Shocking News: Americans and money

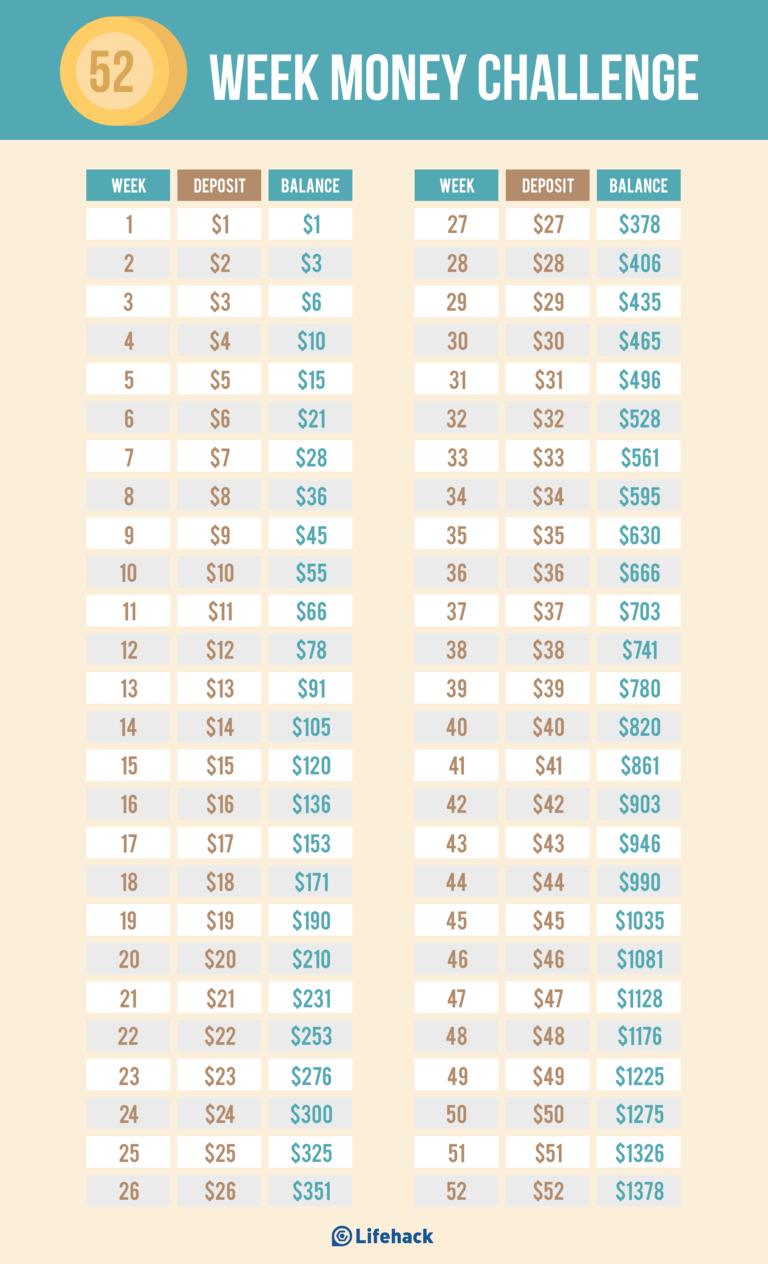

Going through one of my favorite websites, https://www.lifehack.org, I came across an interesting article about what is called the 52 week money challenge. It is a simple challenge that aims to help people save more money, but whats shocking was to find out that 69% of Americans have less than $1000 in savings. More about the survey and the 52 week money challenge in the video below.

The week money challenge schedule:

At times like this, it is extremely important to save money and most importantly, invest it in commodities and deflationary assets. Cryptos are fantastic because they are more affordable than gold and real estate, and their growth potential is better than silver. I have wrote a short but extremely helpful eBook that explains the blockchain technology, wallets, exchanges and introduces some investment strategies in simple terms. The eBook is a must read for crypto doubters and the older generation, I just published it and your feedback will be much appreciated. The link is down below, please do share it with your friends and family.

https://www.amazon.com/gp/product/B074XPYRMW/ref=abs_add_sc_

Follow me @omarkhodeir for tips and tricks to increase your income and productivity.

Great article, but I no longer find it "shocking" that 69% of Americans have less than $1000 in savings.

I was very shocked, after all 69% is more than two thirds the american people. But yeah you are right, after giving it a second thought, consumerism and materialism have taken over modern society and it is hard to fight the urge to spend your money on something.

Is it just consumerism and materialism or do they have not enough income? In Germany, 50% do not have any savings. Over 60% of those who have savings do save less than 100€ per mounth. Maybe just 50 or 20.

10 million people over here (1/8) have to live with 102€ per week, for everything exept rent. This means electricity, groceries, hygiene, clothes & shoes, insurances, whiteware (new or repair), puplic transport or a car (obligated insurance, gas, repairs), maybe pets, TV, hobbies,... everything with 102€. How much can there be left to save it?

ok I see your point. I would argue that it is definitely a mixture of both, consumerism/materialism and insufficient income. Because It is established that as income increases the spending increases, even though the subjects were surviving on less and probably satisfied. My point is, if the income is not great, that is yet another reason to save, that means managing a tight budget and letting go og unnecessary items i.e. cigarettes, alcohol, drugs and deffo pets and pet food. I get that it could be hard, but trust me, I come from a developing corrupt country and you guys are blessed. Saving is still manageable if you imagine yourself living on a smaller income.

I totally agree thats even more important to save money if you don't have much. But I understand that that's not really possible for many people. And for example most of the 10 millions here are not even allowed to have more than 150€ savings per year of their life. Means if you are 30 and have more than 4500€ (including car, life insurance,...) you have to take that money for living, before you even get any benefit. Doesn't matter if you've saved that money over 15 years by putting 10€ aside per week.

If you invest in cryptos and loose your money it's totally your problem, but if you make profit you have to take that for living till you are poor enough again. That's kind of depressing.

I've started this so many times, last time I let someone else hold it, but after severe threats she gave it up HA Great post...hopefully these numbers will change, or we are in trouble, but like clockwork you get a good amount saved and life happens to take it away. :(

yes but it is still better than selling some beloved item or ending up in debt right? I recommend just buying Litecoin off coinbase every month or so; you eliminate the hassle of keeping cash around in a jar, and the temptation of transfering the money from the savings account to spend it.

I tried this challenge a few years ago. It starts good but it gets hard to have the cash available to put into a jar every week. It's not that you don't have the money, it's that you don't have the physical cash to put in the jar and if you miss one week, it gets put off until the next and it gets harder to catch up.

What works for me is to put the same amount into a savings account before I pay any other bills. For me, it's 10% every two weeks. That isn't really that much money once you get used to paying it and chances are it will be more than $1500 by years end unless you are putting less than $25 a week. It used to go into a savings account but now I put it into cryptocurrency which gives me more profits on the gains instead of losing money on inflation when it's sitting in the bank.

Yes I agree, people are moving away from cash and more towards debit and credit cards, and yet they still cannot embrace cryptocurrencies. However I should have made it clear that setting aside the money could also be by moving the money into their savings account. Which is more practical nowadays.

This is great. I wonder if I can save Steem like that each week for my contributions on steemit and have over $1500

This is actually a great idea, better than saving dollars.