LTCUSD - Technical Analysis November 3, 2017 - Current price $55.03

LTCUSD

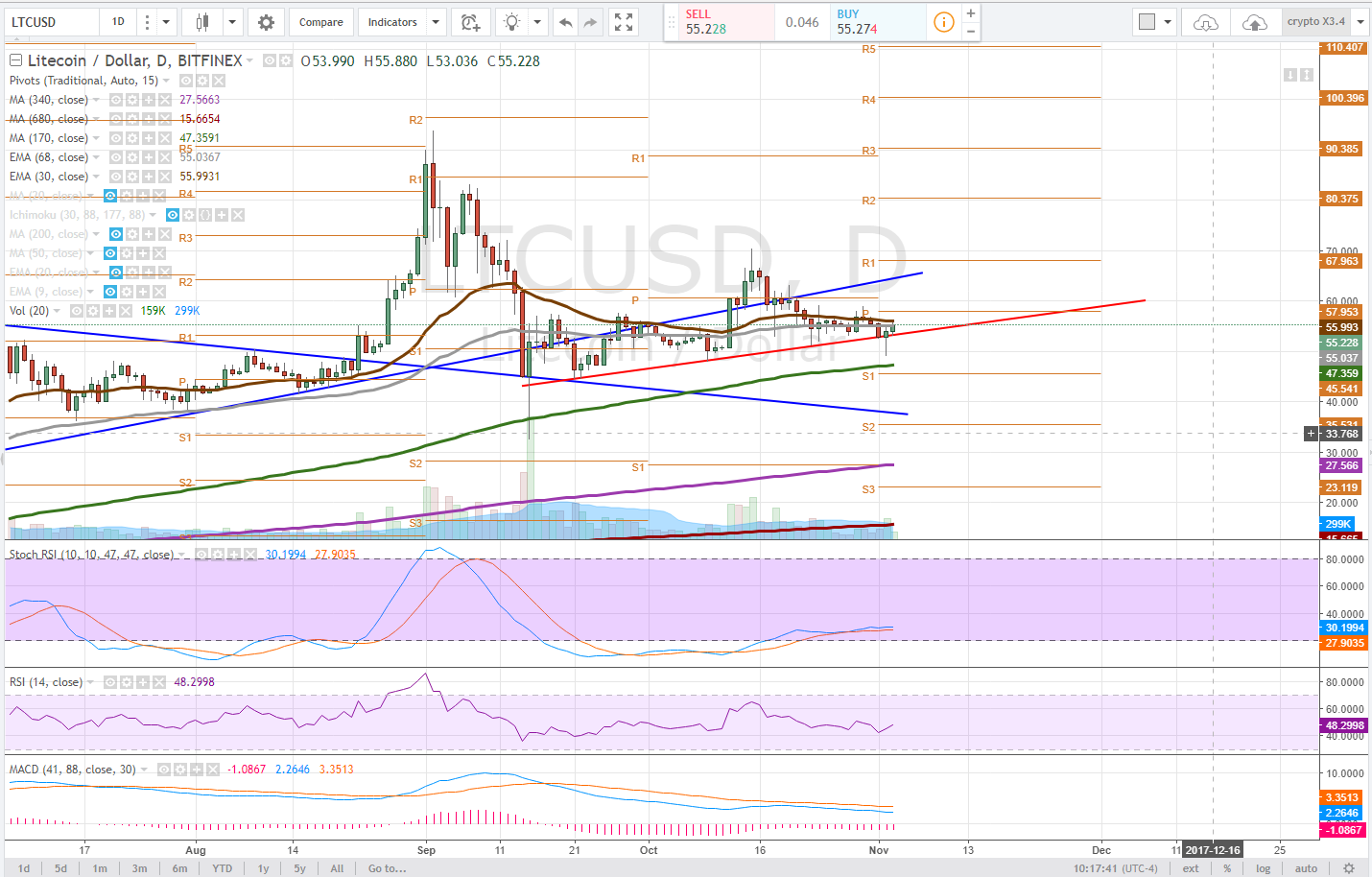

Daily

On the Daily time frame we have been tracking and trading the sideways action of LTC following a trendline and using moving averages as areas of support and resistance (buy and sell ranges)

Currently, the price dipped below the red trendline before reclaiming and now resting just above the price of LTCUSD is trying to reclaim the 30ema as support. Doing so would prevent a bearish cross and give way to a test of the daily pivot, $57.95.

