memo.cash: A kind of Twitter on the Bitcoin Cash Blockchain / Amazon wants to deanonymize Bitcoin Transactions with Data Marketplace / Parity: Is this a Bailout - or a Rescue?

For Bitcoin Cash, memo.cash was released last week: A somewhat rudimentary clone of Twitter that completely stores the tweets or memos on the Bitcoin Cash blockchain. One can find this ingenious or insane. Markets seem to like it - the price of Bitcoin Cash has doubled within a week.

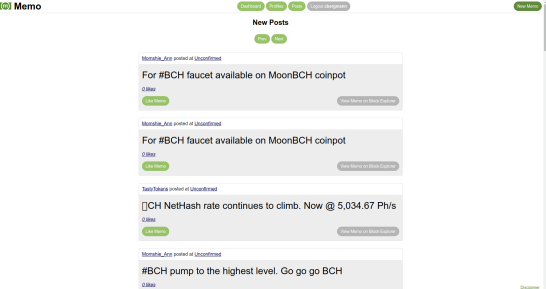

Last week memo.cash went online, a kind of Twitter on the Bitcoin Cash blockchain. You can send short messages with a maximum of 75 characters, follow other users and give memos of others a "like". Every action requires a microtransaction, which can be used to earn money if a tweet gets liked often enough.

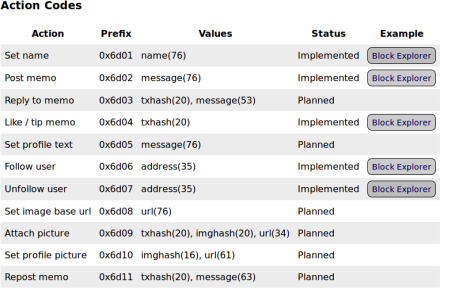

What at first glance looks like a Twitter to the poor is a very interesting technology. Because the website memo.cash is just an interface to interact with a protocol that works completely on the blockchain. A code at the beginning of the message indicates what causes it. In addition to the previously implemented codes - name set, follow, unsubscribe, like and send message - are still more codes planned, such as for retweetening or answers.

This memo.cash is not censored. Memos once confirmed can not be deleted. At the same time, memo.cash is independent of the actual interface. Although the memo website is likely to be the preferred port of call, anyone can search the blockchain for messages with the appropriate code. For example, there is already a memo cash explorer on the website WEWO.cash, which probably displays all memos. At the same time, WEWO.cash has released an API that allows everyone to build their own client for memo. Even Cryptograffiti.info already displays memos, albeit without marking them.

You could say that the difference between memo.cash and Twitter is the same as between Bitcoin and PayPal: it's an open, decentralized protocol that anyone can use with equal rights - while PayPal and Twitter only provide UI APIs for a centralized server , This makes the Bitcoin Cash blockchain an instrument for uncensored communication.

Many find that this is madness and misappropriation. After all, Bitcoin Cash is a decentralized cryptocurrency, and not a decentralized Twitter. The core design of the blockchain is designed to be resilient and provide a compelling history of financial transactions. Not only is such a system usually unnecessary for short messages, but it also prevents it from scaling. If every computer on the network stores and propagates every memo, you'll quickly be faced with an extreme load of data, even if Memo has as much success as Twitter in its approach. Using Bitcoin Cash as a decentralized message server risks harming the system itself more than exploiting it.

A post on yours.org calculates if this can work. His result could be summarized as "yes and no": It is not as tragic as one might think at first glance. One can prune the messages sent via OP_Return, ie delete them from the blockchain of their own node, which does not necessarily damage the integrity of the network. Moreover, the data load, at least at the beginning, still quite manageable. If memo.cash grows at the same pace as Twitter, the volume by 2020 or 2021 will be relatively unproblematic. Thereafter, thanks to exponential growth, it is rapidly increasing. To process as many messages alone as Twitter did in 2013, you would need 1GB blocks.

