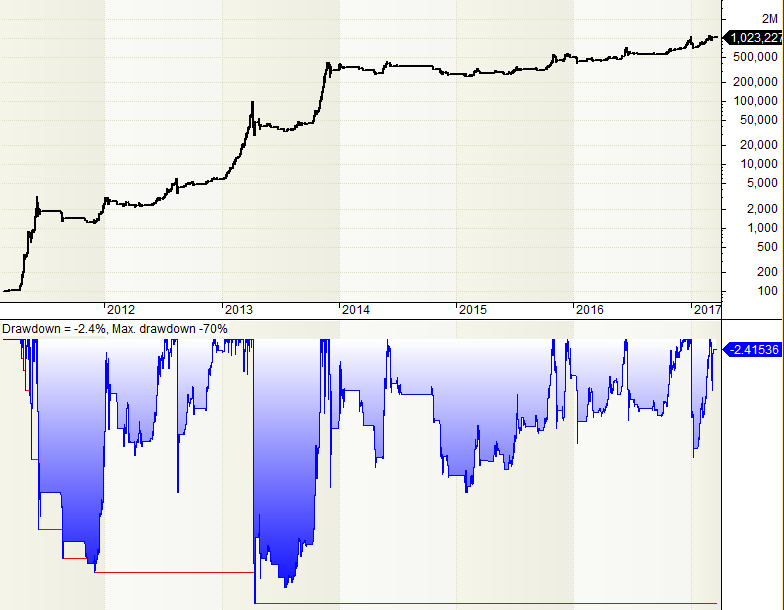

Overall we had 5 profitable years out of 6 (including 2017 would be premature). So a typical holder should be pretty happy. But let's look now at the other side: the drawdowns. The drawdowns (difference between highs and lows) are nightmarish.

Most of today's holders don't remember the first BTC bubble, which happened in the first half of 2011. BTC went from sub $1 to $32. Then, when bubble imploded it went down to sub $2 for a while. It lost 93% of it's value. Now, holders can argue that they can weather such drawdowns (which translates to drop to $90 if we use $1300 as local high). I don't think they are.

In hindsight everything went fine. After a long stagnation, the next bubble peak was at $266, so the previous $32 seemed like a bargain. But explain this to an investor who bought it for $32 and saw his bitcoins lose 93% of their value! The early 2013 bubble ended in next deep drawdown, reaching 70%. 70% drawdown looks a lot like 93% but in fact there's a big difference. 93% is 4 times worse. Then MtGox bubble, and next drawdown, reaching 83%.

What is acceptable drawdown? This of course depends on whom you ask. Google that question and you'll see a lot of answers, but most of them are in the 20% at most. Sometimes it's 30%. If someone is really brave, he brags about withholding 40% maximum drawdown. 70% is crazy. No professional trader will look at strategy with drawdown that high.

As you probably know, profits and losses are not symmetrical. You need 100% profit to make up for 50% loss. You need 900% profit to make up for 90% loss.

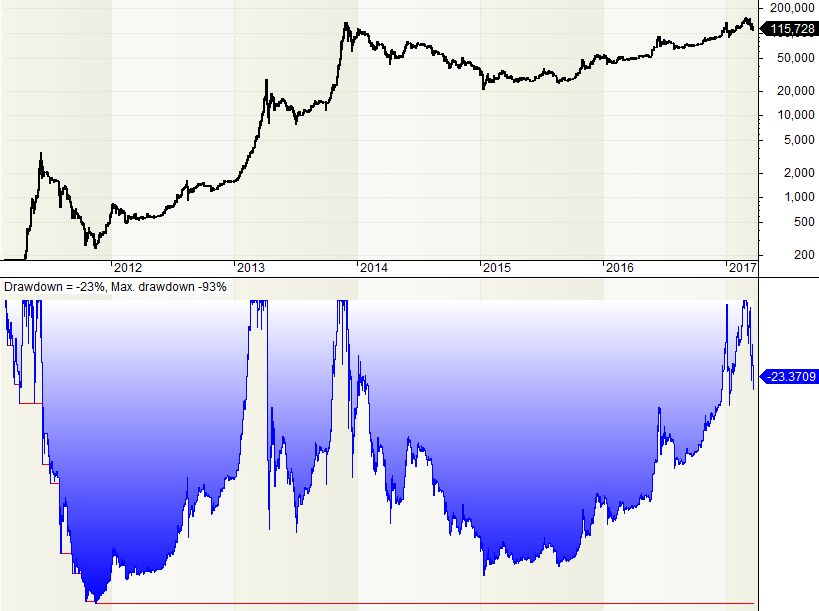

There's more. You see, drawdown is like pain. It has two dimensions: strength and duration. It's easier to endure extremely strong pain which lasts just for a while than less intense suffering which lasts longer. Up to some point you can develop some tolerance but if it the pain is real, you're more likely to by more and more fatigued by it.

