Crypto Portfolio Update

My portfolio performed quite well in 2017 - I made 12x - so no complaints from my side.

But comparing that to the market and to portfolios of my friends it seems I missed out a lot. (Friend of mine did 30x in 2017).

One source of the lost alpha is that I did some bad trades. That I identified already.

But now I want to realign my portfolio for the next run which I expect Feb through May. I want to realign as I think I am to concentrated at the moment (the opposite of my portfolio in the first 9 month of 2017).

At the moment I have about 25% BTC, 35% ETH and 20% Dash. That is already 80%. Than I have Steem 6%, Lykke 4%, Bitcoin Cash 3%, EOS 2%, Civic 1%, SmartCash 1%. Rest are non tradeable coins (Tezos, BOScoin, EQB).

My strategy I am aiming for is to invest in the top 10 coins (except for Ripple and Stellar) plus some extra picks like Smartcash, Civic, EOS, Steem.

Any comments? How were your portfolios doing in 2017 and which coins do they include?

Any suggestion for "must have" coins out of the top 10?

all good coins :) the onlyi dont have from those is Lykke. Sadly i did buy XTZ..

True, but I am waiting for how Steem and SBD will perform after the launch of SMT, I am curious to watchout the trend of Steem and SBD.

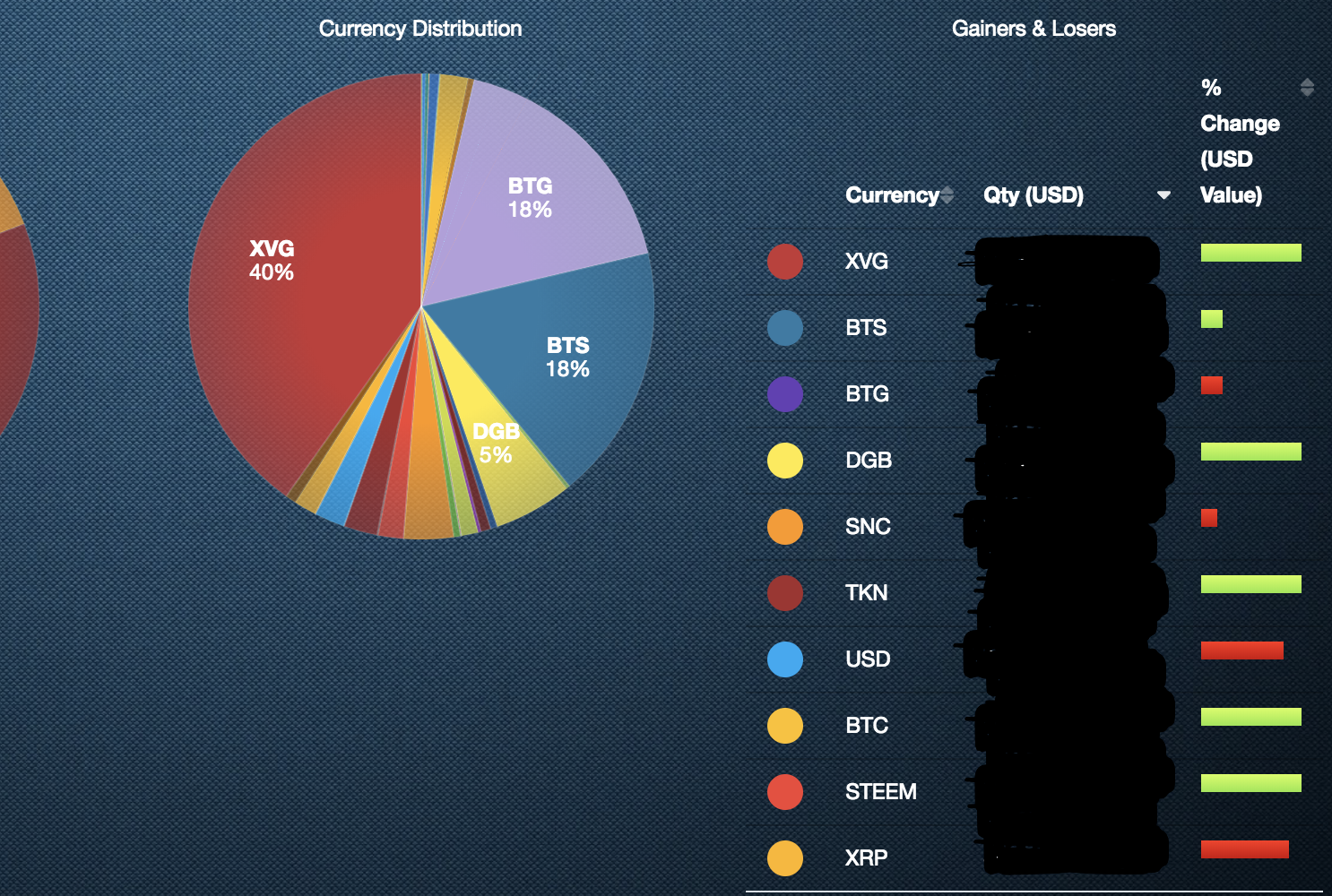

This is what I have!

I have been doing very well and I am very satisfied. What methods does everyone use? I basically used Elliott waves and Chart patterns I do my own analysis now and I have been able to earn good % off of my calls...

I am aware a lot or most people in the market like to use news and fundamental analysis, Does anyone care to explain how they decide what to buy and when??

