Blockstack ICO Report

UPDATE:

After receiving some clarifications from founders and information from their blog, we make the following corrections

- to the section “About”:

- the Blockstack’s group of companies is based in Jersey City, NJ

- the technology works with Ethereum, and Zcash is on the roadmap

- the section “ICO”:

- the mandatory registration to participate in the ICO has been extended until November 15th, 2017

- Stack token price will be announced on November 16th, 2017

- token main sale period will be November 16th, 2017 - December 1st, 2017

- contributions currency: the USD

- the section “Company”:

- Blockstack Token LLC will be the sole member of the General Partner Blockstack Token Fund GP LLC which is not yet been formed.

The information contained in this report is neither legal nor financial advice and presented for informational purposes only. The projects included in cyber•Fund reports vary significantly in terms of investment risks. Before considering any investment, make sure you read the report below carefully and take time to do your own due diligence.

The Blockstack develops a full-stack product including the Internet browser, blockchain name registration system, user identity mechanism and storage for the decentralization of Internet. It works over existing Internet technology stack and underlying Bitcoin blockchain, but avoids centralization features that exists at the Internet application level and can be migrated successfully to another blockchain. The Blockstack is an open-source project that has been running by an established company of top-level professionals backed by venture capital for more than three years. The Stack token will serve to incentivize participants and as a means of payment for network fees. It has fixed supply at the genesis block planned for 2019 with a predetermined mining algorithm. ICO participants will get majority of tokens (66,66%), and early investors (including founders) will have 33,34%. It has to be taken into consideration that Blockstack’s papers don’t provide sufficient information concerning planned use of proceeds from ICO. In terms of legal risks, the tokens are not likely to fall under “securities” definition, but there is some contradiction found in different information sources regarding the name of the one of legal entities running the project (see Company section below).

About

The Blockstack project introduces a new vision of the decentralized Internet where the definition of “domain name” is not limited by a traditional “website” meaning, but also represents a user’s identity within the blockchain network in a human-readable format (instead of a long-tailed public key used in present-day blockchains). The Blockstack system enables users to register personal network space (regarded as “names” in the Technical Whitepaper and “domains” in the Tokenpaper) and access related content without any centralized third party. Once registered, users obtain access to all services provided in the network.

The Blockstack network is being developed by the group of companies based in New York: an operating entity Blockstack Token LLC, the 100% subsidiary of Blockstack Public Benefit Corp. This startup was launched in 2013. Since its start the Blockstack has raised 5,450,000 USD in venture capital to develop the Stack protocol that is enabling decentralized governance and motivation system for decentralized app network. In addition, the team has expressed intention to acquire additional capital by selling its own tokens (“Stack”): the ICO starts on the November 13th, 2017 with tokens expected to get fully developed and deployed on the network by the January 30th, 2019.

The Blockstack was initially launched in March, 2014 on the Namecoin blockchain, but migrated to Bitcoin at the end of 2015. The technology already works with Ethereum and Zcash. Currently several applications have already been deployed on the Blockstack network, among them home-sharing service Casa, personal health monitor Alfa, blogging platform Guild and music player Ongaku Ryoho and more than 75,000 domains have already been registered on it so far. In May, 2017 the Blockstack introduced a new Internet browser, its core product.

Platform use-cases

The Blockstack plans to unite several groups of stakeholders and motivate them to participate in further product development by means of Stack tokens. Paid services are offered for domain names registration, exchange and trade. Motivating options are also announced for application developers.

- Miners can obtain native Stack tokens by a proof-of-burn mining mechanism intended to incentivize people to participate in building the longest blockchain. When miners destroy a proof-of-work-based cryptocurrency (currently Bitcoin) to get native Stack tokens they have to send bitcoins to the “burn address” from which bitcoins cannot be retrieved. This enables the functionality where nodes can select between conflicting blockchain forks, as the blockchain fork with the most amount of cryptocurrency burned is considered to be the “correct” fork. This is important for the supporting light clients, such as mobile devices.

