DeFi Products - Crypto Academy | S4W8- Homework Post for @reminiscence01

In your own words, explain Defi products and how it is shaping the present day finance. (B) Explain the Benefits of DeFi products to crypto users.

Answer to Question 1a

DeFi is an acronym for Decentralized finance. DeFi products therefore are financial services offered to users directly on the online Blockchain through the use of decentralized networks. It can also mean an array of blockchain-based applications and protocols offering peer-to-peer alternatives for traditional financial services and institutions.

In DeFi products, financial services is open to anyone and everyone, provided a user has an internet connection and can maintain it. DeFi products therefore allows financial services to operate in a fully open, transparent, border less and secure form.

Given the many use cases and it's proven ability to transform global finance, DeFi will most likely change the financial services for the better and that is why it has been shaping the present day finance for the better. For example, unlike traditional financial services that offer just trading, insurance, investment, lending, and payment.

DeFi products offer all of these including staking, liquidity mining platforms, decentralized exchanges (DEX) etc. These applications and protocols can be combined with each other allowing for greater variety and flexibility. The availability of DeFi products has also led to an increase in the market capitalisation of all tradeable tokens used for DeFi smart contracts.

The total value locked up in DeFi smart contracts have also skyrocketed. Between October 2017 and July 2021, the total locked has moved from about $2.1million to about $6.9billion and that's more than 3000% increase. Some DeFi services allow users to;

- lend Cryptocurrencies with interest rates attached to them using DeFi platforms

- take part in pools whereby everyone gets their money back and one lucky winner gets the interest in the pool

- buy stable coins usually pegged to the value of a specific commodity or cryptocurrency.

In DeFi, there are no legal requirements as everything is all about mutual trust and agreeing to the privacy. Because of the potentials of DeFi products, mainstream and high financial institutions are getting involved. A report shows that more than 70 of the world's biggest Banks are trading Blockchain technology to speed up payments.

Asset management funds too aren't left out; The company Grayscale are beginning to take DeFi seriously too. More people too have been investing heavily on DeFi products. This is as a result of FOMO (fear of missing out) of its explosive growth even though some of these tokens have little or no worth in the interim.

Certainly DeFi product will most likely replace traditional financial services this is because its decentralised, transparent, high yield, secure with varieties of applications and protocols. Truly, it's shaping the present day finance for the better.

Answer to question 1(B)

Some of the benefits of DeFi products include;

- Transparency:

All the activities on the Blockchain network is featured on the distributed ledger. This is somehow made possible because of its decentralisation. After the verification of authenticity, the information is documented. Because of DeFi products transparency, people are able to identify and avoid financial scams as well as treacherous business practices.

- Immutability:

The use of consensus algorithms like proof of works has made it possible for DeFi products to achieve immutability. With this in mind, it's almost impossible to manipulate records on the Blockchain network. This benefit also heightens the security of the Blockchain. The Blockchain immutability also helps the DeFi projects in carrying out financial transactions effectively.

- Accessibility:

Because of its decentralized nature, DeFi products are accessible to anyone and everyone. Their accessibility helps to reduce the dependence on corporation organisations. In addition, specific transaction histories are easily circulated throughout all members. DeFi access also ensure easy access to financial services by its users including those with DeFi applications.

- Tokenization

Usually, tokens act like prototype to the original data, even though tokens can't be used to guess their values. DeFi products enable the use of tokens. For example, Ethereum a coin, enables powerful smart contract capabilities, opening up way for the issuance of crypto tokens.

These tokens have different features and applications some of which includes; real estate tokens, security tokens and even dApps (decentralized applications) etc. Most important, tokenization brings about better exposure to other physical and digital assets in the form of FIAT, digital currencies, gold, oil etc.

- Saving Pools

People can use DeFi exchanges to manage their savings. With that, they can start earning interests provided they lock their savings in lending protocols. Interestingly, many DeFi savings applications have sprung up in recent years. One beneficial protocol is the yield farming.

With yield farming, users can move their idle crypto assets to various lending protocols for better returns. The benefits of DeFi products are immersive and outweigh those of traditional financial institutions. With DeFi projects, Blockchain applications can be promoted in the financial services sector.

Discuss any DEX project built on the following network (a) Binance smart chain (b) Tron Blockchain.

Pancakeswap

It is a binance smart chain decentralized exchange that permits the performance of transactions on its platform without the involvement of a third party. Its actually one of the leading Dex platform that has quite a large trading volume, of about $27billion trades per day.

