Understanding The Landscape of Managing Your Wealth 👨🏫 🌱 💰 💹

We will discuss the options for managing wealth, from job security to investing in assets.

I'm too busy to research and manage my own investments

Pay a financial planner / advisor

- Determine your income vs expenses

- Determine your assets vs liabilities

- Determine your risk tolerance

- Determine a strategic asset allocation that suits your risk tolerance for both your retirement fund and your taxable "extra money fund"

- Determine your intellectual interests and spend a percent on self education in order to maximise your long term employment wealth

- Determine threats that could affect your long term employment wealth such as disability risk, redundancy risk, skill set adaptability etc.

Talk to some friends who seem like they know what they are doing

This is a high risk option, but can be ok if you are lucky and talk to the right person.

If you choose to copy their asset positions and suffer a loss, this is because different people have different risk tolerances.

It is best to not copy other peoples asset positions unless you understand the asset and the rationale behind the decision.

I'm willing to spend time researching and teaching myself how to manage my own money

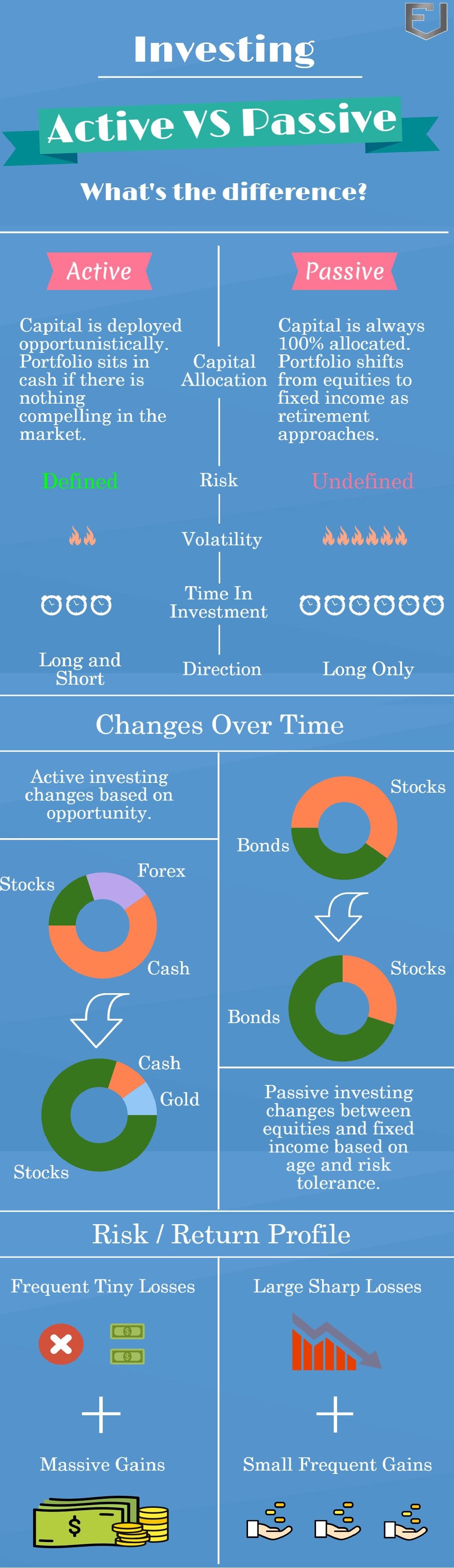

There are two types of investment ideologies, they are -

- passive long term buy and hold

- active short term

If you go to university, academia will say 90% of new traders lose 90% of their wealth within 90 days.

This is why they teach diversification and portfolio management as a focus, and are persistent in saying that it is better to have a passive 5 to 10 year investment time horizon, as opposed to an active 3 days to 3 months time horizon.

I'm a believer in being passive to begin with, and once you research for 3+ years building your proprietary active trading competitive advantage, then you can shift allocations from your passive strategy to your newly created active strategy.

Below graphic from macro ops, shows the difference between active vs passive.

Their link is here https://macro-ops.com/why-active-investing-is-better-than-passive-investing/

Macro ops suggests active is better than passive, but in my opinion active is only good if the investor is willing to make an effort to research and learn, and build spreadsheets.

Calculate Low And High Risk Allocations

- Open up a spreadsheet and determine your income vs expenses, and assets vs liabilities as in the previous section

- Calculate your current net worth minus liabilities, and your investable net worth

- Determine what % of your investable net worth you are willing to lose within 1 year

- If you have $80k to invest but you are only willing to lose $20k within 1 year, then your low risk allocation is 75% and high risk is 25%

Defining Your Perception of Low Risk Allocations

Risk in finance is often described as standard deviation. This is essentially a measurement of how far apart historic data points fluctuate against its rolling average.