The potential of memo.cash should certainly not lie in a replacement for Twitter, but possibly in the transmission and publication of censorship-resistant news. This could be useful if Twitter is banned, such as in Iran or in Turkey, or if Twitter itself censors country-specific. Also in discussion is to use a memo.cah code to propagate BitTorrent download links. This would make (illegal) file sharing censorship resistant, which is of course morally and legally doubtful.

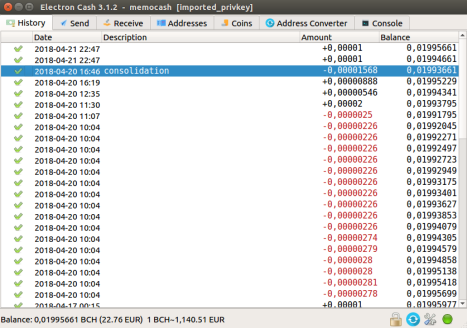

In addition, memo.cash shows two things that set quite good signals for Bitcoin Cash. On the one hand, the website follows the wallet standard for micro payments already established by yours.org: Every transaction takes place onchain, and you can export your key and import it into Electron Cash. So you have the coins that you use on yours or memo.cash in your own wallet, and even if you have lost the password or the page is offline, you can transfer the coins. This could become a nice standard for micro payments as well as any kind of platform that works with onchain transactions.

Secondly, memo.cash shows a certain enthusiasm of the Bitcoin Cash community: a few days after the announcement of memo.cash, wewo.cash was created and Cryptograffiti recorded the memos. Also Bitcoin.com has already declared to integrate memo into the wallet, and a user has already programmed a browser extension for Chrome, with which Memo.Cash looks much better. It has also been proposed to encrypt messages via ECIES. Anyone who makes an action on memo.cash publishes its public key, which in itself allows sending an asymetrically encrypted message. This could introduce the previously missing "purpose" for transactions.

Obviously, there is dynamism in it. If you add the upcoming hardfork, which increases the maximum block size to 32 megabytes and the space in the OP_Return field to 220 bytes, you can be optimistic. The markets are in any case: The price of Bitcoin Cash has risen sharply since mid-last week. From a good 600 euros, he has now risen to just under 1,200. No other cryptocurrency has performed so well in the last ten days.

A patent from Amazon shows how the IT group with a marketplace intends to pervade privacy on the Internet. The focus will probably be mainly on Bitcoin transactions, for example, to be connected to the IP addresses. Anyone who has an interest in data protection should have their backs cold.

Data only becomes powerful when you connect it. As long as they are fragmented and disjointed, they do not yet reveal so much about the individual. But when you put them together, they give a shockingly accurate grid.

Amazon wants to exploit this fact with a data marketplace. A recently granted patent describes a marketplace for data streams. Individuals, companies or organizations can provide data streams and customers can subscribe, correlate and combine them. The combinations thus obtained can also be offered on the marketplace and further combined. Because whenever you put raw data to useful, values are created.

The patent gives an example of how data combinations can be worth more than the sum of parts. These are Bitcoin transactions that are visible to every participant on the network but hide the identity of the sender and recipient behind a pseudonymous address. "This raw transaction data does not disclose much to the customer unless it correlates with different elements of other useful data streams." For example, merchants that accept Bitcoin could correlate the delivery address with the data from the Bitcoin transaction and republish that combination as a new data stream , Then, for example, the Internet providers can subscribe to these data streams, correlate them with the IP addresses and place them on the data marketplace as a new package, where, for example, the tax offices can download and connect them with tax data. And so on.

Such a flow of data could help traders to implement the "blacklists" that some regulators are looking for. Just as, for example, in the case of mobile phone contracts concluded online, data is requested from credit scoring providers, so when a transaction is accepted, traders could automatically ask if it is too close to dark sources. Whether this is desirable in order to prevent, for example, that Bitcoins from blackmail circulate, or whether this affects the fungibility of Bitcoin - and thus its suitability as a means of payment - can be discussed, after all. One can not argue, however, that it is devastating for any rogue in the data marketplace to gather information together to find out how many Bitcoins someone who lives in this or that physical location has. It is also unquestionable that the very existence of these correlations is an inordinate mass surveillance of innocent citizens ...

