Are Cryptocurrencies in a Bubble in 2017? Are believers in a cult?

Ladies & Gentlemen,

This submission is a modified version of a one-on-one exchange I recently had with a channel subscriber and friend on Facebook.

Let's talk about bubbles.

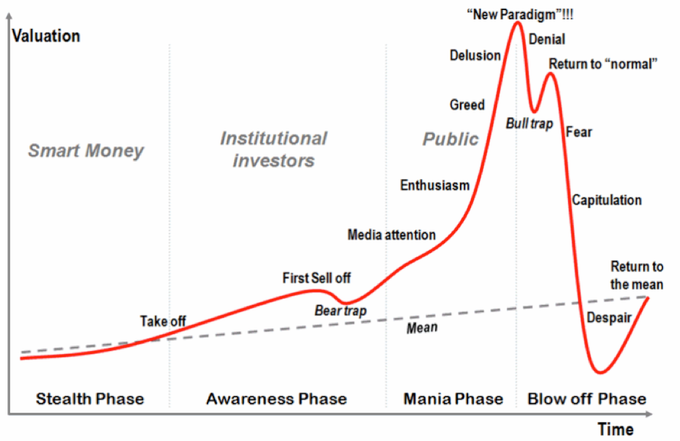

Every bubble throughout history has burst. There has been no bubbles that have not burst. Not one. The trick is to get in early and then get out before the bubble bursts and the shit hits the proverbial fan.

So - Are cryptos in a bubble?

They definitely have all the hallmarks of a speculative bubble. As Peter Schiff says - If it looks like a duck, walks like a duck, quacks like a duck it's probably a duck. But only time will tell. In the meantime money will be made and lost in cryptos just as it is in other markets.

Robert Shiller wrote a booked called Irrational Exuberance back in 2000. Irrational Exuberance evoked Alan Greenspan’s infamous 1996 use of that phrase to explain the alternately soaring and declining stock market. It predicted the collapse of the tech stock bubble through an analysis of the structural, cultural, and psychological factors behind levels of price growth not reflected in any other sector of the economy.

I first read Shiller’s book Irrational Exuberance in 2000 when it came out and I thought he made very good and convincing arguments. I'm actually a very big fan of his work and have read a lot of his articles over the years so when he utters bubble as he has recently done in regards to Bitcoin we should definitely listen and take note and seriously consider what actions we should take (if any).

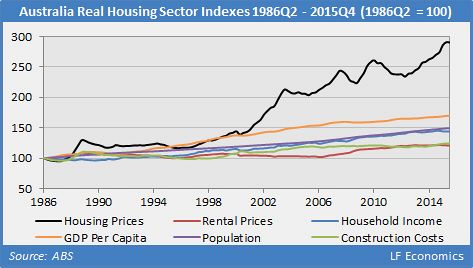

As an example - back in 2000 it was easy to see Australian housing was starting to bubble. I was convinced of this especially after reading Shiller’s book. Why was I even reading his book? What brought me to his work? I was convinced I was seeing people act very irrationally in housing. Did it burst? No - it went straight up and has continued to go up ever since reaching extraordinary highs. I refused to participate in that bubble and have always invested my money elsewhere – predominantly in index funds, silver, individual stocks and my defined benefit pension fund.

The reality is though 2000 was very early days for the Australian housing bubble. The market had started rising in 1997 so we were only 3 years in at that time for what turned out to be the longest running bubble in Australian housing in history - and it’s still going.

Where are we today with cryptos?

I say we're very, very early. The market only just started taking off in 2016 - just one year ago. Reflect on that fact. We're just one year in. ONE YEAR!