So traders have special measurement for pain caused by drawdown. It's called Ulcer Index ( UI ) and takes into account both: depth and duration of drawdown.

UI is much better measurement of strategy risk than maximum drawdown, since the latter is one time incident, so it has not much statistical significance (this not stands in opposition to what was written above, in case of BTC drawdowns of 70% were rather a norm). There's however even better measurement for overall performance of strategy, called Ulcer Performance Index (UPI), which takes into account CARG and divides it by Ulcer Index. This will be our ultimate benchmark, allowing us to compare between strategies. For B&H it's 3.54.

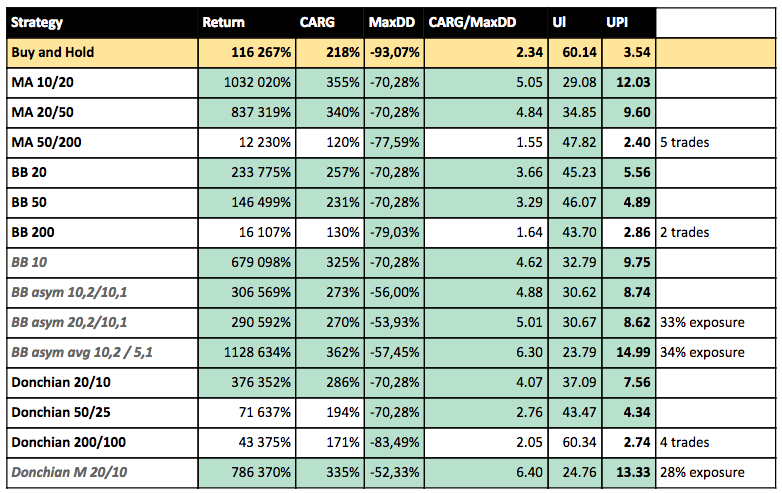

We can continue into main act now, which is comparison of some well known trading strategies with B&H. We learned how to compare them: by comparing profit, max drawdown, UI and finally, the most important: UPI.

I could easily create a strategy that would beat B&H in all aspects and beat it hard. Knowing the past you can create strategy that fits into the past, sells always near the top, buys near the bottom. This is called curve fitting and is a nightmare to most quant traders. So instead I selected a bunch of well known strategies and tried them on BTC. Even this is overstatement: instead of picking the strategies manually, I used strategies from well known blog Au.Tra.Sy blog – Automated Trading System . On this blog several strategies are tested every month on many markets, from stocks to currencies, from metals to agricultural products. They don't test it on cryptocurrencies though.

Strategies tested here were developed many years ago and – it's told – most of them are not working on today's markets anymore (last string of tests on that blog seems to confirm that). Let's see how they perform on BTC.

First we'll give a MA Crossover system a try. This system uses two moving averages of prices: one using shorter period (fast MA), closer following price and one using longer period (slow MA), more smooth. When fast MA is above short MA we'll convert all our USD into BTC. When it falls back below, we'll sell it. It is kind of "hello world" of trading strategies.

Question is, what should the MA lengths be? How to pick the "best" values? For now the answer is: we won't pick the best values at all. We'll use the values they used at blog: 10/20, 20/50 and 50/200.

And we have a winner right at the start: the first pair 10/20 gives much better results than B&H. Average profits are more than 50% higher, and that difference translates into nearly 10x larger total return. One million percent! What about drawdowns? Here we have some improvement, too. Maximal drawdown of 70% is high, but comparing to 93% it's 4 times better.

Ulcer index is much lower (though still high) at 29 and it's obvious why is that when you have a look a the drawdown chart. The max drawdown is a small peak (or rather dip) in 2013, and periods of large drawdowns are much shorter. This dip and the maximum drawdown value will be common for many strategies – it was a single day just after MtGox collapsed when market tanked more than 30%. Equity line (black) is much smoother than for B&H.

Next values pair gives slightly worse results. While CARG is just a bit smaller, the total revenue is down by 20%. Still UPI is significantly better than for B&H. Finally, for 50/200 pair we have much lower profit, a bit better drawdown, but overall worse UPI. This is not very significant as we had just 5 trades.

Then let's move to Bollinger Bands strategy. I won't dig into details here, the strategy is well described on the blog. This strategy has just one parameter (is less prone to overfitting) and we'll use 3 values of it. And again: for two values the results are better than for B&H, especially when it comes to drawdown. The last test, for parameter value 200 (which is the length of the MA used by bands) we get just 2 trades and we can skip it.

