How to do long term Investing into Stocks

As a newcomer to stock trading and long-term investing, it's important to understand the different types of stocks that can be suitable for long-term holding.

Blue-Chip Stocks:

- Blue-chip stocks are shares of large, well-established companies that have a history of financial stability, strong brand recognition, and consistent dividend payments.

- These companies are typically industry leaders and tend to be less volatile in the short term, making them a good choice for long-term investors.

- Examples of blue-chip stocks include companies like Apple, Microsoft, Coca-Cola, and Johnson & Johnson.

Dividend-Paying Stocks:

- Dividend-paying stocks are those that regularly distribute a portion of the company's profits to its shareholders.

- These dividends can provide a steady stream of income, which can be reinvested to compound your returns over the long term.

- Companies that have a track record of consistently paying and increasing their dividends are often considered good long-term investments.

- Examples include companies like Procter & Gamble, Exxon Mobil, and AT&T.

Index Funds:

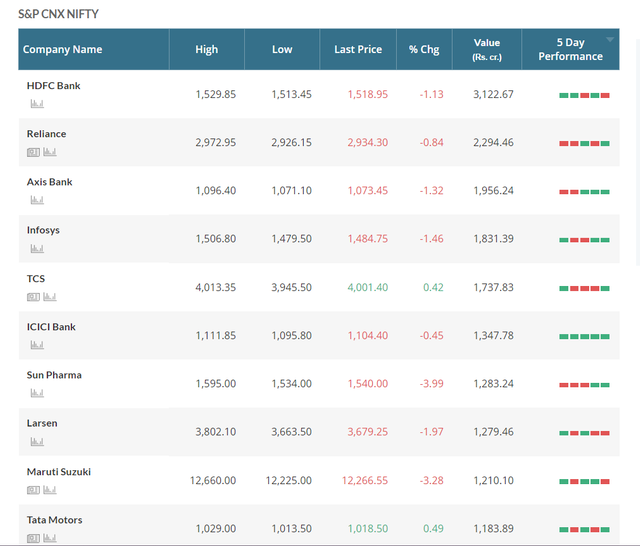

- Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500 or the Nasdaq Composite.

- These funds provide instant diversification by investing in a broad range of companies, reducing the risk associated with individual stock selection.

- Index funds often have lower fees and have historically outperformed actively managed funds over the long term.

- Examples of popular index funds include the S&P 500 Index Fund (SPY) and the Nasdaq-100 Index Fund (QQQ).

Growth Stocks:

- Growth stocks are shares of companies that are expected to experience above-average growth in earnings and revenue compared to the overall market.

- These companies are often in sectors like technology, healthcare, or consumer discretionary, and can provide significant long-term capital appreciation.

- However, growth stocks can also be more volatile in the short term, so it's important to have a long-term investment horizon.

- Examples of growth stocks include companies like Amazon, Tesla, and Netflix.

When investing for the long term, it's generally recommended to diversify your portfolio across different sectors and asset classes to manage risk. Start with a mix of blue-chip stocks, dividend-paying stocks, and index funds, and then consider adding growth stocks as your investment knowledge and risk tolerance grow.

Remember, long-term investing is a journey, not a sprint. Be patient, do your research, and stay disciplined in your approach to build wealth over time.

Sort: Trending

[-]

successgr.with (73) 19 days ago