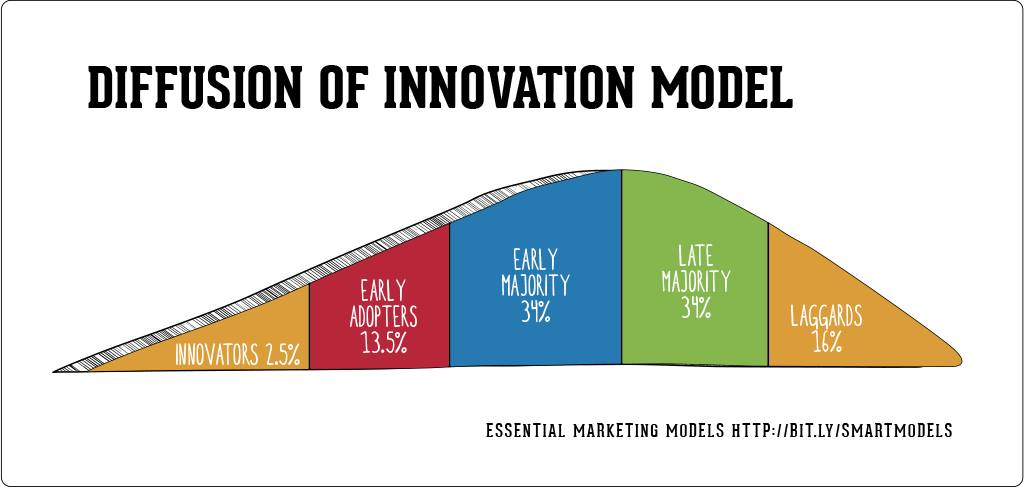

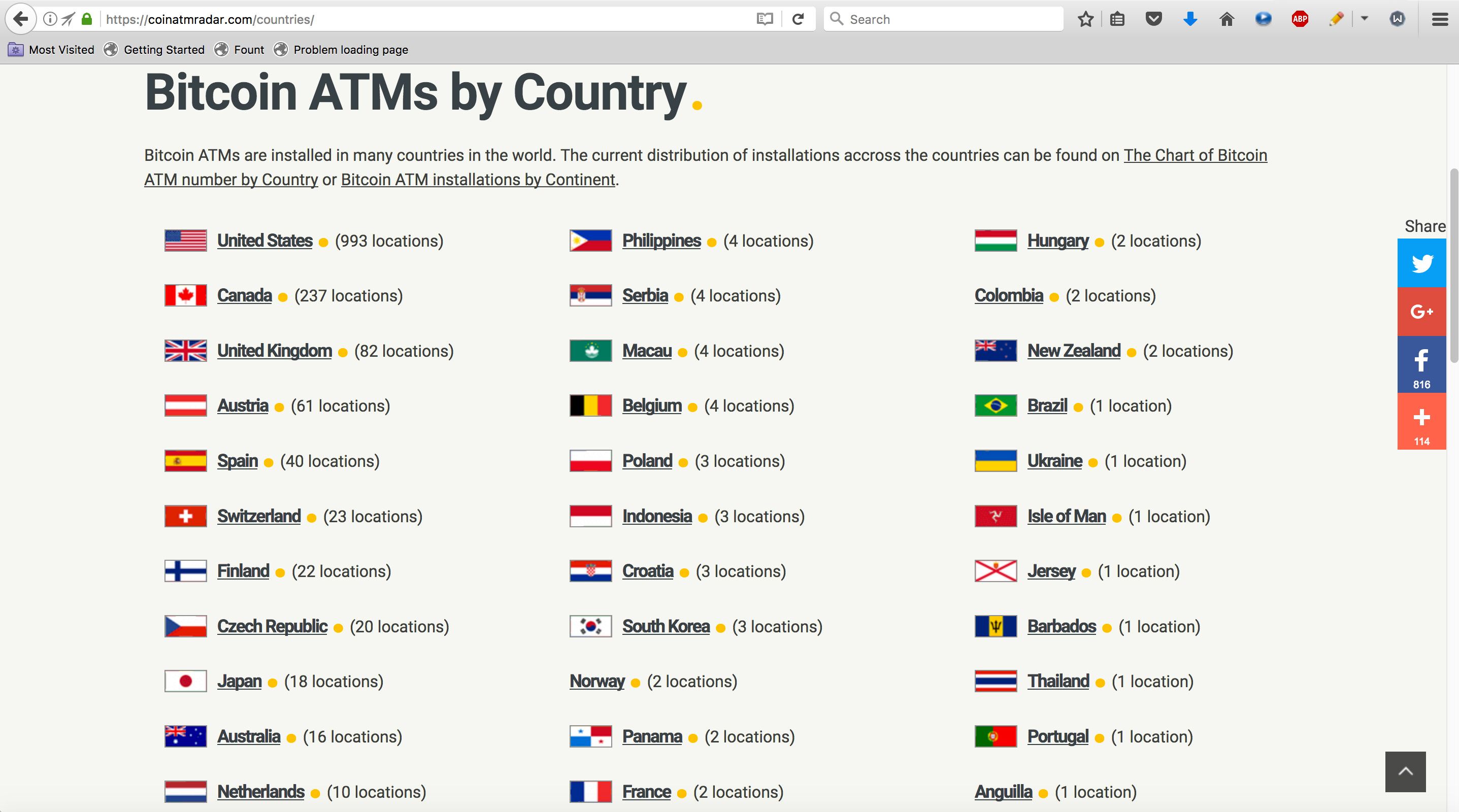

What does the market penetration of bitcoin ATM's say about where we're at in terms of the diffusion of innovation model?

Australia has only sixteen Bitcoin ATM’s. Three thousand are about to be introduced. Thailand has just one bitcoin ATM. One! There are 3 million traditional ATM's in the world vs approx 1630 Bitcoin ATM's. I see a lot of potential for growth there - over 184,000% potential growth. Consider too - $126 billion for all cryptos is a tiny market cap when you consider we're talking about currencies and the fact that there is an extraordinary amount of innovation going on in the sector upon which ultimately the value of the underlying coins and the companies involved will reflect.

Think about it from this perspective - why would I go start another startup, work my arse off, make little to nothing for many years, cop flack and shit from colleagues at my day job and others, lose respect, on and on with the odds very high that I will ultimately fail and this failure will cost me a lot of wasted time, effort, lost relationships and money when I can simply buy a basket of the cryptos who's values will ultimately represent the success or otherwise of all the hardworking nerds, business people, marketers etc who are playing the startup lottery working for the startups that have issued coins via ICO's? It makes far more sense for me to NOT create another startup - just buy the cryptos and/or the companies that represent their work, then sit back and do nothing.

