How inequality hurts the US economy and why Bitcoin gives regular people a chance to create decentralized wealth

Bitcoin provides ordinary people an opportunity to build wealth in a decentralized system that, unlike the financialized US economy, doesn't cater to the top 1%, or the top 1/100 of the 1%.

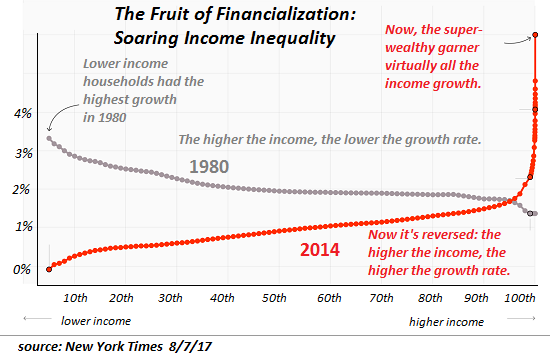

The hyper-financialization of the US economy over the past two decades has caused unprecedented financial inequality in the US. While Occupy Wall Street tended to target the top 1%, what's often not appreciated is how the top 1/100th of the top 1% has completely skyrocketed in wealth from their access to to reap easy financial returns from a low interest rate environment. Check out the astonishing chart from the New York Times below.

Such a disconnect in financial worth and a complete implosion of the middle class is anathema to a healthy, steadily growing economy that President Trump claims to be working toward. Without consistent spending from a middle class that sees its income rise, the economy will continue its slog. Just recently it was reported that restaurant spending is down 17 months in a row. That's a clear signal that the average American just isn't spending money like he or she used to.

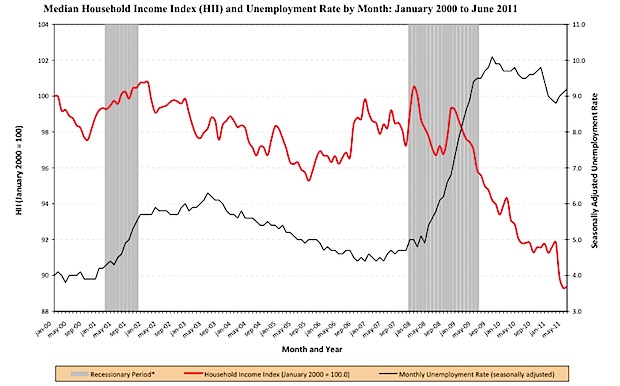

The chart above shows how median income for Americans collapsed after the 2008 financial crisis. A severe divergence took place where the top 10%, the top 1%, and the top 1/100th of the top 1% saw their wealth increase while the rest of the US economy was left in the dust.

So what are ordinary people to do in a virtual economy where wealth is continuously being aggregated to the very top?

Buy Bitcoin! The decentralized Bitcoin is the great equalizer to the highly centralized US financial system. And unlike gold and silver, it's price cannot be manipulated. Those that claim that the issue with Bitcoin is that it is a virtual currency seem to not consider that they are living in a virtual economy, one where prices no longer represent real supply and demand and companies simply buy back their own stock with profits instead of investing in workers or capital. Bitcoin is as real and tangible as the US economy.

Check out the article I wrote five days ago about why the Federal Reserve prefers Bitcoin of gold and silver.

check out Charles Hugh Smith's article below

http://www.zerohedge.com/news/2017-08-16/why-were-doomed-our-economys-toxic-inequality

yes Bitcoin is the peoples coin, decentralization means its the only free market werealy have or closest thing to a true free market!

And it shows us all how powerful free market really is for creating wealth! Bloclchains re a whole nother story and will alow us to devcentralize all of human civilization from healthcare to education to government al of it blockchain!

LOL And that looks like the the bitconnect logo! This image is always used everywhere I wonder who made it!

http://www.bitconnect.com/?ref=zackza bro make sure when u have $100 to invst u get into bitconnect using my link

Anyway yeah man focus on the idea of "Buying Back" stocks

i think msot peopeldont know what that is!

explain what buying back stocks is and its funny how bitcoin proghrams like bitconnect actually buy back their own coins!

yeah also when stock markets are on the BLOCKCHAIN type system, it will allow for more transparency and u wont be able to rig the markets as much

And its not up to them to choose, somepone will create their own decentralized stock market and it will simply outcompote the NYSE and Nasdaq!

Just liek Darknet markets have been online and running since silkraod was shutdown, they never went away, and theres always going to be people selling drugs online from bitcoinf orever!

They better just legalize drugs then, or else peopl will ALWSYS buya nd sel dope using bitcoin! :D