Does Technical Analysis Work in Crypto Markets?

Image from https://cdn.weisseducation.com/

I’m positive this post will either have people nodding their heads or screaming I’m an idiot, so let’s see how that works out. The comments are likely to be as relevant to this as the content of my post.

The Question of Why is Technical Analysis Used in Crypto?

The essence of my question is that I have found myself second guessing the value of technical analysis (TA) in crypto assets and thought I’d document my thoughts. It’s also true that some investors rely heavily on technical analysis and believe it works, while others believe it’s nothing more than a contemporary incarnation of astrology. The question I find myself continually asking when I think about this issue in crypto is, can we really predict the future based on averages of what has happened before, when there isn’t a stable historical period we can base our mathematical models on?

We use charting to foresee price targets and predict when to buy and sell assets. This charting is considered as an exact prediction as to when we should move – i.e. buy, sell, hold (I’m not going to use HODL as I’m trying to be somewhat sensible here). By all accounts, chart analysis helps predict a future state with a degree of certainty so that we can make better investment decisions, especially where highly likely outcomes are expected.

Why Does Technical Analysis Work?

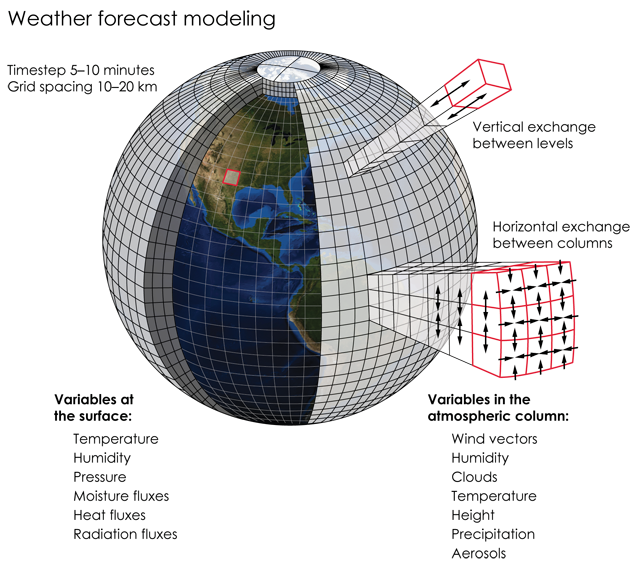

Using statistics to predict price changes, based on what’s happened in the past, can only work when the fundamental market drivers remain somewhat constant. Most disciplines that attempt scientific forecasting rely on complex mathematical models factoring millions of input variables across an incredible landscape of changing baselines, to try and offer a view of the situation soon, over a medium range and in the long term. Take weather forecasting as the perfect example. Looking at charts of barometric pressure, temperature and humidity, forecasters can determine the location and direction of progression of weather fronts, and from that they can give you an idea whether you need your umbrella or sunscreen.

But here’s the thing. How often have you cursed the weather prediction you were relying on for planning that picnic at the weekend only to have it rain when it should have been sunny. It may seem straightforward to forecast the weather a couple of days in advance, when we consider only three variables – pressure, temperature and humidity – but there is so much more to the synoptic weather picture at any one time, especially at the local level, than a simple model can give you. What if there is a fire, pushing more condensation nuclei into the atmosphere, hence helping clouds form, making it more likely for rain? Concrete in cities raises the local air temperature higher than it otherwise would over countryside, so urban heat islands need to be considered in the model. Coriolis force, solar winds, volcanic ash, hills, valleys, etc. are all factors that change local weather. But how can they all be factored into the model and how can that model continually take input from sensors to ensure it re-calibrates as things change? It’s a big problem. But the good thing about the chaos of weather is that it at least doesn’t have the one thing that financial system also need to consider, as well as all the other fundamental inputs. Human sentiment.

Image courtesy of https://www.earthmagazine.org

Yet strangely enough, large-scale systems like forex markets are predictable, largely. The reason in this kind of market is that banks have predicable and well-understood reasons to maintain the price of any given currency, making changes relatively easy to predict – I say relatively since political unrest suddenly kicking off in a major US export market could drastically affect the short-term price of the dollar, which wasn’t in the ‘model’. So in all reality, technical analysis can work in a market like forex, especially when we can develop AI and machine learning systems that can take a lot of input from a variety of sources and re-baseline the model as things change. It’s a relatively simple system, albeit on a macroscopic global scale.

