Chart: Why is the crypto currency still there?

Those 12 images that will agree that it is not too late to invest in crypto coins.

Those 12 images that will agree that it is not too late to invest in crypto coins.

The first website was launched in the year 1991, and since then the internet has largely changed humanity. The first bitcoat was made in 2009, and it will also launch around us worldwide.

The crypto-currencies and the composition of the Internet itself suggests comparisons (the crypto coin was already "Netscape moment"). Let's draw parallel and find out what stage of development we have in crypto coins.

First, the crypto-currencies in the world need to be determined. However, it will not be easy to do this for several reasons:

Some private folks prefer to store crypto-coins and one person may have the same parse multiple times - each for its own crypto currency.

Others store crypto-currencies in exchange, but then a parse address does not match the user of this exchange. In addition, the exchange often creates separate purse addresses for each transaction.

Therefore, it is possible to say how many people using crypto coins and how often they are used, it is almost certainly possible.

We calculate the increase in the number of crypto currency users

Let's count the number of users of crypto currency, the following data analysis:

Increase the number of Bitcoin and Nets;

Increase the number of active addresses for Bitcoin and Ethan (estimated number of active users per day);

Increase in the number of users of crypto-exchange exchange (fiat-crypto and crypto-crypto);

The total volume of trade in all the years of crypto currency. Overall, there are approximately 24 million addresses in Bitcoin-Perseus. This does not mean that the number of Bitcoin users is 24 million, because you may have multiple addresses and it is recommended to start a new BitCoin address for each transaction.

Overall, there are approximately 24 million addresses in Bitcoin-Perseus. This does not mean that the number of Bitcoin users is 24 million, because you may have multiple addresses and it is recommended to start a new BitCoin address for each transaction.

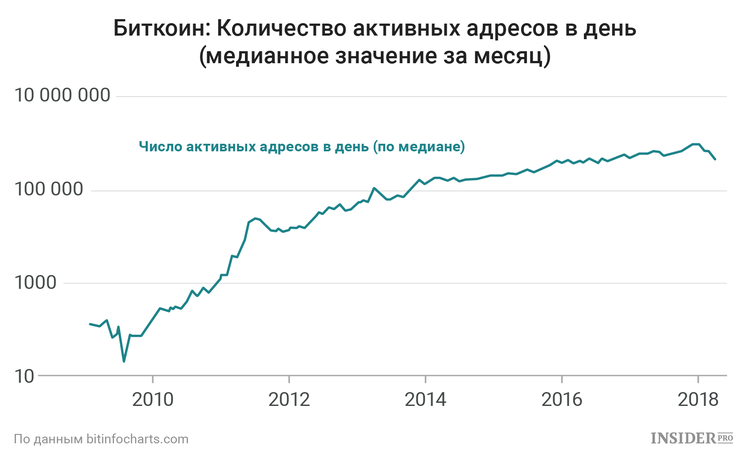

We can estimate that the number of Bitcoin users in the 24 million world-wide upper limit. In addition to the number of wallets, we are interested in the number of active addresses every day. For this graph, accept the mean value of the active addresses for the month and apply it to the logarithmic scale. The maximum active addresses in the daily circa 1,1 million - and this is the number of active users active in the Bitcoin network every day. However, if we assume that the main function of Bitcoin is simply considered as a means of capital protection, the number of daily active users should be much lower than the normal mobile application or site.

The maximum active addresses in the daily circa 1,1 million - and this is the number of active users active in the Bitcoin network every day. However, if we assume that the main function of Bitcoin is simply considered as a means of capital protection, the number of daily active users should be much lower than the normal mobile application or site.

The same analysis can be done for ether, see the number of Ethereum addresses and the number of active address numbers (on a logarithmic scale).

Overall, there are 31 million atheric addresses, and the most active address at the Ethiopian network is 1,1 million.

Overall, there are 31 million atheric addresses, and the most active address at the Ethiopian network is 1,1 million.