The stochastic RSI has managed to perk out of a downtrend, though the rate of ascent is muted and therefore indicates that there isn't much bullish momentum. The RSI itself is relatively trendless. This is a sideways trades, scalp accordingly - we are waiting for a move in either direction as the MACD continues to trend towards the zero line.

4 hour

On the 4 hour time frame we are observing more prominent bullish momentum in the stochastic RSI as the price tested an bounced back above the 680 DMA and is currently in a tight range between the 30ema (brown) and the 68ema (grey) Bulls would like to see the price retake these moving averages as support with the pivot near by consolidation should be expected under the 170dma, our goal for some bullish price action on this time frame. If price can reclaim 170dma bulls will look to target pivot R1 ($60.16).

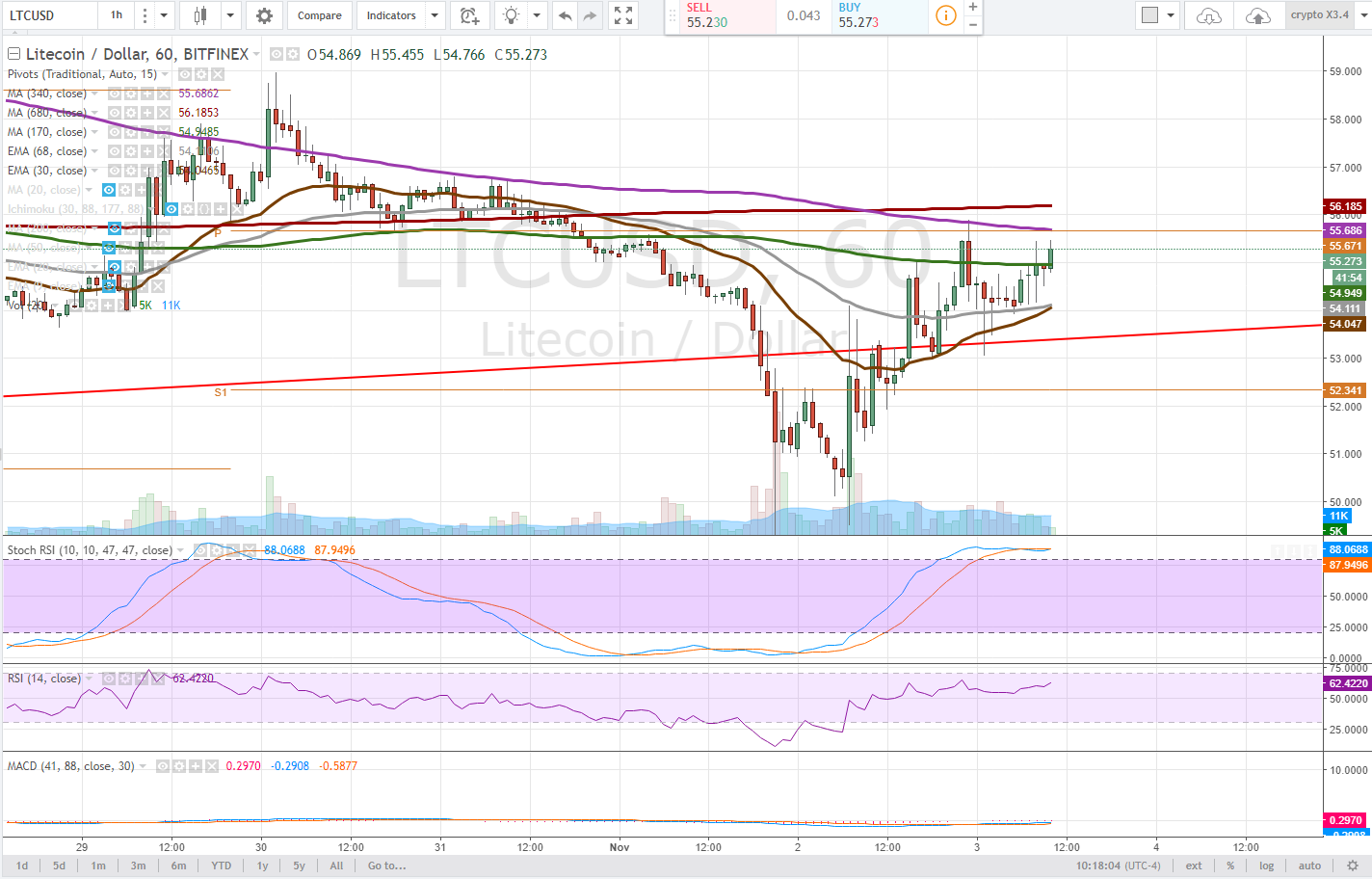

1 hour

The stochastic RSI on the 1 hour time frame is extended and the bullish price action is potentially driving a bullish cross of the 30ema over 68 ema. Shorter term this very bullish for a trendshift. The price is currently stuck between the 170dma and the 1 hour pivot approximately $55.67. Bulls need to see the pivot become support on any test and a rejection would not be conducive to price progression. While the RSI did reach oversold, and the price bounced this is why bulls should be cautious as this may well be a dead cat bounce and a retest of the red trendline must hold to start staircasing the price upwards. The first real sign of a trendshift will occur when a series of higher lows and higher highs begins to form.

Bullish Above: $56.20

Bearish Below: $54

RISK TRADE: Wait for a break of 56, price above the 4 hour 170dma, looking for a test of the daily pivot, and if it breaks to the upsid bulls look to R1 pivot on the 4 hour chart, $60. Use stop losses as if the price loses pivot support after a break up it could indicate lower.

Don't forget to use stop losses!!!

Previous Articles:

BTCUSD

BCHUSD

ZECUSD

LTCUSD

BTCUSD

ETHUSD

BTCUSD

LTCUSD

XMRUSD

