Intro to Crypto 📈 FREE COURSE ⚡Chapter 1: Introduction to Distributed Ledger Technology (DLT)

Welcome back to the @blockchainblog

📈⚡

Free Crypto Insights on Steemit

03/22/2018

Chapter 1: Introduction to Distributed Ledger Technology

Agenda:

- Distributed Ledgers

- The Classic "double-send" problem

- Blockchain

- Bitcoin Mining

- Disruptive Opportunities

1) Distributed Ledgers

On Halloween 2008, during desperate times after the financial crash, an article was released by a pseudonymous author named Satoshi Nakamoto. The article was titled “Bitcoin: a Peer-to-Peer Electronic Cash System”.

Most importantly, the paper introduced the concept of a blockchain to solve the classic “double-spend” problem without a central intermediary. Since then, a stampede of new cryptocurrencies has emerged.

2) The classic “double-spend” problem

If Alice has $10, she may send it to Bob or to Charlie; however, if she sends it to both Bob and Charlie, then the payment system at hand is no longer useful. This is often described as the “double-spend” or “double-count” issue.

In traditional payment systems, a central operator (such as a bank or a credit card issuer) that verifies transactions and is responsible for solving the double spend problem. In traditional systems, there is always some kind of trusted third party that prevent funds from multiplying.