There are other measurements that could be used to measure risk such as ATR(Average True Range), drawdown etc. But you can easily google/duckduckgo for more info on this matter.

Besides quantifying risk, you could also assess an assets global macro / micro economic risk.

An example would be, lithium centered assets have historically been performant due to Tesla's announcement of building large battery plants, but a speculated threat of new and competing storage technologies, would therefore decrease lithium demand.

If your investing style is long term passive you would not allocate funds to lithium based assets in this case.

If your investing style is short term active, you could place a long allocation and exit until your identified economic risk is in effect.

In general, text book examples of long term "low risk" assets include, performant managed funds, corporate and government bonds, and indexes such as S&P500.

It is often best to use a combination of quantification & economic analysis to determine whether something is low risk.

Text book examples of low risk assets are sometimes no longer valid, so it is best to assess low risk based on your own criteria.

Defining Your Perception of High Risk Allocations

In general, high risk allocations include stocks, foreign exchange of fiat currency, exchange of crypto currency, precious metals, gas and oil.

Just like previously discussed, you could assess risk by quantification or economic analysis.

The perception of a high risk asset could be changed if you are a subject matter expert in that asset class.

For example if you spent 6 years working in the gas and oil industry at an executive level, you would understand the micro economics of what drives the value of this asset class. You would then take advantage of this and develop your own model for forecasting that particular asset.

In this case, gas and oil would not be high risk for that particular investor.

Summary For Assessing Risk

If you are a jack of all trades, allocate your assets based on traditional perceptions of high and low risk, and re-enforce this with quantification and economic analysis.

If you are subject matter expert within an industry / asset class, slowly increase your % allocations for that asset, every time your performance metrics tells you to.

The Rational Asset Allocator

A decision matrix is a great way to manage your prospective asset allocations, and your invested allocations.

You will have a view of sector and asset class exposure, and threat of competition.

An example of one is described in my previous article here - "Build Your Own Crypto Currency Decision Matrix" - https://steemit.com/cryptocurrency/@edendekker/build-your-own-crypto-currency-decision-matrix

Exits and Entries

So when should i enter into a position?

When should i exit my position?

If you're passive long term buy and hold, you would probably want to identify if the macro economic drivers of your entry speculation has already occurred.

This could be done using SMA (Simple Moving Average) cross over indicator techniques.

Using this technical indicator as an entry is quite popular and is often used incorrectly by itself.

Technical indicators should always be used in combination with a fundamental economic view.

You should also exit based on technical indicators and / or in combination with the identification of a shift in economic behaviour.

Rebalancing Your Allocations

If your initial low risk and high risk allocations were 75% and 25%, after one year those allocations would change to maybe 67% and 33%.

You would then shift funds between your current allocations to fit your initial risk tolerance of 75% and 25%.

Obviously you would rebalance according to your current risk tolerance which may have changed after one year to something like 80% and 20%.

Rebalancing too often could result in large fees and missing out on large trending prices.

Understand How Global Economies Work

Here is an amazing 30min video by Ray Dalio, that sums up global macro and micro economics without going to university.

If you are risking your hard earned money, you really need to watch this.

You will be positioned to protect your portfolio during economic down turn, and profit from economic booms.

Conclusion

If you are new to managing money, try out long term passive investing first.

It is easiest.

Academia approves it.

Everyone is doing it.

You will be forced to research managed fund performances, index performances, retirement funds etc.

You may decide on a low risk, globally diversified, and active managed fund as 90% of your investable wealth.

And you may invest the other 10% of your high risk allocation on diversified crypto currencies.

Once you are satisfied and fully invested in your current passive low risk investment strategy, you can then spend your spare time - researching proprietary active strategies, and testing them out on demo trading accounts.

Expect to have satisfying performance metrics on your active strategy after 1 year if you are amazing, or 3+ years if you are tied down with employment commitments etc.

At the end of the day, managing your wealth by yourself is about understanding your risk tolerance, researching your investment universe, and strategically making decisions based on your own analysis.

Related Articles -

- Build Your Own Decision Matrix - https://steemit.com/cryptocurrency/@edendekker/build-your-own-crypto-currency-decision-matrix

@OriginalWorks

The @OriginalWorks bot has determined this post by @edendekker to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!