The iron is HOT for BitShares. A look into BitUSD

Tether (USDT) was in the news lately. Headline: Tether Confirms Its Relationship With Auditor Has 'Dissolved'

Why is this important for BitShares and, of course, affect the price of BTS? I'll get to that (and an explanation of what BitUSD is) after a long-ass detour!

As some might know, Bill Gates presented a tablet years before Steve Jobs blew the world's mind with the Ipad. The microsoft product was a total flop, the market simply wasn't ripe for this kind of innovation. The technology wasn't quite there as far as being able to provide a good user experience and mobile simply wasn't dominating the market as it was a mere couple of years later.

Well Dan Larimer designed (and released) a revolutionary crypto product called BitAssets, now rebranded as Smartcoins or Market Pegged Assets (MPAs). You can watch this (slightly hilarious) video of Dan explaining the ideas behind BitShares and the BitUSD:

His creation actually solved a real world problem: A volatility-free crypto-asset that doesn't require trust in a third party.

I've used it quite successfully in the past. BitUSD was a safe harbour from wild markets. No need to convert to back fiat.

But like BitShares itself, it didn't catch on quite as much as it should have. The crypto crowd was quite small until... 8 months ago lol. Also, those that knew BitShares by name would dismiss it since this community was seen as "anti-mining", pro "ninja mining", centralized, corporatists, etc.

Funnily enough, their lack of research into what this community was advocating was reminiscent of the critiques they themselves as bitcoiners received from the public "This is just for criminals and pedophiles!" a.k.a. "imma do no research but criticize the shit out of you anyway" haha.

Nevertheless, BitUSD was there and working. The main issue with it did not come from a flaw in its codebase but from our failure at marketing it. There wasn't much volume at all in BitUSD. Since its inception, there was consistently only about 100k worth of BitUSD on the DEX (BitShares Decentralized Exchange) greatly diminishing its use.

Enter Tether

Tether came in to corner the market BitShares wasn't able to penetrate. Tether offered a crypto-token that pegged to the USD. They got exchanges on board and the rest is history. People have been using USDT as a way out of crypto that is quicker than selling your BTC for Fiat. Not being fiat, many crypto to crypto only exchanges use it, which provides huge added value since it's kind of like cashing out of crypto while staying ready to buy back again at the next dip.

Tether was a hugely successful product!

Issues with Tether

Tether is a centralized corporation that issues USDT tokens and backs them up with reserves of fiat US dollars. In other words. there is an issuer, there is a third party, there is a head... heads are a central point of failure.

One of the key attractions to a stable crypto is to escape risk. With USDT, the risk from volatility is taken care of, but one of the whole points of going into crypto is that you want to avoid the risks associated with third parties! This space in general is quite anti-bank, anti-counterparty, anti-middlemen and all about trustlessness.

Parking your wealth with Tether is simply trading the risk of volatility with the risks of loosing everything due to hacks, government shuts downs, mismanagement, etc.

Perfect timing for BitUSD

Hopefully, BitShares will successfully promote one of their best innovations, the Market Pegged Asset. Specifically the BitUSD.

As I stated before, the BitUSD works, has been working well for years and it avoids all the issues and risks associated with Tether's USDT.

What was the big problem is BitUSD again? Yes only 100k of liquidity. So you can't really park that much value in there. Well check this out:

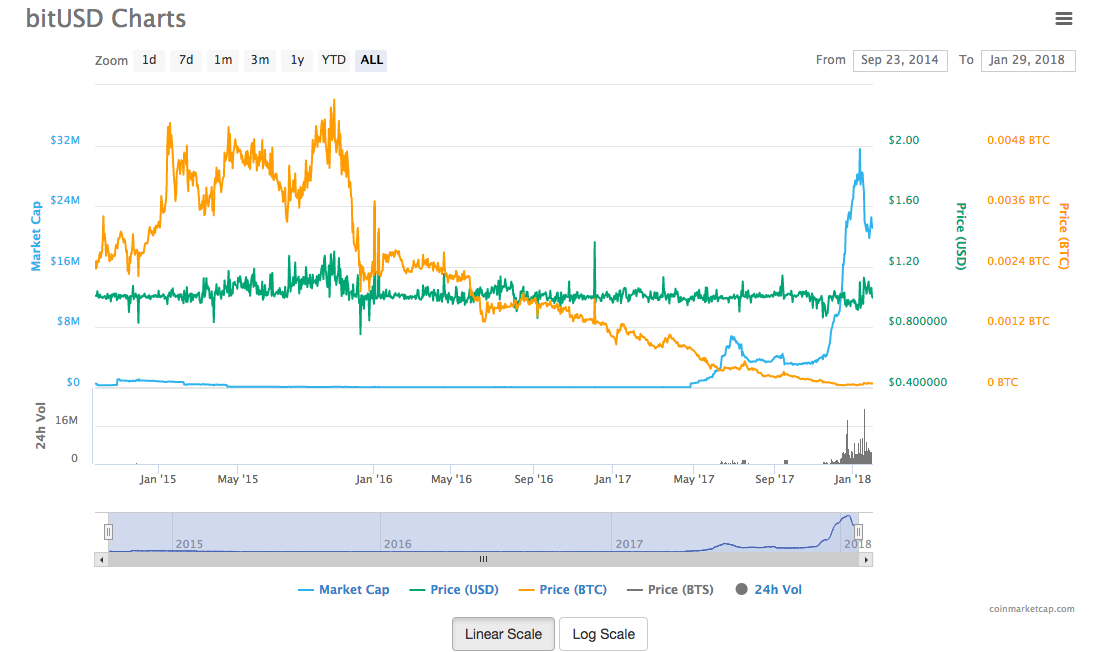

(taken from https://coinmarketcap.com/currencies/bitusd/)

There are currently over 21 million USD of liquidity in BitUSD (see blue line)

The green line shows you the relative stability in the BitUSD's value. Amazing, considering there is no counter-party involved!

The iron is hot now and this is the time for the crypto investors to discover the BitUSD and make use of it. It should be pitched to all exchanges as a much safer replacement to USDT.

What exactly is a BitUSD

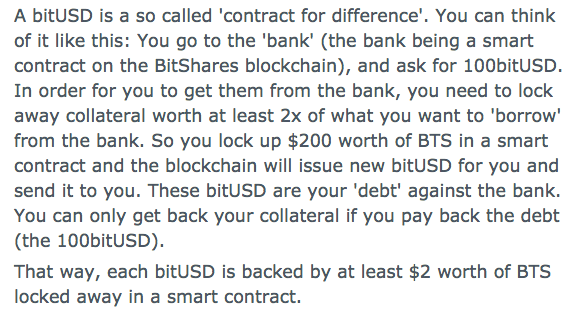

Where do they come from? Any user can create a BitUSD by locking up at least 2 dollar's worth of BTS as collateral.

They aren't issued by a central authority, anyone can create them. The issuers of BitUSD don't need an external firm to audit their collateral since they already have one: it's called the BitShares blockchain haha. You lock up your collateral (BTS) on chain in order to prove that this BitUSD is in fact (over-)collateralized.

Here's an old reddit post by @Xeroc which is very concise in explaining how a BitUSD comes into existence:

How does the Blockchain know how much collateral you need to put behind the created BitUSD?

The Delegates (called Witnesses in Steem) have an extra job to do as block producers. They need to push out a price feed in order to know how much the outside world values BTS compared to the USD.

The price feed is the median of many sources that are updated at least once per hour.

(Taken from https://bitshares.org/technology/price-stable-cryptocurrencies/ )

Compare this to Tether where USDT relies on one company. BitShares is DPOS and that means we can FIRE any block producer that is trying to manipulate the market. When you fire a block producer, he not only looses his ability to publish a price feed, he loses his salary as well. Good luck trying to fire the Tether company as a USDT holder.

Wait I have to create BitUSD?

No. Most users will merely buy it on the market for 1 USD, just like Tether. What I was explaining above is that, contrasted to Tether, everyone can issue the stable token! Not just one corporation but everyone. There isn't a central point of failure and the blockchain audits each token's backing! The blockchain is much stricter than any third partie auditing firm.

What's this do to the markets?

If people (especially if exchanges add it to their listing!) start buying the actually decentralized stable token the BitUSD. This means more than twice that amount in BTS must be purchased and locked up by those that choose to issue/create the BitUSD. This has creates huge demand for BTS while reducing available supply of it (since it's locked up by the chain)

So keep your eyes on any negative news regarding to Tether and the USDT. Start spreading the word in regards to the virtues of a MUCH better crypto product that not only does the same job as tether's USDT but actually keeps true to the spirit of decentralized and to the removal of central points of failure.

If you hear any news regarding exchanges adding BitUSD to act as a better Tether, take it as a HUGE buy signal for BTS!

Sum up

Tether is just a regular centralized company that creates IOUs. There's nothing transparent or trustless about it. The USDT is 100% transparent, yes but that's not why you'd want USDT at all. You want it because it is collateralized by 1 USD of purchasing power. That's how tether maintains their peg. They hold physical USD. The risk is enormous considering the nature of this emerging crypto economy and it is a huge step back towards centralization.

