Crypto Academy / Season 3 / Week 5 - Homework Post for @kouba01

INTRODUCTION

In the crypto ecosystem, traders have different strategies to analyze trends, price movements, support, and resistance. However, the Ichimoku cloud is one of the important indicators which helps crypto traders to understand trends, price volatility, dynamic supports, and resistances. Although it's for the savvy trader who understands the Ichimoku cloud chart.

Discuss your understanding of Kumo, as well as its two lines.

KUMO

In the Ichimoku Kinko Hyo indicator, Kumo is a key part of the indicator which passes a piece of relevant information to crypto traders about the dynamic support and resistance, price movements of a market. As such, can be used to forecast future price actions and trends.

Basically, the Kumo is the horizontal position between two lines in the Ichimoku cloud known as Senkou span A and Senkou span B. Moreover, anytime the market price of an asset moves below the Senkou Span B then the overall trend goes down known as a downtrend (Bearish trend).

From the chart Senkou Span is above Senkou Span B with a bullish move

Also, once the market price of an asset moves above the Senkou Span A then the overall trend goes upward which is known as Uptrend (Bullish trend).

From the chart Senkou Span is below Senkou Span B with a bearish move

However, in Ichimoku, for a trader to enter a long position, the Senkou span A must be above Senkou Span B with a further bullish move, also for a trader to enter a short position, The Senkou span A must be below Senkou Span B with a further bearish move.

Furthermore, in some cases, we can as well observe where there is no trend in the market which can be referred to as a "Neutral trend".

Senkou Span A (Leading Span A)

This is a component of the Ichimoku Kinko Hyo indicator that's also known as the leading span A. It is referred to as leading span A as a result of its values which traders use to forecast future support and resistance. Moreover, Senkou Span A-lines can also pass messages to crypto traders since they can be used to measure price action.

Basically, it can be calculated by the addition of the Tenkan-sen line and Kijun-sen line, then divide by 2. Furthermore, 26 periods are used when performing the calculation. Also note that in the cloud, it's referred to as the faster boundary as a result of the use of 26 periods and 9 periods, as such to react very fast once there are price fluctuations. And when joined with the Senkou Span B lines, it creates a cloud called the "Kumo."

Once, we notice the Senkou Span line A is above Senkou span line B with an upward movement, then it indicates the future uptrend.

Senkou Span B

This is another component of the Ichimoku Kinko Hyo indicator that's also known as the leading span B. Moreover, Senkou Span B lines can pass a message to crypto traders since they can be used to measure price action and predict future support and resistance.

Basically, it can be calculated by the addition of the highest high(HH) and lowest low, then divide by 2. Furthermore, 26 periods are also used when performing the calculation of the Senkou Span B. Also note that in the cloud, it's referred to as the slower boundary as a result of the use of 26 periods and 52 periods, as such reacts very slow once there are price fluctuations. And when joined with the Senkou Span A-lines, it creates a cloud called the "Kumo."

Once, we notice the Senkou Span line A is below Senkou Span line B with a downward movement, then it indicates a downtrend.

The relationship between this cloud and the price movement

Just as I mentioned earlier, that the area between the Senkou Span A line and Senkou Span B line is known as the Kumo or cloud. We have two basic lines that form the cloud. As such, the price movement of any asset is based on these lines as well as its thickness. Let's check it out.

We observe Upward price movement whenever the Senkou Span A line is above the Senkou Span B line. While downward price movement occurs when the Senkou Span A line is below the Senkou Span B line. We can see the relationship between these span lines of cloud and the price movement.

Let's check out the relationship between the thickness and thinness of the cloud and the price movement.

THICK CLOUD

A thicker cloud is formed when there are massive large price movements, which then, in turn, creates stronger resistance and support levels. And the cloud height entails the extent of price fluctuation of the market. Hence it's very ideal to understand that the more the thickness of the cloud on a chart, the stronger it resist the price movement to break in.

