Buy side stop limit order triggering under the market price. Let's talk.

What happens to a buy side stop order if we place our stop price and our limit price below the market price? In our previous discussion, we place our buy side stop order's parameters above the current market price like so:

Now, we want to consider what will happen if we flip this logic. We want to place our stop and limit price parameters below the current market price like so:

The current market price is right around $55.00 USD. Now, we are going to configure our stop order in the following way:

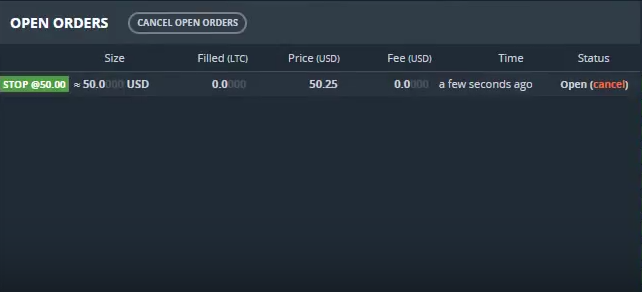

This gives us a buy side stop order under the current market price of $55 USD. Now, we are ready to place this order. As we place the order, we see the stop order hit the book. We know the order is a stop order because we can see the STOP @50.00 tag on the open order.

However, this state only exists for a split second. As soon as a new trade happens, the trade history is updated with the last trade price. At the same moment, we see our stop order turn into a limit order. We know this because our amount hits the buy side of the order book and the stop tag in the open orders section is removed.

This behavior is what we expect because buy side stop orders are not meant for the buy side of the order book. Buy side limit order are meant for the buy side of the order book. The buy stop order is on the sell side. This is why we need the stop price. It allows the order to hover over the sell side of the order book until the order is triggered. At the moment the order is triggered, the buy side limit order will hit the sell side of the order book and a buy/sell match will be made. To see this in action, please view the video here: