Kyber Exchange Beta goes online on ETH mainnet - Ethereum's premiere DEX

The Kyber Exchange Beta just went live and can be used since today! Kyber is a highly anticipated Decentralized Exchange and is one of the two pet projects that Vitalik Buterin himself is an advisor to.

KYBER BETA

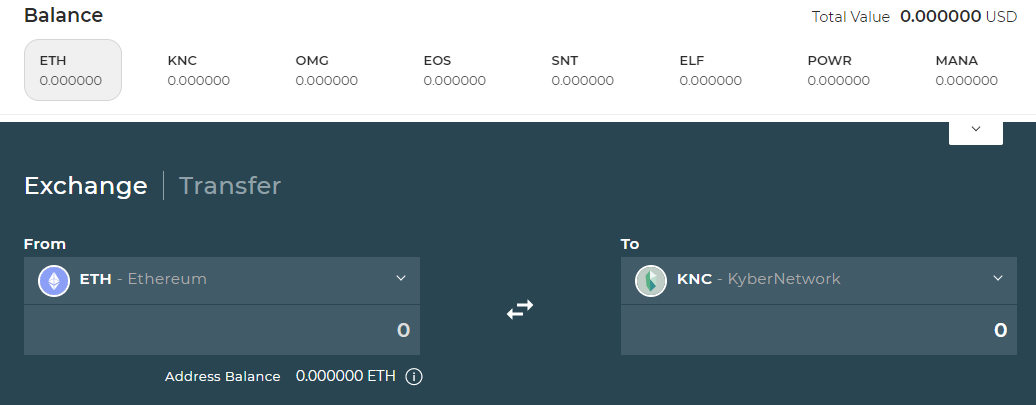

The Beta version of Kyber went live today and can already be used if you want! It supports Ethereum and 10 ERC20 tokens right now, among which favorites such as OMG, REQ, BAT, POWR and EOS.Even though the exchange is public, and allows for logging in, you can't actually trade there yet unless you have KGT (Kyber Genesis Tokens) tokens. These were handed out to ICO participants only and are currently the only way to pay for trading/gas fees. This means that unless you're an ICO participant this Beta is a 'watch only' Beta to you and you will have to wait until this stage of Beta is over and they change the trading fees away from KGT.

What I immediately like about Kyber is their wide wallet support. As a DEX, you don't have an account when you trade with Kyber. Instead you connect your wallet directly to the exchange, and this is essentially your account. Your funds will automatically be loaded and there is no sign-up or KYC involved, and your funds remain inside your personal wallet and newly traded funds always end up in your wallet too, giving you full control and eliminating trust.

Kyber is a 'next generation' DEX over solutions like Etherdelta because these older style 'DEXes' often have off-chain orderbooks and order matching. Kyber improves over these solutions by handling the majority of actions on-chain, meaning less trust is involved or required, and they also guarantee liquidity by having a built-in decentralized reserve to fill your orders with.

One thing to note though is that judging by the Beta, Kyber is not actually an exchange in the sense that we are used to. It doesn't have price graphs and doesn't allow many features that we're used to in exchanges.

Instead, Kyber looks to be more akin to a Shapeshift rather than a Bittrex: You tell the network which coin you want to trade and for what, and then commit your order. Essentially this uses the current market price, although some limited Advanced options are available to influence the buying price, it is clear that Kyber aims to keep it simple.

HIGHLY ANTICIPATED

Kyber is a popular and well loved project in the cryptocurrency sphere. Much of this is due to the fact that Vitalik Buterin, the founder and creator of Ethereum, is personally advising this project as one of the only two projects that he advises (the other being OmiseGO). Vitalik's backing inspires a lot of confidence and many people see Kyber as one of the premiere Ethereum projects because of it.Another big reason is that Kyber is a South-Korean project, and Koreans sure do love their crypto. It is hoped that Kyber gains a significant footing and userbase in South Korea, although the project is of course aimed globally.

Thirdly, Decentralized Exchanges have been touted as 'the future' for a while now, and with Kyber being a DEX it shares part of the excitement as well.

I haven't invested in Kyber's own token because I didn't find the token value proposition enticing enough (it is basically a tokenburn as it's value proposition). I believe this is the main reason for the low market cap of this coin, because it definitely has enough popularity to be among the top 20. I think this DEX may indeed become a popular choice for crypto enthusiasts and traders, much in the same way that Shapeshift is very popular today as well. Except this will be decentralized and trustless.

>> Click here to go to the Kyber Network Beta <<

Great share. I resteemed it to have as a reference and to spread the word. I agree, decentralized will be big in the future.

Thanks!! And thanks a lot for the resteem too!!

And yes I am anxiously waiting to go all-DEX when I can. Ironically enough, Bitcoin is the main problem with DEXes so far. Most DEXes that I can find so far don't actually support Bitcoin. I think the first real DEX that offers both a great UI, identical service and speed to centralized ones, in combination with being able to handle Bitcoin, is going to be a winner.

Sounds like you did your research...

I will study it a bit too

Thanks for bringing it up!

Following you

And Resteemed

What do you think will happen to the centralized exchanges? I am thinking about Binance and Kucoin. I have invested in their tokens, and I am selling them now, because I had a good gain and I find the DEX much more appealing. Do you have any information if Kucoin or Binance wants to turn themselves in DEXes? I think that that would be the only way to survive and the only way to keep the value of their tokens.

Actually yes, Binance is planning to go fully decentralized at some point. They have stated their the BNB token will play an integral role in their DEX, once it (re)launches. The details are still unclear, and they probably are still in the planning phase. As for Kucoin I don't know.

I think centralized exchanges will remain for the foreseeable future, but perhaps become less popular over time. Centralized exchanges are still much faster than decentralized ones, and currently offer a lot more liquidity. Perhaps this changes in the future... But then centralized exchanges can still offer benefits to users, like insurance (they take responsability for the care of your crypto - some people trust exchanges more than themselves). Large institutional investors may demand certain insurances, too.

They will have to innovate to adapt, and perhaps some of them will evolve into DEXes as well, or become hybrids.

For 2018 I am pretty sure centralized exchanges will remain popular.

Great post and I do believe DEX is the future. Any idea how Kyber compares to Bitshares?

Kyber is different because it is built on the Ethereum blockchain, and actually trades out of the Ethereum wallet you have directly. With Bitshares you first have to send your EOS (for example) into a BTS wallet, which then 'converts' your EOS into BitEOS (or OpenEOS if you come from OpenLedger) which is sort of like an IOU on the Bitshares network for an EOS token. Then when you want to take money out, it unwraps the BitEOSand gives you back the EOS.

With Kyber no such conversion takes place. Your EOS token is directly moved from your wallet into the buyer's wallet, and vice versa.

Kyber however currently only supports Ethereum based tokens, whereas Bitshares has Bitcoin and other blockchains, and even digitized/tokenized assets like Gold or other metals.

This post has received a 1.58 % upvote from @drotto thanks to: @pandorasbox.

Great information

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

You have a very good post. This article is a good idea to me.

"Decentralized Exchanges have been touted as 'the future' for a while now, and with Kyber being a DEX it shares the part of the excitement as well."

Hope this is better than you.

Thanks for the post.