When the cloud is thick, it entails there's strong support and resistance whereby the price of the asset can not break the cloud either upward or downward. As such, indicates better price movement and more probable trade.

THIN CLOUD

The formation of thin Kumo, result in weak support and resistance levels. And once we see such a scenario, it means the price can penetrate easily through these levels. So when we observe that the cloud is thin, it signifies weak support and resistance whereby the price of the asset can break the cloud either upward or downward due to its weak nature. And once the price penetrates the cloud either upward or downward it suggest a better and more probable trade.

Moreover, anytime the price movement gets close to the thin cloud, it passes a message to a trader that the trend is getting weak or a possible reversal is about to happen. Though, it needs a savvy trader who understands the Ichimoku cloud chart.

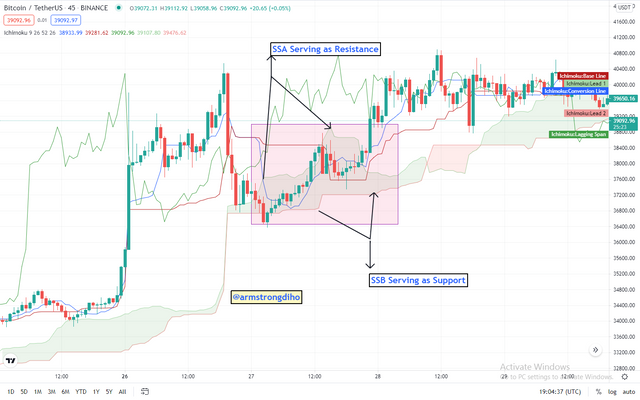

How to determine resistance and support levels using Kumo?

Basically, traditional support(S) and resistance(R) traders always marked dynamic support and resistance as horizontal lines on the chart most especially when the price movement tested twice or more in a ranging market. However, using the Ichimoku cloud, determining support and resistance is possible and doesn't require much strategy.

To determine support and resistance using the Ichimoku cloud requires the user to understand the two basic lines of the Kumo( SSA & SSB). When a market observes any of the trends, there is the formation of support and resistance which is formed by the SSA and SSB. Once the price movement change, there is an instant change of height and shape in Kumo which might affect the support and resistance levels.

Moreover, these two lines can serve as support and resistance most especially when the price movement breaks either the support or resistance level and retest and breakout with the massive movement of any of the lines. When price moves above the SSA and SSB lines on top instantly serve as support, whereas the lower lines in turn will serve as a second support level. when the price falls below the cloud, the lower SSA and SSB line instantly serves as resistance levels, whereas the higher SSA and SSB lines, in turn, serve as the second resistance level.

Generally, traditional S&R user has this mindset to buy an asset when in support level, while selling an asset when in resistance level. But Ichimoku S&R users can not because they understand the implications about when the cloud is thin that the price action of the asset can break the cloud either upward or downward due to the weakness of the support and resistance. As such, can not make any trade decision.

How and why is the twist formed? And once we've "seen" the twist, how do we use it in our trading?

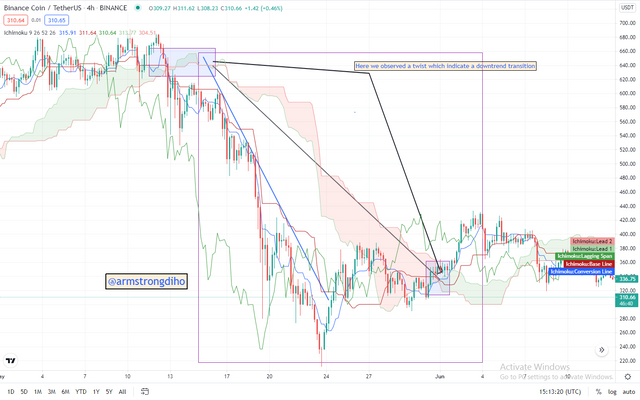

In Ichimoku cloud space, the twist is another unique strategy since it can serve as additional confirmation which Ichimoku users can apply when trading. In the Kumo environment, the twist can be formed when senkou span A line crosses over the senkou span B line.

