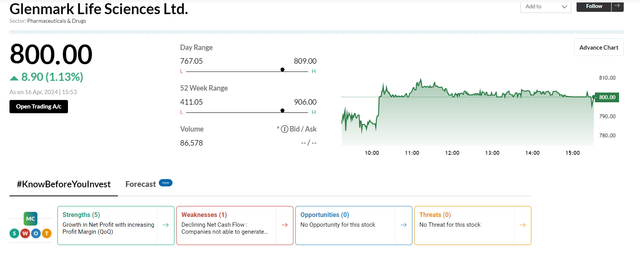

How is Glenmark Life Sciences Ltd stock?

Glenmark Life Sciences Ltd is a pharmaceutical company that was spun off from Glenmark Pharmaceuticals Ltd in 2019. The stock is currently trading around ₹478 per share on the NSE (as of April 2024).

In terms of the long-term outlook:

- Glenmark Life Sciences has a good track record in the pharmaceutical APIs (active pharmaceutical ingredients) and complex generics business. This is considered a relatively stable and growing segment.

- The company has invested in expanding its manufacturing capabilities and R&D, which could drive future growth.

- Analysts are generally positive on the long-term prospects, citing the company's strong product portfolio, diversified customer base, and growth opportunities in the global generics market.

For dividend income:

- Glenmark Life Sciences has paid dividends in the past, with a dividend yield typically in the 1-2% range.

- The company's dividend payout and consistency will depend on its future earnings growth and cash flow generation.

- As a mid-sized pharmaceutical company, Glenmark Life Sciences may not be the highest dividend payer, but it could still provide a reasonable stream of dividend income for long-term investors.

Overall, Glenmark Life Sciences appears to be a reasonably well-managed pharmaceutical company with solid long-term prospects. It could be worth considering as part of a diversified portfolio, both for capital appreciation and potential dividend income. However, as with any investment, one should do thorough research and analysis before making a decision.

You've got a free upvote from witness fuli.

Peace & Love!