One can and should complain that Amazon intends to undermine privacy in masses. One can also point to the German or European data protection, which presumably forbids the fact that it simply throws the address or IP data of customers on a marketplace where they can be seen in principle by anyone. However, Amazon's patented data marketplace is actually a way to make things that work better, even more efficiently. There is already data that can connect Bitcoin transactions to IP and physical addresses. Although they are still isolated in the silos of different servers, you never know if they have already been combined. A data marketplace would, after all, eliminate the existing uncertainty: one would have to assume that all data that one produces are already linked.

For the users then only one option would remain: to produce as little data as possible. To what extent this is possible is difficult to say. You can not permanently use Tor to prevent your ISP from connecting your IP address to a physical address. Possibly helps a VPN, possibly one is lucky that the Internet provider assigns dynamic addresses. On the side of Bitcoin transactions, one only has to maintain strict wallet hygiene. Coins that are "dirty" in the sense that they came into contact with a company that may sell the data - such as Amazon - should be separated from coins that have not yet come into contact with such companies and therefore not with the address be correlated. Maybe it helps to avoid service providers that are not based in a country with strong data protection, such as Germany or the Netherlands.

Probably the strongest solution would be to use mixers or other methods to anonymize coins. Because this would break the correlations aimed at Bitcoin addresses, making it difficult or impossible to derive from that address to others belonging to the same person. However, these methods have the stall smell of money laundering. If you use them, you risk spoiling your coins or ending up on a blacklist - making the situation worse. Here, however, it is time to rethink. If the German justice system is really serious about data protection, it should not tolerate that procedures to protect the blockchain's privacy against such attacks are equated with money laundering by the police. On the contrary, they should be explicitly allowed and perhaps even certified and issued by the government itself.

In the 1970s, NIST released DES cryptographic algorithm in the US to ensure that American citizens and businesses can communicate securely over the Internet. Amazon's patent shows it's time for a similar cryptocurrency initiative.

A bug in Ethereum Wallert Parity's multisig contract in November last year caused $ 300 million in damage. Now the community is discussing whether to restore the coins via hardfork.

In November 2017, Ethers and tokens worth hundreds of millions of dollars froze on the Ethereum blockchain. To understand the discussion that currently exists around EIP999, it is worth remembering what exactly happened then:

The multisig contract that the Ethereum wallet Parity creates over the user interface used another smart contract on Ethereum to store and call a library of scripts. That's clever in itself, as it makes the actual code leaner. However, the library contract had a suicide function. After it was more or less accidentally triggered, the scripts were deleted - rendering unusable the multisig wallets made with parity. All credits stored in them have since frozen. At the time, these were estimated at $ 100 to $ 250 million, partly in tokens, partly in Ethers. A very large part belonged to the company Parity Technologies itself, or their Polkadot spin-off.

EIP999 to save the lost coins

Recently, Afri Schoedon of Parity Technologies filed an EIP999 proposal to eradicate the damage via hardfork. The proposal does not change Ethereum's rules, but makes a single change to the "state", the state of the blockchain, which replaces the self-destructed library code in order to restore the contract so that it can no longer destroy itself. This could be used to spend the credits stored in the multisig wallets again.

The proposal was of course controversially discussed, both on Github, Ethereum-Magicians and Reddit. It seems a lot of the developers and the community rather skeptical. The common reasons are that such a "bailout" weakens the immutability of events on the blockchain and he sets an example that can go to school, which in the future everyone wants their mistakes to be reversed, and therefore the developers make less effort to write secure smart contracts.

Incidentally, the term "bailout" is misleading. Because a bailout means that you use taxpayer money to rescue companies - mostly banks - after they have lost money. EIP999, on the other hand, only invalidates an event that led to a loss. It could be compared to having your bank delete all the money accidentally, but it could recover through a hard disk repair. The victims of the bug win, and nobody loses anything, at least not directly.

