How I've built my crypto currency portfolio

Hello!

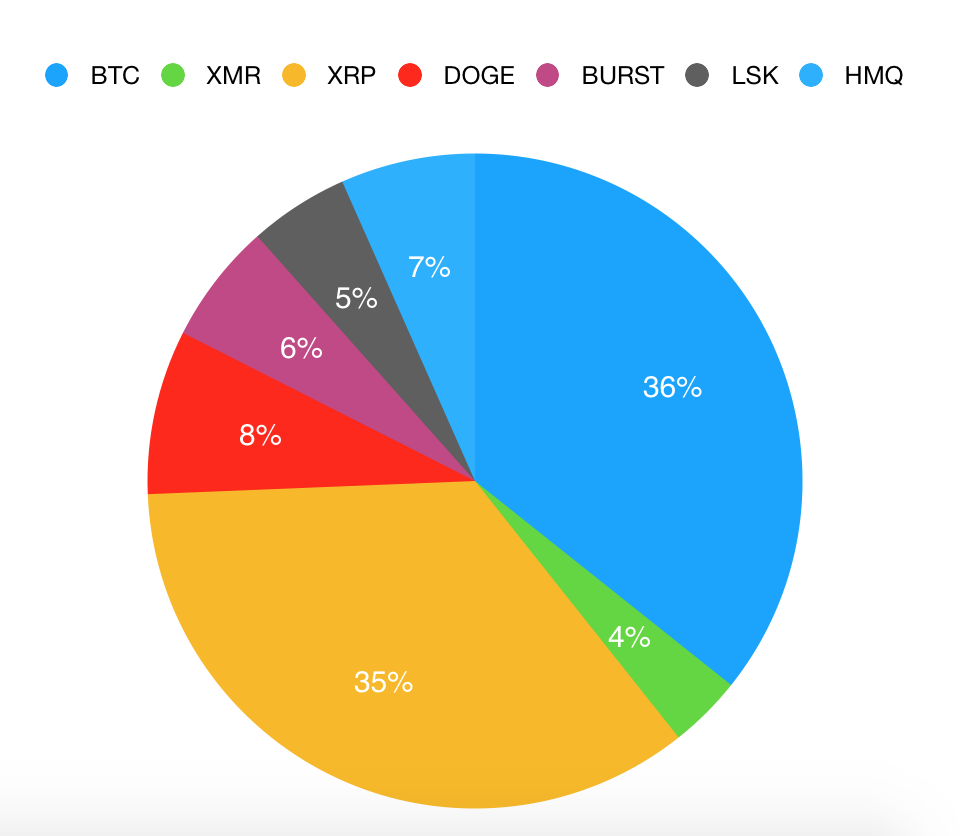

today I want to share with you the choices I made 3 years ago in building my portfolio and the choices I did recently to update it with new trends. I will give you % split among crypto I own converted to fiat value. A following post will go through "big names" that I am missing and see when/if I could enter.

Bitcoin

36%, owning BTC is not only a portfolio move but also a testament. I believe this is a real financial innovation, having a pre-planned inflation currency is a much needed asset for the current economy. I am lucky to live mostly in the EU but much of the world population is using currencies that are handled by governments who have no clue at what they are doing. My dears friends in Venezuela knows what I'm talking about. I believe bitcoin will play a major role as a store of value and as reference unit of measure for inflation, as such I project its value to 50.000EUR.

Ripple

35%, back in 2014 when I made my first move it was not clear to me that POW was actually useful and Ripple has a beautiful approach to it, there is consensus on confederated nodes, no need to waste energy on validation. Put this together with the fact tha Google Ventures entered Ripple and that they are shaping a product for the banking industry in the currency exchange market.. this for me was a no brainer and so far it really paid of. I remember discussing on some forgotten chat the ideal price point to exit ripple at 0.10 USD.. we are way past there man! I have set my current exit at 2USD.

DOGE

8% was a bet on the community, DOGE was widely adopted when I mined it in 2014 with two Vulcanos, good times.. Doge also made very interesting moves merge-mining with litecoin. I think technologically speaking there is no real reason to like Doge, but a currency in the end is worth also if people use it, and Doge is used. To the moon! Trade volumes are always respectable. Pay attention you need to understand the hyperinflation Doge model before investing. With the current knowledge I should have chosen LTC over Doge but we will see.

BURST

6% I was puzzled by why to waste so much energy for PoW and BURST has this beautiful hard-disk mining model which is so much more energy efficient. I think the technological layer of BURST is quite strong, the coin just misses a good marketing team, making BURST still a very underpriced coin in my opinion.

XMR

4% this is a bet on alternative technology to the BTC mining process. ASIC circuits can't handle Monero cryptonite easily and this is something important to upkeep an healthy network (meaning you need commercial CPU or GPU to mine XMR, you can't cheat and create your ASIC mining farm). What I don't like still so much of Monero is that it relies heavily on his core developer "one-man-show", he is doing great so far both on the technical and on the marketing side. We will see..

HMQ (new entrant 2017)

I wanted to take part on an ICO and wanted to try out this ethereum based technologies, Humaniq.co has an interesting project for creating a biometric id system coupled with a currency that you can loan to unbanked. So far the token has performed very well for me but I want to see if they can deliver all that they've promised, if so.. this could be my biggest win:)

LSK (new entrant 2017)

Ethereum has a list of problems which I will speak about in another post, technical problems (definitely not marketing ones), I understand the power of distributed computing and I believe it is going to be big, but I could not step into ethereum. Lisk has the same approach of a coin used to run distributed programs but the programming language is Javascript! This is really huge. Moreover Lisk foundation has 8.000 bitcoins holdings, so they have enough money to keep going and develop a fully functional platform. So I decided to invest in Lisk rather than in Ethereum. Was I wrong? Maybe! But I don't like to trade I like to invest in long term plans and Lisk had a sweet sweet price, the resources to deliver the project and a roadmap which is more developer friendly than ethereum (try to run a smart contract in solidity and let me know).

Good job, waiting the post on Ethereum problems =)

Upvoted because you upvote me AND because it's a good post.

Again nice to meet you and happy to see you make some trading too. (A lot of steemers trading) ^^

In your choice I think the most dangerous is Lisk and especially Doge if I was you and will try to make it short if you can, don't push up ur objectif to much on these coins, even if who know... In the other alts you pick i think there is a good chance so just a matter of time... ;)

(just my opinion base on my feelings hahaha take it or not). But holding XP + Bitcoin and a couple of alts is a great idea i think it will pay in you future ;)

I totally see the Doge problem, it is super-hyper-inflated and I agree it's probably time to look for a good exit. But what is your doubts on LSK? I see it as an ethereum easier for developers, am I missing something? Maybe the team is too small?

Resteemed thx

Followed ;)

Yay thanks! I've followed you too, please let me know if you have comments on the portfolio

Balancing your portfolio with what you like is a great way to do it.........Crypto on.

Yea, I think it is important to mix different technologies and to understand that what can be pitfalls of one can be strong points of the other.. and buying both:) I try not to buy too much into marketing but I try to study first the technology.