- App developers can get Stack tokens by the app-rewards mining that incentives application developers in the early stage (first four years) of the ecosystem. Independent bodies, called “App reviewers” (elected for a 1-year term) select eligible applications and assign them appropriate weights which are used in calculating mining rewards for apps

- App reviewers will receive 2% of Stack tokens allocated to curated app developers

- Users (those who will consume token-paid services from the apps presented on the platform) will be incentivized by web-of-trust mining mechanism. An initial trusted-set of unique users is selected in the genesis block and, in the future, the initial set of users can expand the web-of-trust after the network goes live: users can receive tokens by joining and verifying their accounts

- Domain name registration. Users have to pay fees for registering a unique name in a chosen namespace (described as Blockchain name system in the “Technology” section below). Those fees depend on the desired name length and complexity

- Creation of the namespace. Any user (or, even the group of users) can create a namespace, such as “.id”. This is also a paid service; currently users can create namespace by burning the certain amount of tokens of the underlying blockchain (currently - Bitcoin)

- Namespace proceeds collection. The namespace owner (or, the group of owners) can collect proceeds for the names registered in the namespace owned. The platform service even helps to distribute those proceeds among the group of owners

- Atomic Swap is a new service for secure domain name sale/exchange: the domain owner creates a transaction offering the domain for sale, and the bidder responds with the matching token transaction. This would trigger the simultaneous release of the domain and tokens to counterparties without any third party involved

- Namespace auction is supposed to counterbalance demand for new namespaces preventing from two sides: unfair pricing and dormant namespaces bought due to low price

Market

The Blockstack project team outlines that the Internet market originally intended as a decentralized network has become dependent on centralized authorities, such as Domain Name System (DNS) or digital Certificate Authorities. In addition, hosting of the majority of end-user data resembles an oligopoly market controlled by several large corporate players, whose servers become vulnerable for cyberattacks. The Blockstack’s aim is to change the existing market picture by creating a new marketplace for users and service apps developers with a new type of relationships between them concerning users’ data control.

Traditional domain market has already reached its maturity stage: at the end of Q2/2017 it had approximately 331,900,000 domain name registrations with year-to-year growth rate of 2.1%. Since vast majority of businesses has already established presence in the traditional Internet, the annual market growth rate is quite moderate (please see the Domain Industry Brief by Verisign).

At the same time, the blockchain Internet is an emerging market niche with just few players providing DNS-like services on a decentralized basis: Ethereum Name Service (ENS) and Blockstack. Expectedly, the growth rate of this new market segment could be higher (comparing to the traditional Internet) in the long term due to the following factors:

- more consumers become involved in the cryptomarket, thus forming demand for the services provided on the blockchains

- global businesses might shift to the decentralized Internet because of lower costs and higher security, plus a possibility to be in control of their own resources

Competitors

As mentioned earlier Blockstack will have to compete with existing centralized Internet-services.

| Domain Name System (DNS) | Blockstack Name System (DNS) | Ethereum Name System (ENS) | |

|---|---|---|---|

| Registered domains | 331,900,000 | 75,000 | 180,822 |

| Domain median price | 10 USD | 5 USD | 0.02 ETH |

| Operations start | 1993 | 2014 | 2017 |

| The network worth | n/d | 425,000 USD | 168,595 ETH |

| Renewal period | 1 year | 2 years | 1 year |

| Renewal fee | 7.50 USD - 35 USD | - | Fee determined based on deregistration rate |

| Subdomain rentals | Available on the main domain owner discretion | Namespace Auctioning | Available on the main domain owner discretion. Also, referral fee applicable |

| Secondary domains market | Listed on variety of sites; some of them are specialized domain trading marketplaces, such as Sedo | Currently domain names on Blockstack can be listed on commerce sites, like eBay and Sedo, and purchased by individuals who want to buy them. | Supported by such services as ENSListing, NameBazaar |

| Number of Apps (Web apps, dApps) | >100000 | <10 | >800 |

| Apps run on-chain | No | No | Yes |

| Legal entity | ICANN | - | ENS Foundation |

| Compatibility | DNS, incompatible with blockchain naming systems | Generally supported by DNS. Apps using Blockstack run in traditional web browsers | Not compatible with DNS and BNS, except one feature |

| Account data is controlled by user | - | + | + |

Comparing to the traditional Internet segment, the Blockstack network’s distinctive features might have positive and negative impact:

- Key advantages:

- Users’ personal data privacy - no service provider stores users’ personal data

- For users - no spamming from intrusive services

- Service apps become less attractive to cyberattacks comparing to centralized services keeping the data on their own servers

- Anticipated disadvantages:

