Build Your Own Crypto Currency Decision Matrix 📋 🏗️ 📚 💸

Understand Your Asset Class

What is crypto currency?

A system of transferring wealth using encryption for storing and validating the open ledger.

Uses separation of power to validate transactions.

Global and unregulated.

How does it hold value?

In the beginning people thought it was a scam and it was hard for non technical people to understand and use it.

Today, market cap has increased incredibly and your average risk taking joe bloe is now using it.

Crypto assets can be seen as either a safe haven like gold assets, or as a utility asset like any other stock.

BTC (Bitcoin) has little utility but is often used by the joe bloe as a cheap alternative to gold.

Other cryptos like SiaCoin, have utility and therefore value would increase as demand for that product's utility increases.

Safe haven cryptos like BTC & VGX, have little utility but its value would increase if there is a fear of fiat instability just like in the market crash in 2008, or if there is media hype about its future value against fiat exchange.

What risks are involved?

Your country could ban crypto currency.

There are ways around a country ban, but that's for another article.

There is no financial protection like VISA.

There is no refund mechanisms.

For ICO (initial coin offerings) alternative coins, the team could be scamming a pump and dump move and not be in it for the long term.

Historic volatility for some assets reach a fall of 50% in one year.

The crypto developer community could be too slow to adapt to the threat of quantum computing decryption of the public blockchain. In simple terms, a corrupt government with a quantum computer could in theory decrypt the blockchain and transfer wealth into their own wallet, since there is no regulation it would be fair game.

EDIT: I found this on a facebook group, so i thought i should add it as part of risks. In summary, between 2016 and 2017, only 8% out of the 26 000 ICOs and are still actively maintained on github according to Deloitte researchers - https://www.cnbc.com/2017/11/09/just-8-percent-of-open-source-blockchain-projects-are-still-active.html

CNBC has not discussed in the article whether this is due to the product being mature enough, or whether it's due to project abandonment.

Gather Your Asset Universe

Find your local multi coin exchange on google/duckduckgo and dump all tradable coins in a spreadsheet.

If you're like me you will have 60+ coins listed.

You will have a coin per row.

Design Your Matrix. What Do You Value the Most?

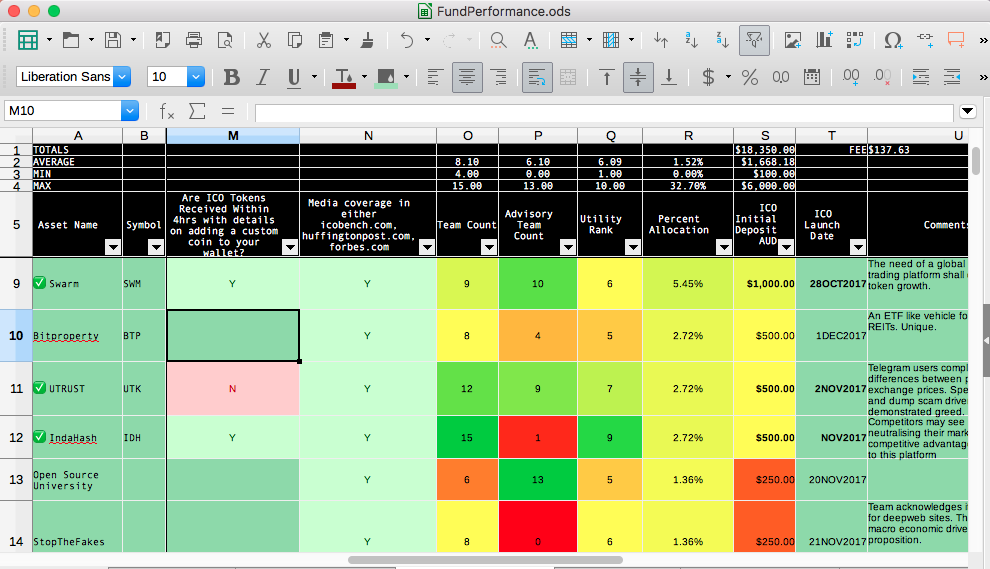

As your spreadsheet headers, you will list what you value the most as columns.

Examples include - team count, advisory count, has a minimal viable product before ico, has media coverage in forbes huffingtonpost or icobench... etc.

Now do some research and fill in your spreadsheet!

Apply a sortable filter on your column headers.

You can now sort by things like asset allocation %, utility rank etc.

You can also filter and view competing coins if you filter by coin industry.

By dumping & researching all data onto a spreadsheet, you will be well positioned to allocate a strategic % allocation of your wealth based on risks that you value the most.

Example Spreadsheet

Risk Management

By diversifying against many crypto assets you are dampening volatile swings of the individual ones.

By building a decision matrix you are reducing risk and maximising return by strategically allocating percentages based on your conviction of risk & future value.

For ICOs, your matrix would identify possible scams, & short term pump and dumps.

Process Over Rumours and Gambling

You could become a millionaire just by randomly putting an allocation to BTC and hope for the best.

Or, you could even buy the rumour and sell the truth.

But the truth is - How much effort and research you are willing to make, will determine how much luck you need, and how much return you are probabilistically going to get.

Related Articles -

- Understanding the Landscape of Managing your Wealth - https://steemit.com/finance/@edendekker/understanding-the-landscape-of-managing-your-wealth

@OriginalWorks

The @OriginalWorks bot has determined this post by @edendekker to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

"Buy the rumor and sell the truth"...I like the sound of that! Simply sagacious! You should probably do a post on the variables for the Spreadsheet matrix...that's bound to add some mighty value! Cheers

Thanks for your comment!

I'm guessing everyone's variables will be dependent on their creativity, their values, and their knowledge. A full finalised spreadsheet would represent what they value the most in terms of risk. This would be a competitive advantage that they would not share.

It is always good to give enough to inspire ambition, but not too much. I hope this inspired you! 😀

Nice perspective man...cheers!