Crypto Academy Season 3 Week 8 Homework Post for@yohan2on: Risk Management.

Define the following Trading terminologies.

Introduction

I am happy to be apart of this season's classes and it's a pleasure to learn about risks in trading and how to significantly reduce or eliminate them. It's always great to take the necessary steps to do away with those issues that can cause us loss as we trade.

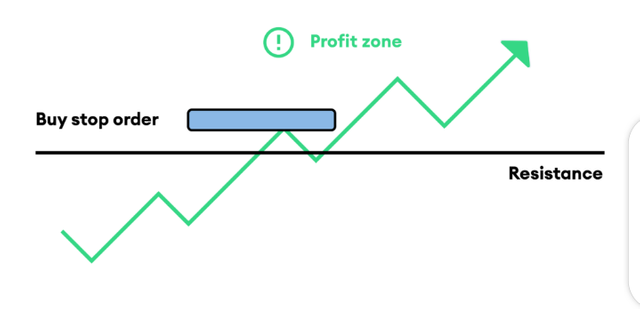

Buy Stop

A buy stop loss order is entered at a stop loss price higher than the current market value. Investors often use stop-loss buy orders to limit losses or protect gains on stocks they need to sell short. The sell stop order is entered at a stop loss price lower than the current market value.

When the predetermined price is reached, the buy limit will guide the merchant to buy the security. Once the price reaches this level, the buy stop loss will become a limit or market order, which can be executed at the next available price. This type of stop loss order can be applied to stocks, derivatives, currencies, or various other instruments in circulation. The basic assumption is that the stock price will continue to rise after reaching a certain height. To place a stop loss order, once the security price reaches the specified stop loss price, the asset price must trend upward. This is a strategy to profit from rising stock prices by booking. Buy stop orders can also be used to protect unlimited losses caused by short positions.

Consider the trend that TRN's stock price is about to break through the $9 to $10 trading range. Suppose a trader bet that the price of TRN will rise to the upper side of this range and place an order to buy. The stop loss is at 10.20 USD. Once the stock reaches this price, the order will be converted to a market order, and the trading system will buy the stock at the next available price. The same type of order can be used to close a position. In the above scenario, suppose that the trader has a large short position on TRN, which means that he is betting that its price will fall in the future. To avoid the risk of stocks moving in the opposite direction, i.e. price increases, traders set a buy order with a stop loss. If the price of TRN rises, the buy position is activated. Therefore, even if the stock moves in the opposite direction, the trader can make up for his loss.

Stop Loss

Stop loss is used to sell any asset traded in the market at the current price. Although it looks like we are going to lose our way at first, we may lose even more if the price breaks through the strong sell-off. If the price does not break, our stop sell order will not be executed.

Buy Limit

Buy limit is where traders buy or sell shares at a specified price or better. A buy limit order can only and only be executed at the limit price or lower while a sell limit order can only and only be executed at the limit price or higher. A buy limit can only be executed when the market price of the stock reaches the limit price.

If the value of any asset is lower than its current price, it is called a purchase order to execute the acquisition. The purpose of a trader placing an order is to make the asset price fall first, and support the price to rise rapidly after placing the order. Buy limit orders provide investors and traders with an accurate way to enter positions.

For example, when the stock transaction price is 2.50 USD, you can buy a limit order at 2.45 USD. If the price drops to $2.45, the order will be automatically completed. It will not run until the price drops to $2.45 or less.

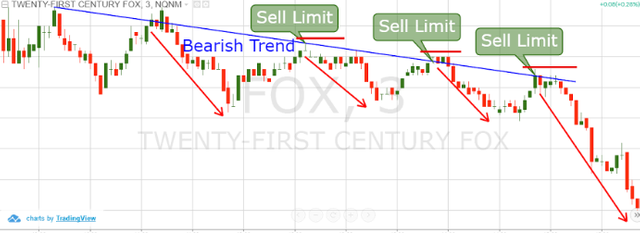

Sell Limit

The limit sell order will be executed at the limit price or higher. Generally speaking, limit orders allow you to specify a price. The stop loss order includes specific parameters used to trigger the trade. Once the share price reaches the stop price, it will be executed at the next available market price. If the value of any asset is much higher than the current price and a sell transaction is required, then the sell order that is executed under these conditions is called a sell stop loss. Here, traders believe that asset prices will first go up and then go down. You may think that the resistance level is too strong now.

If the volume is not too high and therefore the trend is not strong enough, traders believe that the value will rise further and then decline. In this case, traders can predict that the value will decrease after a certain increase.

Trailing Stop Loss

Trailing Stop Loss, also known as Trailing Stop Loss, is a market order that sets a Stop Loss at a specified percentage below the asset's market price, rather than a single value. Therefore, the stop loss will lag behind the shares as the share price changes. Trailing stop order feature allows traders to demand profit and avoid losses. The purpose here is to gradually increase the profit of the trader. When the market fluctuates, traders will place a previously analyzed and determined order, which has a percentage difference from the market value.

In this type of order, if the current price does not move in the direction expected by the trader, the loss is limited and the profit is protected. If the value changes based on the merchant's requirements, it changes based on the required percentage (for example, 5%). In this case, the transaction remains open. If the trader makes a profit, he will lock in the profit provided. Conversely, if the value falls, when the value moves a certain percentage, the trailing stop loss order will end the transaction at the current price.