- Users will have to pay (in Stack tokens) when consuming services provided by the network apps, whereas centralized Internet services (such as Booking.com) remain free of charge

- Service providers (app developers) won’t obtain direct permissionless access to customers (by e-mail or mobile phone), and this will limit traditional direct promotion options

- The network’s service apps might have low index positions in popular search engines (like Google) comparing to existing reputable centralized services

Comparing to Ethereum, which also attracts attention of apps developers, the Blockstack will have several beneficial features:

- Developers can create apps in any chosen language (no need to switch to the blockchain language, such as Solidity for Ethereum)

- Flexibility resulted from no-need to follow a particular blockchain rules

- All complex computations shifted to the virtualchain vs. on-chain smart contract running in Ethereum (consuming gas): this gives the Blockstack scalability and cost saving advantage

- Scalability of data storage: the Blockstack allows choice between own Gaia or external Google Drive, Dropbox vs. on-chain data storage by Ethereum.

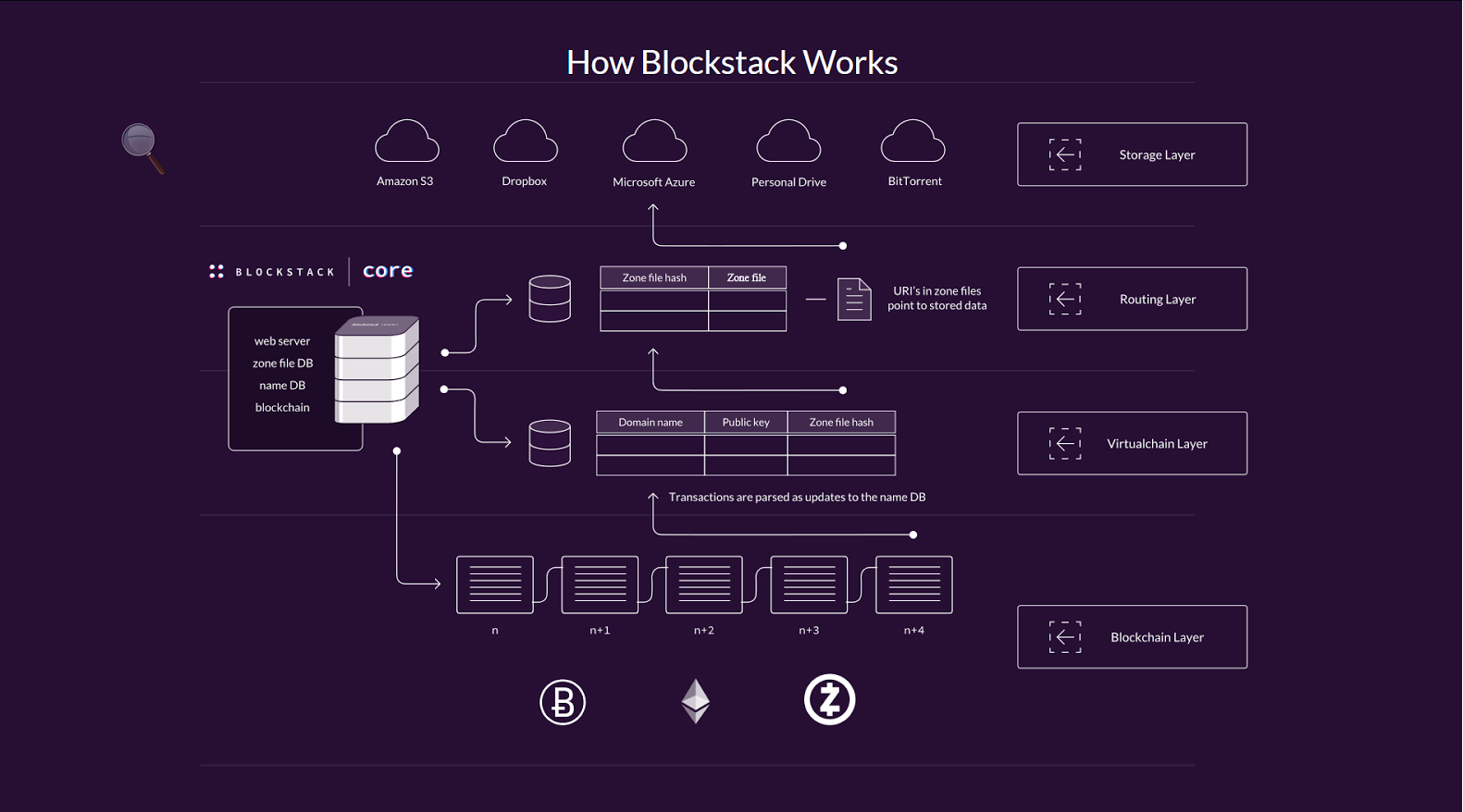

Technology

- Blockchain. This layer combines the underlying blockchain and the “virtualchain”. The layer carries two technological functions (according to the Technical Whitepaper): “...provides the storage medium for operations and maintains consensus on the order in which the operations were written”. All operational computations and logic, including mining operations and consensus algorithm, is processed by the virtualchain (like a virtual machine) where the underlying blockchain is treated as a communication channel that just carries totally-ordered operations. The platform’s architecture predetermines that any number of underlying communication channels can work, and any underlying blockchain can host several virtualchains of a different type (that do not interact), thus resolving the problem of on-chain computations scalability. The Blockstack’s network can migrate from one underlying blockchain to another. This boosts security as allows to migrate to more secure blockchain protocols

- Peer network Atlas. This layer keeps record of the routes (called “zone files”) pointing to the main data storage implemented on the top layer (see Storage Gaia below). Zone files can be verified by peer network, so cannot be tempered or compromised. They are relatively small in size (4KB per file), and Atlas nodes can easily keep the full copies of routing making node attacks inefficient

