LedgerX granted derivatives clearing organization license(DCO) - What this means for you!

Today LedgerX recieves DCO from the CFTC

The CFTC (Commodity Futures Trading Commision) has granted a DCO (derivatives clearing organization license) to the startup, LedgerX to exchange, clear and hold custody over blockchain- based crypto currencies for the first time ever.

Derivatives are designed to help investors and traders mitigate risks and increase profits through leverage. Some common examples of a derivative are futures contracts, options and ETF's (Exchange Traded Funds). With the crypto currency asset class crossing a $100 billion market cap earlier this year, this approval is just another sign of acceptance and adoption of the new industry. It really is fantastic news and for those of you who don't know, the CFTC is an extremely important regulator and service provider of US equity markets. In short crypto currencies are now recognized by U.S. Government Institutions - the crypto asset class isn't going anywhere.

Two Things Will Happen

The CFTC will begin to, and now provide guidance and regulation for crypto currencies.

"It means a lot, not just for the industry, but globally, because the CFTC will set the example of what a well-licensed clearinghouse and exchange based around digital currencies will look like."

It's not about one single company opening for business, but it introduces the possibility of more, uniform function, rules and best practices. I am excited and you, my fellow 'retail investors' should be too.

The second thing that will happen, Institutional Investors can now enter the market, its not so gray. That's right, hedge funds, big banks, pension funds, business etc, they will all be able to carry a crypto balance in their assets - this can further bolster the stability and value of the currencies they choose based on how long they carry the trade or investment and how much.

It has always been my view that any institution would simply record a crypto currency as an asset on their balance sheet.

Accordingly eligible participants will include, "broker dealers, banks, futures commission merchants, qualified commodity pools and qualified high net worth investors." - quote source

CFTC regulation - Yes it's Wall Street - It is Also Transparency

The DCO license isn't just a right to party. LedgerX will be responsible for monitoring institutional investors that it caters to to ensure that CFTC and SEC regulations are adhered to - No naked short selling sounds good to me!

There is no way for me to better explain what a derivative is than to point you to the Investopedia definition. In short form, a series of extremely complex contracts or arrangements will be derived from an underlying asset, in this case crypto currency. Swaps, Futures Contracts, Forward Contracts, Options and Credit Derivatives - that is all happening!

What does this do?

Well first and foremost, it is my opinion that it will increase the value of every crypto currency a derivative is formed from in the immediate term. In order to write a derivative, there must be an asset in holding to write it on. Also, creating ways to hedge a crypto currency, panic selling, which is very common, may wane - in theory there could be way less volatility - which is good for investors, bad for traders.

It does not mean that every crypto will be used to create derivatives. We look for the stalwarts, BTC, ETH, LTC, XRP, FTC, ZEC - the coins that comprise the majority of the cryptographic asset class' market cap. At least in the immediate term, this is how I would expect the new firm to manage risk. There is a great deal of risk any firm undertakes when they become an underwriter for derivatives.

