If You Don’t Care About The Safety Of Your Funds - Support The Big Block Community

Bitcoin Cash has gained popularity in the last month and the price went up significantly in anticipation of the hard fork that took place last Wednesday. I think many newbies were buying Bcash without knowing anything about the history of the big block movement.

Influenced by misinformation from CNBC’s fast money where it is known of that the husband of the marketing manager is the head of the Bitcoin Cash fund in London and websites as Bitcoin .com and r/btc that are managed by Roger Ver, newbies bought Bcash thinking that it was the improved version of Bitcoin.

This might be their biggest financial mistake ever, in the long run they will miss out on the REAL Bitcoin. But more importantly, the big block devs have a history of huge mistakes, you really don’t want to trust them with your life savings!

People that bought Bcash recently because they heard on CNBC that it is the real or better Bitcoin probably don’t know anything aboutt the history of Bitcoin.

When Bcash forked off from Bitcoin

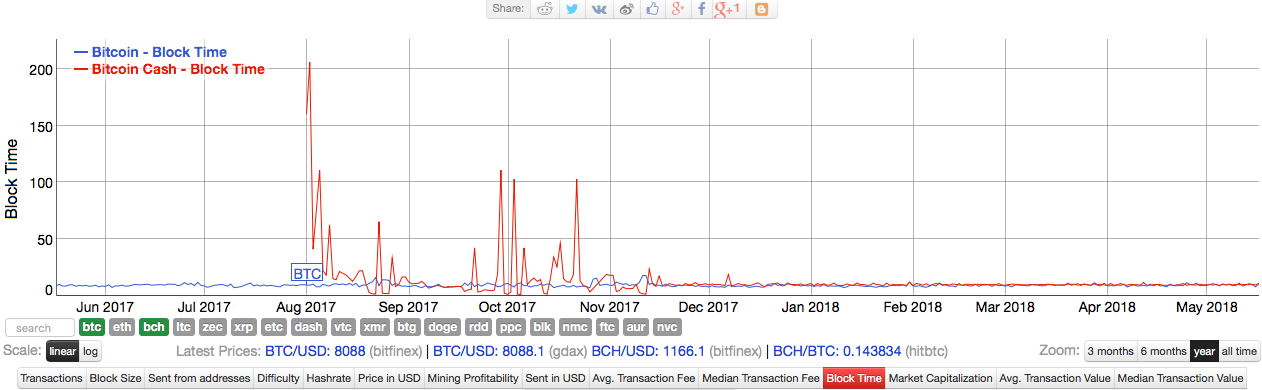

The first of August 2017 the Bitcoin ABC hard fork took place, but because there was no consensus (only around 5%) they split off from Bitcoin and Bcash was born. Because the difficulty will only adjust every 2016 blocks, a Bcash block took 200 minutes after the fork and this would have been the case for up to 403,200 (2016 x 200) minutes what equals 280 days. Because transactions would be extremely slow and mining extremely unprofitable, even more miners would leave and this would certainly create a dead spiral. Bcash would be dead on arrival.

To avoid this, Bcash devs created the EDA (Emergency Difficulty Adjustment) that would adjust the difficulty faster. But because the EDA was flawed and untested the difficulty overshoot every time. Periods of extremely slow blocks were followed by periods of extremely fast blocks.

In the periods of fast blocks multiple blocks were found in a minute what caused hyper inflation because also the block reward was released a few time per minute and in periods of slow blocks it took more than 100 minutes to find a block so it took ages for transactions to be confirmed. This went on for 3.5 months (Bcash is only 9.5 month old today) and was finally solved through another hard fork.

This flaw caused by untested code launched by incompetent devs will still have it’s aftershock in the future. Because the periods of hyperinflation the halving of Bcash will take place a few weeks before the halving of Bitcoin and this will halve the profitability of Bcash mining too. Many miners will leave Bcash to mine BTC and a huge attack vector will appear. Exchanges are delisting Bcash already because a double spend attack is very possible, at time of the Bcash halving in 2020 it will be even easier.

In 2020 a double spend attack that is very profitable for the attacker will be extremely easy. Will we see a giant hack or another hard fork to solve this issue and cause new instabilities? Will the code be carefully written and heavily tested to ensure safety? I doubt it………LOL

The Segwit 2X fork

The Segwit 2X fork was another example of the incompetence of the devs of the big block community. Most of the Core devs were against S2X because the code was untested and the agreement was signed behind closed doors and thus centralised, not because they were against a block size increase per se.

S2X was backed by 95% of the miners and some of the biggest exchanges, but the future market signalled that around 85% of the users were against it, so it was an internal fight between users and corporations. Because the corporations were afraid for financial losses because their version of Bitcoin would be less valuable, the fork was cancelled one week before the planned date.

The fork was cancelled by 4 or 5 important figures behind S2X, very DECENTRALISED right?

Although the fork was cancelled, some miners decided to go on and trigger the fork anyway. When the moment was there and the first S2X block would be minted the nodes crashed and the new blockchain was dead on arrival. If S2X was not cancelled and 95% of the miners would have ran it the entire Bitcoin network would have crashed that day!

https://cryptovest.com/news/the-hard-fork-freeze-why-segwit2x-crashed-and-what-follows/

