Crypto Academy Season 3 Week 5: Homework Post for@yousafharoonkhan.

Introduction

There are many technically analysis key indicators and this week we are excited to learn about the Golden Cross and Death Cross. These indicators are used by traders to be able to manage risks and make profitable investments. Lets get down to business.

Define Death Cross and Golden Cross in your own words.

And what is the significance of DC and GC in trade? And what effect do these two have on the market?

Golden Cross and Death Cross.

When someone comes across the terms * Golden Cross and Death Cross*, it is obvious that the first thought they will get is 'extreme gains' or 'extreme losses' in trade but that is not really the case with both these crosses.

GOLDEN CROSS (GC) is an indicator which provides information on the market trends which occurs when a short term moving average crosses over a major long-term moving average to the upside and can therefore be interpreted as signalling an upward or bullish trend in the market. The short term average trends basically go up much faster than the long term average upto when they cross.

There are three stages of the GC

I) A downward trend

II) Shorter moving average crosses through long moving average upward

III) Continuing uptrend, higher prices.

What is the Moving Average Indicator?

This is an indicator where the average which the market has either gone up or down depending on the length of time. This therefore means we have the short-term moving average which is usually 50 days, and the long-term moving average which is usually 200 days.

DEATH CROSS (DC) is an indicator that occurs when the long-term moving average crosses the short term moving average to the downslope and can therefore be interpreted as a bearish trend in the market where prices are falling and sell orders decrease.

Both GC and DC refer to a consolidated confirmation of a long-term trend by incidence of the short-term moving average crossing over a big long-term moving trend.

Significance of DC and GC in trade.

The GC suggests a long-term bull market going forward while the DC suggests a long-term bear market and either if the two crosses is considered of more Significance when accompanied by high trading volumes and are potentially lucrative when handled well. Some of the significance of GC and DC include among many;

Potential for investment

The GC can be contrasted with DC to indicate a bearish price movement and this can show potential to buy and hold for better prices when the bullish trend is indicated otherwise. Those who jump in early take a higher risk although potentially higher returns.Momentum for Consolidation

The GC and DC indicators are points at which the eyes of many traders light up and an alert is sounded! When the 50 day moving average moves through the 200 day moving average, there is a strong momentum and if prices are changing therefore, buyers will regain control. The indicator acts like a confirmation for investment and lowers on the risk with a re-tracement below the trend line. All favourable trade depends on the confirmation after a consolidation period.Highlighting Changing Trends

The two indicators are accurate when it comes to highlighting the changing trends in the E-Mini S&P 500 futures where the swift rebound would have caught out many traders. This therefore is significant in giving more balance to caution rather than optimism and risky trading.Used Along Side Other Indicators

GC and DC can be used alongside other market technical analysis indicators even though these two are based on moving averages which can take time. However, when used together with others such as Moving Average Convergence Divergence (MACD), Stochastic Oscillator, Bollinger Bands and Relative Strength Index (RSI), they can be powerful in predicting price trends before hand for considerable time periods.Short, Medium and Long Term Futures

The indicators can be handy for those who have time limits on trade. It could be Short term or Long-term. This is because they give confirmation to trading ranges and therefore, a trader can take calculated risks. This is also used in conjunction with a stop-loss limit and keeping a keen eye 'on the ball'

What effect do these two have on the market?

These indicators affect the market in ways such as these.

Risk

Some traders are liable to taking accessive risks with the early signs of a change in price such as if there is a Bullish trend as indicated with a Golden Cross, while others will prefer a more solid confirmation when there is a Bearish trend as indicated by the Death Cross, which could reduce their potential profit. If not used well with other indicators, traders may follow blindly as they compel traders to act.Lagging

Since these indicators are based on moving averages, there are possible lags between day to day index movements and without a proper balance between HODLing and FOMO, traders have no reliability on price movements.Focus

Successfully traders will use the indicators to make focused investment decisions whilst incorporating stop-loss strategies. This creates reductions in the downside and maximization on the upside.The psychology of the traders is easily managed due to eliminating the false optimism levels, especially in the long-term trading and this also weighs in on the trading volumes

2.How many days moving average is taken to see Death cross and Golden cross in market for better result and why?

