Whale Watching: How to Spot Crypto Whales

A whale is a someone who has a lot of money to trade and can cause massive waves in the price of a cryptocurrency. Whales attempt to sway prices towards their preferred direction and usually succeed in the short-term.

Spotting a whale early could allow smaller traders to go along for the ride and profit alongside the whale as well as avoid being crushed by the whale and being left with losses.

How to Detect When A Whale Is BUYING

Looking to go long (buy) an altcoin? Why not wait for a whale to appear first?

CLUE #1: Look for abnormal increases in the bid size throughout the order book.

Let’s say this is a normal order book for a cryptocurrency. Normally, the average bid size is 1000 and the average ask size is 1000.

If there is a whale in the house, the order book might look like this:

Notice the difference in magnitude of the bid sizes.

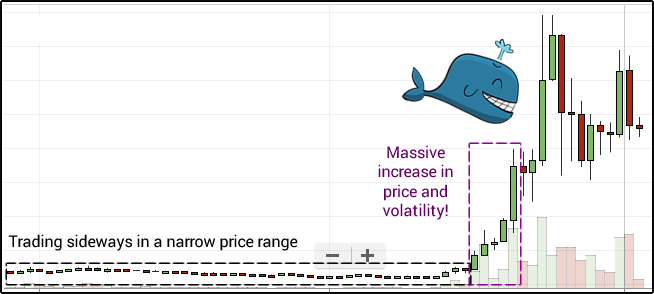

CLUE #2: Look for an increase in volatility and price during a quiet period.

If a coin has been trading within a narrow range in a recent period, and all of a sudden….there is an unusual increase in volatility AND price spikes upwards, there could be a whale or whales in the house.

CLUE #3: Look for an acceleration of buying volume versus selling volume.

In a normal market, you’d usually see volume split evenly between the bid and the ask orders. This means 50% of the volume are buyers and 50% of the volume are sellers.

If price is an uptrend, buyers may be 60% of the volume, while sellers are 40%. And vice versa, if price is in a downtrend.

But if a whale is in the house, you’ll see an acceleration of volume on the buying side.

For example, if 90% of the volume is on bids within a short window of time, there’s probably a whale there.

How to Detect When A Whale Is SELLING

Assuming you’re not hodling, you don’t want to be long when there is a bearish whale, also known as a BearWhale, lurking.

CLUE #1: Look for sudden cancellations of big buy orders.

If you see large bid sizes starting to quickly disappear in the order book, there might a whale in the house who is about to take a massive dump (sell in large quantities).

Here’s what an order book might look like before the whale makes its move:

And here’s how it looks right before the whale is about to sell:

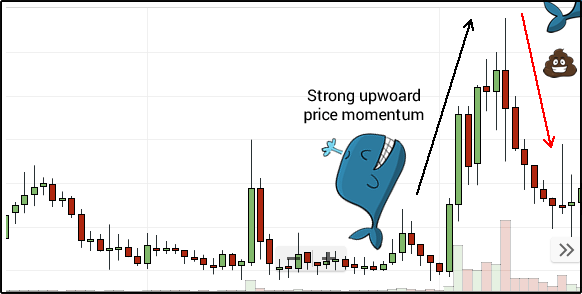

CLUE #2: Look for very strong momentum in price within a short amount of time.

When a coin has skyrocketed in price in a short amount of time, it’s considered to have very strong momentum. But it’s very likely that this momentum will quickly disappear just as fast as it appeared.

Why? Because the price was probably not driven by any new material information or real news, but due to a whale in the house driving up the price.

Once price has reached a certain level, the whale will stop eating (buying large quantities) and will want to take a massive dump (sell in large quantities).

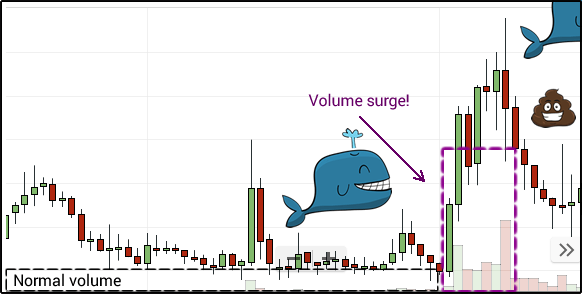

CLUE #3: Look for very strong acceleration in volume.

If there is a sudden surge in volume and the amount of trading volume is abnormally high relative to recent volume (e.g. 3x larger than usual), there might be a whale in the house.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.babypips.com/trading/how-to-spot-crypto-whales

Interesting read thanks

Congratulations @didas! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Crypto whale watching is awesome but have you actually tried watching whales from shore or land? No? Well, you should definitely try it and here are some binos that can help you spot the creature taking your safety into consideration.

https://binocularsumo.com/reviews/whale-watching

Thanks for the insightful article and think about https://www.cameraio.com/