Why you’re always gonna have a hard time spending your cryptos

Spending crypto is hard to do!

Spending your cryptos can be a challenge but help is at hand. There’s an ever growing list of projects and talented people trying to break down barriers and bring cryptos to the mainstream. They are working hard to increase general acceptance of cryptocurrencies for everyday transactions and making it technically easier for you to spend your cryptos. Projects like Monaco, TenX, TokenCard, and others are working with existing card payment processors like VISA or MasterCard to bring us a crypto user experience that’s similar to how we currently spend fiat using debit and credit cards but with added bells and whistles.

As well as these cards, more and more retailers and outlets are beginning to accept Bitcoin and other cryptocurrencies directly for payment. These developments can only make it easier for you to spend spend spend!

While it is becoming technically easier to spend your cryptos, there is a more fundamental and non-technical issue that will hold people back from spending cryptos and it’s probably not what you think.

I’m not an economist or financial expert, but I believe the current economics of spending cryptocurrencies to buy everyday goods or services just does not stack up and I’ll try and explain why in this blog.

Before I get to that, lets have a brief recap of how basic economics usually works in the traditional fiat world so we can better understand the problem.

“A Dollar today is worth more than a dollar tomorrow”

You’ve all heard that saying before. In economic circumstances that most of us are used to, this principle generally holds true—prices increase overtime due to inflation. A certain level of inflation is welcome in developed economies as it helps to drive demand and investment, keeping money flowing and credit ticking over.

But too much inflation can be extremely bad, that’s why Central Banks likes the Fed and ECB like to keep inflation to a target of around 2% per annum. In a world with inflation, a dollar today is worth more than a dollar tomorrow because inflation erodes the buying power of the dollar over time. If inflation is rampant like in Weimar Republic (1923) or Zimbabwe (2008), consumers tend to treat cash like hot coals—too hot to handle—and try to offload it as quickly as possible by exchanging it for tangible goods.

What if a dollar today buys you less than a dollar tomorrow?

Here we are looking at the opposite situation, in other words—deflation. Instead of prices going up, they keep going down and this has some interesting outcomes. Deflation is probably more dangerous for consumer driven market economies like in the West because much of the driver for these economies comes from consumer demand and loans to feed further demand.

In a deflationary world, everything is turned on its head. Consumers tend to hoard cash, avoid borrowing and delay spending. After all, if prices keep going down you will get the item for less if you just wait a little longer. Therefore deflating prices creates a clear disincentive to spend or borrow and is a nightmare scenarios for consumer driven economies. Why else would central banks create policies that aims to generate mild inflation rather than zero or negative inflation.

So what’s all this inflationary/deflationary stuff got to do with cryptocurrencies?

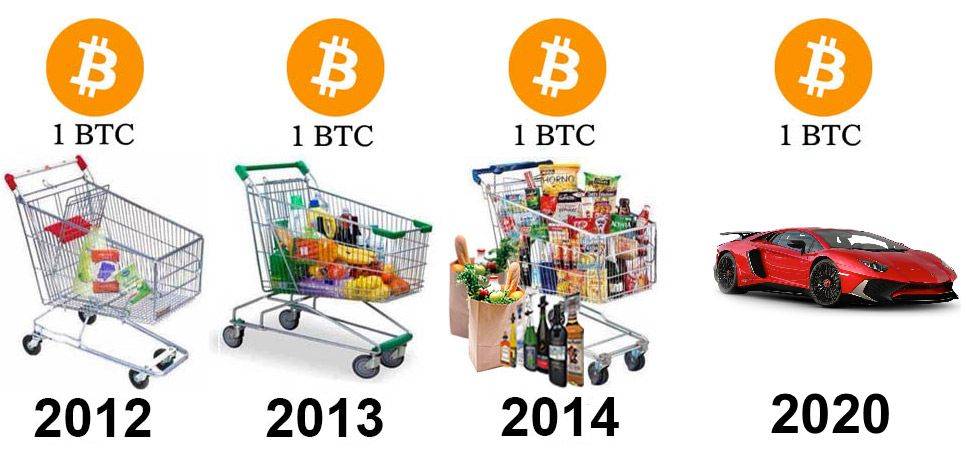

One of the biggest obstacles to cryptocurrency ambitions to displace fiat is deflation. To put it another way, the problem is the seemingly ever increasing value of cryptocurrencies and its deflationary affect against things priced in fiat currencies. As fiat currencies fall in value compared to cryptos, prices of goods and service denominated in fiat falls at the same rate as the value of crypto goes up. A 30 percent gain in value of BTC versus USD effectively means a USD priced item becomes 30 percent cheaper.