• DEATH CROSS

Takes a moving average of 50 days and this is because it's the average closing price over the previous 50 days on the market. This is also called the DMA. If the cross SMA 50/200 value is less than 1, it means the 50 day moving average is below the 200 day moving average.

• GOLDEN CROSS

This takes a moving average of 200 days because the short term moving average crosses over a major long-term moving average to the upside. The long term moving average therefore corresponds to thee recommended 200 days to have clear indication.

How to see death cross and golden cross on the chart.

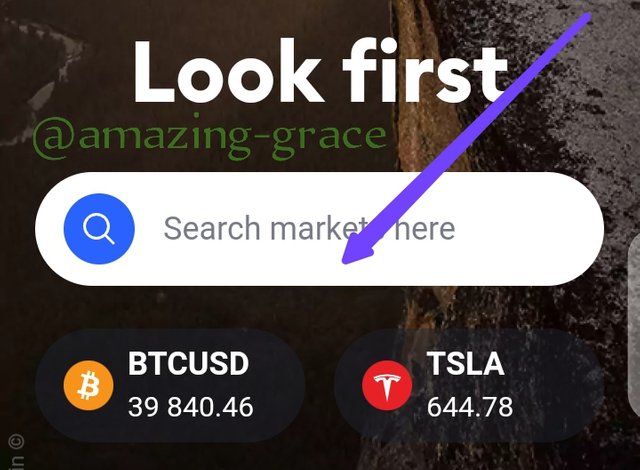

To see the Death Cross and Golden Cross, we use the any trading website. I will use trading view website as well and follow the steps.

• Go to https://www.tradingview.com

• Click on Chat

Confirm the market you want to see the DC and GC charts from. I will click BTCUSD for Bitcoin.

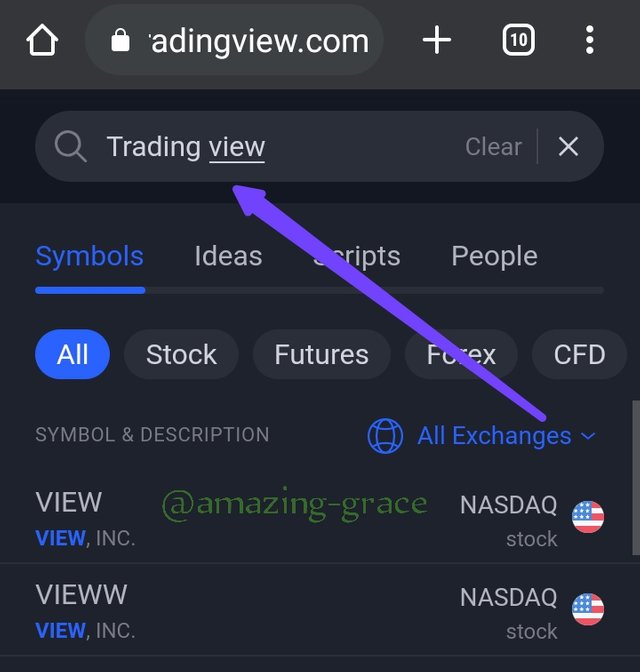

• Click Indicators and Strategies

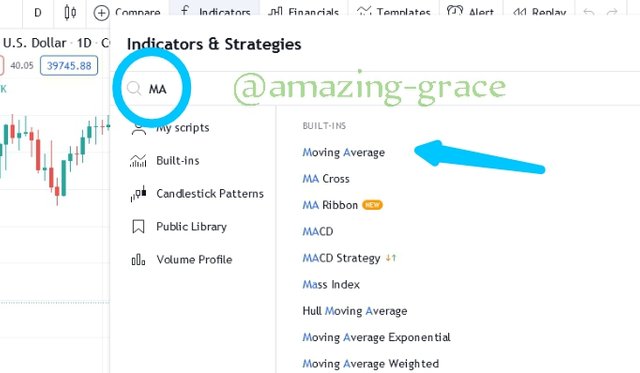

• Type MA in the search bar

• Go to 'Moving Average Indicator', double click on it.

