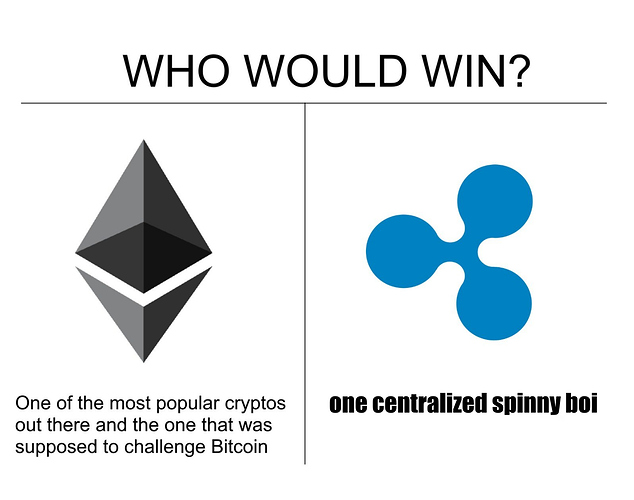

Ethereum vs Ripple by 2021

Ethereum versus Ripple may appear like a lightweight cryptographic money encounter when contrasted with Bitcoin, in any case, one day one of the earliest reference point of these digital solutions may surpass the estimation of the pioneer. However, how do the two frameworks set side by side, and which one is better put to accomplish this by 2021?

One of the key perspectives in the Ethereum versus Ripple juxtaposition is simply the way that the two digital currencies advertise themselves. Ethereum is considered fairly like Bitcoin, viably an advanced token proposed as a unit of trade. While Ripple has promoted itself as a valuable instrument in cross-border exchanges specifically.

It is eminent that the banking industry has got on board with Ripple more than some other blockchain item. This is on the grounds that the financial division wishes to apply tenets to the blockchain that accomplish cost-efficiencies and enhance profits through the powerful deployment of innovation. This is partially why there has been such antagonistic vibe towards Bitcoin, which is basically a libertarian reaction to the concentrated nature of the banking framework.

By contrast, Ripple has been reprimanded by supporters of digital currency for being decentralized, which it is attested conflicts with the very ethos of the cryptographic money revolution. This could be a weakness in accomplishing the kind of breakout value that has just been connected to Ethereum. Be that as it may, it will be favorable position as far as drawing in the standard financial order.

This could be a major factor in the Ethereum versus Ripple fight, especially in an atmosphere in which digital currencies are being demonized by the specialists. A few nations have just passed enactment which is unfriendly towards the different digital forms of currency.

Any Ethereum versus Ripple contrast must be enlightened by key parts of the two digital forms of money, and it is right off the bat beneficial to evaluate the adaptability of these two arrangements. Scalability alludes to the quantity of exchanges that can be finished by the blockchains related with these digital forms of money in a predefined era, which is generally one moment.

Ripple has a monstrous preferred standpoint over Ethereum around this area, and this is one way that the digital currency has built up itself as an especially credible solution. Ripple can convey an extraordinary 1,500 exchanges each second, which is, unbelievably, 100 times that of Ethereum. When one takes a gander at this figure, it turns out to be straightforward why the standard financial framework is more energetic about the capability of the Ripple blockchain.

Ethereum versus Ripple will likewise be characterized by the speed of exchanges conveyed by the two frameworks, and it is not really astounding that Ripple wipes the floor with the opposition here too. Ripple inspires with the speed of exchanges conveyed, and its processing is far quicker than that of Ethereum.

While one can anticipate that an exchange will take around two minutes on at the Ethereum blockchain, Ripple can convey an exchange every four seconds. Once more, this is a region in which none of the real cryptographic forms of money can truly rival Ripple, and it is another sign of how the innovation could be embraced by the standard budgetary engineering in one not so distant.

Unquestionably the banking industry has made its assessment on the Ethereum versus Ripple correlation clear. Ripple has been significantly more embraced by standard associations and establishments, with numerous trusting that the Ripple idea can convey something very extraordinary and profitable to standard financial associations.

In any case, regardless of this reality, Ripple can't generally be thought to be a part of the standard at present. Ethereum is exchanging at costs enormously in overabundance of the Ripple investment opportunity, and this is probably not going to change within a reasonable time-frame. Ripple has without a doubt made a ripple in the digital currency sector, yet Ethereum still dwarfs the estimation of this new entry to the market, and Ripple has some distance to cover before it can be positioned close by Ethereum.

While the majority of the enormous performing cryptographic forms of money have subsided in value as of late, there is still some level headed discussion over the course of the market going ahead. Some trust this is a transitory amendment that will soon be corrected. However, numerous are distrustful about the solidity of cryptographic money frameworks, and trust that authoritative threatening vibe will at last hose down what has been the speculation story of the century.

Technical contrasts ought to likewise be mulled over in the Ethereum versus Ripple correlation, with the former ready to manage an extensive variety of convoluted collaborations between numerous parties. CNBC has noticed that it gives various potential uses, for example, reconciliation, empowering savvy contracts to be dispersed on the Ethereum network. Ripple is a considerably more straightforward element proposed to manage moderately basic exchanges, yet to convey them at a speed that is obscure inside whatever remains of the cryptographic currency World.

Indeed, the stage that Ripple gives has officially gotten a lot of praise. Ripple empowers money exchanges to happen quickly in a wide range of stages, which has been one of the essential explanations behind the fervor encompassing the Ripple item. Ripple offers huge control over the framework, and keeping in mind that this is appealing to the banking segment, it has additionally prompted cryptographic money perfectionists censuring the advanced financial arrangement.

The fidget has all the Trillions with big boys behind him!

But Vitalik got Microsoft and other tech companies on his side!

I m going to Ether.... maybe even overtaking BTC in some time :P

hehehe, it would also fine xD