The cold hard reality is being an entrepreneur with few resources SUCKS. SUCKS! Instead of walking into the dragons den on ones knees asking for money - BE THE DRAGON. That’s what buying the cryptos gives us the chance to do in many ways. Let’s remember the Nasdaq hit $8 trillion at it's peak in 2000. Cryptos would have to go up almost 64 times to equal that. Is this an unreasonable market cap figure? I don’t think it is and others are saying $5 trillion+ is coming.

Now - how do people behave when they see their neighbours making "easy money"?

I'm confident there will be a stampede into cryptos and every man and their dog in the developed world will be getting into them and talking about them in the same way they are in Australian and other bubbly housing markets. I think it’s totally reasonable to stake 3-5% of ones net worth in this market.

A little history - like many others I foresaw the rise of the internet in the early 90’s. I wrote an essay on it in 1993 when I was 14 years old and I recall I got good marks for it. I should see if I can dig it up and make a video about it. I had no money at that time. My parents didn’t know what the fuck was going on but my father wisely after much begging from me bought me a Pentium 75 PC with a 28,800 baud modem. The first thing I did was bring my best mate over to see porn on the internet. My parents didn’t have brokerage accounts and didn’t own even a single share of stock and there is no way I could convince them to buy into technology stocks despite me seeing clearly and telling them what was going on, them seeing me in front of the computer for hours a day, bringing home Linux journal magazines, talking about technology companies etc. I was the first in my family to open a brokerage account and buy tech stocks when I first earned some money when I was 20 years old.