Top 10 in portfolio

)

)

For example, here is a analysis I have created to determine where the price will go :

https://steemit.com/bitcoin/@cryptosuf/rdd-reddcoin-could-be-done-correcting-soon-i-expect-it-to-shoot-up

So far it has been working out very well.

Thanks!

Thanks for the good overview!

That is an interesting portfolio as it is one not betting on ETH and BTC.

Instead Verge, Bitshares and Bitcoin Gold.

Can you explain a bit more your thought process behind it? I would be very interested.

@famunger yes I can kinda explain lol.

I got BTG at some good prices and I went oveboard and just waiting to see what happens. for a long time it was following or leading bitcoin cash and they where moving in the same exact manner. So i was happy and assuming it will take off with it. they shot up 3 weeks ago but BTG came back down. Nonetheless I am still holding as I believe it is undervalued and will soon be in the thousands.

XVG and BTS are very good coins from a fundamental perspective and from a TA perspective and both are going to rise very soon IMHO.

When I started I noticed how slow BTC moves and really didn't like it. I love BTC for everything it is, expect the % gains.

I see it as being a save investment/ long term. When I make alot of money I do plan to put SOME in BTC.

So far betting on ALTs has been very successful although I am aware it is risky because of the nature of alts.

Sometimes I will jump back into BTC and ride the rallies if a ALT looks like its going down ot not going up a lot. that too has been working well. :)

Hi @famunger! Good start of the year to rebalance a bit :-) I did the same thing in the last days and will post an update about that shortly.

Anyways, I think it is most important to 'define' your portfolio. Do you want to have a diversified and more 'safe' collection of coins or do you want to have more upward potential and more risk? Which part of your portfolio should have which aim? I would try to set some guidelines for yourself around that :-)

Looking at your portfolio, maybe it is interesting to reduce a bit of your ETH position and pick 1 or 2 other 'platform' coins to invest in. NEO might be interesting since a lot of ICOs are coming. Waves might be another interesting one for the same reason combined with the fact that they are not that overhyped and actually are building a sustainable ecosystem (incubator, Tokonomica, liquidity fund etc.). Of course I am a bit biased since I am also invested in those, but I just like to bet on the house instead of the players ;-)

If you are looking for a few coins that are not in the top 50 (yet), these might be interesting: Neblio (platform), Vericoin (dual chain with VeriumReserve), Wagerr (blockchain betting, 15 jan release) or Ubiq (platform). They might beat the top 20 easily, but they might also never reach anywhere near the top 20 of course :-)

Good luck with the rebalancing!

Thanks @cryptotem.

I had Neo for quite a while - sold it @70. I find Neo difficult with the ICO ban of China. Or did I missed s.th. so that they will have the chance to host ICOs anyway? I still think it is a strong project but I thought price wise other projects (Qtum, Cardano) have more upside potential at the moment.

Thanks also for the "not top 50" coins. I need to look into them as I haven't heared of them at all (except for Ubiq).

I get your concerns and those are also my thoughts about Neo. I believe it means that they just had to push the pause-button, so I think it is all temporarily. I will check the status of this with the people from Neo, since they have an event in Amsterdam on the 13th of Jan that I will attend.

Those 'not top 50' coins are a good starting point, but of course there are a lot more interesting projects. Make sure to let me know when you found a different gem ;-)

BTW, I just posted a more detailed update about my cryptocurrency portfolio than usual. Maybe it is interesting for you to check out. And if you do, let me know what your thoughts are!

https://steemit.com/cryptocurrency/@cryptotem/my-strategic-cryptocurrency-portfolio-update-7-details-distribution-and-developments

Cheers!

I guess it all comes down what odds you want to play. Sure you can make huge gains on some small coin, but you can loose it equally fast. For hodling I think you have some good coins.

I would increase some EOS. I'm still long term bullish on Bitshares. Iota i think is interesting.

I think Smart Cash will make big gains.

I think my increase are similar to you but I have Steem as one of my bigger investments that has been holding me back. It looks like that will change a lot in 2018 :)

Check out DigiByte, BitBean, LDOGE, and BURST. Those are some I'm watching. EOS as well.

Hey @famunger!

With the current SBD price, it is not really wise to set your post-rewards to 100% power-up, this will burn you a lot of money ;)

You probably understand why, if you don't, I made a video about two weeks ago (https://steemit.com/dtube/@theaustrianguy/db0silea)

Regarding your portfolio - Have you thoight of IOTA?

Thanks.

You are right - I am not posting too much so I just have thought about it. Will change post-reward structure next time.

I am a little late to the party, but would say you are missing two key coins in your portfolio - BTS and GRC.

Since the fear and doubt surrounding the centralised exchanges is getting bigger, I expect the Openledger (BTS) DEX to gain significant popularity. Even now, we have C-CEX locked down for a full months, Poloniex randomly raising fees, and doubts on the actual backing of USDT. Decentralised exchanges are the future, and Bitshares is at the forefront.

GRC is gaining significant attention lately, as it is continuing to be tied to scientific progress in many fields. A lot of big investors are coming on board, buying as much as 1 million GRC (0.25% of the supply) in one go. The Gridcoin network is now effectively the world's largest supercomputer, and any scientific project can tap into it for free.

From my end, I have not looked into Lykke yet, which I see you have in your portfolio. Time to do some reading.

i think steem coin is one of the coin in top 10

so if you want u can cash steem coin.

because steem is going for big blast

i think steem coin will b good for coin cash

but to be honest your portfolio would double or triple in this year for sure :)