Central Bank of South Korea is exploring Blockchain Technology for Micropayments

South Korea's Central Bank is moving towards distributed ledger technology with the intention of developing a blockchain-based micropayment settlement infrastructure

The Bank of Korea – also known as BOK has just announced that the Central Bank is conducting extensive research and testing, as part of an initiative to utilize Blockchain technology to help the national bank facilitate micropayments.

It has been confirmed on 30th October that Blocko will be spearheading the latest development of the Central Bank blockchain-based micropayment pilot program. As for now, there will be a 2 month testing phase to determine the applicability of the disruptive technology for micropayments and to ensure that security, scalability and privacy are aligned with industry standards.

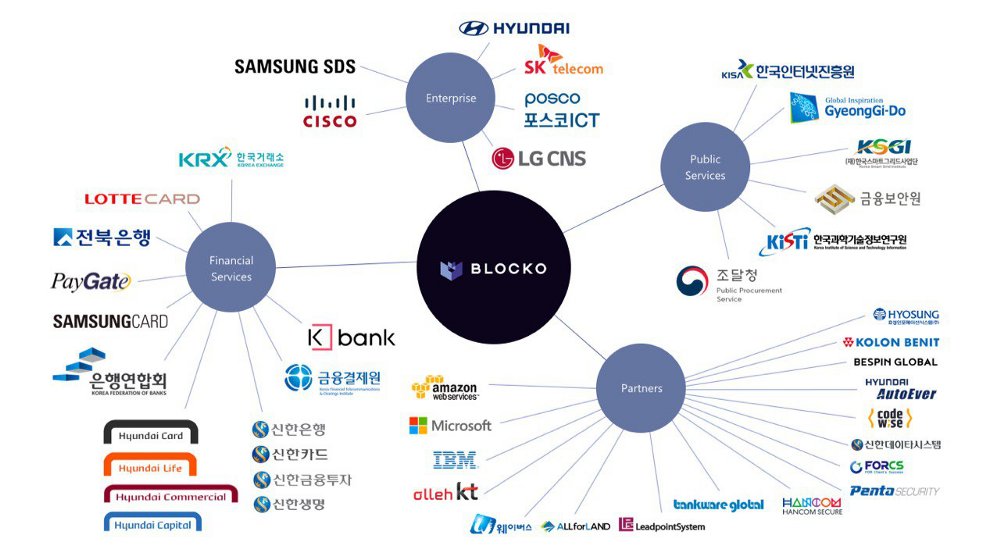

South Korea central bank has partnered up with Blocko, one of the world's leading blockchain platform provider to help financial institutions such as Credit Suisse, KBank and conglomerates such Samsung, Hyundai Motors, Microsoft and many more, to develop enterprise-ready blockchain-based solutions. Coinstack which is a blockchain-as-a-service platform for upcoming projects such as Aergo, has over 25 Million users worldwide using the proprietary platform through Blocko’s partnered companies.

Since mid-2017, there has been increasing demand for cryptocurrencies amongst the Korean investors. It's been an exciting year for the overall South Korean crypto space, following the release of a new regulatory framework for crypto businesses and blockchain projects - Keep in mind that previously, the government provided little legal clarity & had a more negative stance towards Cryptocurrency regulation since the inception of Bitcoin.

With the Central Bank collaborating with Blocko, and the startup focusing on providing a more open ecosystem with Aergo, South Korea is set to become a more Crypto friendly region as the result of blockchain technology expanding among enterprises, government and now - Central Banks

Central Banks around the world are experimenting with Blockchain technology, by quietly releasing details surrounding the work that is being done in the shadows. It seems as if a few Central banks are now embracing the blockchain technology to revamp their own infrastructures and government is quickly changing their tune towards digital currencies - after seeing the potential of enterprise Blockchain solutions.