- Storage Gaia. The top layer hosts the actual data values of arbitrary size. It’s implemented in the form of the backend cloud storage and is similar to other cloud storages, such as Google Drive or Dropbox. In addition, the Blockstack makes it possible to use different storages when pointers to those storages remain stored by the Blockstack, and only encrypted data is kept by the storage providers

- Based on this architecture, the Blockstack deploys the blockchain name system (BNS) by defining operations in the virtualchain and storing the data routing information in the peer network Atlas. Backed by the the consensus protocol of the underlying blockchain, the virtualchain processes complete ordering of operations maintained by BNS: name registrations, name updates and name transfers. Thus, the virtualchain reflects the global state of BNS: “who owns a particular name and what data is associated with a name”. BNS’s domain name structure is similar to the centralized internet: for instance, “blockstack.id”. It has two parts: the name = ”blockstack” and the namespace =“.id”

- The implemented mechanism of transaction verification requires users to run full nodes that requires significant disk capacity (approx.1GB as for now). Stack protocol supports light clients, such as mobile devices. Light clients can independently validate if the mine transactions were included in the underlying blockchain by making enquiries to the public Blockstack nodes for the consensus status (the latest hash) and the full set of mine transactions

- Departing from the fact that the blockchain layer is used for the user authentication purpose solely, web applications have almost no need to interact with the blockchain layer. This is beneficial for app developers who can construct their apps in any chosen language. The Blockstack promises very easy plug & play approach to various applications (you can find the tutorial of building a simple application on Blockstack here). So developers can plug into the user’s API instead of incorporating into the centralized API with no need of maintaining servers, databases and user management service

- All computations needed for the apps are processed in the Blockstack architecture layers controlled by users, not involving the servers of the service providers. This allows to treat the apps deployed on the Blockstock network as fully decentralized and server-less apps); though, the apps don’t make processing on the blockchain level as it is the case on Ethereum blockchain

- As an open source network undergoing annual hard forks, the Blockstack needs decentralized governance. The consensus algorithm, however, hasn’t been developed yet

Economics and token

- Blockstack will have its own token “Stack”. The token will have 6 decimal places

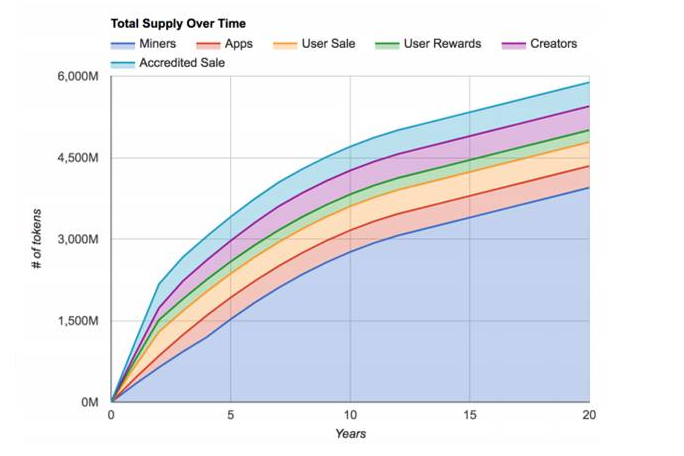

- The Stack tokens will have a fixed supply of 1,320,000,000 at a genesis block (the first block after Stack is activated on the network will be the genesis block of the protocol)

