Jamie Dimon is the definition of FRAUD

When the head of the largest financial institution in the world calls something a “fraud”, you should pay attention. JPMorgan ($JPM) is now worth over $333 billion with $2.56 trillion in total assets. This is the same institution that was bailed out by the US Government during the great financial crisis caused by JPMorgan and other banks making bad mortgage loans. The stock market crashed and led millions to be out of work. JPMorgan was ordered to pay $13 billion in a civil settlement with the Justice Department for its mortgage lending practices and in these negotiations, Dimon reportedly pushed for absolving bank employees of criminal charges related to mortgage securitization.

This is the same bank that gets money from the Fed at essentially no cost and charges its customers up to 25% APR or more on their credit cards.

Is this a person you would trust with your money and take advice from on fraud?

I should mention that a market abuse claim has been filed against Dimon in Sweden claiming he deliberately spread false and misleading financial information on bitcoin. It was also discovered that JPMorgan brokered large quantities of bitcoin for their clients following these claims, very shady.

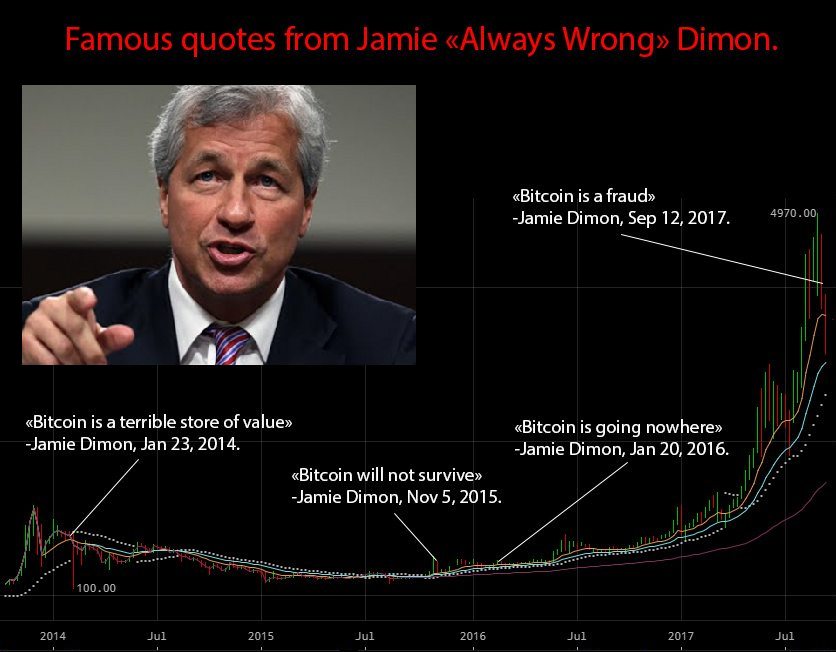

Below are some quotes from Jamie Dimon on bitcoin:

“Bitcoin is backed by nothing“

“Bitcoin is a horrible store of value”

“Bitcoin will not survive”

“Bitcoin is going nowhere”

“Bitcoin could go to $100,000, but will end badly”

“My daughter bought bitcoin and it went up and she thinks she’s a genius”

And the best…

“Bitcoin is a fraud” See below for how accurate Mr. Dimon has been on Bitcoin.

John McAfee, developer and CEO of the first commercial anti-virus program McAfee Anti-Virus who expects Bitcoin to reach $500,000 asked Dimon how much it costs to create a US Dollar and stated as one of the largest miners in the US that it costs more than $1,000 to create a bitcoin through computer equipment, facilities, computational power, and electricity costs. The bitcoin network is the most secure as the worlds largest super computer and has not been hacked since its creation in 2009. Unlike banks including the recent Equifax hack of over 143 million Americans or 44% of the population.

The answer to how much it costs to create a US dollar is 4.9 cents per note from data from the Bureau of Engraving and Printing and is backed by nothing more than thin air and an alleged 8,133 tonnes of gold in reserve.

4.9 cents, unlimited supply, and no mathematical backing vs. 1,000+ dollars, fixed supply, and cryptographic mathematical backing

I’ll let you be the judge of the fraudulent currency.

With all that said, how does our current monetary system work?