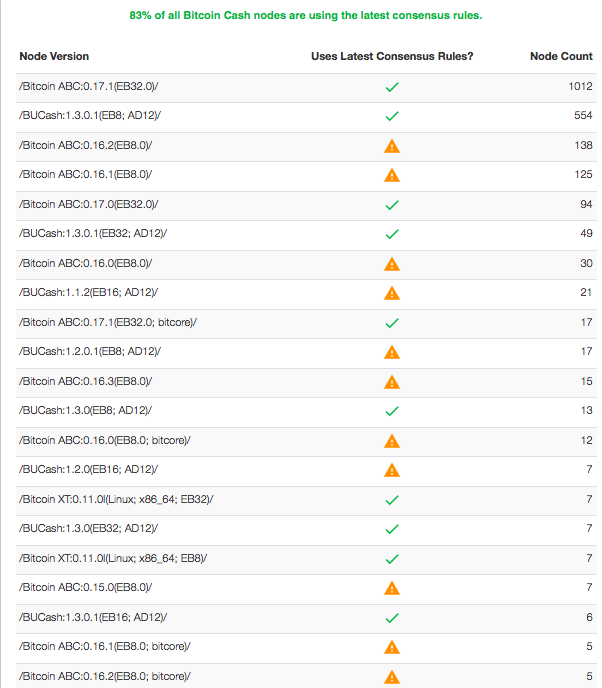

The recent Bcash fork

Also the recent Bcash fork that took place this week didn’t go smoothly. 20% of the nodes were kicked off the network and were not able to synchronise. This means that 20% of the users are not able to make Bcash transactions after the fork. Today 3 out of 4 hard forks done by the big blockers went not smoothly. You will trust them with the next fork? (By the way, the only smooth fork was a fix of another f*ck up!)

Bitcoin has been in danger two times

Many wonder why I hate Bcash so much. The reason is that they delayed Segwit and thus Lightning, both very promising, for about one year and they almost destroyed Bitcoin for 2 times through their incompetence. The first time was via S2X and the 2nd time was when the flawed EDA made mining Bcash so much more profitable for a while that they were able to steal 70% of the miners and made BTC very slow and vulnerable to attacks during that time.

During this event the Bcash community leveraged this attack on Bitcoin by heavily spamming the BTC network, price manipulation to make mining Bcash even more profitable, Bcash support on Coinbase and a tsunami of paid shills on social media.

Conclusion

The big block community is hostile to Bitcoin, but more importantly, the devs are extremely incompetent and reckless. Flawed code is launched without proper testing and security parameters are messed with. When you hold Bcash you did not only buy the fake thing, but your assets are also vulnerable to huge risks.

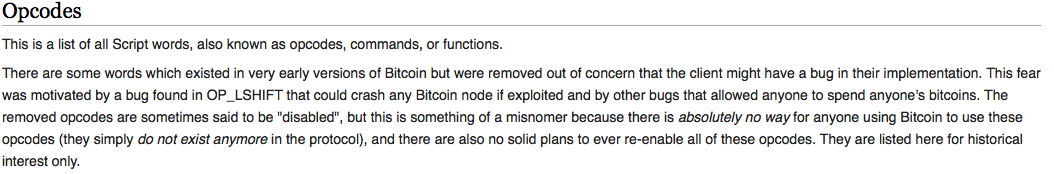

The recent Bcash hard fork re-introduced old opcodes that were removed from Bitcoin because very serious bugs were found. Old discussions on Bitcoin forums are telling that there was total consensus at that time and everyone agreed that the opcodes could only be re-introduced after deep investigation and heavy testing.

You really think the Bcash devs did any investigation or testing? LOL

The bugs that were found are not things to think lightly about, one would crash all full nodes and the other one would enable users to steal each other’s coins. What will the next not yet explored bug be?

Trusting the Bcash devs with your money is the most stupid thing you can do! LEARN THE F*CKING HISTORY!!!

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Bitcoin Cash is a fork of the original Bitcoin Blockchain. It operates with a number of changes that make it faster and better able to scale when compared to its older brother.

It does this by introducing a block size of 8mb, up from Bitcoin Classic’s 1mb. This increase in size allows more transactions to be entered into each individual block before they’re encrypted into the blockchain. This allows more transactions to be processed at once, and so vastly increases the speed of the entire process - allowing transactions and currency to move and be confirmed faster.

This allows Bitcoin Cash to retain the security and utility of the Bitcoin blockchain, while having the ability to deal with transaction volumes close to that experienced by Paypal or Visa.

This post has received votes totaling more than $50.00 from the following pay for vote services:

buildawhale upvote in the amount of $51.93 STU, $72.48 USD.

upme upvote in the amount of $49.34 STU, $68.87 USD.

rocky1 upvote in the amount of $45.94 STU, $64.13 USD.

smartsteem upvote in the amount of $42.95 STU, $59.95 USD.

For a total calculated value of $190 STU, $265 USD before curation, with a calculated curation of $48 USD.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

Is it not true for the ETH devs as well?

And this is giving them the benefit of the doubt.

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

You got a 18.18% upvote from @luckyvotes courtesy of @stimialiti!

@youtake pulls you up ! This vote was sent to you by @stimialiti!

Funny thing is that segwit is what bch want but just hates. Segwit create a safe 0-cof requirement Hmm...isn't that what Bch wants?

Now that big blocks-they just keep Hf a the expense of nodes-remember the only full nodes needed are miners /s

Next time Bch just says that big blocks=low fees and fast speed

Iota and Nano have less fees and sometimes fast speeds.

Dogecoin is the most like Bch and it has less fees and fast speeds.

Dogecoins is the real Bch... ;)

mind blooming

please buy now, it's time you will receive a profit. thanks for sharing @michiel, this is very useful.

Which exchanges are already delisting bitcoincash? Sounds very unlikely to happen.

Nothing is certain for now. Who knows? Things can still change in the future.

You should follow @icowatchdog. ICO Watchdog is your comprehensive solution to following the cryptocurrency market. Follow the market with 100% Free and Real-time cryptocurrency alerts for all your favorite messaging applications today. Follow @icowatchdog Steemit account for news updates and token sales/air drops.

Thank you for this great read! Would you also be interested in reviewing World Wi-Fi project?