- After launch of the new network, the Stack protocol will release new tokens into the system through a mining process

- New tokens can be mined by three methods broader described in the section “Platform use-cases”:

- proof-of-burn mining

- apps-reward mining

- web-of-trust mining

Ongoing mining properties: - tokens released in the first year: 440,000,000

- mining reward per block in the first year: 8000 tokens

- mining reward will decrease by 500 annually until it reaches 2000

- 25% of the mining reward will be given to apps, distributed proportionally based on the app reward points for each app

- Total supply of tokens after ~10 years: 4,702,500,000 assuming 144 blocks per day (average in Bitcoin)

- Expectedly, the described above supply will result in a ∼2% annual inflation rate after the 13th year of the network running

- Stack tokens will be used for performing operations facilitated by the Blackstock network. Protocol operations will “consume” tokens, so users are supposed either to purchase tokens or obtain them by mining. Consumed tokens will be destroyed that will result in total supply reduction.

- Token utility:

- registration fees for domain names

- bidding on the namespace auction

- collecting namespace proceeds from domain owners

- exchanging/purchasing domains in the atomic swap

- motivating miners to maintain the “proof-of-burn” mechanism

- motivating apps developers

- motivating unique users registration

- consuming services (making purchases) provided by applications

- voting on protocol changes needs

- Fees

- Currently the Blockstack supports such maintenance operations as update, transfer and revoke on the name record; all network operations require a transaction fee on the underlying blockchain

- In addition to the user registration procedure, the registration of records in the Blockstack will be a paid service; this helps to prevent spam. Currently paid in Bitcoin; however, switch to the Stack token is expected after the network launch

- App Reviewers receive 2% of the token rewards allocated for the app-rewards mining; this motivate App Reviewers to serve their apps curation function during the 1-year tenure

ICO

- According to CoinDesk, on the August 16th, 2017 the Blockstack created the venture capital fund to finance development of the decentralized internet (you can find more details here and here). 25,000,000 USD were raised from venture capital investors

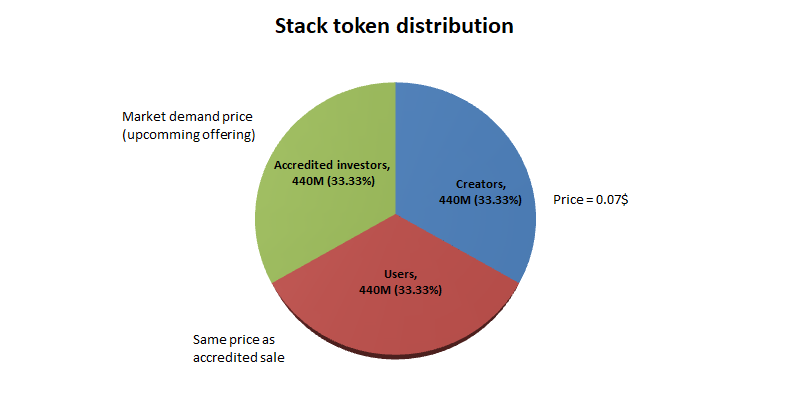

- Initial distribution of 1,320,000,000 Stack tokens after the ICO

- Private offering preceding the ICO was organized for “Creators” - existing shareholders of Blockstack Public Benefit Corp (see Company section below), founders and employees; Private offering had 440,000,000 Stack tokens at the price $0.07

- No pre-sale and no discounts for the ICO declared except the Private offering

- The ICO is organized for three groups of potential investors:

- Qualified purchasers (see the definition in the Blockstack Token Sale Mechanics) will invest in a new Delaware fund (Qualifies Investors’ Fund) that invests in Stack tokens.

- Accredited investors who are not qualified purchasers and want to purchase more than $3,000 USD will invest through another Fund ( Accredited Investors’ Fund - similar to those created for qualified purchasers), or by means of Simple Agreement of Future Tokens (“SAFT”) which gives a right to receive units of Stack tokens in the future on terms similar to the Fund.

