Crypto-currency exchange rate: success forecast

Crypto-currency exchange rate: success forecast

1 The forecast of a course crypto-currencies on an example bitcoin

2 What is the forecast for the bad news?

2.1 Forecast for China: frightened authority

2.2 Forecast of the rate of investors for crypto-currencies

Bad news from officials against crypto-currencies - a good forecast of the course for investors.

The rate of crypto-currencies over the past few weeks is struck by a double blow:

- The employee of JP Morgan James Dimon predicted that bitcoin is a fraud and a bubble that will "explode".

- China announced that the crypto currency is temporarily closing its doors to a free rate in response to pressure from regulators and an undefined regulatory environment.

The forecast of a course криптовалют on an example bitcoin

People who believe in a long-term forecast and invest in crypto currency should rejoice at the bad news. Incidents create opportunities for buying at a favorable rate. For this it is enough to see how bitcoin behaved on the bad news last year.

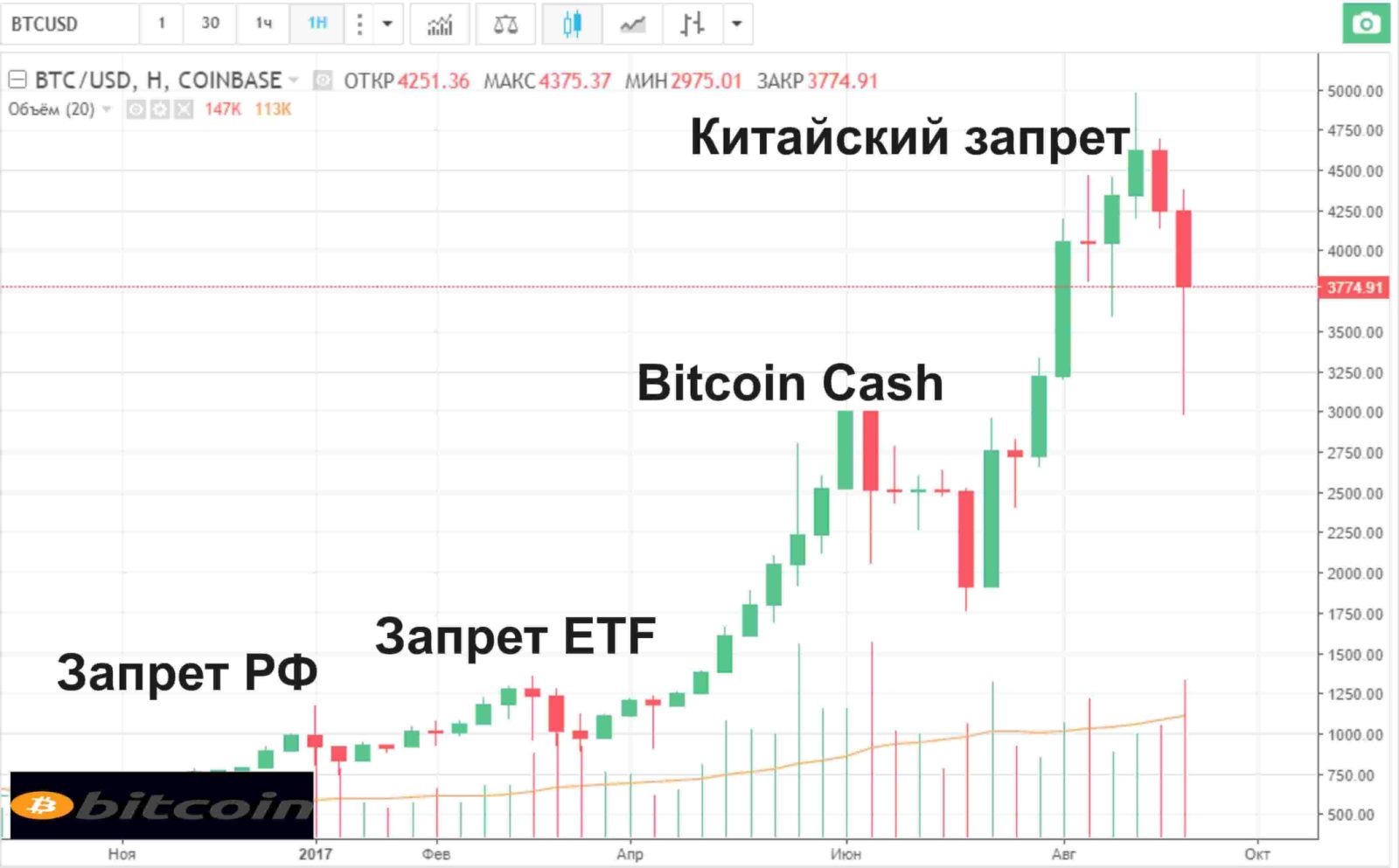

In each case, the bitcoin course fell sharply and briefly, and then grew higher with a new force. The rate doubled from 2,400 dollars to 4,800 dollars in just the last summer month against all forecasts, not counting that it tested the mark of 5000!

The graph shows that every bit of "bad news" fueled a miniature rally. Bitcoin does not have any elements of the pyramid scheme. Crypto currency is not MLM, it can not be manufactured or controlled by any organization. Rather, it is an example of pure demand and recognition in the market - an acceptance mechanism that leads to alternative investments. The advantages of crypto currency are multiplied, as more and more users are convinced of the forecast for a stable rate and join the trend.

What is the forecast for the bad news?

If in the mathematical basis of virtual money there were weaknesses to create counterfeit coins, the whole cryptoimpery would collapse. At the moment, it is more interesting how far the long-term crisis has grasped virtual currencies? To answer, you need to determine how dangerous public fears about this are.

Forecast for China: frightened authority

Like most governments, the Chinese are concerned that the growing bitcoin affects the liquidity of the national currency. They are also concerned about the forecast of an increase in the exchange between the crypto-currencies operating outside the strict regulatory framework.

Digital currencies deduce the flow of money in the country and beyond from the state control, with their help citizens evade taxes and, unfortunately, organize criminal activity.

Like any government that deals with the financial regulation of the national currency rate, the PRC authorities are trying to regulate crypto-currency.

It is worth noting that the PRC does not discourage the production of bitcoins and even personal savings of citizens, but only worries about the spread of unlicensed exchanges and anonymous users. In the end, most of the virtual facilities are moving in China, helping to balance the loss of liquidity in the national currency.

The forecast of the rate of investors in crypto-currencies

Investors in bitcoin are increasing due to factors - a new payment mechanism and a form of storage of valuables. For governments this course is a poor forecast. When management loses control over its own reserve and monetary policy, it provides more opportunities than threats. Gradually, economists, officials from treasuries, heads of reserve funds and oligarchs will come to this conclusion.

When governments try to restrict activities that can not be controlled or forced and do not leave alternatives, they ultimately feed the course of the Crypto-currency.

After all, if the public can not determine a reasonable basis for state censorship or excessive restrictions, this will lead to other interests, the search for innovations and the emergence of new hot markets.

And you managed to use the correction kriptovalyut?

Write about it in the comments to the article.

source