COLLAPSE IN THE CRYPTOMONDS WOULD NOT HAVE AN EFFECT ON THE WORLD FINANCIAL SYSTEM, ACCORDING TO THE RISK CALCULATOR S & P

Recently, Standard & Poor's (S & P), the financial risk rating agency, reported that they do not believe that a collapse in the cryptocurrency market harms the global financial system.

In a report published by S & P entitled "The Future of Banking: Cryptocurrencies will need some rules to change the game", it explains the development that cryptocurrencies have had during the last year and their possible relationship with international financial markets is studied. Also, the Head of Financial Institutions of S & P, Mohamed Damak, has spoken on this issue.

For now, a significant drop in the market value of cryptocurrencies would only have the effect of a wave in the financial services industry that is too small to disturb stability or affect the solvency of the banks we rate. We believe that the future success of virtual currencies will depend to a large extent on the coordinated approach of global regulators and legislators to improve the confidence of market participants in these instruments.

Mohamed Damak

Head of Financial Institutions, Standard & Poor's

This report explains that the main reason why the collapse in the cryptocurrency market would not be transmitted to the international financial market is that the exposure of banks to cryptoactives is quite limited, since banking investments in this market they are much smaller than those of retail investors, who do represent a very important weight in that market, and it would be the latter who would mostly assume the losses of a collapse in the price of cryptocurrencies.

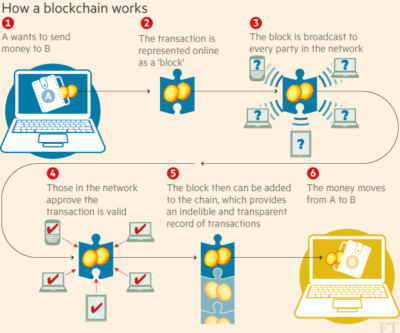

However, S & P believes that blockchain technology can have positive effects on the financial system, having the potential to reduce costs and increase transaction speeds. And not only by itself, but the cryptocurrencies of the central banks would also form a new paradigm.

Blockchain technology could be a positive disruptor for several financial value chains. If widely adopted, blockchain could have a significant and lasting impact on the speed, traceability and cost of financial transactions (...) The creation of a cryptocurrency backed by a central bank that gives citizens direct access to the block chain This central bank is potentially a game changer for banks as we know them. This does not mean that banks will disappear, but it does mean significant changes in the way business is done.

Standard & Poor's

The usefulness of blockchain technology in the banking sector has not gone unnoticed. Thus, for example, one of the most important Spanish banks, Bankia, has launched a platform called STOCKMIND, which allows the tokenization of any type of asset. The ABN Amro Clearing Bank, the fourth largest bank in the Netherlands, will also include a new user registration service based on blockchain technology.