BITNATION Token Sale Post 2: The Bitnation token sale structure

The Bitnation token sale structure

By: John Mathews, Bitnation CFO

Sale structure

There is a fixed number of Pangea Arbitration Tokens (PAT) (42 billion). The token sale is split into three phases and a total of 14.28 billion PAT (34%) will be sold across the three phases of the sale.

Sale phases:

- Phase 1: Presale - completed in December 2017.

- Phase 2: Public auction - 1 month auction of up to 7.3% of PAT supply.

- Phase 3: Slow release - the remaining unsold tokens will be sold via exchanges over the following 24 months so that a total of 14.28 billion (34%) have been sold by April 2020.

The total amount of PAT in circulation 24 months after the public sale finishes (25 April 2020) will be 14.28B (34% of 42 Billion) as well as PAT allocated to the core team and issued for bug bounties.

Phase 2: Public token sale

The public sale begins March 25th 4pm CET and finishes when either the hard-cap is reached ($27.3M of Ether has been bid), or on April 25th 16h00 CET.

The sale is hard-capped at $27.3M USD and the token price is set by the market. This is achieved using a reverse auction with a variable price for the token.

One of the effects of this model is that we do not know how many tokens will be sold during the auction. The higher the market-set price of PAT, the fewer tokens will be issued in order to reach the hard-cap.

The reverse auction model:

The price starts at a maximum and declines at a predefined rate during the sale (see chart below)

Every contributor purchases PAT at the same price (the price is denominated in Ether).

The price of PAT is fixed at the time that the sale cap is reached, or at the end of the sale if the cap is not reached.

Auction participants place their bids by sending Ether to the contract address at the time that the price of PAT decreases to the maximum price they are willing to pay.

If the sale continues after an investor has sent Ether, (because the hard-cap is not yet reached and it is not yet April 25th 4pm CET), the price of PAT continues to decline and the participant will receive PAT at a cheaper rate than they were willing to accept.

If an investor waits too long and the sale cap is reached before they send Ether to the sale address, the investor loses the opportunity to participate

All Ether sent to the contract is used to purchase PAT.

All participants pay the same price per token (excluding bonuses). The price of PAT is fixed when the sale ends.

Phase 3: Slow release

During this phase, unsold PAT from the sale pool (14.28 billion) will be sold at a steady rate over 24 consecutive months.

Whilst this happens Bitnation will be improving the utility of Pangea and the market will receive more information about Bitnation, or plans and our chances of success. We expect the price of the token to reflect this extra information.

The slow release phase creates a strong incentive for Bitnation to deliver continuous improvement, communicate clearly and build market confidence.

Additionally, Bitnation is aware of regulatory uncertainty around KYC (Know Your Customer) and AML (Anti Money Laundering) requirements for token sales and crypto projects. The impact of this uncertainty on Bitnation is reduced by selling through exchanges which already have KYC/AML procedures in place. Phase 2 is required in order to jump start the supply of PAT and create a market for exchanging the token.

During the slow release phase, Bitnation will continue to improve the Pangea app, and user adoption of the platform will continue to grow. This will increase the utility and value of PAT. The price of PAT will reflect Bitnation's progress and ability to deliver useful software.

Auction example:

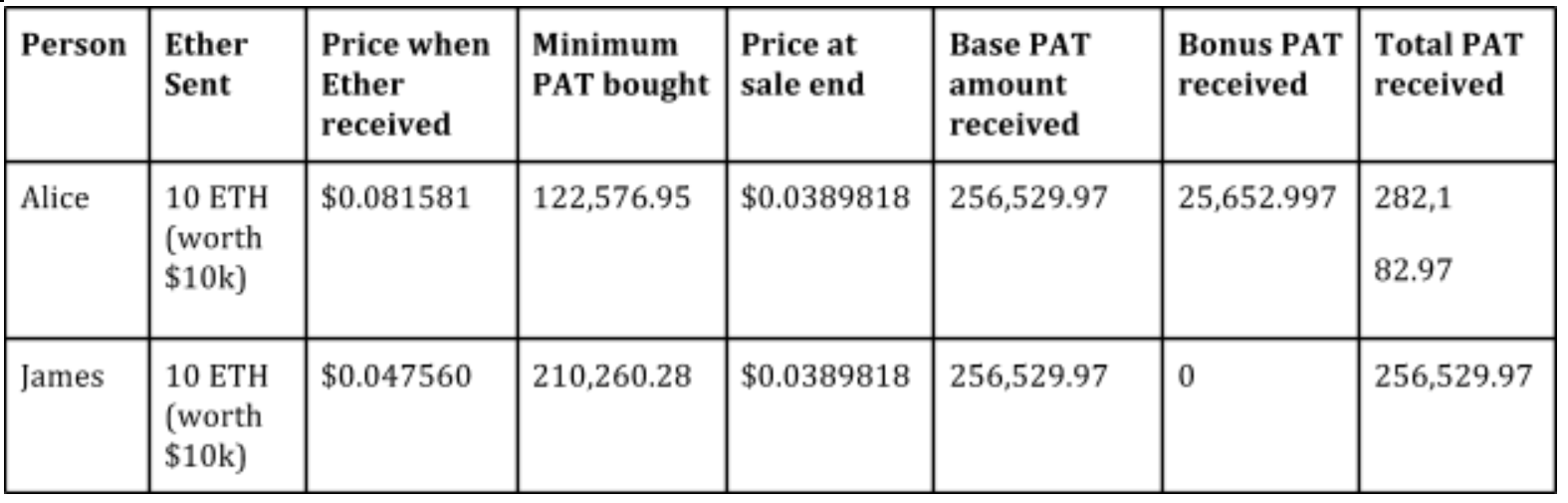

The numbers from this example are also shown in the table below.

This example is designed to show how market sentiment will set the price of PAT, and that there is no disadvantage to sending funds early during the auction. There is no disadvantage because all participants buy their PAT at the same base rate (excluding bonuses). Early participation is rewarded with bonus amounts. The market chooses the price of PAT by signalling the maximum price each participant is willing to pay by sending Ether to the auction address. The auction ends when $27.3M of Ether has been received and the price of PAT is set at the time the cap is exceeded:

- For this example, we assume that Ether is trading at $1000

- Alice sends 10 ETH 1 day after the auction begins

- James sends 10 ETH 7 days after the auction begins

- Lizzie is prepared to pay a maximum of $0.025/PAT and therefore waits until the price is below this level before sending Ether to the auction address. She knows the auction price will be below this level during day 17 of the auction.

- The hard cap is reached 10 days after the auction begins

Alice sent 10 ETH before the hard cap was reached, when the token price was $0.0815814, signalling that he was willing to purchase PAT at this price. She knows he will receive at least 122,576.95 PAT ( 10,000 / 0.0815814 ). Because Alice sent Ether at the end of the first day of the auction, she will receive 10% extra tokens as an early bird bonus

James sent 10 ETH before the hard cap was reached, when the token price was $0.0475601, signalling the he was willing to purchase PAT at this price. He knows that he will receive at least 210,260.28 PAT ( 10,000 / 0.0475601 ).

The hard cap is reached at day 10, when the token price is $0.0389818. This is good news for Alice and for James, because they both buy PAT at this price, using all of the Ether they each sent.

James receives 256,529.97 PAT ( 10,000 / 0.0389818 )

Alice receives 256,529.97 PAT plus an additional 10% because she sent Ether during the first day of the sale. Total PAT bought is therefore 282,182.97 PAT ( 256,529.97 + 0.1*256,529.97)

Lizzie did not send any Ether to the auction, because the hard cap was reached before she decided to participate. The auction ended automatically once the hard cap was reached, locking the price of PAT and automatically sending every participant the correct number of tokens.

Technical details:

Due to the price volatility of Ether the sale is described in dollar terms, however the auction will be denominated in Ether because we are using the Ethereum blockchain. The conversion rate from US Dollars to Ether will be fixed when the sale contract is deployed. This will occur as close to the start time of the sale as is practically possible.

PAT starting price: $0.0951/PAT

PAT closing price: $0.0093/PAT

Auction duration: 31 Days

Token price P at time t: P(t) = A ln (t + B) + C

where:

- P(t): Price at time t,

- t: time in days

- A: -0.02885

- B: 1.665

- C: 0.109864

We can buy good price if we wait enough days,

However it face to possibility that we can not buy any token after hard cap reached.

Let decide best time to buy.

Good luck everyone!

i got a question.. what are the requirements for the "token receiving address"?

thank you!

It should be a MyEtherWallet address.

I have a wallet from downloading the pangea.co app on my phone. It will have a wallet for both eth and xpat. That's about all you need unless you use something like trust or an erc 20 token wallet.

Posted using Partiko Android

What is the minimum contribution ammount in ETH?

0.05 ETH

So why would people buy early if it gets cheaper close to the end?

I participated in a pre-sale in November, but have you been able to confirm it?

I participated in a pre-sale in November, but have you been able to confirm it?

I am trying to buy xpat but I couldn't make it. I went to the website that you said I can buy it from there (gemini or coinable). How can I buy it? or Bitnation is available to buy it?