Ethereum should be used to conceive as a platform, as a way of smart contracting as a way of not only protecting the capital, because there are smart contracts, because of their own address and broadcast, ethically, more often than Bitcoin.

In addition, it should bear in mind that Ether and Bitcoin are not mutually exclusive units of users, on the contrary, both of them use a lot with crypto currency.

An estimated estimated increase in the number of users in crypto-currency is the study of stock exchanges (both Fi-crypto and crypto-crypto).

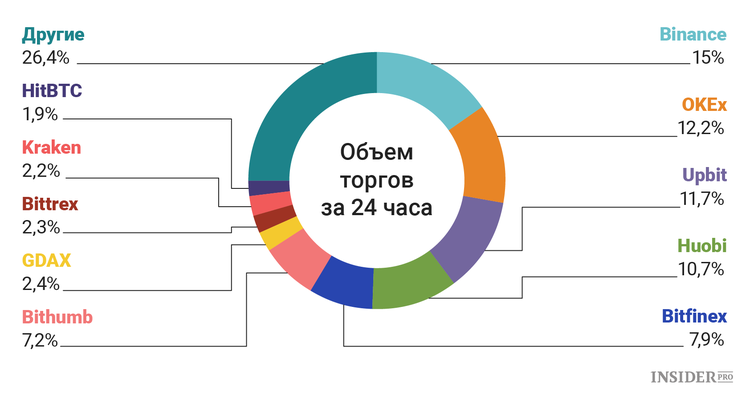

Unfortunately, some exchanges publish published statistics that increase the number of users and their number. However, what we found here: If we accept all the crypto-exchange exchanges on which the commission is charged, then the distribution of market shares will look like this:

If we accept all the crypto-exchange exchanges on which the commission is charged, then the distribution of market shares will look like this:

In addition, if we accept all the transactions where we can know the number of users and the amount of business, we can calculate the estimated amount of each user's trade. To divide the total trading volume from all exchanges to this number, we get the total number of crypto currency users - 20,2 million people

In addition, if we accept all the transactions where we can know the number of users and the amount of business, we can calculate the estimated amount of each user's trade. To divide the total trading volume from all exchanges to this number, we get the total number of crypto currency users - 20,2 million people

Let's take this image for the low limit of the numbers of crypto currency users, who are based on the number of people who purchased and sold the crypto currency on different exchange.

Next, let's look at the total trading volume in all crypto-coins, from 2014 to 2018 to evaluate the dynamics of trading. The chart below shows the median quality for the month, impressed on a logarithmic scale, for greater clarity. Although not all of these calculations give us a fair number of users, we can assume that the total number of crypto coins in the world is 20 to 30 million people

Although not all of these calculations give us a fair number of users, we can assume that the total number of crypto coins in the world is 20 to 30 million people

Let's compare the increase in the number of users of crypto currency with the increase in the number of internet users

Now that there are an estimated number of our crypto currency users, we can focus on increasing the number of internet users and we now understand the development curve.

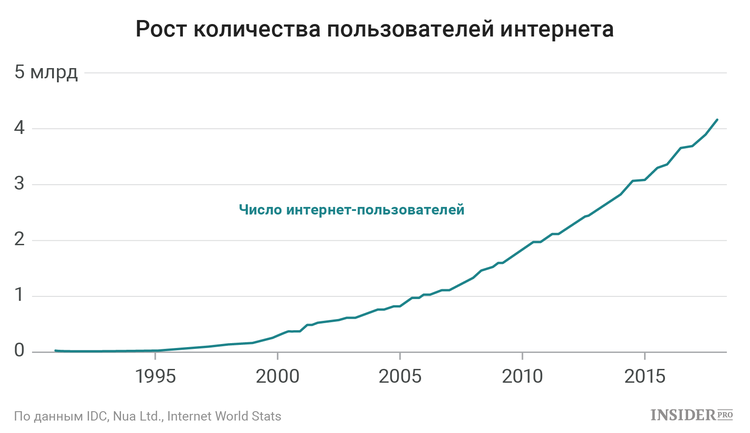

Here's how the number of internet users increased: Now let's compare Internet statistics for 1990-1995 2013-2018 statistics for the Crovo-currency:

