What are the reasons behind Bitcoin's record increase?

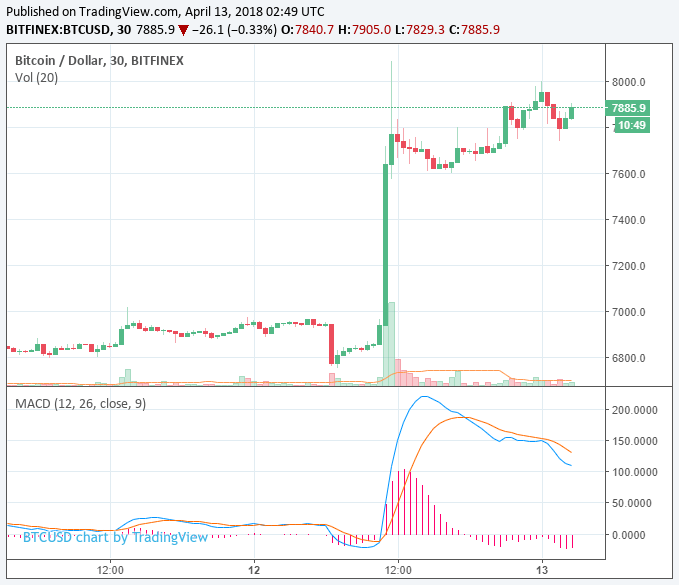

What are the reasons behind Bitcoin's record increase? Bitcoin maintains a 13 percent gain after the record increase. Bitcoin, the most dominant cryptographic currency in the global market, rose from $ 6,900 to $ 8,000, increasing by 15.94%. With the introduction of massive purchasing volumes, the price of crypto money increased by $ 1,100 in a 30-minute window.

Bitcoin price surged by 16 percent

Some reports suggest that Bitcoin performed the most transactions within an hour on a 12-year date. It is difficult to verify these data, given that the transaction volume of all cryptographic exchange transactions on the global market needs to be analyzed. Bitcoin saw a sudden increase of 16 percent in price due to its large market valuation and high daily trading volume.

Need billions of dollars to influence bitcoin price

Billions of dollars have to be traded to affect the bitcoin price (BTC), which is over $ 9 billion of daily trading volume. More importantly, billions of dollars of new capital needs to flow into the crypto money market to boost BTC and bring the entire market together.

Crypto money market valuation increased more than 20 billion dollars

The increase of BTC on April 12 was not due to investors moving to Bitcoin from alternative crypto currencies (sub-coins) or transferring their funds to Bitcoin from other major crypto parcels. Because, on the same date, the valuation of the crypto money market has increased more than 20 billion dollars.

There are new investors behind Bitcoin's record increase

There is a wave of new investors behind Bitcoin's record increase. Potentially, a few institutional investors quickly allocated billions of dollars to the market. These investments led to a short-term pump, which allowed the price of the crypto currency to rise.

It is impossible to justify a single factor to justify the price trend of Bitcoin

It is almost impossible to cite a single factor to justify the price trend of any crypto currency. Because several factors can contribute to the momentum of a crypto currency. In this case, the question of whether BTC has increased due to the introduction of institutional investors or individual investors has less precaution. The most important indicator is that Bitcoin will reach a level of support of $ 7,500 during April, and the recent price increase will allow Bitcoin to bounce back to the $ 8,000 zone with a strong momentum.

"Corporate investments will further increase the value of cryptographic money."

On April 12, it was reported that Pantera Capital, one of the longest-lived crypto-currency-focused protection funds on the global market, was in a bottom-up call for Bitcoin, and that the market would soon return to reasonable levels. Panthera Capital CEO Dan Morehead and Joe Krug, the founder of Augur, who works as a manager on the hedge fund, said:

For those who are new to Pantera, it will always take a long time for those who think a fund manager like Pantera can think. I rarely have a strong belief in timing. Institutional investments will further increase the value of crypto money.

Individual investors' opinion on crypto money market changes

Investors and businesses were tired of seeing the introduction of the market for institutional investors and individual investors as an important factor in the long-term price increase of Bitcoin and other crypt money. The fact is, institutional investors' demand for the market still does not exist. But in April, the view of individual investors on the crypto money market changed after George Soros, the Rockefeller family and Rothschild's entry into the market.