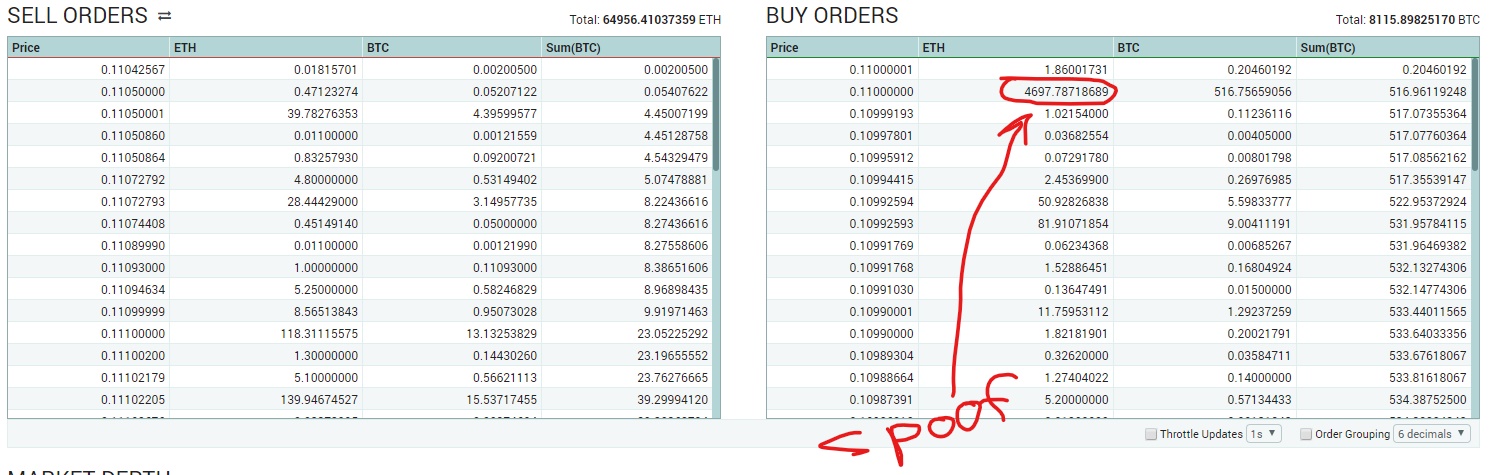

It brings Wall Street into the fold - expect to see more volume, liquidity, stability, bigger moves - and unfortunately, more tricks, more algorithms. It is naive to think that any of the tactics that work in equity markets are not at play here on the crypto exchanges.

These orders never get filled and are intended to trick both people and algorithms. After the 4000 lot buy order showed up, it was my cue to sell and shortly after Ethereum tanked, right back to its base. I should have shorted it - but hey it was still a great run. Spoofing is not an exact science, but it is just another tool that traders are on the lookout for.

It is about time we got some guidance

Now I get the whole concept of decentralized, of self regulating, of breaking away from the system. However, the single biggest risk to crypto currencies generally has been abated with this decision by the CFTC - a regulator. Globally this simply strengthens the case for wider adoption in our lives, both as a legitimate currency and as a trading and investment vehicle.

The CFTC decision is paving the way for the Securities Exchange commission and regulators in the EU and Asia to move forward, to progress and to build these new opportunities.

What does it mean for you?

It ultimately means that for 'retail traders/investors', you, me, the average Joe - we should see more price stability and less volatility over the long run. It also means the game got more complicated. Professionals who are restricted due to regulation and their designations - will no longer have barriers to entering the crypto currency market.

It means stay the F*CK away from options. For real - real talk - if you have never traded options in your life, and dealing with this bear market already cost you some hair, options are the surest way for unsophisticated retail traders and investors to lose their shirts.

What are options? Leveraged vehicles that provide you the right to buy or sell an equity or asset at a specific price. They can go to zero as fast as they can appreciate. Options expire and you can lose everything on that single trade if you are wrong. So I highly recommend that majority do not use these vehicles, you will fleeced, its how it goes, sad, but true.

Now I can't stop you, and you've probably been lucky so far (it is a bull market, hard to lose in those circumstances) but stick to what you know. If you want to get into options, you best study, practice (paper trade) and never, ever risk more than you are willing to lose. Trading and investing is not for gamblers, if that is what you are looking for, buy lotto tickets.

Long story short, very exciting times for the future of cryptographic assets - very promising for traders and investors alike!

I would love to hear your thoughts on this development in the comments!

Damn too many big words. Anyone give me the short is this good or bad news haha

I wish she would dumb it down for my brain also... Hi @smartphone!

LOL u guys !

She was schooling me in cryptotalk about btc today in chat. Whats up yunkzilla

This post received a 3.5% upvote from @randowhale thanks to @satchmo! For more information, click here!

I will have to digest my thoughts. I am glad that you looked into it. This is what I had mentioned privately last week. AttaGirl. I always like to hear your viewpoint.

hahahah yep i was just doing my daily scan and lo and behold! Im excited -- so so excited, but also worried for people so i felt a little explaining to start may be helpful. Options are so dangerous to the less savy.

Happily Resteemed! I couldn't put it into words myself.

Thank you!

Thanks for the info!

quite welcome!

@satchmo got you a $0.43 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

LOL that is the best