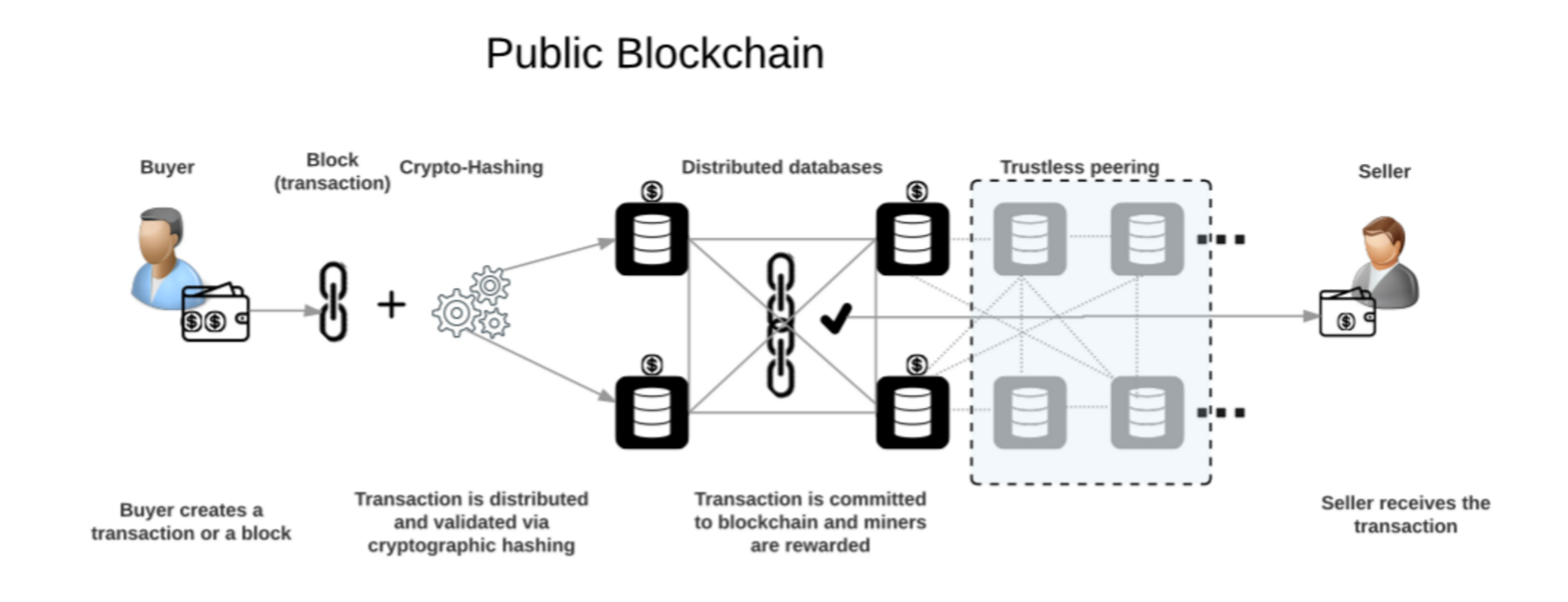

The bottom line is I want a diversified stake in this new technology. The whole idea of applying cryptography to the storage and transmission of data is still very new. The fact that anyone can directly buy the currencies that power these cryptographically secured blockchains is much like the public actually getting a chance to invest in the internet during its infancy - without needing to go through the intermediaries like investment bankers and the like (which puts the public at a large disadvantage by the way and mostly we only get to invest in the WORST IPO's that they and their well connected friends don't want). I have bought into cryptos with a small % of my net worth and I expect based on the balance of probabilities I will probably do well out of them. If I don't then it doesn't really hurt me. If it’s a bubble then we’re still in the early 90’s. Let it bubble. Wake me up in five years time in 2022. Twenty years would be better.

But won't the big banks be winners out of this blockchain technology?

I urge each of you to study the underlying bitcoin technology and try to understand a bit about how it works from a technical perspective. The big institutions are implementing what is known as private blockchains which they centrally control which are not decentralized. That's bastardized blockchain which negates the most important advantages of it. Big institutions are acting very predictably and trying to keep as much centralized control as they can and that's bad for the general public. These guys are essentially the buggy whip manufactures and the horse carriage manufacturers during the dawn of the automobile.

All the poindexters involved in crypto development understand that the public blockchain will kill these guys and are working feverishly around the clock to make it happen. That's why it looks cultish - the nerds understand the power of it and are going for the jugular of the big banks. It's not a good idea to bet against the nerds. Imagine as an example betting against Linux. At the time that would have looked like a great thing to bet against.

