An insane truth I learned about Cryptocurrency in 2017.

So its been a full year and I have been really paying attention to how things have gone with cryptocurrency in much greater detail than before. And I learned some pretty crazy shit that pretty much nobody is just coming out and saying at this point in time. Its been a wild ride this year, especially near the end.

The main thing I learned is that all of it was a complete wash. Nothing mattered. The speculation, the pro tips, the king of crypto Bitcoin, professional advice, day trading tactics, learning to read the market and making sound choices.

Nothing mattered, it was all completely worthless. Everyone fucked up and everyone single one of us had no clue what we were talking about. Even the smartest of the smart early adopters with years of training in the stockmarket were all wrong. Those people who berated others for any portfolio not having at least 50% Bitcoin were completely wrong. Anyone who thought Bitcoin was a good investment in 2017 was completely wrong.

The only thing that ultimately mattered was how many of a coin you were holding. It barely even mattered what coin it was. A lot of people have been under the impression that Bitcoin was the king of 2017 and everyone who held Bitcoin made the most money. When you pay attention to ROI (Return On Investment) starting at 1/1/ 2017 you will quickly realize how meaningless all speculation was this year. Bitcoin was not even close to the top coin this year. It shouldn't even be on the list!

Pretty much nothing mattered. If you don't believe me then buckle up, I have the numbers to prove it and you are in for a ride.

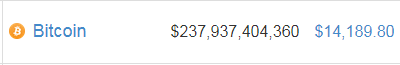

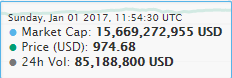

Lets go through a list of coins and pretend that on 1/1/2017 you invested exactly 1000 USD. Lets begin with Bitcoin.

$1000.00 of Bitcoin on 1/1/2017 would have got you 1.025 BTC

ROI for 2017 : $14557.31

Not bad right? If you were smart you would have likely sold off at 19k and made close to 20k total.

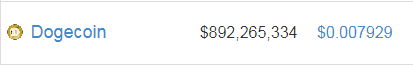

So right away I want to go for the throat on this. Example number two is going to be a fairly well known joke coin that pretty much nobody takes seriously. The ever well known Doge Coin. You are probably thinking that this is a complete joke right? Well, lets look at the numbers.

$1000.00 of Doge on 1/1/2017 would have got you 4524886.877 Doge

ROI for 2017 : $35877.82

35k!! What the fuck, Doge was insane this year!!! This joke coin was no joke at all actually, it was complete fucking blow out and it destroyed the hell out of Bitcoin ROI this year...

Well, lets take another look at a joke meme coin nobody took seriously this year...

Many people refer to Monacoin as the Japanese Doge. Nobody has ever gone on record as taking this coin seriously. So lets take a look at the ROI for Monacoin in 2017...

$1000.00 of Monacoin on 1/1/2017 would have got you 42643.923 Monacoin

ROI for 2017 : $445628.99

Well, uh, I would be a millionaire right now... Easily. Off a fucking joke Japanese cat coin. Where were the speculators talking about how to maximize profits for this? They were all butt riding bitcoin. So when I bring this up a lot of people tend have this fairly common response.

"well, sure, but it would have been such a huge gamble to find that one coin that would have gone higher, Bitcoin was always the safer choice."

The problem is, The above two examples are not some random occurrence. I am flat out saying it was barely a gamble at all. Looking over coin market cap shows a very large number of coins out paced Bitcoin by more than double in 2017. And most of those coins were considered safe holds at the time as well. The list of coins that didn't is very low. Lets take a look at other, "safer" alt choices in 2017.

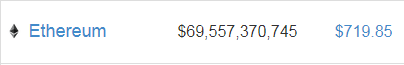

$1000.00 of Ethereum on 1/1/2017 would have got you 121.506 Ethereum

ROI for 2017 : $87466.09

$1000.00 of Ripple on 1/1/2017 would have got you 153964.588 Ripple

ROI for 2017 : $227867.59

And Ripple is already looking really strong for 2018 right now... Good god...

$1000.00 of Litecoin on 1/1/2017 would have got you 236.406 Litecoin

ROI for 2017 : $56574.31

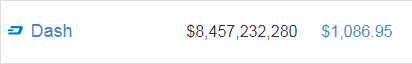

$1000.00 of Dash on 1/1/2017 would have got you 87.796 Dash

ROI for 2017 : $95429.86

Now I can keep going with this. There are some coins that did not do so amazing in 2017. Then there are some that just exploded the hell out. I have gone through a lot of the list on coin market cap and have not found a single coin that did worse than Bitcoin however. Bitcoin, as of right now, is the worst performing coin for 2017 especially when compared to the more well known alt coins.

The fact that Doge coin beat Bitcoin alone should give pause to anyone who thought they had their head in the game. If I told people in 2017 that I went all in on Doge I would have been laughed at. People would have assumed that I had lost my damn mind.

But the honest truth is that, in 2017, Doge completely destroyed Bitcoin. I would have more than doubled my gains... You could have almost literally threw a dart at a dart board with pictures of coins on it while blind folded and increased your gains by more than double this year.

Everyone was fucking wrong. EVERYONE.

You are mistaking, not making the perfect choice, with making the wrong choice.

lets say one persons bets a $1,000 on a roulette wheel and wins $37,000, did they make the right decision? their EV profit was -$50

The problem is, Bitcoin was the worst choice for this year by a very large margin and nearly every other coin did better. In other words, its not like I am saying "Oh X coin did so great!" I am saying you could could have blindly invested in random coins and had a 90% chance of higher gains in 2017.

This is not about making the perfect choice. Its that Bitcoin was at the bottom of the list.

ah but the best choice by your definition was to pick the correct lotto numbers each week.