You see cryptocurrencies don’t currently behave like “normal” fiat currencies that we are all used to. Cryptos behave a bit like fiat currencies but also a lot like stocks but on steroids. Normal fiat currencies don’t usually increase or decrease dramatically in value from one day to the next.

Even though over the long term, most fiat currencies have seen their purchasing power steadily decrease, they are still considered to be relatively stable.

Crypto spender’s remorse

In the world of cryptos, wild swings in value in the order of plus/minus 10-50% in a day are quite normal. Frankly ridiculous increases in value of hundreds of percentage points over a short period of time like a day is not unusual. A quick glance on coinmarketcap.com at the top gainers/losers page will show you what I mean.

In the past eight months the BTC/USD exchange rate increased from around $900 to around $5000 in September.

Source: coinmarketcap.com - USD/BTC Chart covering January to September 2017.

Another big player with ambitions to be a global fiat alternative—Dash rose from $11 to $384 in the same period (approx 35x your money).

If you had spent 1 BTC or 80 Dash to buy a new phone back in January 2017, wouldn’t you be just kicking yourself right now in September? Your phone is probably worth half what you paid for it but if you had held onto your crypto, the same 1 BTC or 80 Dash would now buy you several phones.

This problem is perfectly illustrated by an infamous event in BTC folklore which is commemorated each year on the so-called Bitcoin Pizza Day (May 22). Seven years ago, Laszlo Hanyecz achieved everlasting fame by exchanging 10,000 BTC for a few pizzas valued at $41. The value of 10,000 BTC at the most recent peak is approximately $50M—those pizzas will probably continue to be the most expensive pizzas ever bought in human history.

Bad for shoppers but potentially great for vendors

Knowing that the cryptocurrency in your wallet is likely to go up in value by hundreds if not thousands of percentage points in a matter of a weeks or months just by holding on to it, you have to ask yourself this question: why would you want to spend any of it now? You would have to be mad to swap your rapidly appreciating cryptos assets for a consumable product or depreciating asset like a new gadget or even a Lambo right?

Cryptos have many great attributes but its rapid appreciation in value is both a blessing and a curse. Unfortunately, this makes most cryptos unsuitable for use as a currency for purchasing everyday goods and services because you could miss out on massive future growth as soon as you spend it.

For those accepting cryptos for payment, you are potentially onto a winner by being paid with a rapidly appreciating asset. Of course this is only true as long as cryptos continue to head to the moon or even Mars and beyond.

So where next for cryptos?

Nobody can say for sure but just when you’re thinking that crypto prices can’t go any higher, it breaches yet another higher target. Sure there’s been many stomach churning pullbacks along the journey to the moon but just like pruning weak branches on a tree to make room for more growth, the cryptos just bounce back stronger each time. People on social media and forums often talk of coins blasting off to the moon or Mars purely based on past performance.

Source: NASA. Bitcoin and cryptocurrencies blasting off beyond the solar system!

Some commentators have speculated that the price of one BTC may reach $250,000 or more within a few years. John McAfee even reckoned on it reaching a cool half million dollars within three years (2020) or else he’ll perform some extreme eating act on national television. I hope for the sake of John and for the general public that he is proven correct in his belief.

How do you feel about spending your cryptos?

Leave your comments below and let us know what you think.

Please up vote if you like this story.

Thanks for reading.

great article! Indeed, there seems to be a vast gulf between the promise of crypto payments at scale and reality. The price fluctuations being one. Why spend a Bitcoin now if you believe it will go up 100 times in value still. either you are investing with it or spending it... can't have it both ways.

For certain countries Bitcoin is one of the few practical ways to move money, and yes it is volatile but they say, at least overall the volatility goes up not down like their national currencies...

RESTEEMED BTW

Thanks @the-traveller. Appreciate the resteem. I think there's plenty of articles talking about the technical aspects of spending cryptos but not many talking about this deflation issue. I think you put it well when you say it's an investment or currency for spending but not both. Same way you can't spend shares in a company.

Very very well written thought provoking post @cryptojaxx. :)

Plenty of interesting stuff to reflect on. This post actually deserves lotta more visibility & brain's attention out there. Therefore, this article has my unconditional Upvote & Resteem to contribute to the noble purpose of spread the vision and informing well.

And you've just gained a new follower interested to check what else do you have cooking on the stove on these subjects in the close future.

Cheers!! :)

Thanks @por500bolos, much appreciated

My pleasure mate!! Keep on with your good work. :)