3) Blockchain to the rescue

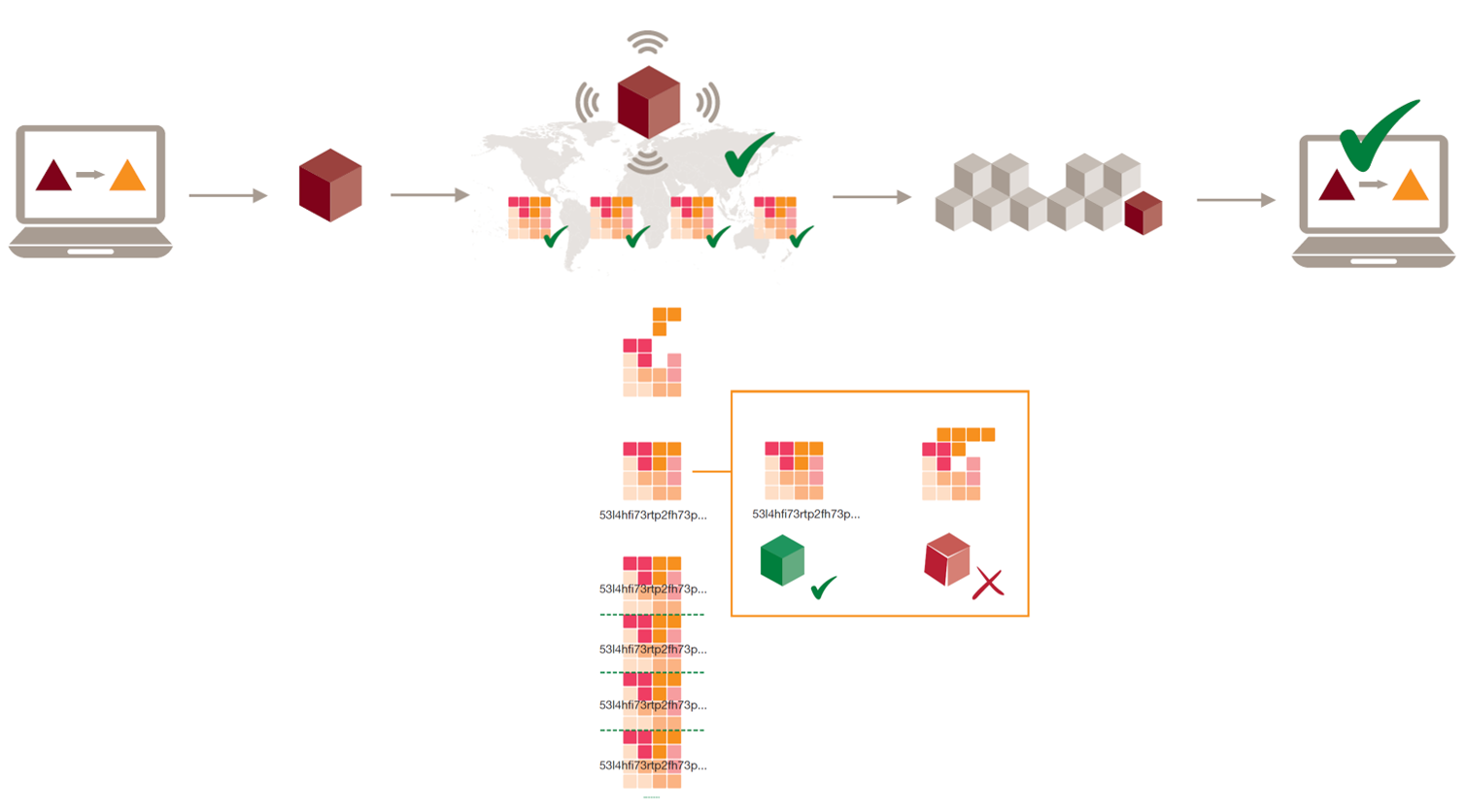

Blockchains can verify transactions through consensus algorithms and smart contracts, without the need for a central authority such as a bank.

A blockchain is simply a chain of blocks, where each block may contain transactions of assets between parties. Each new block contains a link to the preceding block, all the way to genesis block (the first block on the chain).

A valid blockchain may not contain conflicting transaction. Invalid blockchains are ignored by the system. When a system user observes a transaction of $10 from Alice to Bob, they may verify if that same $10 was previously transacted or not.

Nonetheless, this alone does not solve the double spend problem. There could be more than one valid blockchain: one where Alice send $10 to Bob and another where Alice send $10 to Charlie. So which blockchain is correct?

For the payment system to be useful, there must be a way to ensure that no payment is considered complete until the “correct” blockchain is determined. Bitcoin’s blockchain solves this problem with a consensus algorithm called “proof-of-work”, also known as “mining”.

4) Mining Bitcoins

Mining is a system that verifies, authenticates and keeps track of transactions in a distributed ledger. It is accomplished by attaching billions of energy costly computations to a blockchain and rewarding miners for extending the longest blockchain.

If there are two valid blockchains, eventually one will become longer than the other one. Since miners are rewarded for simply extending blockchains, the longer blockchain will continue to grow longer so long as the bitcoin system continues to operate.

One would have to outpace all the miners in the world to make the shorter blockchain longer, which is technically impossible with current computational technology.

The mining reward also solves another problem: asset distribution. Bitcoin is not issued by any central authority and cannot be endlessly printed on fake paper bills. Instead, the Bitcoin blockchain gives bitcoins to those who secure the blockchain by mining.

5) Disruptive Innovation

As the source code of Bitcoin was made available to the decentralized WEB, dozens of competing and complimentary systems have emerged. Some pioneers saw Bitcoin and similar crypto assets as the perfect anti-government tool while other cryptographers and software engineers saw them as great advancements in financial privacy and efficiency.

Bitcoin does not rely on a central intermediary that can disallow certain transactions from occurring. As such, bitcoin cannot be easily regulated, controlled or shut down. No court order can be enforced to stop a bitcoin transaction or to seize bitcoins.

Some of these new systems were mere imitations of the bitcoin protocol and were introduced as part of a get rich quick scheme.

Certain parties would introduce a new crypto asset in the hope of controlling a significant amount of its supply, increasing the value of that asset through marketing and then sell out quickly before the scheme collapsed.

Amidst all the crypto scams, some innovators saw distributed ledgers as powerful new tools that could be optimized to solve a myriad of other problems found in the many industries. A flood of technical innovation began. As bitcoin allowed for peer-to-peer transactions, new innovations such as Ethereum were created to allow peer-to-peer smart contracts and other decentralized applications or DAPPs.Conclusion

Make sure to follow @blockchainblog. You do not want to miss all the priceless information we are about to share with you. Show is just getting started... 📈

Our goal is to educate and help you gain financial freedom.

Stay tuned!