You would of easily had the highest ROI but that doesnt stop it being a poor EV choice to play the lotto.

Not a good idea to look at something with a level of randomness in hindsight like this.

Now that we know what we know from 2017, moving forward to 2018. Only a fool would have Bitcoin in their portfolio moving forward.

That trend will most likely continue...the microcap cryptos only take a small portion of the money flows to move them significantly...and since the centralized exchanges price everything in BTC, money flows from BTC and into Alt Coins...and more people are going to HODL even more next year in the US with the new IRS tax rules...if they are even paying attention to those.

You’re describing a gamble. Gambling can be profitable in the short-term if you know how to play your cards right. The same can be done with lesser known cryptos

Everything in this sphere is a gamble. But the basic truth is that you would have had a 100% chance to more than double your gains if you dumbed Bitcoin for at least the more popular alts on 1/1/2017. That means you there was no gamble about it.

Back then it may have felt like a gamble. But it was more or less, a linear increase in profits had you gone with any of the other coins.

Exactly, it was evident that advertising and adoption of early coins was going to cause a linear increase in lesser cryptos just due to the fact that they get traction when people start knowing anout them. This why I bid on XRP. It was a fairly unknown crypto compared to BTC and ETH on 1/1/17, yet they were building a sound product and giving meaning to the crypto instead of just letting the masses dictate the value of the coin.

Not me ^_^

I played towards return on profit. OVER 9000!!! or not interested :D

Return on profit, return on investment. Same thing. You fell for the trap like pretty much every else did. You made way less money because you went with probably the worst coin in 2017.

No way. I got 20,000%+ on some coins. Over 9000% is my jam.

I hodl no bitcoin. Pure alt short to long term hodls. Did my maths back in march, and focused on return rather than the shiny popular coins that won't have as much return.

Oh I misunderstood. I thought you meant over 9000 USD lol

Sorry!

And on that note you are 100% right. I was a fool to only hold Bitcoin for most of this year... I wont be making this mistake a second time.

I've been in the game less than a month, and I very quickly realized just how full of shit most of these experts actually are. I just wish mining altcoins was easier. At least Steem is easy enough to farm up...

They mostly just talk bs and get the free ad money..

Yeah, that's basically it. And the funny thing? There's nobody who can truly provide good, sound advice about the stuff. There's no precedent, no history to draw upon, it's all a crap shoot and (almost) everybody knows it.

Nobody knows exactly how the things will be after a year or even six months. But when comes to coins, especially to Bitcoin, the things went just crazy this year. The market was not really used to cryptocurrencies. Most of the people bought coins just because their friends did, not knowing the projects behind them. Now, let's see what comes next. Anyway, the prices, in my opinion, will go even higher.

We may begin to see a shift towards projects that can be used for tangible things. Steem and Sia will likely be valued more in 2018. But one thing I think will be a big deal is Visa Debit cards, those will be super ultra shiny to normies and nocoiners a like.

You’re completely right. This is something I’ve been telling my friends and family about the crypto world. Honestly nobody knows shit, the only thing that matters is information and cold hard statistical analysis. You don’t need to be a finance expert to tale advantage of this tide.

Interesting point, I agree with commenters that you misphrased the argument but your statistics are really facepalm moments.

As with any investment. Data shows something like 99% chance a product following index will always beat a managed product. Meaning investing long term, diversified, low cost etc is what is needed to be successful in the long run. Leading to financial stability in say 20 years time for rest of life.

Alternative is to do the short term gambling with hitting highs and lows, few assets and lots of trades. Have huge profit this year, huge losses next year, then huge profits again etc. But certain to end up with 0 in long run. The provider of the system, product or asset on the other hand will always be a winner though, as this behaviour creates income for them.

This and similar thoughts might be good to have if crypto currency is the first type of investment that you got into. Not directed @thecastle specifically, just a general boring advice to anyone random.

I do not know what happened to Bitcoin in the front days. . Nobody knows exactly how the things will be after a year or even next months.

I do not understand that the coins in the bit are doing any wrong things?any great post. .

Very important post, it was necessary to know about this matter. . thank you @thecastle

I was just scrolling through the 'Hot' section and came across your post, and wow, great article! I've been wondering about this myself. I started this year with a little bit of BTC and LTC and when LTC rose to $30 I sold them, and started trading back and forth between various crypto's. But I've had a lot of old coins in the past too, which are now booming. Dogecoin is one of them, Reddcoin was another I mined way back in 2013/2014. I sold those for BTC as well. But looking back, I really wonder about all my sales... sometimes it feels like no matter what, it's always better to just hodl. Even the shittiest shitcoin seems to explode, as long as you're patient enough to wait for it.

I'm baffled by it myself, it makes no sense logically, except if it's all due to large investors who just decide to invest in 'the entire market' instead of specific crypto's. There are those who do not investigate much, and instead just buy a bunch of every cryptocurrency. It's worth losing 2/3rds of all investments, if the remaining 1/3rd goes up 100x, perhaps?

And seeing Dogecoin with the numbers you calculated: wow, I guess they are right.

Anyway, as I was saying.. I was scrolling through the 'Hot' section and saw your post and liked it. Checked out your profile and saw you write opinionated pieces about crypto, which I like too! I decided to give you a follow. I have a similar repertoire of articles, feel free to have a look and perhaps you'll see stuff you like as well!

I checked out your blog and I like what I see! Followed!

Thanks!

I'm on the lookout for 'real' Steemians who write similar stuff, so I am glad to find your blog! I am in the process of replacing the 'useless' blogs that show up in my feed with blogs that I actually want to read. Maybe form our own little non-spam crypto circle, or something like that!

those numbers are very true! I wish I invested only 25$ in it in 2010 :)