- Other investors, who’re not accredited investors or qualified purchasers, will get a “voucher”: an option to purchase up to $3,000 worth of Stack tokens at ICO price. This group is supposed to present the voucher to Blockstack Token LLC to exercise its option to purchase the tokens and make the payment at a later date that will be specified by Blockstack Token LLC. However, the issuer warns that the voucher cannot be considered as any promise or guarantee, so reserving the right not to accept it.

- The number of Stack tokens offered through the ICO: 880,000,000 (of them 440,000,000 for Qualified purchasers and Accredited investors, and another 440,000,000 for Other investors)

- A mandatory registration to participate in ICO is needed (starts on the November 1st, 2017 and ends on the November 10th, 2017)

- For Qualified purchasers and Accredited investors registration will be held through the CoinList platform with accreditation according to US accreditation standards, including KYC/AML compliance check

- For others (non-accredited) investors, the subscription for vouchers will be processed through the Blockstack browser. After downloading the browser and obtaining a personal Blockstack ID the investor can submit a form for Token Sale Registration (scan of the personal ID document is required). Vouchers will be distributed to investors before November 17th, 2017, and further redeemed with Blockstack Token LLC in (a specified later period) to finalize the Stack token purchase

- Token sale period: November 13th, 2017 - November 20th, 2017

- The Blockstack papers don’t specify in what currency contributions from non-accredited investors will be accepted; supposedly, other categories of investors will receive explicit payment instructions during the registration procedure

- Sale price for Stack tokens bought during the ICO (for all group of investors) will be determined based on market demand after the registration period (in a $0.05 to $0.25 range). The final price will be announced by Blockstack Token LLC on Nov 13th, 2017. The issuer provides some examples of possible outcomes of the ICO for Qualified purchasers and Accredited investors depending on price:

- at $0.10, the ICO size will be 44,000,000 USD

- at $0.25, the ICO size will be 110,000,000 USD

- The project team sets the following milestones, after which the Fund’s proceeds can be spent :

- successful deployment of the Stack token within the network - before the January 30th, 2019

- acquiring at least 1,000,000 of verified users (disclosure of the criteria is expected later) - before the January 30th, 2020

- The Blockstack’s papers don’t provide sufficient information concerning planned use of proceeds

- Lockup period: As explained in the Blockstack Token Sale Mechanics, “...the tokens will be delivered to ICO participants when and if the network goes live” (expectedly - before the January 30th, 2019). However, the tokens will become usable and transferable after the lockup period expiration that is different for each holder group:

- Users’ stake: 2-year lockup

- Accredited investors’ stake: 2-year lockup

- Creators’ stake: up to 7-year lockup:

- 75% to Blockstack PBC shareholders, vested over the first 3 years

- 25% to the Blockstack PBC treasury, vested over the 4 years

- After issuing the genesis block the frozen Stack tokens will be released and dispatched in the network according to the following pattern:

- Expectedly, the secondary market for the Stack token will exist, since users will need to purchase the tokens to consume services provided by apps within the Blockstack network

- ICO webpage on CoinList: https://coinlist.co/blockstack

- Terms of Sale are available here

- Team’s latest update on token sale available here

Company

The Blockstack network is developed by the group of companies. The documents available on the Blockstack website and on the Blockstack section of CoinList website refer to Blockstack Token LLC and Blockstack Public Benefit Corp. (Blockstack PBC). The information about the token issuer, Blockstack Token LLC (incorporated in September 2017), is available on the Delaware State Official Website. Blockstack PBC , which serves the roles of a development structure and an investment vehicle for early investors and founders, can be found there as well (exists since 2013). Unfortunately, there is no additional information about general partners of Accredited Investors’ Fund and Qualifies Investors’ Fund. Fund Term Sheet indicates that Blockstack Token Fund GP LLC will perform the role of General Partner (GP) in those funds. Delaware entity ledger website has no information about a company with such name. We contacted the support team of the Blockstack project and they clarified us that Blockstack Token LLC will be the GP. This information contradicts the Fund Term Sheet, which clearly distinguishes Blockstack Token LLC and Blockstack Token Fund GP LLC (p. 3 Blockstack-Fund-Term-Sheet-Nov-1-2017.pdf).