• Click on the cross button to close indicator page.

• Click on Indicators and Screenshots

• After viewing the 2 indicators, we go to settings to set 50 days Moving Average.

• For the long term moving average, set to 200 days.

3.What is Binance P2P and how to use it ?

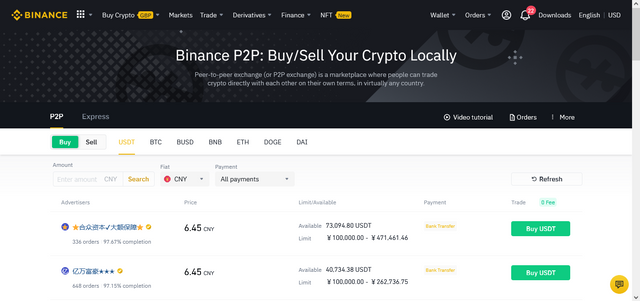

Binance P2P trading is an online cryptocurrency marketplace where people buy and sell currencies amongst themselves depending on their own terms and conditions. It stands for Peer to Peer.

Peer to Peer on Binance allows you to buy Bitcoin and other Cryptocurrencies with local Currency at 0 fees and users can choose traders and payment methods are managed using the smart contract with crypto escrowed by Binance.

How to use it.

- First, choose you choose from all the available offers in the marketplace.

- Then place an order to buy your crypto, and pay the seller based on the mutually preferred payment methods

- Secondly, you get your crypto from the seller after you complete the fiat transaction and confirm your payment on Binance P2P.

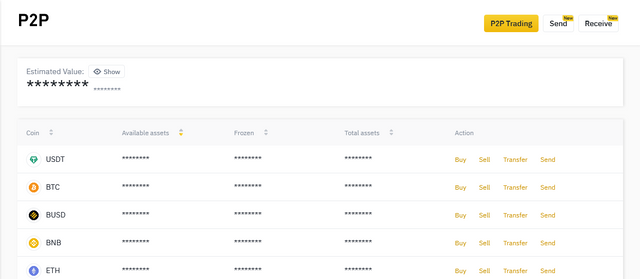

There are available actions on P2P that indicate how to buy or sell such as;

SELL

Indicates where traders can sell and get paid In local currency.BUY

Indicates where traders can buy crypto in local currency.TRANSFER

Indicates where crypto assets can be moved from P2P wallet to other Binance wallets.SEND

Indicates where assets can be sent from P2P wallet to another P2P account.

How to transfer cryptocurrency to p2p wallet?

To transfer cryptocurrency to P2 P wallet you will need to trade them in the binance exchange for USDT, ETH, BTC, BNB, etc. You convert your currency from the one you hold to another one that is acceptable in your country in the exchange and go to the P2P to transfer. I have already converted Steem to Ethereum so, Let's go through the steps.

Step 1

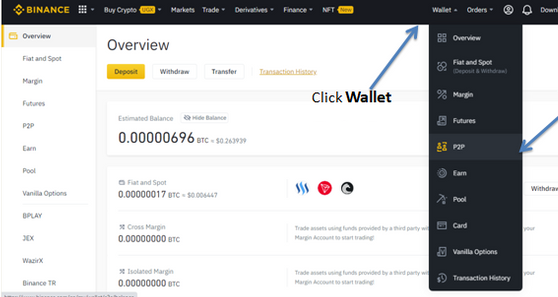

Go to www.binance.com and log in.

