Nexty: the future of the payment systems

WEBSITE ANN TWITTER TELEGRAM FACEBOOK

🔽 🔽 🔽 🔽 🔽 🔽 🔽

Every day new ways to transfer money appear. But what is the reason for the appearance of new payment systems? Why are the existing types of banknotes: cash, cashless payments, plastic cards failed to satisfy all the needs of users?

The answer is obvious and simple. Electronic money can all and even a bit more. Web-money can be paid for goods and services, one can transfer money as payment, replenish the account of a mobile phone and even buy food. Of course, e-currency will not be able to replace a habitual cash. There are still many goods that are sold only ‘from hand to hand’ and t is still impossible to pay for them with bills (for example at the market).

The advantages of E-payments

But still it's necessary to mention all the advantages of e-payment and tendencies of its development.

In addition to the speed of transfers, electronic money has more advantages over cash:

- Unlike cash, there is no need in recounting e-money and there is no need in change;

- It does not occupy a physical place in your wallet;

- It does not require the resources on making coins or banknotes, it does not have a material expression;

- Savings and storage of money are significantly simplified, as well as their physical protection from a possible theft;

- The moment of payment is fixed by electronic systems, so payment can not be hidden from the taxes;

- Electronic money does not wear out and does not lose its qualities over time;

- Safety and security, which is provided by cryptographic and electronic means.

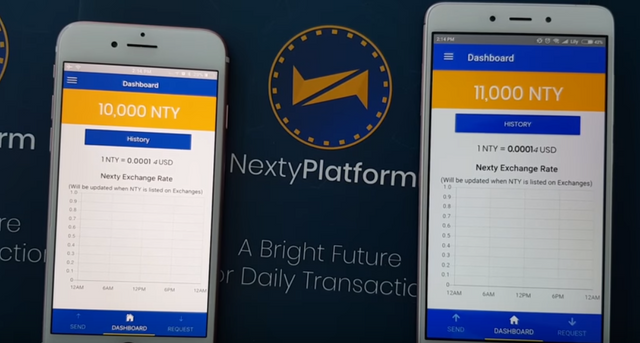

The theory of a “Unipurse”

What is in your wallet now? Payment means in the form of bank cards, paper money and checks, as well as other personal items that serve as a means of your identification. All these means - passport and money will be combined and placed in your mobile phone. Thus, mobile devices, whether tablets or smartphones, will play a much more active role than now.

The whole idea of a single purse makes bank cards unnecessary. At the same time, the risk level of such payments is reduced to zero, before every payment the bank connects with the cardholder via SMS and reassures that the operation carried out with the help of the account is safe.

The disappearance of cash will lead to the disappearance of anonymous and illegal transactions. The entire financial system will lie on the surface. A “unified mobile wallet” will provide the person with the most simple way of making payments, the presence of a single device will save his owner from wearing a wallet and a pile of paper money than can be torn apart, get wet or a necessary document is completely lost. Tracking the location of a consumer through a mobile device one can analyze a purchasing behavior in real time and offer personalized recommendations based on the analysis of data. For example, informing about special promotions or offers based on information received based on the current location of a person. And the purchase history will allow you to offer more accurate loyalty programs to encourage your customers.

Look at the Nexty video review:

🔽 🔽 🔽 🔽 🔽 🔽 🔽

Autor this article: adamreb

https://bitcointalk.org/index.php?action=profile;u=1334940

0x9612cfd9fa69290890c0af63f13c3561bfa84313