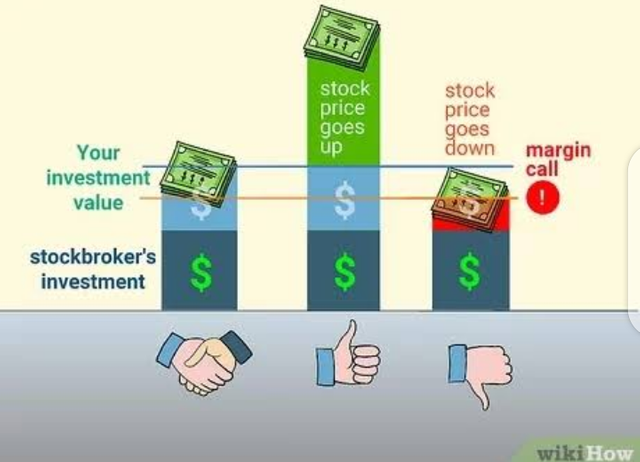

Call Margin

Call Margin requires additional funds or value to allow the margin account to reach the minimum maintenance margin. If the trader does not deposit funds, the broker can force the trader to sell the asset, regardless of the market price, to meet the margin call requirement. When certain conditions are met, this is a call from the broker to investors. Imagine a trader is exchanging all his money and he is losing money. In order to keep the merchants in position and not suffer greater losses, he accepted the broker's instructions. In this case, the investor is designated to fill in the margin

2 - Practically demonstrate your understanding of Risk management in Trading.

What is Risk Management?

Risk refers to the probability of negative events in your activities; events that run counter to your expected results. Risk is an integral a part of cryptocurrency trading. Unexpected results may occur within the transaction, resulting in losses. for instance , the five hundred risk of a brief position only means there's a 50% chance that the worth of Bitcoin will rise, resulting in your loss.

Traders should take precautions to eliminate the risks they'll face in trade which can arise and this is often one among the foundations of trade. If the trader doesn't persist with the principles he has set, we cannot say that he has made a successful trade. Managing risks is vital for one to realize success in trading.

Risk management strategy are often divided into 3 categories;

• Position Sizing,

• Risk / Reward Ratio,

• Stop Loss and Take Profit.

- Position Sizing / Portfolio Management

Position sizing dictates what percentage coins or tokens of cryptocurrency a trader is willing to shop for. Great profits in crypto trading tempts traders to take a position 30%, 50% or maybe 100% of their trading capital and this is often a disruptive move that puts them at serious financial risks. The best option would be to exploit different possibilities or investments. Here you can use this method to realize position sizing.

Amount vs Risk Amount

This approach considers two different amounts. The primary aim involves money as you're willing to take a position in every single deal. It's advisable for traders to stop at this amount.

The enter amount can be defined as below;

A = ((Stack size * Risk per Trade) / (Entry Price – Stop Loss)) * Entry Price

For instance, to get ETH with USDT with a target of $13,000. The parameters would be:

Stack Size: $5,000

Risk per Trade: 2%

Entry Price: $11,500

Stop Loss: $10,500

Our enter amount would be:

A= ((5,000 * 0.02) / (11,500 – 10,500)) * 11,500 = 1,150

With the increase of other cryptocurrencies within the basket, you will have tolerated your loss. Therefore, when trading with cryptocurrencies, you need to have a minimum of 5 different cryptocurrencies in your portfolio.

- Risk / Reward Ratio

It is the speed of profit we'll get reciprocally for the risk taken after any trade. The foremost popular risk-reward ratios used are 1/2, 1/3, and 1/4.

The risk/reward ratio compares the particular level of risk with the potential returns. In trading, the riskier an edge , the more profitable it can get. Understanding the risk /reward ratio enables you to understand when to enter a trade and when it's unprofitable. The risk/reward ratio is calculated as follows:

R = (Target Price – Entry Price) / (Entry Price – Stop Loss)

From the previous illustration:

Entry price: $11,500

Stop Loss: $10,500

Target price: $13,000

Our ratio would be:

R = (13,000 – 11,500) / (11,500 – 10,500) = 1.5 or 1:1.5

A ratio of 1:1.5 is considered as good. It's always advisable for traders to not trade with a ratio less than 1:1. Setting the risk-reward ratio as 1/3, if your stop loss level is $ 8, your sell price are getting to be $ 14. If the trade develops as expected, you make a profit of $ 4, if it doesn't develop, you lose $ 2.

- Stop Loss and Take Profit

One of the two important strategies that savvy traders use when trading is Stop Loss and Take Profit. In trade, if the market progresses beyond expectation, if there is a decrease within the asset price, the stop loss is activated to avoid further loss and our trade is closed. On the contrary, if trade proceeds as we expect, it's an order that's activated just in case of an increase within the asset price.

Stop Loss refers to an executable order which closes an open position when a price decreases to a selected barrier while Take Profit, is an executable order that liquidates open orders when the costs rise to a particular level. Both are good approaches to managing risk since stop losses prevent from trading in unprofitable deals while Take Profits allow you to get out of the trade before the market can turn against you.

Conclusion

As taught by to he professor @yohan2on, as a trader, you can make use of Trailing Stop Losses and Take Profits which follow the rate’s changes automatically as well as the Buy Stop, Sell Stop, Buy Limit, Sell Limit and Margin Call to manage the risks in trade. Fortunately, with crypto terminals like Superorder, you'll set your Trailing Stop Losses and Take Profits right from the terminal. Thank you.

Hi

Can you please use the correct exclusive tag

#yohan2on-s3week8

Done. Thank you sir.

Hi @amazing-grace

Thanks for participating in the Steemit Crypto Academy

Feedback

A buy Stop and Sell Stop have nothing to do with the Stop loss. The 2 are different from the Stop loss. They are NOT stop-loss orders.

You need to go back and check for the correct explanations of all the trading terminologies. You lacked a clear and straightforward understanding of the highlighted trading terminologies.

I surely will. Thank you professor.