However, this can be observed in any of the trends either uptrend or downtrend, or even neural trend. Generally, the twist is formed in order to provide signals. A savvy user who understands the Kumo twist will gain profit since they can serve as an additional confirmation to identify future trends. Below are the signals.

Signal from Kumo Twist

UPTREND

Once we observe that the senkou span A crosses over the senkou span B and with an upward price movement, this entails bullish market transition which means an uptrend transition. With the trader can place long position.

DOWNTREND

Moreover, when we observe that the senkou span B crosses the senkou span A and with a downward movement, this signifies bearish market transition which means a downtrend transition.

Therefore, once we over there's a twist on the chart, it shows that the trend is getting weaker, as such, passes a message to the user about the current price trend.

Using Twist in our Trading

I have discussed signals which Kumo Twist provides. Though I only discuss two criteria which are the uptrend and downtrend, it can also be observed in a neutral trend. It is also important to know that once we over there's a twist on the chart, it shows that the trend is getting weaker, as such, passes a message to the user about the current price trend.

However, with the help of these signals criteria, the Ichimoku user will use this as an advantage to take a long position once they get a clear chance in the aspect of an uptrend, whereas it will also enable the Ichimoku user to wait for a clear chance to take a short position as such can lead to profitable reward in the case of bearish transition.

Twist can also serve as a means by which a user can identify trend reversal before any trend transition. As such, the user can use this as an advantage to buy assets at a lower price and sell them at a higher rate. Although, it needs advanced users who are well savvy about the Ichimoku cloud chart.

For instance,

suppose Armstrong a trader, have detected the twist and knows the trend is about to go downward and upward. Immediately, he will place short and long entry, and we can see how the price reversed. Believe me Armstrong will be happy because he went home with certain percentage interest from this trade. The image gives more interpretation.

USING KUMO TO CONFIRM TRENDS

Every objective of Ichimoku users is to gain maximize profits and minimize losses. However, to achieve that is very necessary to have a suitable strategy to use for confirmation. And one of the uses of the Ichimoku cloud is to spot out trends and price momentum as such enables users to make good trade decisions more easily. Ichimoku trend confirmation strategy with the cloud lies on the trend.

Generally, understanding trends in the basic confirmation strategy in the Ichimoku cloud environment. So let's check out the trends( uptrend, downtrend, and neutral trend).

UPTREND

To confirm if a market is in an uptrend in any given timeframe, the Senkou Span A is always above the Senkou Span B with the cloud moves in an upward movement. By default, it indicates a green cloud.

DOWNTREND

It is very important to understand the direction of the trend before placing any trades. To identify and confirm a downtrend, the Senkou Span A line is below the Senkou Span B line with the cloud moving in a downward movement, then it is a confirmation that the market at that particular timeframe is in a downtrend. By default, it indicates a red cloud.

NEUTRAL TREND

In this case, once we observe that the price movement is within the Kumo forming flat pattern, then it is a confirmation of a neutral trend.

SIGNALS TO DETECT A TREND REVERSAL USING KUMO

Using Ichimoku cloud to detect trend reversal, we must understand and observe when the twist is formed, the price movement of the market, and in most cases Chikou span line.

Twist

When the Senkou Span A line crosses over the Senkou Span B line which might result in Ichimoku cloud twists, as such trend reversals in an uptrend or a downtrend may be observed regardless of the timeframe.

Price movement

Price movement is another possible way we can detect trend reversal since the morphology (height and shape) of the Kumo can change as a result of the change in price movement, as such might affect the support and resistance levels. Moreover, anytime the price movement gets close to the thin cloud, it passes a message to a trader that the trend is getting weak as such price movement can penetrate which can lead to possible trend reversal transition.