I've also done a few more test for Bollinger Bands, playing with parameters a bit (those strategies names are italicized in the results table) For example I've set even shorter length values, and average price of the day instead of closing price. This is the best strategy I'm presenting. Highest revenue, lowest UI has to give best UPI at nearly 15!

When using a strategy like this, you have either 100% BTC or 100% USD in your pocket. The percentage of days when you're fully invested in BTC is called exposure. For B&H the exposure is of course 100%, however for some strategies here, it is much less. For example strategy, BB asym 20,2/10,1 has exposure of only 34%. So most of the time you have dollars, not bitcoins. Is it good? I think it may be. You're less exposed for some completely unexpected event (like new technology that can mine bitcoin a million times easier or some exchange collapsing).

The next few strategies use Donchian channels (see description here). Here, as before, "shorter" values perform better. The last test, for parameters 200/100 give just two trades, so we can forget it. Then, I did test for a popular version of this strategy using "middle line" as sell signal( Donchian B 20/10 ). This gave one of the best results here. And it has just 28% exposure!

The results table speaks for itself. Every strategy that gives a meaningful number of trades gives better results than B&H both in terms of revenue (with one exception) and drawdown. Improvements in both departments could be drastic. This doesn't mean that any of those strategies are tradeable, drawdowns are still too severe in my opinion. You can experiment with other values of parameters, modify the strategies, add more sophisticated money management. Some exchanges offer short selling which may be helpful.

Just don't keep on holding. It's not rational at all. Guy from Sparta movie was tough, was brave and is dead now.

No. I'm selling.

Disclaimer: Information provided in this article is general in nature and does not constitute financial advice. Trading is risky, trading cryptocurrencies is extremely risky.

Acknowledgements: Huge thanks for @philtable from Coinfund slack for proofreading and editing this article. @noisy helped me a lot with getting my feet wet with Steemit, I own him a beer.

Hello @reuptake, welcome to Steem! :-)

Oh wow, this looks like a really interesting read (I quickly looked through the reddit posts too - commenting here to read when I have more time)

also welcome to Steemit!

Awesome read. Welcome to steemit. Just followed you in hoping to see more of this.

This is awesome content. Really interesting read and very enjoyable!

Hope to see you continue with this type of content.

Really well done, thank you :)

What's the unit for the MA lengths, or does it make any difference? Is it days or minutes?

Days in this case. I tested on daily candles.

Congrats you have been selected as Author of the day by the Steemvoter (SV) Guild, keep up the good work and helping make Steem great!

Note: You should receive many guild votes in an hour or so, enjoy!

Very good post! :)

Personally I do not consider myself as trader. I think a lot of users hodls, because simply they do not want to waste time on analysing everything daily.

Making a decision whether hold or sell is hard. People like to avoid thinking about difficult things. I believe that is the main reason why most people hold cryptocurrencies.

Welcome on Steemit.

PS.

You have new follower! :)

You're right, but on the other hand holders are often spending a lot of time checking prices, discussing it and shouting "HODL!" to each other. So in terms of time and attention holding – in reality – is not better than checking signals from some strategy.

in case of those traders I believe, this behavior came from fear from missing a pump. Almost every coin sometime has a period of rises, and no one actually know why and when next one will happen. So for many traders to not miss a pump... they just prefer to wait for it.

just FYI:

This article was linked by @reuptake on reddit: https://www.reddit.com/r/BitcoinMarkets/comments/62daie/is_holding_rational_lets_test_it/ where it already has 18 comments and 8 upvotes :)

I am one of those people that cannot sell anything if it means I am locking in a loss. If I brought something for $5 and it drops to 4, then 3, then 2 and slowly slowly down I almost never sell it even though I have a feeling I'll never get my money back, because I just don't want to lock in that loss.

Maybe I am too optimistic of a comeback eventually lol!

In cases when its very clear to me the company is about to go bankrupt then I do sell at a loss but I think its a lot rarer for me personally than the average professional "trader" type.

Holding has deep psychological roots, I admit that and may be kind of comfortable to some. But it's personal, so that's why I posted numbers, not feelings.

That just depends on your perspective. And a bit on how you look at it (or more: how often).

Like the stock market: Invest and forget it for 30 years.

Everything under 10 years is short term in stocks, and everything under 1 year in crypto is short term.

If you are a holder, you have long-term perspective. You may not even know about the drops, if you do the rational decision to not look at it again after your defined time is over.

I don't negate the possibility that there are people like you describe. Still, from what I see, holders tend to watch the price rather close, reassuring themselves that they're holding.

I still regard this a kind of closed-eyes driving. And it prevents you to put any significant amount into it. Maybe I'll do another post on it.