DAPP Idea: Automatic crypto asset management with smart contracts on the blockchain to optimize yield-to-risk ratio and to attract traditional investors in crypto

Hello Steemit!

Let me point out my vision at the very beginning:

My vision is to make crypto currencies and crypto assets attractive to any investor who generally believes in crypto by reducing the effort (no babysit, not FOMO, being able to sleep) and by guaranteeing the best yield-to-risk ratio.

Crypto will certainly rise. But which currency will thrive? Bitcoin, Steem, Ethereum, Ripple, Lisk, Digix, Augur or maybe something else? Well, if I knew the very best investment, this article would have no clue. But apparently no one really knows.

The basic idea is that every (lazy) investor from outsite the crypto ecosystem can make a one time deposit to profit from general crypto development and does not have to care about a specific asset. Because basically that is what 'normal’ people who have a life outside trading and asset management want. Most investors do not want to babysit their assets on a daily basis and would love to have their cryptos managed automatically without any trust involved. Welcome to the blockchain. Welcome to smart contracts.

Most of you own different crypto currencies and assets. Looking at coinmarketcap or poloniex there are dozens of different currencies and assets traded. It is similar to a traditional stock market or FOREX (foreign exchange). Have a look at coinmarketcap:

696 currencies and 64 Assets. What to invest in and how much?

Excursus: How does portfolio management work in traditional markets?

Traditional portfolios (stocks, traditional assets like gold, oil etc...) are either managed automatically which follows the idea of an adjusted 'minimum variance portfolio’ or they have a manager who manually decides which trades are done. The yield with automatic management is often seen as a benchmark score for managers to beat.

Automatic management? Yes. Most rational and risk neutral investors know not to put all eggs in one basket – so to diversify their assets for risk management to have an efficient portfolio. The 'automatic management' calculates which particular fraction of every asset is efficient. This mathematically complex calculation is based on

- historical variance

- expected yield

- historical co-variance between assets

and recalculated / adjusted after a specific timeframe.

[ It would take too long to explain in particular how the calcuation works. Feel free to google 'minimum variance portfolio with n assets' or 'capital market line'. The good part is that these algorithms already exist and can be calculated relatively easy (even in Excel I think) ]

Why not do exactly this for crypto currencies and assets via smart contracts?

(As far as I know) this does not exist for crypto assets yet. I wonder how many of you actually hold an 'efficient' portfolio of assets in terms of yield-to-risk ratio. Possibly too few. My vision is to improve this.

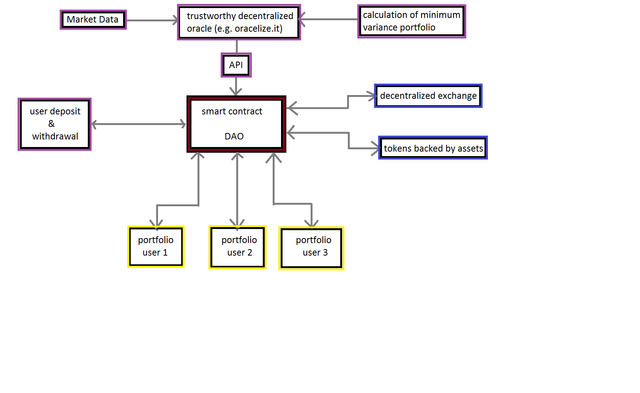

How could this work? Have a look at the following sketch. The whole construct lives on the Ethereum blockchain.

Users make a deposit with ETH and chose which assets they want in their portfolio

The smart contract / DAO knows the market data and the efficient asset weights for the minimum variance portfolio from an API provided by a trustworthy oracle (oracelize.it is providing such data to interact with smart contracts).

The smart contract calculates the difference between the actual and efficient portfolio (e.g. on a daily or weekly basis)

The smart contract then automatically does the calculated transactions via (1) decentralized exchange or (2) tokens that are backed by the actual assets they represent. E.g. the contract could change from BTC/ETH/Steem 50/25/25 to 40/35/25 with related market data

Progress finished, repeat calculation after a fixed time period / block number.

Final remarks

To be honest – this project is far from being realized in the very near future. Not only because lots of serious programming in solidity and a development team is needed. But also because decentralized crypto exchanges with decent volumes are crucial for this project. Another question is how to handle the private keys. The easiest way would be to have ethereum-based tokens that are backed by the particular assets they represent combined with multisignature wallets. You may see this article as a white paper or something to introduce this vision.

Let me hear what you think! Wouldn’t this kind of DApp / DAO be amazing?

Thank you for reading!

This is a great idea. I've been looking for a way to invest in a portfolio of cryptocurrencies easily. There would be a lot of work to put into this, but I see this being a big part of investors portfolios in the future. Great vision. Now make it happen!

Simply Great Information and Presentation