Chikou Span

Another possible means we can detect trend reversal is the Chikou Span. Basically, the Chikou Span is not among the lines that form the Kumo, it is only the Senkou Spans A and B that form Kumo. Hence, we can use the Chikou Span to detect trend reversal since it visualizes the current price movement just like the price movement we observe in Senkou Spans. That's in some cases, once we observe that the Chikou span has crossed over the price it indicates a trend reversal.

USING THE CLOUD AND THE CHIKOUS SPAN

The Chikou Span is another important component of the Ichimoku indicator, that basically serves as a price momentum indicator, and in conjunction with the Kumo, it serves as a tool a trader could use to confirm trend reversal. The Chikou Span can also be called the Lagging Span because big its unique nature to project the closing price of the current period using 26 periods in the past. The Chikou Span passes messages to a savvy trader on when an uptrend or downtrend transition is about to occur since it projects the closing price of the current period using 26 periods in the past.

CHIKOU SPAN UPTREND IN CONJUNTION WITH KUMO

UPTREND

However, once we observe that the current market price is above the price of 26 periods ago, signifies an uptrend transition for that asset within a given timeframe.

DOWNTREND

Also, once we observe the current market price is below the price of 26 periods ago, it signifies a downtrend transition for that asset within a given timeframe.

Moreover, with the help of the Chikou span, a trader can identify when the price momentum of any asset is getting stronger and weaker. Signal for stronger price momentum, the Chikou span doesn't switch or come in contact with the price movement which signifies a strong price movement, as such might result in price to rise, but the signal for weaker price momentum, the Chikou span is below the price movement which signifies that the price movement is getting weak, as such might lead to falling of price. And once we detect the Chikou span and the price line is in contact(interacting) it signifies a sideways trend.

From what I have explained, using the cloud and Chikou span is very interesting and can help to detect and confirm trend reversal. Generally, every trader needs to identify and confirm a trend and trend reversal before placing any trade. Using the cloud and Chikou span have provided the solution to that. Though it's not 100 percent sure because the market can be manipulated sometimes. Once a trader detects the trend and trend reversal, it's very easy to make a quick trade decision either to place an entry or to exit from the trade as such maximize profits and minimize losses can be achieved.

For instance, from the BTCUSDT chart, Mr. Armstrong a trader place short trade,he observed the Chikou span penetrated the price, as such there was a trend reversal which leads to a downward move.

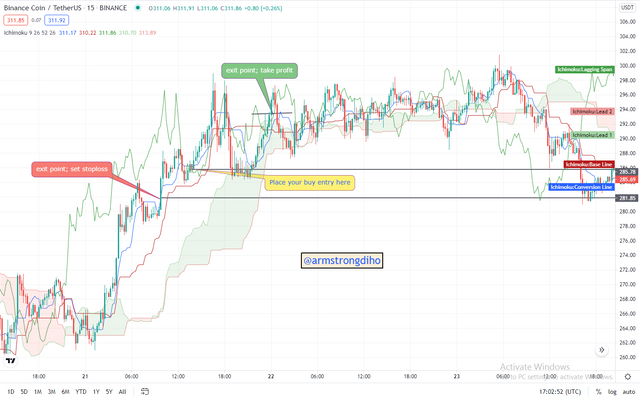

SCALPING WITH THE ICHIMOKU CLOUD

In the crypto ecosystem, scalping trading means a short-term trade. And a trader who demonstrates this is called a "Scalper". For more clarification, this is a trader who doesn't hold the position for a long time and doesn't focus on big timeframes like 4h or A day instead it concentrates on small timeframes like 5,10, or 15 minutes and most at times 1h. One unique about scalping trading strategy is all market is very favorable to them.

How can we achieve scalping trading strategy using Ichimoku cloud indicator.

Since my chart is already set with the Ichimoku indicator, then I have to select a coin of my interest. Now, I have to wait and observe the market to detect trends and trend reversal. We can apply a similar method we used when detecting trend reversal but in this scenario, it requires using a lower timeframe. Remember, we use the Kumo twist, price movement, Chikou Span signal, and cloud direction to detect trend and trend reversal.

