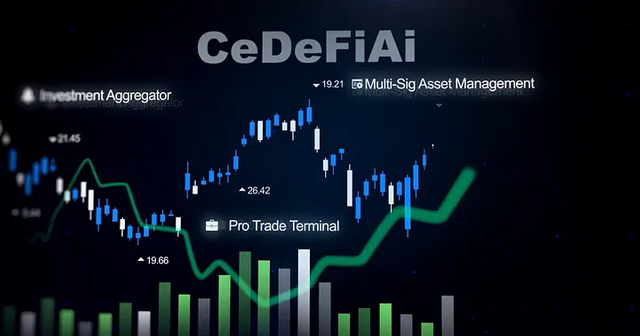

Unlocking the Future of Finance: How CeDeFiAi is Transforming the Landscape of Centralized and Decentralized Finance with Artificial Intelligence

In the ever-evolving world of finance, a new term has been making waves, promising to reshape the landscape of how we interact with financial services. This term is CeDeFiAi—a fusion of Centralized Finance (CeFi), Decentralized Finance (DeFi), and Artificial Intelligence (AI). As we stand on the brink of this revolution, understanding CeDeFiAi becomes crucial for anyone looking to navigate the future of finance successfully.

Introduction to CeDeFiAi and the Future of Finance

The financial sector has always been at the forefront of technological innovation, seeking ways to offer more efficient, secure, and accessible services. CeDeFiAi represents the latest frontier in this quest, merging the best aspects of CeFi and DeFi with the power of AI to create a new paradigm that could potentially redefine the entire financial ecosystem.

Centralized Finance has long been the backbone of our global economy, relying on traditional financial institutions such as banks to provide services. On the other hand, Decentralized Finance emerged as a blockchain-based alternative, aiming to eliminate intermediaries and offer more democratic financial services. Artificial Intelligence, with its ability to process vast amounts of data and learn from it, offers unprecedented opportunities for enhancing both CeFi and DeFi platforms.

Understanding Centralized Finance (CeFi) and Decentralized Finance (DeFi)

Before diving deeper into CeDeFiAi, it's essential to grasp the foundational elements it builds upon: CeFi and DeFi.

CeFi, or Centralized Finance, operates through established financial institutions like banks, which act as intermediaries in financial transactions. These institutions play a crucial role in managing, lending, and safeguarding funds, utilizing a centralized system where all decisions and transactions are controlled by the institution itself.

DeFi, or Decentralized Finance, takes a different approach by utilizing blockchain technology to create a system where financial services operate without centralized intermediaries. This model allows for greater transparency, security, and accessibility, as it is built on a distributed ledger that is open to anyone with an internet connection.

The distinction between CeFi and DeFi lies in their approach to financial services—the former emphasizes security and regulation through centralization, while the latter prioritizes accessibility and transparency through decentralization.

The Limitations of Traditional Finance Systems

Despite the advancements in CeFi and DeFi, traditional finance systems are not without their limitations. CeFi, with its reliance on centralized institutions, often suffers from inefficiencies, high fees, and a lack of transparency. These institutions can become targets for cyber-attacks, and their centralized nature means that users must place a significant amount of trust in them to manage their funds properly.

DeFi, while addressing some of these issues by removing the intermediary, faces challenges related to scalability, user experience, and regulatory compliance. The decentralized nature of DeFi can also lead to a lack of accountability, making it difficult to address fraud and other illicit activities.

These limitations highlight the need for a new approach that combines the strengths of both CeFi and DeFi while mitigating their weaknesses—enter CeDeFiAi.

The Rise of CeDeFiAi: Exploring the Synergy Between AI and CeDeFi

CeDeFiAi represents an innovative fusion that leverages the centralized control and reliability of CeFi, the transparency and accessibility of DeFi, and the analytical and predictive power of AI. This synergy promises to address the limitations of traditional finance systems by offering a more secure, efficient, and user-friendly platform.

The integration of AI into CeDeFi creates opportunities for enhanced data analysis, risk assessment, and decision-making processes. AI algorithms can analyze market trends, predict fluctuations, and offer personalized financial advice, making CeDeFiAi platforms more responsive and adaptable to user needs and global financial changes.

Moreover, the combination of AI with blockchain technology enhances the security and efficiency of financial transactions. Smart contracts, powered by AI, can automate and secure transactions, reducing the need for intermediaries and lowering transaction costs.