Step 2

Got to Wallet and then select P2P

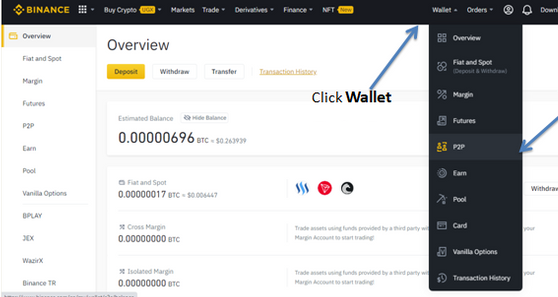

Step 3

With various options in P2P, select transfer.

Step 4

Select amount and Transfer the Crypto to the P2P wallet.

How to sell Cryptocurrency in local Currency via P2P.

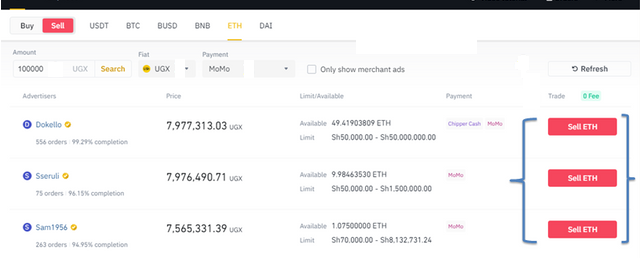

After successfully moving assets to our P2P wallet, we can now sell. I am in Uganda so will sell to Ugandan Shillings.

Step 1

Click on sell from the P2P wallet.

Step 2

On the sell page, we click P2P trade and we can see various prices on the market.

Step 3

We choose our preferred buyer after considering the buyer's successes and volume of trade among other things

Step 4

We click amount to sell and wait for payment to be confirmed. The buyer's order is ticked and confirming order, transaction is complete.

![Screenshot 2021-07-29 at 16-20-43 The Steemit Crypto Academy Season 3 - Week 5 Death cross Golden cross, How to use Binance[...].png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmfPzDB7iFbCRkyhdYiZ11a4pzrq5XqGpChE16wrie7u1o/Screenshot%202021-07-29%20at%2016-20-43%20The%20Steemit%20Crypto%20Academy%20Season%203%20-%20Week%205%20Death%20cross%20Golden%20cross,%20How%20to%20use%20Binance[...].png)

What are the things to keep in mind during P2P trade?

The things to keep in mind as you perform the P2P transaction include;

It is important to sell to a buyer who has higher successful trade because it creates confidence and shows thier level of consistency with completing transactions. Atleast 95% trade successes show this kind of consistency. Also ensure that the account owner’s name is consistent with your verified name on Binance.

There should be a good or acceptable mode of payment and in any case a variety of options to choose from so as to avoid being compromised due to such misunderstandings.

The timing or clock is very key as some buyers may take too much time to complete the transaction or even respond.

The peer to peer platform has got terms and conditions between the seller and buyer, make sure to read and understand them well before engagement.

Always confirm money before releasing the asset as scammers cannot be ruled out. And there should always be no third party.

Describe it's four advantages and disadvantages.

| ADVANTAGES | DISADVANTAGES |

|---|---|

| 0 Trading Fee | In case of mistakes, refund is almost impossible |

| Supports local Currency | Fraud is high |

| There is an Escrow for Security | No guarantee for safety or insurance for loss |

| Variety of traders to choose from | Scammers are part of the many traders |

| Has a time clock | There are few regulations |

Conclusion

To conclude the above homework task, I would like to thank Professor @yousafharookhan for the lesson. I have so much wanted to try this out on my own for sometime now since I joined the platform 4 months ago and to say that I have learnt alot is an understatement. I am grateful for this chance to learn how to trade. Thank you. I submit.

PS: All images from Binance.com

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 5

thank you very much for taking interest in this class