Survivor bias in business, cryptocurrencies and investments

Summary

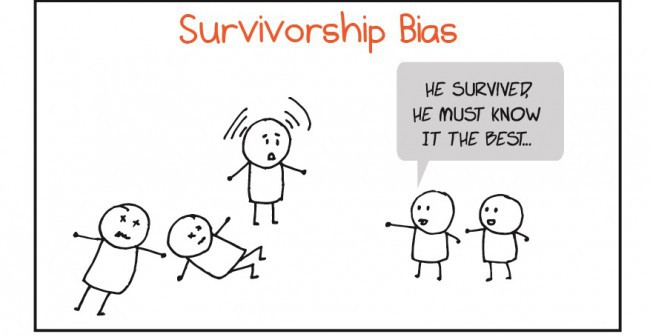

- Survivor bias is where bad or failed data sets are removed or not counted from a population of data, and hence skew the data sets towards the data that are good or succeeded.

- This first major time this was encountered was during World War 2 when the RAF attempted to armor its planes.

- In business, mutual funds will often use survivor bias to market themselves as successful.

- Cryptocurrency communities often use survivor bias with the fear of missing out to promote the idea of being rich.

- Survivor bias is everywhere, and any deal that looks too good to be true should always be scrutinized.

Introduction

Survivor bias is where bad or failed data sets are removed or not counted from a population of data, and hence skew the data sets towards the data that are good or succeeded. This blog will look at the origins of survivor bias, survivor bias in business and survivor bias in cryptocurrencies and investments.

Origins of Survivor Bias

World War 2 was the first major time where survivor bias was found to be present on a large scale. During World War 2, British Royal Air Force (RAF) bombers were being shot down when they went out on missions. The RAF decided to fit these bombers with armor in different areas of the plane (they couldn't armor the whole bomber, because there would be too much weight and the bomber would not fly).

They looked at the bombers that came back, and armored the places that had not been hit, assuming those were the areas that needed to be hit for the plane to fall. However, how were they to know what made the planes fail if they did not see the planes that did not come back from their mission?

This is known as survivor bias, and is the first large scale time recorded where this occurred.

Survivor Bias in Business

Survivor bias in business occurs a lot, and should always be something that someone in business should look out for when presented with any forms of facts or list.

Mutual Fund Companies

If a mutual funds company has 8 poor performing mutual funds out of 40 mutual funds it manages. The mutual fund may remove these funds or merge them with other managed funds so they have 0 poor performing mutual funds, but now only have 32 mutual funds. This now means the mutual funds company can say they have 32 funds, and these funds are performing well.

Mutual funds will tend to do this to market themselves as good mutual stocks. Survivor bias is also shown when listing the "Top 50 Mutual Funds" based on performance. The list will usually promote these mutual funds, and how good it is to invest in mutual funds. However, what these lists do not mention, is a large majority of mutual funds have failed or under performed the market. DOW Publishing Company found, when looking at the industry in 2007, mutual funds tend to under perform the market, and this is worse when survivor bias is considered.

University Entrepreneurs

A lot of students either in school or university, know that Mark Zuckerberg and Bill Gates founded multi-million billion dollar companies. However, they dropped out of school to pursue their ambition. There is often a conclusion that comes out from that, where if someone drops out of university and pursues their own wealth and dream, they can become successful like those big entrepreneurs.

Although it is true that currently employers are looking more for experience and knowledge, rather than fully relying on someone with just a degree. Most people who have a degree, on average, make more money and are more successful than their counterparts that either drop out or do not undertake a degree. Also, what is not said, is how many of those start-up businesses that people have dropped out from, have failed or are just surviving. This where survivor bias is again profound, out of 1 person that succeeds in their start up, there would be over 1,000 more that fail.

There is a degree to which people succeed. What a lot of people do not realize is there is a lot of chance when it comes to entrepreneurialship. The more a person knows or is smart does not mean they will succeed, but increases the chance of them succeeding. Your knowledge or qualifications improves your luck, but it does not mean that you will succeed.

Survivor bias in cryptocurrencies and investments

Cryptocurrency news is plagued with people saying how people who invested $1,000 into bitcoin in 2010 would now be millionaires. The whole idea of these investments is to show someone to look at what cryptocurrencies did for these people, and what it can do for you. This pushes on the idea of fear of missing out (FOMO), where people see the success of others, do not want to miss out on their success, and invest in that asset to be successful like others before them have. This is the same for penny stocks, such as Microsoft and Apple shares in the 1990s.

There are success stories of people who did make millions of dollars by investing into these institutions when the assets were originally worth pennies. However, what isn't told to people, is the 99% of other people who invested into penny stocks, and who lost it all. For example, there would have been people who invested in bitcoin when it hot $3,900 AUS and it has not reached that point since. Also, if you saw bitcoin in 2010, not knowing where the price would be in seven years’ time, would you really have invested in it?

Conclusion

Survivor bias is present in a multitude of areas including business, problem solving and investments. It is always important to take a grain of salt when looking at any investment opportunity that is too good to be true, because the chances are, it just might be.

Sources

2veritasium 2016, 'Survivor Bias', 2veritasium, YouTube, retrieved 5 July 2017, www.youtube.com/watch?v=_Qd3erAPI9w

Chris Dunn 2017, ‘Should You Trade Bitcoin Or Just Buy & Hold’, *YouTube, retrieved 5 July 2017, www.youtube.com/watch?v=z0MdbdyWP8Y.

DOW Publishing Company 2007, ‘Mutual Fund Efficiency and Performance’, DOW Publishing Company, retrieved 5 July 2017, http://www.dows.com/Publications/Mutual_Fund_Efficiency.pdf.

Investopedia n.d., ‘Survivorship Bias’, Investopedia, retrieved 5 July 2017, http://www.investopedia.com/terms/s/survivorshipbias.asp

Mangel, M, Samaniego, F 2001, ‘Abraham Wald’s Work on Aircraft Survivability’, Journal of the American Statistical Association, Vol. 79, no. 386, pp. 259 – 267, retrieved 5 July 2017, https://people.ucsc.edu/~msmangel/Wald.pdf.

Roy, A 2014, '[COMICS] Dear Readers, I'm sorry But Jack Ma's Advice Will Do You No Good', Vulcan Post, retrieved 5 July 2017, https://vulcanpost.com/35131/jack-ma-advice-no-good/.

Wald, A 1980, ‘A reprint of “A Method of Estimating Plane Vulnerability Based on Damage of Survivors” by Abraham Wald’, Center for Naval Analysis, vol. 432, retrieved 5 July 2017, http://gymportalen.dk/sites/lru.dk/files/lru/docs/A_method_of_estimating_plane_vulnerability_based_upon_damage.pdf.

thanks for sharing mate.....followed n upvoted

Thank you for your support. Have a great day :)

You're welcome