Now let's compare Internet statistics for 1990-1995 2013-2018 statistics for the Crovo-currency: As you can see, the crypto currency graph repeats properly in the initial stage of the Internet. If we can assume that crypto-currents repeat the way of the internet, the current conditions are related to about 1994.

As you can see, the crypto currency graph repeats properly in the initial stage of the Internet. If we can assume that crypto-currents repeat the way of the internet, the current conditions are related to about 1994.

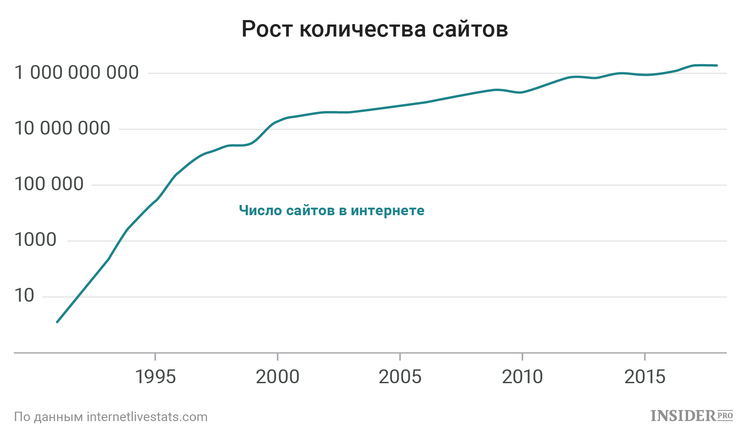

You can manage a similar analysis, compare the number of sites in the initial stages of the Internet with the number of crypto projects - here we include all crypto-coins, tokens and DApps. Here's how the curve of the site increases the number of curves: Now compare the 2014-2017 place for the 1991-1995 year for crypto property (tokens that received funds and DAPS):

Now compare the 2014-2017 place for the 1991-1995 year for crypto property (tokens that received funds and DAPS): And this chart is in the 1994 year period. Compared to the number of kriptoproektov in a last, graph number, with the number of Internet Startups in the financial year 2014-2017, the year 1991 has received investment from 1995. (Investment shown for inflation and it is only about companies involved in the field of Internet and software development.)

And this chart is in the 1994 year period. Compared to the number of kriptoproektov in a last, graph number, with the number of Internet Startups in the financial year 2014-2017, the year 1991 has received investment from 1995. (Investment shown for inflation and it is only about companies involved in the field of Internet and software development.) Information too

Information too

Despite the increase in the number of users of crypto, tokens and DAPPS, we are still in the year 1994 - if we compare the rise of the crypto-currency with the internet charts.

This paradigm may be surprisingly accurate, or completely meaningless - depending on what you see the main purpose of blockades and crypto currency.

If you think that the main purpose of cryptocurrency becomes a new kind of asset, their growth curve is not coincidentally with the growth curve of the Internet - these users apply to the growing number and the growing number of assets (the Internet, they match the sites).

But if you think that the main function is to be a platform for cryptocurrency decentralized applications (DApps) - what is called a decentralized Internet - the growth curve of users will be similar to cryptocurrency and DApps numbers increase the number of Internet users and websites.

The main suspect in the future of DAPPS is that when decentralized applications are not used actively, they are not used. Now, crypto-currency is used mainly as speculative, capital collection, money, resources, etc.

By evaluating available data, we see that crypto-coins are more sophisticated and accountable in the form of an asset class. It is very interesting if we talk about the future of decentralized applications, but it can not be predicted right now.