Zero-Based Budget Template: When $0 Is the Right Thing to Do

You can’t improve what you don’t measure. That’s why budgeting has always been a cornerstone of financial planning, whether for individuals or businesses. Tracking where every dollar goes helps you avoid financial pitfalls, eliminate unnecessary spending, and create a clear path to achieving your financial goals.

One of the most effective ways to manage your finances is by using a zero-based budget. This budgeting method assigns a purpose to every single dollar, ensuring that your income is fully allocated across essential expenses, savings, and other financial goals. The aim? To have your income minus your expenses equal zero.

In this article, we'll explore everything you need to know about zero-based budgeting, from how it works to how you can use it to manage your finances effectively. Plus, we’ll guide you through creating your very own zero-based budget template.

What Is a Zero-Based Budget?

A zero-based budget is a budgeting strategy that requires you to allocate every dollar of your income to a specific purpose, such as expenses, savings, or investments. The goal is to make sure that, by the end of the month, your total income minus your total expenses equals zero. This doesn’t mean spending all your money—it means ensuring that every dollar has a job, whether it's paying bills or contributing to savings.

Unlike other budgeting methods that may focus on general estimates or rough percentages, the zero-based budgeting method gives you complete control over where every cent goes. For example, if your income for the month is $3,000, you’ll need to allocate every dollar of that amount until you reach zero.

By doing so, you prevent overspending, manage debt, and save more effectively, as this method forces you to prioritize your financial decisions.

How Does Zero-Based Budgeting Work?

The key idea behind zero-based budgeting is that your income should match your expenses exactly. Here’s a step-by-step breakdown of how it works:

Calculate Your Total Income

Start by calculating all your sources of income for the month. This could include your salary, freelance work, side hustles, or any other regular income streams. Be sure to use your net income—the amount you have left after taxes and other deductions.List All Your Expenses

Next, make a comprehensive list of your expenses. These should include both fixed expenses (like rent or mortgage payments) and variable expenses (like groceries and entertainment). You may also want to include occasional expenses like car repairs or insurance premiums.

Be as specific as possible—every dollar should be accounted for. Some common expense categories include:

Rent or mortgage

Utilities

Groceries

Debt payments

Savings contributions

Subscriptions and memberships

Allocate Every Dollar

Once you’ve listed all your expenses, it’s time to assign each dollar of your income to one of those categories. The goal is to match your income to your expenses so that by the end, your budget equals zero. If you find yourself with money left over, you can allocate it toward savings or investments.Monitor and Adjust

The final step is to monitor your budget throughout the month and make adjustments as necessary. Life can be unpredictable, and unexpected expenses may pop up. The beauty of a zero-based budget is that it can be flexible—you can adjust your allocations as needed, as long as you ensure your final budget still totals zero.

What Should You Use Your Zero-Based Budget For?

A zero-based budget is one of the best tools for managing both short-term and long-term financial goals. Here’s how it can help you:

Build an emergency fund: Allocate a portion of your income toward creating a safety net for unexpected expenses, such as medical bills or car repairs.

Control spending: By assigning every dollar a job, you can avoid impulse purchases and stick to your financial plan.

Pay off debt: A zero-based budget allows you to focus on debt repayment by allocating funds specifically for paying off loans, credit cards, or other liabilities.

Boost savings: With all your spending accounted for, you can easily direct any leftover funds toward your savings goals, like retirement or a vacation.

Plan for the future: Whether you’re saving for a down payment on a house or a new car, a zero-based budget helps you manage your money with long-term goals in mind.

By using a zero-based budget, you gain more control over your finances, reduce financial stress, and increase your confidence in managing money effectively.

Advantages and Disadvantages of Zero-Based Budgeting

As with any budgeting method, there are both pros and cons to using a zero-based budget. Let’s explore both:

Advantages

Complete control over your money: With a zero-based budget, every dollar has a specific job, which gives you full control over your spending and savings.

Flexibility: While the budget is strict, it’s also flexible enough to accommodate changes. You can adjust your allocations if unexpected expenses arise.

Improved financial discipline: This method forces you to focus on your financial goals and avoid wasteful spending, which can lead to more responsible money habits.

Better debt management: You can prioritize debt repayment in your budget, helping you pay off loans faster.

Disadvantages

Time-consuming: Setting up a zero-based budget can take time, especially if your income and expenses vary each month.

Requires attention: This method demands close attention to detail, which may be overwhelming for some.

Limited flexibility for high-variable incomes: If your income fluctuates significantly from month to month, it can be difficult to stick to a rigid zero-based budget.

How to Create a Zero-Based Budget

Creating a zero-based budget is simpler than you might think. Follow these steps to set one up:

Step 1: Calculate Your Income

Gather all your income sources, including salary, freelance earnings, and side hustle income. Ensure you’re working with your net income (after taxes).

Step 2: Track and List Expenses

List out all your expenses, from the essentials like rent and groceries to discretionary spending like entertainment or dining out. Be honest about what you spend each month to get an accurate picture.

Step 3: Assign Every Dollar a Job

Now, assign every dollar of your income to an expense category. If you have money left over, direct it toward savings or debt repayment.

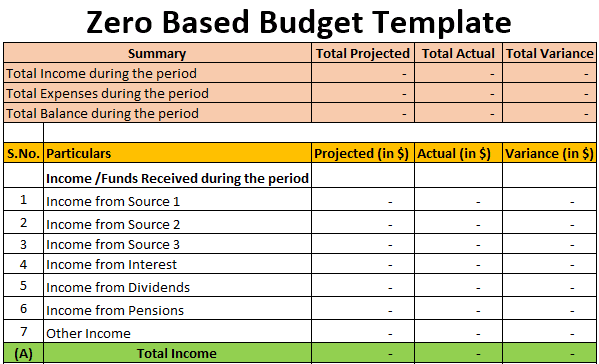

Step 4: Use a Budget Spreadsheet

You can make this process easier by using a budget spreadsheet in Excel or Google Sheets. There are also plenty of zero-based budget templates available online, which we’ll explore below.

Where to Get a Zero-Based Budget Template

If you want to save time and avoid creating a budget from scratch, you can use a pre-designed zero-based budget template. Here are a few options:

Smartsheet Zero-Based Budget Template: This user-friendly template allows you to track both income and expenses easily.

https://www.smartsheet.com/

https://www.vertex42.com/ExcelTemplates/zero-based-budget-worksheet.html

Microsoft Excel Budget Template: Excel offers a built-in zero-based budget template that you can customize based on your financial needs.

Using a template takes the guesswork out of budgeting and allows you to quickly and efficiently track your financial progress.

Conclusion: Why a Zero-Based Budget Is Worth It

A zero-based budget can seem daunting at first, but the benefits far outweigh the initial time investment. By forcing you to account for every dollar, this method helps you take control of your financial future. Whether you’re trying to get out of debt, save for a big purchase, or simply improve your money management skills, a zero-based budget gives you the tools you need to succeed.

With tools like Excel and pre-designed templates, creating your budget is easier than ever. Start today and see how a zero-based budget can transform the way you handle your finances!

Source: https://royalcdkeys.com/blogs/news/zero-based-budget-template-when-0-is-the-right-thing-to-do