Why did Linux end up winning?

It was open source, developed by volunteers around the world, development was decentralized and anyone could contribute to it and they did - in droves and many did so for FREE creating the best open source operating system in history - all stemming from the work of one nerd - Linus Torvalds. Where is Solaris now? Where is IBM Unix? Where is HP UNIX? These systems had large corporate development, big budgets and support and they LOST to Linux! These big corporates with well financed internal nerds LAUGHED at Linus and the nerds working with him for free. None of them ever believed Linux would become the dominant Unix operating system.

Who's laughing now?

Don't be under any illusions - large financial institutions with their shitty, buttoned down corporate environment and cultures will not develop blockchain technology in house that will beat the global army of blockchain nerds from around the world working together collaberatively in many cases for free to create public, transparent blockchains. Don't bet against the collective effort of the nerds. To put it in terms the common man can understand - why would the general public PAY MONEY for a product that's CRAP which f*cks themselves over when they use it when they can get a much better version of it FOR FREE or a version of it that MAKES THEM MONEY?

This isn't about faith or cults or anything like that. The nerds are going nuts and have that cultish look in their eyes because they understand that this technology will give power back to the people. The same people that HATE banks! I challenge each of you to study the underlying blockchain technology carefully and if you're not convinced come back and tell me - a lifelong skeptic and atheist why my belief that this technology will take power away from banks and governments is misguided.

Now think about this - the types of people involved in almost all cults generally speaking are not the best and brightest. Who do we see involved in the crypto development space? Oh yeah - the best and brightest! This isn't the lemon detox diet or snuggy crowd.

Buying cryptocurrencies now requires vision and the courage of ones convictions at a time in history when it's not exactly clear how things will ultimately turn out.

As a thought experiment - I will take the other side of the argument and argue against cryptos and then I will give examples of highly esteemed people throughout history who have bet against emerging technologies.

Here goes:

"Bitcoin and other cryptocurrencies will never take off. The good people of this world trust their governments and their banks to do the right thing by them. Privately issued, decentralised global currencies that cut out the government and banks? Those will NEVER work. Ha ha! Bosh! Flimshaw!" Jarod – The Pretender Thailand.

“There is no reason anyone would want a computer in their home.” — Ken Olson, president, chairman and founder of Digital Equipment Corp. (DEC), maker of big business mainframe computers, arguing against the PC in 1977.

“We will never make a 32 bit operating system.” — Bill Gates

“Lee DeForest has said in many newspapers and over his signature that it would be possible to transmit the human voice across the Atlantic before many years. Based on these absurd and deliberately misleading statements, the misguided public … has been persuaded to purchase stock in his company …” — a U.S. District Attorney, prosecuting American inventor Lee DeForest for selling stock fraudulently through the mail for his Radio Telephone Company in 1913.

“There is practically no chance communications space satellites will be used to provide better telephone, telegraph, television, or radio service inside the United States.” — T. Craven, FCC Commissioner, in 1961 (the first commercial communications satellite went into service in 1965).

“To place a man in a multi-stage rocket and project him into the controlling gravitational field of the moon where the passengers can make scientific observations, perhaps land alive, and then return to earth – all that constitutes a wild dream worthy of Jules Verne. I am bold enough to say that such a man-made voyage will never occur regardless of all future advances.” — Lee DeForest, American radio pioneer and inventor of the vacuum tube, in 1926

“A rocket will never be able to leave the Earth’s atmosphere.” — New York Times, 1936.

“Flight by machines heavier than air is unpractical (sic) and insignificant, if not utterly impossible.” – Simon Newcomb; The Wright Brothers flew at Kittyhawk 18 months later.

“Heavier-than-air flying machines are impossible.” — Lord Kelvin, British mathematician and physicist, president of the British Royal Society, 1895.

“There will never be a bigger plane built.” — A Boeing engineer, after the first flight of the 247, a twin engine plane that holds ten people

“Nuclear-powered vacuum cleaners will probably be a reality in 10 years.” -– Alex Lewyt, president of vacuum cleaner company Lewyt Corp., in the New York Times in 1955.