Healthy rigor - or religious asceticism?

However, it is now feared that such an approach damages the immutability of Ethereum, be it in fact, because the example makes school, be it in the eyes of the public. It is now a constitutive feature of a blockchain that things that happen on it are final, and Ethereum specifically promises that the smart contracts executed on the blockchain are irrevocable. If you break this rule because the Parity developers have messed up, you risk sawing on this important pillar of Ethereum.

Of course, one could argue that this is an exaggerated, downright religious understanding of immutability. In practice, EIP999 does not change anything. It does not change credits, does not create new Ethers and does not introduce a new rule nor does it override an old one. Should Ethereum really deprive itself of the option of eliminating misfortunes, if it has the opportunity, because "on principle" does not change anything? That sounds like an asceticism. In essence, this leads to the same discussion that already existed at the DAO hardfork, in which fundamentalists and pragmatists face each other.

The devastating consequences of a chainsplit for tokens

However, a lot has changed since the DAO fork. Ethereum is no longer so beta and experimental, but has become the platform for a growing ecosystem of smart contracts and tokens. As the developer Alex Van de Sade explains, it is known today that a chain split that can be triggered by a hardfork will last a long time. At that time it was still thought that a chain would die off quickly. Ethereum Classic, however, has shown that this does not happen. If it comes to such a split, all tokens will have to split. You have to decide on which side of the fork they are valid. Both sides are not possible for many tokens if they represent something else. "And in each case, developers are being asked by both sides to support the chain, and each time another version of the argument of which chain is better is repeated." It will be even worse for exchanges that need to determine which ones the tokens are now valid. Therefore, according to de Sade, a chain split should be avoided at all costs.

Help could bring a choice here with credit on the Blockchain. Via carbon vote you can vote with Ether. For about 6 days, a survey is running among the stakeholders, which will now be over. According to this, not even 40 percent are for the hardfork, but more than 55 percent against. This could mean that the project was called off.

However, a statement by Afri Schoedon, the author of EIP999, leaves room for further interpretation. To Trustnodes, Schoedon says they have neither started nor supported the election. There are no plans to split the chain, but as usual, will try to build a consensus between the developers and the community through the EIP process. It can be understood that Parity will continue to promote the recovery of tokens and Ethers. It can also be understood that a split as a last resort will continue to be an option. After all, you do not know what Parity Technologies is at stake.

Image Sources:

- Article headers created by myself

- https://memo.cash/protocol

- http://patft.uspto.gov

I am happy that I bought few BCH at $700

My condolences on your capital misallocation.

BCash is Very Wrong Ver's attempt at social engineering and mimicry. He's gone so far to even mimic a character in "Silicon Valley".

Instead of "New Facebook" and "New Snapchat", its "New Bitcoin". Unlike other forks of Bitcoin's code, Very Wrong Ver has explicitly stated he wants to usurp Bitcoin itself.

He isn't competing on merit, he's using the same tactics a sleazy vendor of knock-off merchandise does -- copying an established name, and pushing it on people as the original.

This, quite simply, is fraud.

He's gone as far as to list Bitcoin prices in USD, then have a drop-down link on his .com site with BCash as the default. This is designed to dupe new users into thinking they're getting authentic Bitcoin -- but they aren't.

I'd stay away from a project that feels it needs to trick and cheat people to achieve traction.

For those that are interested in a thorough debunking of Very Wrong Ver's tactics, please read this excellent article -- https://hackernoon.com/thats-not-bitcoin-that-s-bcash-f730f0d0a837

I don't agree with Roger Ver's tactics but unfortunately at the moment they seem to be working rather well hopefully having "a kind of twitter" on the bitcoin cash network will show why big blocks is not the answer really looking forward to seeing an average user try running a bitcoin cash node and try to synchronise when 16MB or even 32MB blocks are being churned out every 10 minutes.

Lightning network has more nodes than bitcoin cash now which tells me all I need to know.