Team

The Blockstack team unites 12 top-skilled awards-winning professionals (including five PhD degree holders) in computer science with entrepreneurship experience. Dr. Muneeb Ali, Co-founder, PhD in Computer Science (Princeton University) specializing in distributed systems, worked as a researcher at Princeton and PlanetLab . Ryan Shea , Co-founder, MSE Mechanical engineering, minor: Computer Science (Princeton University). Worked as software engineer at ZocDoc and authored open-source cryptography and blockchain libraries. Guy Lepage, Design Partner, Bachelor of Fine Arts (BFA) degree holder awarded from the North Island College. Software designer and front-end developer with broad entrepreneurship & startup experience (his prior projects, however, didn’t include the blockchain technology). Jude Nelson , Engineering Partner, performed PhD-level research in distributed systems at Princeton. Worked as a core member at PlanetLab.

Advisors and partners

The Blockstack advisory board has scientists specializing in distributed systems and scalable infrastructure:

- Dr. Michael Freedman, Technical Advisor, a distributed systems Professor at Princeton

- Dr. JP Singh, Technical Advisor, PhD (Stanford University) and the Director of Princeton CTO program

According to CoinDesk, the Blockstack venture capital fund has olso obtained support from venture capital partner investors, such as Lux Capital , OpenOcean , Compound , VersionOne and non-profit organization RisingTide Capital . Also, the project is underpinned by Union Square Ventures , SV Angel and Digital Currency Group.

Summary

- The Blockstack develops the decentralized Internet network as a full-stack product (including the Internet browser, blockchain name registration system, user identity mechanism and storage) where users will keep their information, and not any central authority or storage service provider can control it

- It allows the network to be indifferent to cyberattacks, since there is not any central party keeping personal information, passwords etc. It also creates something that seems to become the “spam-free Internet”, since applications won’t have direct permitless access to users’ personal information like e-mails or mobile phone numbers

- Departing from the point that the Blockstack doesn't have direct competitors within blockchain industry, the network’s success will depend on its apps’ ability to win customers from existing Internet services

- The fact that the team unites top-level professionals and the project has passed selection procedures undertaken by venture investors with sound names adds to assurance in the project long-term sustainability

- The Blockstack team incentivizes the decentralized network governance mechanism by Stack tokens distributions, thus motivating a wide range of stakeholders (including users and developers) to participate in further protocol and network development satisfying a “two-sided market”. Stack tokens will be used for paying fees for variety of services including registration, transfer and exchange of domain names maintained by the Blockstack

- The project papers explains the full process of token purchase and provides clear terms for qualified and accredited investors. Tokens may be obtained under SAFT and will give a right to purchase services that will be provided on the platform (the procedure is similar to Filecoin ICO). Taking into account that the tokens are vested until the moment of the platform launch, we believe that they are fully compliant with the US securities regulation. In addition, the Blockstack is going to issue vouchers for non-accredited investors; however, there are no guarantees given that these holders will Stack tokens in the future

- Token distribution model is pretty clear and decentralized: investors (both accredited and non-accredited) get 66,66% of tokens genesis supply against 33,33% going to the Creators (including founders); the community (users and developers) have strong incentives (mining rewards) to participate in the Blockstack network

- The Blockstack papers don’t provide sufficient information about use of proceeds from the ICO

- There is no direct feedback channel organized with the Blockstack’s team, such as Slack or Telegram; however, we have contacted the team by e-mail and got feedback to our enquiries

- Legal risk: there is no clear and complete information about general partners of Accredited Investors’ Fund and Qualifies Investors’ Fund. Information in the Fund Term Sheet names Blockstack Token Fund GP LLC as a General Partner (GP) in the mentioned funds; this, however, contradicts with Delaware entity ledger website, which has no information about a company with such a name.

Useful links

For more details on the project check the Blockstack’s website, Technical Whitepaper, Tokenpaper, Token Sale Mechanics,GitHub, Docs, Youtube channel or join their Forum.

You can also check Blockstack’s profile on cyber•Fund website or improve Blockstack’s page on Github

Done by @cyberanalytics — the team of the cyber•Fund company that conducts the analysis in fields of crypto-economics and blockchain industry

You can also read this article on Medium

Most of the fundamental ideas of science are essentially simple, and may, as a rule, be expressed in a language comprehensible to everyone.

- Albert Einstein