How CeDeFiAi is Transforming the Landscape of Finance

The transformative potential of CeDeFiAi in the financial sector is vast. By integrating AI into CeDeFi platforms, financial services can become more inclusive, efficient, and secure. CeDeFiAi can automate complex processes, from loan approvals to risk management, making financial services more accessible to a broader audience.

Furthermore, CeDeFiAi's ability to analyze large datasets offers significant advantages in identifying and mitigating risks. This predictive capability can lead to more stable financial markets and a better understanding of global economic trends.

CeDeFiAi also democratizes access to financial services, breaking down barriers that have traditionally excluded underserved populations. With its decentralized nature and AI-driven personalization, CeDeFiAi can offer tailored financial services, empowering individuals and businesses worldwide.

Benefits of CeDeFiAi in Finance

The benefits of CeDeFiAi in finance are manifold. For one, it enhances operational efficiency by automating and optimizing financial processes, reducing costs, and increasing speed. This efficiency is not only beneficial for financial institutions but also for end-users, who can enjoy faster and cheaper services.

Secondly, CeDeFiAi significantly improves the security of financial transactions. The combination of blockchain's immutable ledger with AI's predictive analytics can detect and prevent fraud more effectively than traditional systems.

Lastly, CeDeFiAi promotes financial inclusion by providing access to financial services for people who are currently underserved by traditional banking systems. Its decentralized nature, coupled with AI's ability to tailor services to individual needs, means that more people can access the financial tools necessary for economic participation.

Real-world Examples of CeDeFiAi in Action

Several pioneering projects and companies are already leveraging CeDeFiAi to transform financial services. For instance, platforms that offer automated trading and investment services using AI algorithms have become increasingly popular, providing users with insights and strategies that were once the domain of professional financial analysts.

Another example is credit scoring systems that use AI to analyze non-traditional data, making it possible to offer loans to individuals who would be deemed too risky by conventional metrics. This approach not only opens up new opportunities for underserved populations but also creates a more diverse and resilient financial ecosystem.

Moreover, insurance companies are beginning to use AI to streamline claims processing, reducing fraud and improving customer satisfaction. By combining AI with blockchain, these companies can automate claims processing, making it faster, more transparent, and less susceptible to human error.

Challenges and Potential Risks of CeDeFiAi

While CeDeFiAi offers numerous benefits, it also presents challenges and potential risks. The integration of AI into financial services raises concerns about data privacy and security, as these systems require access to sensitive personal and financial information. Ensuring the protection of this data against cyber threats is paramount.

Another challenge is the regulatory landscape, which is still adapting to the rapid developments in technology. Navigating this evolving regulatory environment is crucial for the widespread adoption of CeDeFiAi, as it must balance innovation with consumer protection and financial stability.

Lastly, there is the risk of over-reliance on AI algorithms, which could lead to unintended consequences if these algorithms are flawed or biased. Ensuring transparency, accountability, and ethical use of AI in financial services is essential to mitigate these risks.

The Future of CeDeFiAi in Finance

The future of CeDeFiAi in finance looks promising, with the potential to significantly impact how financial services are delivered and consumed. As technology continues to advance, we can expect to see more innovative applications of CeDeFiAi that will further enhance efficiency, security, and accessibility in the financial sector.

However, realizing this potential will require collaboration among technologists, financial institutions, regulators, and consumers. Together, these stakeholders can address the challenges and risks associated with CeDeFiAi, ensuring that this revolutionary approach to finance benefits everyone.

Conclusion: Embracing the Transformation of Finance with CeDeFiAi

CeDeFiAi stands at the forefront of financial innovation, offering a new way to think about and interact with financial services. By combining the strengths of CeFi and DeFi with the capabilities of AI, CeDeFiAi promises to transform the finance landscape, making it more efficient, secure, and inclusive.

As we look to the future, embracing the transformation brought about by CeDeFiAi will be crucial for individuals, businesses, and societies seeking to thrive in the evolving global economy. The journey ahead is filled with opportunities and challenges, but one thing is clear: the fusion of centralized and decentralized finance with artificial intelligence is set to unlock a new era in the world of finance.

FOR MORE INFORMATION VISIT:

WEBSITE: https://cdfi.ai/

TWITTER: https://twitter.com/CeDeFiAI

TELEGRAM: https://t.me/CeDeFiAi/1844

INSTAGRAM: https://www.instagram.com/cedefiai?igsh=MWFtMnR4ajZnY25qeA==

Author

Forum Username: Tatank

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2463756

Telegram username: @Tatank

BSC Wallet Address: 0x8585deaf2f4a79f575abee557f39a82570f7f7c9