They aren't "working well".

http://fork.lol/tx/txs

BCash has had flat transaction volumes for months now. There is no adoption, there is not acceptance. Even the flawed marketcap calculation puts them at 5.6% share. They have nothing but the con-game that Very Wrong Ver is attempting.

And now, on the brink of being sued in a class-action, he stands to lose it all.

There has been massive merchant adoption, which is one of the prerequisites for using it as money.

Meanwhile, the BTC fork has been seeing negative merchant adoption - all because unpredictable fees were an upwards driver of support costs for businesses making Bitcoin more expensive to accept than credit cards or paypal.

There is also adoption from developers, this just isn't immediately apparent because software takes time to develop.

You're joking, right?

Look carefully at this transaction chart -- http://fork.lol/tx/txs

The wiggling orange line, Bitcoin, is in a range consistently above the near flatline blue line, BCash.

That isn't adoption, its 110 or so transactions every 3 hours compared to ~1,500 or higher for Bitcoin. Its been like this for months. Saying you have "merchant adoption" that doesn't translate into more transactions for BCash means --- no one is using your merchants.

Its right there, stats and all.

The "muh high fees" narrative has been shredded since the spam attacks stopped, and now with the addition of Lightning, there haven't been any issues with instant payments, even as low as 0.00000001 -- paying a fee of 0.00000001. Its one of the reasons Very Wrong Ver doesn't mention it anymore, and is now attacking Lightning itself through various posts and campaigns.

Maybe read this article, it breaks down why Very Wrong Ver will continue being wrong - and more about the legal problems he now faces -- https://hackernoon.com/thats-not-bitcoin-that-s-bcash-f730f0d0a837

Dude your joking right? You provide no fee statistic to back up that its higher cost than credit cards or paypal. More importantly there is a reason Bcash is listed 99th on coin geko's developer rating... not even Very Wrong Roger can pump that up!

https://www.coingecko.com/en?sort_by=developer_score

Bgold is in the #23 spot so why are you not shilling that instead or does that not fit your core conspiracy world view? Low fees plus no mining cartel, and best part of all no charlatans with billion dollar lawsuits coming up like CSW. Rogers Bitcoin dot com lawsuit probably wont be in the billions lol.

Merchant adoption day of segwit upgrade (april 27th 2017) https://coinmap.org/#/world/25.79989118/-16.87500000/2

7,271 Total Merchants on Coin Map

Today there is over 12,373 merchants using BTC - almost doubled the amount of merchants compared the all the years previous combined. Yes probably some of those are using Bitcoin Cash but by your logic you would only use Bcash after trying the "broken" BTC.

Are you a Flat Earther as well? Lots of cross over between the Bcash community and that group. I'm talking to a brick wall and should probably just stop if you a Flat Earther I know you don't like to fuck with logic and reason.

regardless of this I think it's a good thing ver's is getting sued as he is using trickery to lure users and has surely caused more than a few people to miss invest as bitcoin.com is a very missleading website.

What about this is deceptive?

Why did Steam stop accepting BTC? Because of the unpredictable fees. People would make purchases with out of date wallet software that would include an insufficient fee for the transaction to confirm. Then when their purchase didn't go through, they would contact Steam support. The costs incurred by this were greater than the profit they were making from BTC sales.

Now, I can see that I am wasting my time replying to you, since you are clearly clueless. SW was not locked in or activated until August.

No one owns the name "Bitcoin". When it comes down to it, BCH is an upgrade to the BTC chain, and a legitimate contender for the BTC name. By the Nakamoto Consensus, when BCH accumulates more cumulative PoW on its blockchain, by the consensus rules laid out in the whitepaper it will be Bitcoin.

I say when, rather than if because the fact that BTC has rendered unupgradable due to dangerous centralization of developer power, and it will inevitably stagnate - and stagnant water breeds disease.

Seriously, fo those of us who got involved with Bitcoin before October 2013, Bitcoin Cash is the coin we got involved with. The scaling plan was always to increase the blocksize. The fact that one day, full nodes would require expensive server hardware and would only be operable in datacenters was something to look forward to, because that would have meant that BTC was being used as money on a global scale.