BitUSD is both pegged to the USD and decentralized in nature.

No counterparty risk.

Audited by default by a non-corruptible blockchain.

Finally has volume - which was the old issue with it.

Anyone can issue if they wish

Spread the word (once you've filled up on BTS haha)

Disclaimer: I am a BTS hodler

I can see this gaining traction once Tether implodes.

This is a great post and shows the difference between BitUSD (and why it's trustworthy) and Tether (which is not).

Stan Larimer mentions in the Badcryptopodcast episode 64 how Bitshares has these smart-contract backed assets. He also calls out Tether as a scam in that episode.

Hi cob,

Thanks for this informative post. Really appreciate the quality of your analysis : The value of bitUSD is protected by its decentralized nature.

One question:

You mention: "Any user can create a BitUSD by locking up at least 2 dollar's worth of BTS as collateral." To me, this is an area of (market) risk as a drop in the BTS value may impact the reliability of the BitUSD.

Do you know whether there are mitigation for this?

To illustrate my question: I collateralize 5 BTS today and receive 2 bitUSD. The price of BTS halves the next day. How can bitUSD keep its value? Only by the long term expectation of a higher BTS value?

Thanks again for the good post.

I believe the blockchain forces the issuer to cover his position when the collateral gets too low.

The system also starts with the tokens that have the least collateral. So if you don't want to be the one to get called up to cover your position you can put in 10x the collateral if you want!

Bitshares kind of hacks its way around this. If your collateral ratio ever falls below 1.75, you get put on the Margin Call list; the account with the lowest collateral ratio on this list immediately gets its entire short position put on an order book to buy back BitUSD at a 10% premium. For small drops in the BTS price this is fine; it effectively penalizes the accounts with the lowest collateralization, and serves to reduce the supply of BitUSD.

For large drops in the BTS price, this can be a complete catastrophe. If a short position is ever undercollateralized (collateral ratio <1), BitUSD has a stroke and shuts down, immediately closing all short positions and leaving only a little BTS in a shared collateral pool.

Great explanation! Minor correction, bitUSD now has a minimum collateral level of 175%, not 200%.

Great post!

It is only a matter of time and people will realize the risks of keeping there money on a centralized exchange. (and in Tether)

When that time comes everyone will flock to the bitshares-dex and unlike other crypto it will have no problems scaling at all!

2018 will be the year of the DEX! Another awesome aspect of BitUSD is that since 2x collateral in Bitshares are locked up to create BitUSD, it puts upwards price pressure on BTS which is a bonus! Go Bitshares. As of last week 19% of all BTS are locked up, lowering circulating supply greatly!

Phew..many comments, hope u c my question. If i trade in USD on Openledger (i.c. sold Open.BTC for USD), am i buying bitUSD? Will not bother u more except for saying this was a super great post, thanks.

Openledger is an interface to BitShares just like Steemit.com and busy.org are interfaces to Steem. If you click the asset name in the exchange page on Openledger you can see its details to be sure of exactly what it is, who created it, and how it works before you buy it.

Thanks, the thing is that they trade in BTS, Open.BTC and USD as a base, it is not clear to me whether that is bitUSD or not...

If you are inside Openledger wallet and choose from the right window of assets groups OPEN.BTC you have the list with all BTC assets of Openledger down the line.

On the right next there is a search field where you can use "USD" as a search word.

You get two assets down the list one is USD and the other is Open.USD .

USD is BitUSD . Thats what you are looking for.

I had the same problem also.

I think i helped you with this.

I see what you mean, their interface is much less clear than it should be. What they display as simply the 'USD' base actually appears to be bitUSD. I've submitted a GitHub issue on their repository to correct this ambiguity.

Thanks for the information. I don't know in deep about tether and bitusd. I also like bitshares , bitshares has very big potential because it is more than a coin, it has lots of properties.It is a DEX(decentralized exchange), It has bitUSD,bitEUR,bitCNY etc... and also bitUSD and all of this fiats are decentralized.Every body can create an asset easly with this platform.Lots of people has not discovered all futures of bitshares yet.Bitshares is more then currency.I think that bitshares will go upto 10 $ or more at the end of this year

Holy shit. I really needed this, because after I heard about Tether I REALLY needed something new to "park" my money in. Been using Tether, but I'm nervous to use it now. I will absolutely take a good look into BitUSD now. I don't fully understand it yet, but I hope to do just that soon. Thanks! =)

I am still very much in doubt whether it's even possible to peg a crypto currency to the USD, or any other fiat currency for that matter. But I'll keep reading and researching.