Source: http://www.etnews.com/20180928000128 (Korean)

Here's a partial list of programs deployed by Blocko:

https://blockonomi.com/south-korea-blockchain/

- Lotte Card

- Korea Exchange

- Samsung SDS/Nexledger

- Voting system in Gyeonggi-do

Adoption is catching up and many don't know it!

Well, firstly, I must admit that South Korea is one hotbed for crypto solutions. We all are avidly looking towards the U.S. or even Russia for cryptos but South Korea is silently taking the lead.

Now, coming to the micro-banking solution, how cool is that? I mean, one of the issues for banks is to give out a small loan and if they do so, the paperwork still remains the same and the cost per loan shoots up. What I mean is, I can give a USD 100 loan or USD 250,000 loan, the paperwork almost remains the same. But bring in crypto and the equation changes... Everything automated, all loans (or financing) can be tokenized and tracked to the source, and easy adoption. It was an obvious development to happen but did not happen so far... Thank God, South Korea took the lead!

I can just imagine the use cases for such microfinancing blockchain solution across South Asia, Africa, and the Middle East. This is where most of the poor population of the world live and this where it will help to bring people out of poverty. Kudos to the solution and I am just mesmerized at what blockchain can do.

Just came out of another video talking about tokenizing a building (a physical asset)... The concept of ownership of an asset is going to change! :)

They should be using Ethereum! It's quite obvious that few central banks are planning something. They hate Bitcoin & Cryptocurrencies, but are interested in enterprise protocol and private blockchains

This is to remind everyone who is involve in cryptocurrency that the future has only one outcome which can mean bright future.

I am really happy to hear this news and that am a crypto enthusiast, cryptocurrency and blockchain has helped a lot of people and races struggling most especially the venezualan people. Thanks for sharing such a wonderful piece @crypto.hype.

Chúc mừng @crypto.hype, bạn đã nhận được một upvote 25%. Tôi là con bot của cộng đồng Việt Nam trên Steemit. Tôi được tạo ra bởi nhân chứng @quochuy và được uỷ quyền, tín nhiệm bởi các thành viên Việt Nam, hôm nay tôi vote cho bài của bạn để ủng hộ bạn. Tôi hi vọng sẽ được thấy nhiều bài viết hay từ bạn.

Chúc bạn vui vẻ, và hẹn gặp lại một ngày gần đây.

South Korea a hotbed for Cryptocurrency! Went for a visit there a couple of years ago. Everyone there is really tech-friendly, makes sense that the government will take a more progressive stance. Korea + Japan, both are developed countries, that is currently leading the crypto space in terms of adoption and regulation here in Asia

there is more to blockchain than cryptocurrency

You know what is the perfect blockchain for fast and cheap transactions? Steem. I wish everyone realizes how good this blockchain is for things other than just posting, being free and fast is a huge benefit, but people seem not to see it...

The biggest flaw of Steem...Lack of marketing.

Well, I accept taking the blame, the Steem is the community, if marketing is not great means we must gather users that want ti change this and act ourselves to better this. I am doing what I can using Steem to create tutorials, running my witness node, promoting curation projects to incentivize new users to stay here and working on a simplified and beginner friend interface to use the blockchain. It is our job to improve it :)

Central banks issuing crypto isn't good for the crypto market.

Central banks don't share. They will coerce people into using their exchange or else.

They will use things like dips in the market to claim that the market is flawed there must be state regulation of money.

Of course by eliminating the dips, they also eliminate the peaks and they eliminate the ability of the market to create innovations.

I see this report as bad news for the crypto market.

If Central Bank of South Korea does step up and accept crypto then it will be a landmark move. But that happening depends on the turnover- market capitalization of cryptocurrencies in South Korea. It is a very tech- friendly country and with safety protocols improving, lets hope for a positive move.

This is certainly interesting news, but given the fact that banks creat money out of thin air - ie: for every dollar, euro , pound etc they have 10 on their balance sheet which don't actually exist and blockchain technology won't allow for that I fail to see how this would tie in with the current banking system design. It will however be interesting to see how it all works.