Don't take my word for it: Source

Did you know Vitalik Buterin wanted to build ETH on top of BTC? He only decided to make his own crypto when it became clear that Core would actively prevent him from building ETH atop Bitcoin.

@ashaman 0-conf is an upgrade? Removing Segwit an upgrade? 32 mb blocks that are only using 4kb of transaction data (15 transactions a block) thats an upgrade? LOL

Also you want the mess ETH has going on right now on bitcoin? The smaller the attack surface the more secure we are and ETH is a fucking galaxy of attack surface.

You can stick to your big blocker talking point that I've heard a million times (what you said above) but its been a year and you have less transactions, less hashing power, and zero overall respect in the community.

Money doesn't matter as a medium of exchange until its a store of value. Think about it outside of crypto, how many times do your friends pay in amounts that cover your rent or a mortgage? For me its not that often, most of the my income and the first worlds income comes from major corporations or small businesses. Both of those entities take on loans and venture capital to start the business thus the money comes from places that are legacy stores of values that are not at all in crypto. If we we're only getting paid in the money that comes from sales every business I've worked for in the last 10 years would've failed. ICO's are the only companies I've worked for in years that haven't relied on loans and VC's. Even that is misleading because the big token deals are basically huge VC cash infusions. Do you think they're worried about a transaction fee for a multi-mullion dollar token deal? No because it's either an OTC transaction or in a coin that also has low fee, zero- cost transactions, like you precious BCH garbage.

For us to become a truly world currency we need to disrupt the store of value, get paid in that, then commerce in that new store of value (bitcoin to lightening network). Bankers and VC's don't give a fuck about your crypto low fee transactions, they're invested in Paypal and Venmo already!

You can scream from the top of a mountain, original vision, free transactions, and we're scaling but none of that changes how money is held overtime i.e. bank loans, gold, us dollars and soon to be BITCOIN (BTC).

Further more you say no one owns Bitcoins name but by that definition you say Bitcoin's name will be owned at some point. Until that point STFU and by your own def if your holding BCH right now its not Bitcoin. There wouldn't even be an argument if the Bcash community didn't try to take ownership of the Bitcoin name.

I hope your getting paid for shilling Rogers Scam. Sorry I take this so personally, my mom got scammed by Bitcoin.com wallet saying it was bitcoin when its actually bitcoin cash and she almost lost all of her BTC sending to that address. All because of this bullshit confusion perpetuated by people trying to make gains on a coin thats for transaction only...

Absolutely, that over-engineered hack should have never found its way into the codebase. It would have been fine as a hard fork, but that was out of the question because it went against the false narrative that hard forks are simply too dangerous to attempt.

You got it backwards here. In order for something to be a store of value, people need to have confidence that others will accept it for things of value - in other words, it needs to be used as money first. Gold is only a store of value today because of its multi-millenia history of being used as money. BTC will never be a store of value in the long run if it is not used as money first.

You have either been brainwashed by the propaganda campaign being run out of /r/Bitcoin or you a Core shill (in which case go fuck yourself with a red hot iron poker).

Its fascinating how deep down the rabbit hole you are. Honestly, I couldn't ask for more of a textbook case of Cognitive Dissonance if I tried.

So when you look at this transaction chart -- http://fork.lol/tx/txs

What do you see? I'd love to hear how you spin that one.

Give me your e mail address and we can talk private thanks.

I am on a wedding for the next 5 days but I will pm you.

You can hit me up on Discord, same nick.

okay cool i will do that c ya later on discord

i can't find you on discord it would be cool if you try it and look for my acc. name is danyelk thanks and i hope to c ya soon on discord

damn sorry i am trippen good on shrooms at the moment ;)

send me an invite

You'd have to give me your four digits so I can find your Discord account.

Hell yes let 'em know @talltim!