Money is "created" when someone signs a debt obligation – such as when a company takes a loan, it can borrow money from investors that already have it or from a bank supplied from the Federal Reserve out of thin air (nothing federal about the federal reserve, it’s a private bank and no one knows who owns it). Another way it is created is when the US government issues bonds to fund its obligations and the Fed "buys" these bonds also from money created out of thin air.

The best part is we don’t know how much money the Fed created since 2007 since in 2006 the Fed decided it would no longer publish the volume of money in circulation (a figure also known as M3). However, in December of 2010, the Fed was forced by a US court to disclose figures related to the bailout programs for major banks such as JPMorgan. This showed that as part of the TAF bailout program that $3.3 trillion dollars were created with $1.25 trillion for "subprime" loans. Quantitative Easing (QE) is a new term in monetary history and is where the Fed buys government bonds from new money created out of thin air to manipulate interest rates lower. This massive bond-buying campaign started in 2009, and since then the Fed has accumulated a balance sheet of $4.5 trillion in assets swelling five-fold. They just announced this month that starting next month in October they would start unwinding their massive balance sheet with a measly $10 billion reduction. At the planned rate, it will take until 2024 to get back to its old level under $1 trillion assuming there are no delays or reductions not to mention increases.

Another way money is created is through fractional reserve banking. When you deposit your hard-earned money at the bank, the bank takes a majority of your deposited money and lends it out to someone else who then deposits it and the cycle is repeated increasing the money supply exponentially. If everyone went to withdraw their deposits at the same time, the bank would be unable to come up with funds as they don’t exist. That is why withdrawing your dollars from the banking system and buying cryptocurrency is such a dangerous proposition for Mr. Dimon. If your money is in a bank, you DO NOT control it. If you have cash in your hand, gold in your pocket, or bitcoin in a cold storage wallet you have FULL control of that money.

This video explains why we will have another financial crisis and bank bailout.

With the injection of trillions of dollars into the global economy as well as the federal funds rate at record lows near zero for years, we grew at a tepid 1.2% in Q1 of this year. US debt just hit a record $20 trillion and spending under Trump topped $428 billion in June setting an all-time monthly record. It is quite amazing how much money we are spending now, not to mention the interest payments on the debt. It is clear that spending will not get reigned in as congress can’t even agree on repealing Obamacare and replacing with a better more cost-effective system. Bitcoin is now just 0.0035% of US debt and less than 1% of the globe owns it, BITCOIN IS NO WHERE CLOSE TO A BUBBLE.

The average length of economic expansion in the US is 58 months and our current expansion is in its 103rd month. If there is another recession or global financial crisis (GFC), bitcoin will likely be a black hole for dollars around the globe looking to find a safe haven. Bitcoin is not backed by debt like the US dollar and does not have tens of trillions in obligations behind it.

Jamie Dimon is likely starting to experience the “5 Stages of Grief” as his clients start to ask to invest in bitcoin and other cryptos or even close their accounts all together.

- Denial – “Bitcoin is going nowhere” November 5, 2015

- Anger – “Bitcoin will not survive” January 20, 2016

- Bargaining – “Bitcoin could go to $100,000, but will end badly however the blockchain is promising” September 13, 2017

- Depression – “Some of our business segments have started to see margin pressure due to bitcoin and other crypto assets” October 14, 2018

- Acceptance – “We now accept bitcoin as payment and deposit – JPMorgan” December 21, 2018

Bitcoin ($BTC) price at time of writing $3,698, Bitcoin Cash ($BCH) price $423.

If you understand bitcoin and the blockchain it cannot be stopped and as adoption continues, the price will continue to rise. Many of JPMorgans bankers are leaving the bank to start blockchain ventures and have admitted to owning bitcoin. Mr. Dimon will you be on the right side of history or the next industry in decline due to disruptive technology?

If you haven’t looked into bitcoin yet, take a look before making your next deposit at your local bank.

Good post

Congratulations @rmiseman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPNot all people in the world understand the nature of bitcoin. It is necessary to popularize bitcoin. You wrote a good post. Your work is understandable.

this post is so amazing, I'm so inspired to keep working hard on steem.

You're very right in pointing these statements out very clear. Great read. Creating money out of nothing creates more and more inflation, consumer prices went up about 60% since 1985. It doesn't hurt the system owners but the daily consumers. This has to end some day.