$39M Outflow from Solana: What’s the Future for SOL ETFs?

Last week, Solana (SOL) experienced its largest-ever outflow, with $39 million being withdrawn from SOL investment products, according to CoinShares(https://etp.coinshares.com/knowledge/market-activity/fund-flows-19-08-24). This significant outflow is largely attributed to a sharp decline in the trading volumes of meme coins, a key component of Solana's market activity. The record outflow has raised concerns within the crypto community about Solana's future.

Contrasting Market Movements

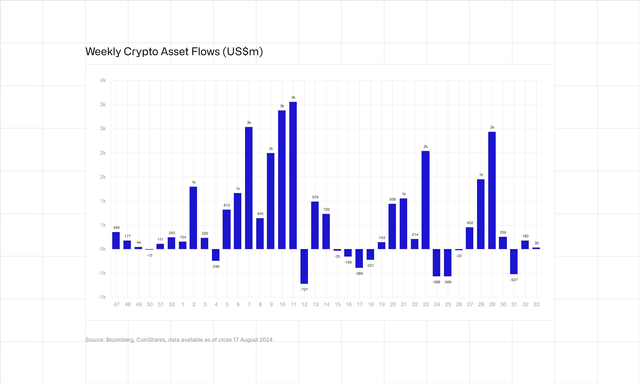

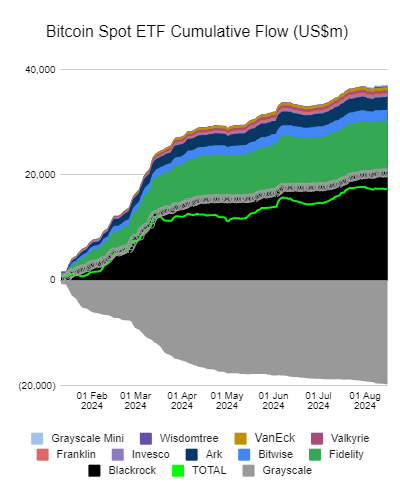

While Solana faced heavy outflows, other cryptocurrencies saw varied investment activity. Digital asset investment products overall recorded minor inflows of $30 million, masking notable differences across assets. Bitcoin (BTC) attracted $42 million in inflows, reflecting strong investor confidence in spot Bitcoin ETFs. Meanwhile, short-Bitcoin ETPs saw $1 million in outflows, indicating reduced bearish sentiment against BTC.

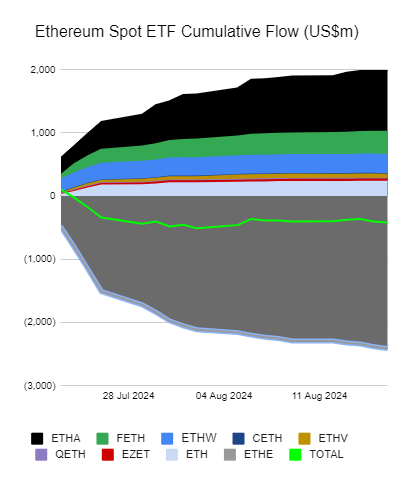

Ethereum (ETH) recorded inflows of $4.2 million, though this figure hides a more complex situation. New Ethereum ETF products saw substantial inflows of $104 million, while Grayscale’s ETH products experienced significant outflows of $118 million.

Challenges Facing Solana ETFs

The record outflows from Solana coincided with growing uncertainty around the approval of Solana ETFs. Recently, filings for Solana ETFs by VanEck and 21Shares were removed from the Chicago Board Options Exchange (Cboe) website, sparking concerns about their regulatory future. The absence of these filings has led to speculation about the U.S. Securities and Exchange Commission’s (SEC) stance on Solana ETFs.

Both VanEck and 21Shares had submitted S-1 forms for spot Solana ETFs earlier this year. However, the SEC did not issue notices of filings for these Solana ETFs, leading experts to debate whether the filings were withdrawn or rejected. The 19b-4 submission, crucial for ETF approval, informs the SEC of a proposed rule change by a self-regulatory organization.

Industry Reactions

Scott Johnsson, General Counsel at Van Buren Capital, speculated that the SEC might not view Solana as a commodity, which could explain the absence of a formal disapproval order. Nate Geraci, President of ETF Store, confirmed the removal of the ETF filings and expressed skepticism about their approval under the current regulatory environment.

Matthew Sigel, VanEck’s Head of Digital Assets Research, criticized U.S. regulators for lagging behind countries like Brazil, which have already approved spot Solana ETFs. He suggested that the U.S. regulatory framework might need a "soft fork" to facilitate the approval of Solana ETFs.

The recent record outflows from Solana, coupled with the uncertainty surrounding its ETF applications, highlight the challenges the cryptocurrency faces in the current market and regulatory environment. The future of Solana ETFs remains uncertain, and the broader implications for the cryptocurrency market are yet to be fully realized.