Bitshares Arbitrage Thoughts

Bitshares is the perfect place to build an exchange if you don't feel like building an exchange. Think about it. All the hard work is done. Sure, you still have to create wallets for native coins and secure them, no small task, but if you were building your own exchange, you'd have to do that anyway.

Bitshares is a true Exchange engine. Fork the UI, establish a prefix like PIMP.BTC for your tokens and stake your claim. Openledger, Rudex and CryptoBridge all understand this and are valuable partners in the Bitshares ecosystem.

This got me thinking about arbitrage and liquidity. It's been difficult to create meaningful volume in part because arbitrage is so cumbersome. I think the core reason arbitrage is difficult is the lack of a FIAT gateway. I equate this to a river very little water in it. FIAT unable to gain entrance into an exchange is like a dam with no outlet. The water just sits there. once FIAT can flow, the river gains strength.

So, while Openledger has a FIAT gateway, it's not really an automated process like say Coinbase. In my opinion, the next best thing to a FIAT gateway is BTC. BTC is the gateway drug for crypto currency. It's got brand recognition and history. For all reasonable intent, it's our gateway. We must make it simple for users to bring BTC into the DEX. This article will not go into detail on how to do that, but we are working on some new deposit modals that will be more intuitive than the current method.

The real reason I wrote this article is to drive home my original point that the Bitshares DEX is an engine for building branded exchanges. One of the most frustrating aspects of this is that each exchange has its own token representing the same crypto currency. Stop and think about this...

- CryptoBridge bridge.btc

- Openledger open.btc

- Rudex rudex.btc

- DEX bitBTC

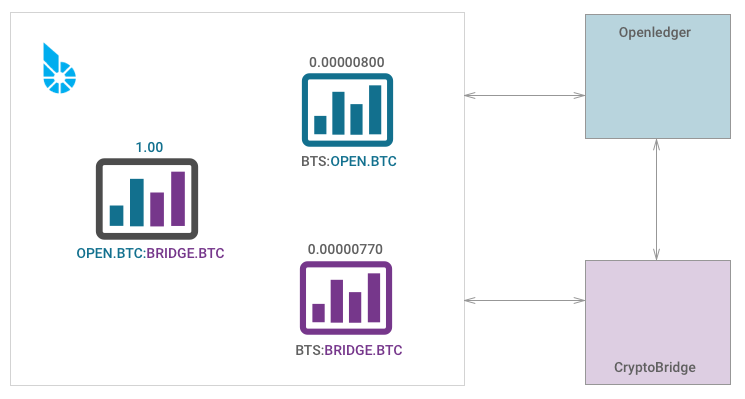

So, we have 3 BTC coins and none of them trade on the same market. We even have bitBTC which is borrowed into existence. These three exchange tokens are almost never at parity due to lack of liquidity and ultimately lack of trust. Why should these tokens have the same value. Each is just a token handed to you by an exchange who is promising to hold your real BTC while you trade theirs on the DEX. While pondering this, I realized that it's possible to simply send these assets between the exchanges via Deposit/Withdraw in addition to trading them on each exchange. This is arbitrage and it's dead simple to do. If BRIDGE.BTC is trading low relative to OPEN.BTS, buy some, withdraw it to Openledger. Sell that OPEN.BTC for BTS on that market. You can even keep it really simple and just maintain a buy order of .995 and a sell order of 1.005 on the OPEN.BTC:BRIDGE.BTC market and perform a Deposit / Withdraw operation if one side of the trade is getting more action than the other.

I hope this article prompts some enterprising types to start:

- Adding more exchanges

- Manually arbitraging between exchanges

- Building Bots to arbotrage between exchanges

Thanks for tuning in.

Good one Bill. Food for thought with that one :)

Yeah, Bitshares DEX needs some better way on getting BTC funds in.

Bitshares DEX has lost me as exchange client because of Openledger failure (still hope it's not a scam). I'm using it only as a wallet for BTS.

I checked the stats and was shocked about what is going on open.BTC https://cryptofresh.com/a/OPEN.BTC

From more than 8000+ users who hold their open.BTC only less than 50 has more than 2 BTC. The rest or 99.4% has less than few BTC on their accounts.

