HOW TO USE MACD strategy

Strategy in detail

The MACD Triple strategy is based on the indicator "moving average convergence divergence" (MACD - 12, 26, 9). The MACD is analyzed in three units of

is based on the indicator "moving average convergence divergence" (MACD - 12, 26, 9). The MACD is analyzed in three units of time: 4 hours, 1 hour and 15 minutes. Note that the ratio of each time unit to the next is 4: 1. MACD 1 hour and 4 hours are used as trend filters. The MACD 15 minutes gives the buying and selling signals short.

time: 4 hours, 1 hour and 15 minutes. Note that the ratio of each time unit to the next is 4: 1. MACD 1 hour and 4 hours are used as trend filters. The MACD 15 minutes gives the buying and selling signals short.

When to open a position?

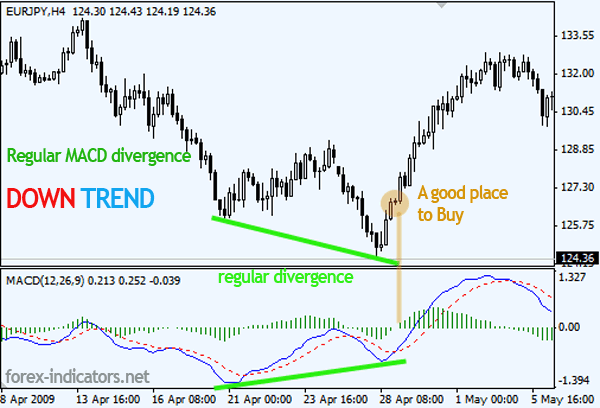

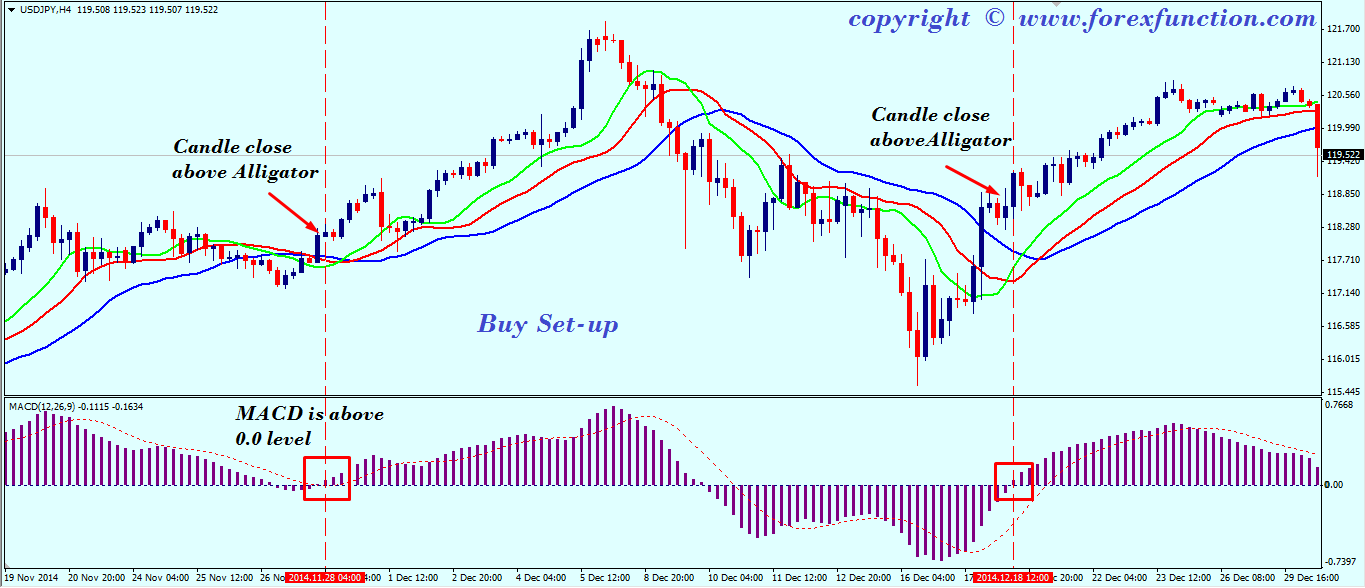

The MACD 15 minutes gives a buying signal when the fast MACD curve (12) crosses the slow MACD curve (26) upward. The MACD 15 minutes gives a short sale signal when the fast MACD curve crosses the MACD curve slowly down.

Before the signals are accepted, they are subjected to a combined trend filter, consisting of the MACD 4 hours and 1 hour. If both are bullish, only buying signals are accepted. If both are bearish, only short selling signals are accepted. If one is bullish and the other bearish, all signals are rejected.

The strategy also incorporates a time filter. The time filter accepts signals from 8:00 to 21:30. The signals appearing outside this time period are rejected.

When to close a position?

The Triple MACD strategy uses both a stop and a profit target. In both cases, they are expressed as a percentage. The stop is placed at a distance of 0.50% of the entry price. The lens is placed at a distance of 1.50% of the entry price.

Positions can also be fenced when an inverse signal appears, ie when the MACD 15 minutes gives a new cross, in the opposite direction. Finally, at 21:30, the time filter closes at the market price any position still open.

سوال للجميع هل يجوز الاستفادة من منشور مدة نشره اكثر من 7 ايام

Thank you for the good post https://9blz.com/macd-indicator-explained/