Sometimes the market can be confusing, so we can clarify our doubt through the confirmation of the trends(uptrend, downtrend, and neutral trend) which I have explained above. Recall that each of the trends has its own Confirmation format. For further emphasis, the Tenkan-sen line and the Kijun-sen line also pass a message to the scalper. I will discuss that when explaining the take long position and take a short position.

ENTRY AND EXIT CRITERIA

There are basic criteria to follow for the Scalping Strategy to maximize profits and minimize losses. Let's check out;

ENTRY CRITERIA

Learning when and where to place an entry is very important to maximize profits. Basically, we have two criteria; buy and sell criteria.

BUY CRITERIA

Remember we can only take a buy(long) position when the market is about to reversal from a downtrend to an uptrend. So once we have detected and confirmed an uptrend early, then we can take a long position. Moreover, once the Tenkan-sen line is above the Kijun-sen line then it signifies an uptrend which means the scalper can position long for the trade. Also, a large green candlestick by default which represents the volume of the asset can as well give confirmation for the long position. The following chart will clarify us better. It's ideal to place a buy position at the lower level.

SELL CRITERIA

We can only take a sell(short) position when we observe the market is about to reverse from an uptrend to a downtrend. So once we have detected and confirmed a downtrend early enough, then we can place a short position. Also once the Tenkan-sen line is below the Kijun-sen line then it signifies a downtrend which means the scalper can position short for the trade. Also, a large red candlestick by default which represents the volume of the asset can as well give confirmation for the short position. It's ideal to place a sell position at a higher level.

The following chart will clarify us better.

EXIT CRITERIA

Not only understanding when and where to place an entry is the key strategy, also have knowledge on when and where to exit a trade is very important when using the Ichimoku indicator because sometimes the trade might not go in the Scalper's favorable direction. As such, setting stop-loss is very important. Exit should be applied once the Tenken line and Kijan lines fall below the Kumo.

Exit criteria for long position; stop-loss and take profit should be set . The chart below will clarify us better so let's check it out.

Exit criteria for the short position; stop-loss and take profit should be set. The chart below will clarify us better so let's check it out.

CONCLUSION

Basically, every crypto trader's focus is on how to identify future trends, price movements, in most cases support, and resistance which enable them to maximize profits. And to identify all these, it require a good strategy, as well as to understand indicators like RSI or Ichimoku Kinko Hyo, and other charts like the candlesticks chart.

However, Ichimoku Kinko Hyo indicator has five components lines with different roles they play on the market. In this article, we discussed majorly on the kumo which is the key component of the Ichimoku indicator. Kumo can be located between Senkou span A and Senkou span B. It can indicate when the market is rising(uptrend), falling(downtrend), as well as in trendless(neutral trend).

Moreover, we can apply the kumo in any kind of trade be it scalping or swing regardless of the timeframe as it indicates future trends reversal, price momentum, and can determine support, and resistance through Senkou Spans and twist. The kumo in conjunction with the Chikou Span can detect trend reversal very easily. So for accurate information, the kumo should be in conjunction with other indicators. However, once a trader identify all these early, it gives the trader an advantage to ride on the trend market, as such can result to high profits.

THANKS FOR READING THROUGH

Cc:

@kouba01

A well detailed and well articulated work you have here @armstrongdiho I'll definitely want to grow to this point soon in the SteemitCryptoAcademy. Welldone and congratulations 👏

Thanks. I know you can because you have all it takes to reach such climax. Congrats in advance.

Hello @armstrongdiho,

Thank you for participating in the 5th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve a 10/10 rating, according to the following scale:

My review :

Very excellent work which covered the subject in all its aspects in a superb manner and with a solid methodology. Most of the answers were precise and direct, which confirms your good understanding of the questions asked.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thanks so much Prof. For your review

A well detailed and well articulated work you have here @armstrongdiho I'll definitely want to grow to this point soon in the SteemitCryptoAcademy. Welldone and congratulations 👏