Follow at your own risk, Not a financial adviser, understand the risks associated with trading and investing. Manage your own Risk - in other words you could lose it all and it's your own fault.

So much to learn and discover in crypto trading. I am going to research on this. Thanks

Segwit2x Free Coins

How To Claim Free Bitcoin Segwit2x Coins

Convert Your Altcoins To Bitcoin By November 18th At http://FlippyCoin.com

Hold Your Bitcoin In A Cold Storage Wallet Where You Control The Private Keys By November 18th. Create A Free Cold Storage Bitcoin Wallet Here: https://www.bitcoin.com/guides/settin...

https://www.binance.com/?ref=10923198 Join Binance! Great new exchange with much lower fees when using the binance coin.

More suitable article for traders.

It can also help people learn - my style of trading is about momentum and moving averages ;)

I simply love your articles, what great content and quality of posting you offer the community here on Steemit and abroad.

Thanks a lot :)

Cool thanks! I hope it helps a few people learn to do technical analysis too.

Thanks For Your Good News.

I mean you could sell it now and see a ROI but I think you'd be missing the forest for the trees.

Most people conservatively advise you not to invest more than you are willing to potentially lose, bitcoin is still an ongoing experiment the likes of which the world has never seen. Personally I would not recommend investing in bitcoin with less than a 5-10 year time horizon and go into it on the understanding that it will either be worth a multiple of its current price or nothing at the end.

Oh none of what i gave is a sell recommendation per-se, it's a trade setup. Investors HODL. Swing and day traders move in and out and have zero affinity for any wealth generating vehicle.It is extrmely important that people understand the difference. Unfortunately most tend to set out as a trader and don't when to take a loss and become investors, they pray.

nice

Nice post man

I just followed you and upvote ur post will you do the same ????

great information .more useful for trading lovers...keep doing dear..

please resteem my this post this is important msg for world https://steemit.com/gang/@ansarikamran/one-time-more-gang-rape-wtf#comments