MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 14 June 2021 (17.6% APR)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.338%, equivalent to 17.6% APR and 19.2% APY.

This is higher than most individuals can earn from vesting their own STEEM.

This post is on time this week!

There will be an announcement in a few days about some changes. These are designed to increase slightly the income to those members who are both supporting the fund and still connected to the site.

I shall also simplify again these posts as they have grown wilder over the weeks.

There is a lot of information to get through today, so please read the News below very carefully.

Some sections may appear repetitive, but some important news does not always change on a weekly basis. I also doubt that every member reads every weekly post, so worth repeating some things.

General Info

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

Please delegate to @accelerator, who is the issuer of the MAPR token. There is no delegation option within the Steemit wallet, but you may use steemworld.org; just go to the Delegations tab on the left, then click Delegate.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 25.7% [1a], 14.6% [1b], 14.2% [1c]

Value of Steem author rewards payouts = APR 100.0% (360%!!) [2a], 57.0% [2b], 55.0% [2c]

Distributed MAPR payouts = 0.338% (APR 17.6%) [3]

Projected Compounded APY 19.2% [4]

Average APR 18.9% (26-weeks)

MAPR BUY Price: 1.218 STEEM [5]

MAPR Price increase = +0.0% APR

MAPR SELL Price: 1.248 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards for most users [2a, 2b & 2c].

Profits will be paid today in the new MAPR tokens. The token buy-backs on Steem-Engine may need to wait a few hours for our power-down to take place.

MAPR News

Since changing the minimum delegation amount to 100 SP, I have been thinking of how to further increase the income distribution to those who contribute the most. The fund is quite small now but continues to earn significant income. Anyway, I shall announce a solution later this week. No, really!

The buyback price will now be fixed at 1.218 STEEM. Everybody has had a good ride, I hope this stimulates some token sales; it also means more income going to delegators, who are those that help generate the income in the first place.

Minimum delegation amount is now 100 SP.

One game-theoretic part of MAPR seems to be overlooked by delegators. The weekly income is split fairly in the ratio of delegators to token-holders. This is how we are able to change the buyback price - that part of the income is turned into the capital held by token-holders. But this also means that if everybody just keeps their tokens, the amount paid to delegators directly slowly falls. It has now reached the point where I have fixed the buyback price in the hope that more tokens are sold off. This will have the effect of increasing our distribution - slowly, but surely.

One other source of income that delegators seem to overlook is their own votes! I've never placed voting as a condition of distributing our rewards, but it remains disappointing to witness the lack of care. In essence, member-voters would be getting a large chunk of their vote back anyway; and if you know how the curation curve works, you could get back more than the vote is worth. Never mind.

Our income distribution remains fairly consistent, as is the raw Steem vote-yield, ignoring the SBD uplift. It has been some 2 months now that our income has been in a narrow band between about 17.8% and 18.2%. All this within a crypto market that has seen pumping and dumping like a nodding donkey!

MAPR has been going for over 3 years and every member has made a decent profit. Times have changed and I need to take steps to improve the current yields.

As always, shall monitor our returns and how they reflect the blockchain's own activity and rewards.

Returns for delegators remain very good compared to the overall blockchain yield and the MAPR token price has held its value compared to so many others.

We shall continue to generate yields that are as high as we can given the economic model.

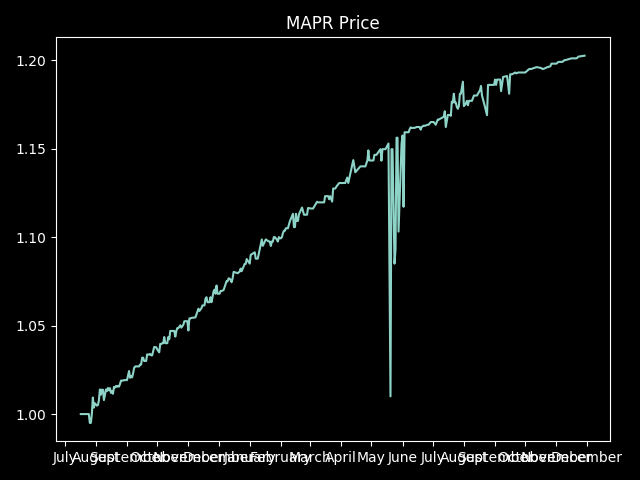

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

Note, looks like since SE changed domain, this graph-generator is not working. Just imagine it extending upwards! I'm not sure this feature will ever return, so it may end up being a historical document!

MAP Rewarder, without the token, has been in operation for some 36 months, so you can extrapolate back from that graph to get an idea of our returns to members. We "celebrated" 3 years of operations at the start of February.

Anyway, don't panic! We may need to flatten the curve slightly but, to be honest, this is the least of our worries.

See you next week!

I hope you all survive 2021!

Next rewards distribution will be on Monday 21 June.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

Am new here.

I will be glad if you make time to take me through this

Delegate a minimum of 100 SP to @accelerator and we pay rewards weekly in MAPR tokens that can then be sold on the market or kept to compound.

Rates are variable and posted every week.