Why?

I would make a requirement to collect stats from all 3rd party partners about transactions and failures. Then promote the ones that works the best and remove the ones that can not deliver the quality of service.

For users it is not so important on how the money comes in, the most important is how reliable the service is. And the best thing would be to promote Bitshares own BTC like bitBTC. Just make it fast and easy to transfer my BTC. I could not find the way to get in my BTC through bitBTC, only open.BTC.

Or maybe they brought in BTS to purchase BTS, LTC ... I hold very little BTC. I don't' think you are drawing meaningful conclusions from your data. If you feel slighted by OL, you should write it up and make your case. Ronny has been fair in most situations I have witnessed.

The DEX != Openledger. That was the point of my article. Don't confuse the two.

Maybe You are in this and do not see how a newcomer sees it?

It is not so clear at the first sight that gateways are not affiliated with the DEX itself. Yes, there are some warnings about third party partners but who goes so far to see the FAQs? 😀

I may be totally wrong and my data is very guesstimated on the few information I got but even you have thoughts that something is not as good as it should be. There should be some other - less biased person who can clarify.

The point is that BTC is the main crypto currency that trades are going on in big exchanges. And if exchange does not have a moving volumes from one currency to other then exchange is dead. Currently Bitshares DEX works as an expensive wallet and playground for micro altcoin traders.

There is no shortage of arbitrage bots on Bitshares. I'd guess there are already dozens. Look at the list of most active traders. They are all arbitrage bots.

The paths you mentioned are already being watched.

Then why are the spreads 5% on PPY:OPENPPY?

Are you saying there is an arbitrage opportunity there? I doubt it.

Wide spreads usually mean no arb opportunity.

Narrow spreads equals potential arbs.

The spreads are wide because no one is trading that pair. Which makes sense because it's just as easy to simply withdraw and send to the other side, as you've described. But why would you do this either? The other markets trading PPY are thin and have wide margins as well. There's no advantage.

Arbitrage doesn't bring spreads closer together. Market making does, which takes on risk. In fact, arbitrage always widens the spread because you're taking orders off the book not adding. The exception to this is a "copy-cat" type market maker which could potentially be characterized as a type of hybrid arbitrage.

I'd love to see more market makers like this. I used to run one myself. That would replicate the books of external exchanges onto the dex. It's somewhat problematic though and subject to manipulation given the 3 second delay on the DEX and near instant response elsewhere.

One last point regarding the PPY:openPPY spread. If I were arbing those markets(I am) I wouldn't care what the PPY:PPY spread was unless It was trading 1.01 PPY for 1 PPY which it never should. It's cheaper to withdraw. In and arb sequence if I buy openPPY and sell PPY. I'm not going to finish the circle by trading my new openPPY back to PPY because I know they are the same thing and I can always get the same for them by withdrawing. The only time you'd withdraw from one to the other is if you run out of supply on one side.

The same:same markets are mostly useless. Especially if you're dealing with a coin with 3 second confirmations. I can see the utility for transferring BTC or some other slow coin as you might want the other BTC more quickly than the withdrawal can offer.

Anyone making a same:same market will have to offer a spread less than the fee to withdraw or no one will use it.

Great arbitrage opportunity https://steemit.com/gifto/@fifelue/tips-be-a-millionaire-using-arbitrage

Holy!!!

A good post..exelent.

That is very not so hard to accomplish within technical aspect of discussion, but it does REQUIRES a FULL CONSENT of all individual businesses in order to be accomplished smoothly.

rudex.BTC I believe is using sidechain for BTC wallet ? Maybe i'm wrong :)

Cheers and great idea Bill!

Luci

How does it require full consent of individual businesses? Each exchange already has a deposit/withdraw operation.

We will discuss it later today on a call, now i'm confused based on what we talked earlier. Even better if it can be done completely independently from others by having all of them mixed into one.

We will talk later, phone is sitting on 100% and charger waiting :)

Luci

You can look for programmer to code an arbitrage bot in Utopian.

good night my brother .. i like the writing abang..sebagai newcomer I have not been able to vote writing abang ... by karna it, help me in adding energy .. hehehe ...

thanks abg