That memo.cash is hot garbage "its like comparing Bitcoin to Paypal" is extremely miss leading. That would be a fair comparison for STEEM / Zappl to Twitter / Tumblr. We're talking on an amazing decentralized social media platform already, are you going to say memo.cash is the original vision for STEEM or Zappl? These bcash'ers really are desperate to fill up those empty blocks. Last Bcash block as I'm writing this (527803) was 4 kbs total weight LOL

It is a very beautiful text, through this I became aware, you have endless religiousism.

I have still all my BCH from the BTC fork and I bought more BCH back in October 2017 at $ 320 ;)

I have week hands :D

You should have bought EOS instead in october... Oh man you could have gotten EOS at $1 or 50 cents oooohh its $15.50 today almost $16 hahahaha

but yeah I appreciate using Bitcoin Cash when I need to top up my Bitpay Visa Debit card without any fees :D

Bro I am on a wedding in full party mode but one thing I have to tell you I bought EOS for $0.56 back in October all is good lol 500K EOS on my account juhuuuuuuuuuuuuuuuuuuuuuuuuu

LOVE&LIGHT

C ya next week and keep steemin BRO

Could have, should have, would have.

Happy B day bro! May all your wishes come true, stay a healthy kid, smoke that broccoli:))

Thanks bro I had a good one and a lot of broccoli lol ;)

Now I am going to a wedding for the next 6 days I will be back at Wednesday next week :)

Keep the memes coming and I talk to you next week :)

Okay have a great time but be careful, these weddings can get out of hands fast lolz

Cheers, to the lucky couple:)

Thanks bro yes I will be careful lol

Wow a really interesting development. I thought that BCH was dying off but it appears it may well prove me wrong!

Great explanation. I heard of it but didn’t know what memo cash was. This is great for bch. The amazon news is quite scary though by comparison.

Yes the amazon shit is real and we have to fight it!

transaction will approve when you use the main formula by getting the permission,,

agree ;)

ive been wondering for a while why there isnt a twitter clone on top of the STEEM blockchain

Your right buddy me too hope some of the IT nerds will bring it on soon. If not I will have to look what I can do to bring a damn twitter on the steem blockchain.

STEEMIT WHALES wake the fuck up

What are your opinions on Storj? You seem to know your Cryptos please share some opinions on my post here: https://steemit.com/altcoin/@dylan607/how-to-find-a-good-and-profitable-ico

I think Storj is a good project but it has some good competition in terms of cloud storage aka SIA etc. we will see in the future who will win that battle.

Just in case I have invested in all off them ;)

my company in which I am the co-founder gest payout from 2 petabytes of data with storj !

https://satoshipapi.io/wolfstein-tech-1

@danyelk Hey Thanks for the reply. As far as I am concerned Sia is cheaper for the consumer but more expensive to the hoster whereas Storj is the opposite with higher price but better paid hosters.

edit: It can not be like Steemit, since Bitcoin Cash has a finite future amount.

It has to be a stricter zero sum game, with people moving BCC to one another with the only guaranteed winners being the miners.

I wonder if it has downvotes and if it has what is their effect.

My initial thought was:

Is it like Steemit or dan's next competition for it?

Like steemit... only as in converting previously siloed value into crypto. Tbh dont think bitcoin coin chain suits this? 3rd gen chains may suit tweets/memos?

Eliminates (micto)transaction fees, but would prob need a solid revenue model to pay for nodes tbh :p

I feel like you know better than I and tried to answer, but I need a translation of what you wrote.

siloed value is not not a known combination of words for me.

By 3rd gen chains you mean stuff like Byteball?

What are microtransactions and are they eliminated in Bitcoin Cash?

I thought it is like Bitcoin but even less advanced due to BTC's adoption of lightning network.

Again I do not know what you meant.

You got a 22.22% upvote from @sleeplesswhale courtesy of @stimialiti!

Everytime i close my eyes to sleep, i wake to hear different sorts of innovations and developments in the blockchain and tech industry. memo.cash, a kind of twitter on the bitcoin cash blockchain, is definitely worth check out. Thanks for sharing this information

@danyelk this is a good update on blockchain. I will check on Memo.cash Asap to see how it works. Thanks bro!

Your welcome ;)