Technical Analysis and Equities

This is where the fun starts. Day traders don’t have the time to study fundamentals of a company or stock, so when enough people follow a pattern of relying on previous history, then the charts effectively become the astrological guide to the human psyche. We predict what the whimsical (in the nicest possible way) investor will do, based on what they all collectively have done in the past, then use this analysis to inform investment decisions later today, tomorrow and maybe a little after that. In all honestly, charting doesn’t really help with investments, aside from timing when to buy in, but after that if you are investing, it pays to learn about the company and make your decisions based on what they are doing. However, the madness of the crowd will certainly drive the price up or down in the short term, so understanding how good news will affect a popular technology stock over the next few hours is entirely possible. Also, when you know a mining company releases quarterly dividend statements and one is coming up, you should be able to predict how the day traders will react.

Interestingly, over time most academic studies into technical analysis have sat firmly on the side of sceptical, but more recently studies from prominent mathematicians have shown that there might be some evidence to show that at least some of the predictive methods work.

Personal Bias

One massive issue we see time and time again is where personal investing bias is used to influence a market one way or the other. It’s very easy for an investor who wants the price of a stock to go up to select only the TA indicators that show this wish to be correct. There are well over 100 TA indicators that a trader could choose from, so why has the trader chosen one over the other? With the advent of Twitter and StockTwits, etc. it now seems the norm for everyone to use charts to try and influence the crowd to buy into their own desires. I’ve lost count of the number of time I have seen, “Look at $XYZ – obvious cup and handle pattern so definite time to buy…”.

Now, in a large cap market, where there are millions of investors, some guy’s tweet or Facebook post won’t make one $IOTA of a difference (see what I did there?) but in a small cap market, where only a few tens of thousands or even less people are looking to get rich quick, then the guy calling in the TA charts and sounding scientific will certainly influence group think. Again, TA isn’t working here, rather it’s being used to cause an outcome that can be predictive, but it’s the group think and leader following that causes the change, rather than passively predicting. One person’s tweet, leads to a retweet, which leads to someone else’s pump, and so on.

Image courtesy of https://upload.wikimedia.org

Crypto and TA

So, you can already see my bias towards fundamentals is coming through, but I’ve tried to remain somewhat on the fence. In small cap markets, especially crypto, where wild (and I mean wild) swings of sentiment are commonplace, we get massive bull runs before massive crashes. TA cannot predict these. We can use sense to predict that something that’s risen massively over two months can’t sustain that pattern forever, and there will come a time when people want the cash their investment has realized. Taxes need to be paid, college fees need settling and the family wants a holiday. We invest to make money, so at some point bulls will sell and when they do, they want the market to drop so they can use some of those profits to buy back in. But crypto is driven by sentiment, since there is no intrinsic utility yet. We can’t yet go to McDonald's and buy a Bit Mac. When we can, will anyone want to use their coins, because if it doubles in price tomorrow, they could have got fried and a coke for the same number of Satoshis. The so-called velocity of this currency is so low that no one wants to part with it – it’s an investment rather than a utility currency. So, if it’s only value is buy, sell or hold, then it’s no wonder it’s a roller coaster.

However, can we really use TA to predict where $IOTA will be tomorrow? If South Korea suddenly decides that crypto is great and they integrate it into their high-street ATMs, then bitcoin will sail, and every ALT will follow along. If China decides to punish anyone using crypto with imprisonment and manual labor, sentiment will push the price down and so will $IOTA’s price follow. But is there enough history to use the same predictive indicators, such as the cup and handle, on an ALT coin that has only been in existence for six months? Just before Christmas, several high-profile Twitterers, such as John McAfee, started doing Coin of the Week, where he’s point investors at an ALT investment he was looking at. What happened next – the price went through the roof. If John says it’s good, then it must be. Like sheep we follow. It’s lazy and it’s not what investors should be doing. The same goes for TA. This cannot work in crypto currencies, since there is no way to predict in a market where we have no historical data. What drives this market is entirely different, with a different kind of participant, with a modern mindset and modern objectives.

Investing in Crypto

Unless you don’t really care and are happy to follow the shill, my recommendation is to understand what you are investing in and ignore technical analysis. Simple price charts are nice, and they show what’s happened in the past, so you can see how your investment has performed, but they won’t help you see around the next corner. If it really worked, at all, why did so many investors lose their money over the past six weeks? Simple, it’s unpredictable. I’d rather put my faith in the efficient-market hypothesis, which states that the price at any given moment fully reflect all available information for that asset. A wildly moving price will means something is up. If you know your asset and you have sensors in the wind to pick up on changes, you’ll see what’s causing the market to move. TA is as useful as soothsaying or tea leaves in crypto and instead of lazy investing where you look for a quick decision-making tool, do your research and it’ll pay off in spades as you learn to predict the future based on facts rather than the stars.

Good luck in your investments, no matter how you decide what to buy.

CZ

Congratulations @cthulhuzappa! You received a personal award!

Click here to view your Board

Congratulations @cthulhuzappa! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!