“This is the biggest fool thing we have ever done. The bomb will never go off, and I speak as an expert in explosives.” — Admiral William D. Leahy, Chief of Staff to the Commander in Chief of the Army and Navy during World War II, advising President Truman on the atomic bomb, 1945.[6] Leahy admitted the error five years later in his memoirs

“The energy produced by the breaking down of the atom is a very poor kind of thing. Anyone who expects a source of power from the transformation of these atoms is talking moonshine.” — Ernest Rutherford, shortly after splitting the atom for the first time.

“There is not the slightest indication that nuclear energy will ever be obtainable. It would mean that the atom would have to be shattered at will.” — Albert Einstein, 1932

“The cinema is little more than a fad. It’s canned drama. What audiences really want to see is flesh and blood on the stage.” -– Charlie Chaplin, actor, producer, director, and studio founder, 1916

“The horse is here to stay but the automobile is only a novelty – a fad.” — The president of the Michigan Savings Bank advising Henry Ford’s lawyer, Horace Rackham, not to invest in the Ford Motor Co., 1903

“The Americans have need of the telephone, but we do not. We have plenty of messenger boys.” — Sir William Preece, Chief Engineer, British Post Office, 1878.

“This ‘telephone’ has too many shortcomings to be seriously considered as a means of communication. The device is inherently of no value to us.” — A memo at Western Union, 1878 (or 1876).

“The world potential market for copying machines is 5000 at most.” — IBM, to the eventual founders of Xerox, saying the photocopier had no market large enough to justify production, 1959.

“I must confess that my imagination refuses to see any sort of submarine doing anything but suffocating its crew and floundering at sea.” — HG Wells, British novelist, in 1901.

“X-rays will prove to be a hoax.” — Lord Kelvin, President of the Royal Society, 1883.

“The idea that cavalry will be replaced by these iron coaches is absurd. It is little short of treasonous.” — Comment of Aide-de-camp to Field Marshal Haig, at tank demonstration, 1916.

“How, sir, would you make a ship sail against the wind and currents by lighting a bonfire under her deck? I pray you, excuse me, I have not the time to listen to such nonsense.” — Napoleon Bonaparte, when told of Robert Fulton’s steamboat, 1800s.

“Fooling around with alternating current is just a waste of time. Nobody will use it, ever.” — Thomas Edison, American inventor, 1889 (Edison often ridiculed the arguments of competitor George Westinghouse for AC power).

“Home Taping Is Killing Music” — A 1980s campaign by the BPI, claiming that people recording music off the radio onto cassette would destroy the music industry.

“Television won’t last. It’s a flash in the pan.” — Mary Somerville, pioneer of radio educational broadcasts, 1948.

“[Television] won’t be able to hold on to any market it captures after the first six months. People will soon get tired of staring at a plywood box every night.” — Darryl Zanuck, movie producer, 20th Century Fox, 1946.

“When the Paris Exhibition [of 1878] closes, electric light will close with it and no more will be heard of it.” – Oxford professor Erasmus Wilson

“Dear Mr. President: The canal system of this country is being threatened by a new form of transportation known as ‘railroads’ … As you may well know, Mr. President, ‘railroad’ carriages are pulled at the enormous speed of 15 miles per hour by ‘engines’ which, in addition to endangering life and limb of passengers, roar and snort their way through the countryside, setting fire to crops, scaring the livestock and frightening women and children. The Almighty certainly never intended that people should travel at such breakneck speed.” — Martin Van Buren, Governor of New York, 1830(?).

“Rail travel at high speed is not possible because passengers, unable to breathe, would die of asphyxia.” — Dr Dionysys Larder (1793-1859), professor of Natural Philosophy and Astronomy, University College London.

“The wireless music box has no imaginable commercial value. Who would pay for a message sent to no one in particular?” — Associates of David Sarnoff responding to the latter’s call for investment in the radio in 1921.

All the best everyone,

I'm The Pretender

Do you remember when in 2015, people still thought that bitcoins were worthless?

Even with the current developments, I think we're only seeing the beginning. What an exciting time to be alive and have front seats at the show!