2023 Macro

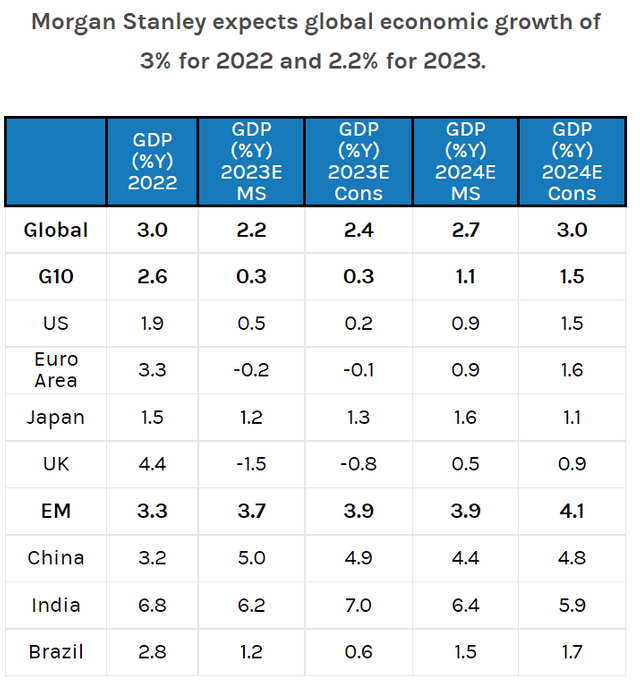

With excessive post-COVID consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, Morgan Stanley believes global GDP growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022.

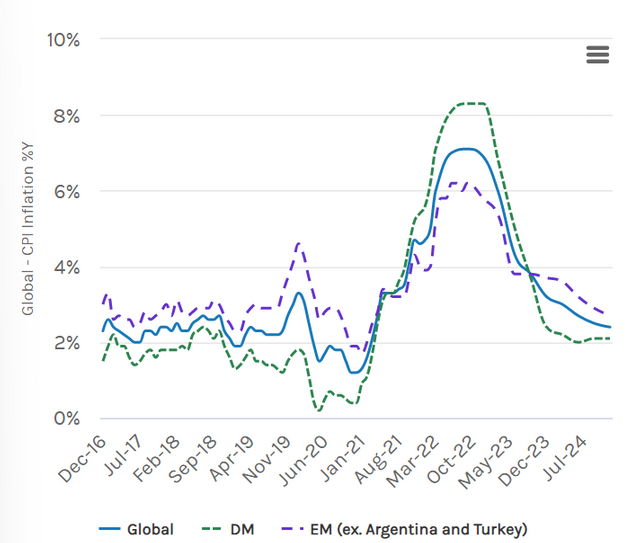

The good news: Global inflation is set to peak in the fourth quarter of 2022.

In fact slowing demand, price discounts due to elevated inventories and declining housing prices, among other factors, will help temper inflation, which should in turn prompt major central banks to pause and assess their recent historic string of rate rises.

Certainly, the interplay of inflation and central-bank intervention will ultimately shape the story of economic growth for 2023.

“The last 12 months have seen the fastest increase in the Federal funds rate since 1981, and the fastest increase in European Central Bank (ECB) rates since the establishment of the Eurozone,” says Seth B. Carpenter, Morgan Stanley’s Chief Global Economist. “But as consumer goods’ supply chains recover and labor markets see less friction, we could see a sharper and broader fall in inflation, which would imply a somewhat easier path for policy and higher growth globally.”

While there are few big surprises in our 2023 outlook, there is plenty of nuance. As always, the story varies by region, in some ways dramatically. In contrast to forecasts for Western economies, Asia could offer green shoots for growth, particularly in India, and emerging market economies could further benefit as the Fed finds its peak rate and the dollar eases.

U.S.: A Soft Landing and Tepid Recovery

All eyes are on U.S. consumer prices—which are currently up 8.2% year-over-year but on a path to be up by just 2.4% YoY by the end of 2023.

The combination of slowing growth and cooling inflation is likely to prompt the Fed to curb its rate hiking. “We expect the target range to reach a peak of 4.5% to 4.75% by January 2023, hold at that level through 2023 and then decline steadily throughout 2024,” says Ellen Zentner, Chief U.S. Economist. In this scenario, the U.S. economy should experience a soft landing and a tepid rebound versus the current prevailing view of a hard landing and faster recovery.

Moreover, Zentner adds, although the Fed has been lightening its balance sheet by not replacing maturing government bonds, such as Treasuries and mortgage-backed securities, “we do not expect active sales. The housing market has already turned down, so selling mortgage-backed securities risks being overkill.”

In the labor market, Morgan Stanley believes that while companies have slowed hiring, lean payrolls and difficulty in filling skilled positions argue against widespread layoffs in 2023. Net job gains have slowed markedly over the year and, together with a modest rise in labor force participation, will likely result in a slightly higher (but relatively healthy) unemployment rate of 4.3% in late 2023.

Source: Morgan Stanley

Upvoted! Thank you for supporting witness @jswit.