It makes use of DEX, which allows users to trade their tokens for other tokens in the DEX market using an Automated technique known as the market maker techniques. It has a lottery feature that helps to provide liquidity in the platform where users are rewarded with the native token of the platform.

The audit of the protocol of pancakeswap is done by Certik, a widely known smart contract security firm. The native token of the pancakeswap is known as CAKE. Users of this platform are able to stake, vote, as well as perform yield farming with their cake tokens on this platform, so as to constantly provide liquidity. The pancakeswap also supports the use of BEP20 tokens as they can be swapped at a relatively cheap transaction fee.

Justswap

This platform allows for fast and easy swap of the TRC-20 tokens, with a very low transaction fee when compared to those platforms built on the etherum network. It is actually a decentralized platform and it makes use of automated market maker techniques.

The issue of third party is completely eliminated with the use of this platform,as transactions are executed through the process of smart contracts. The use of this platform is very convenient as transactions are executed almost immediately. It also allows for swapping of tokens at any given point in time. With the swap of TRC-20 tokens, users of this platform are able to benefit,while also creating liquidity.

In The DEX projects mentioned in Question 2, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (Screenshots needed)

Swapping using Just swap

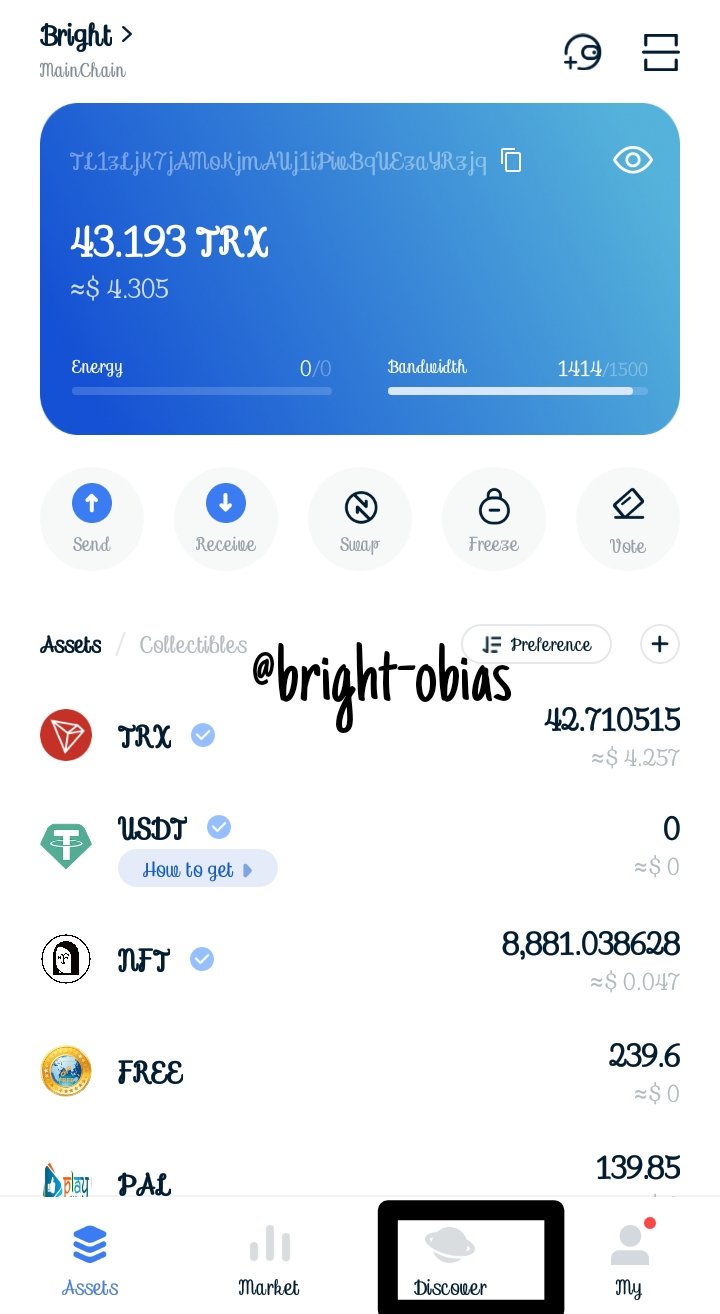

- first I logged into my tronlink, on homepage, I clicked on discover.

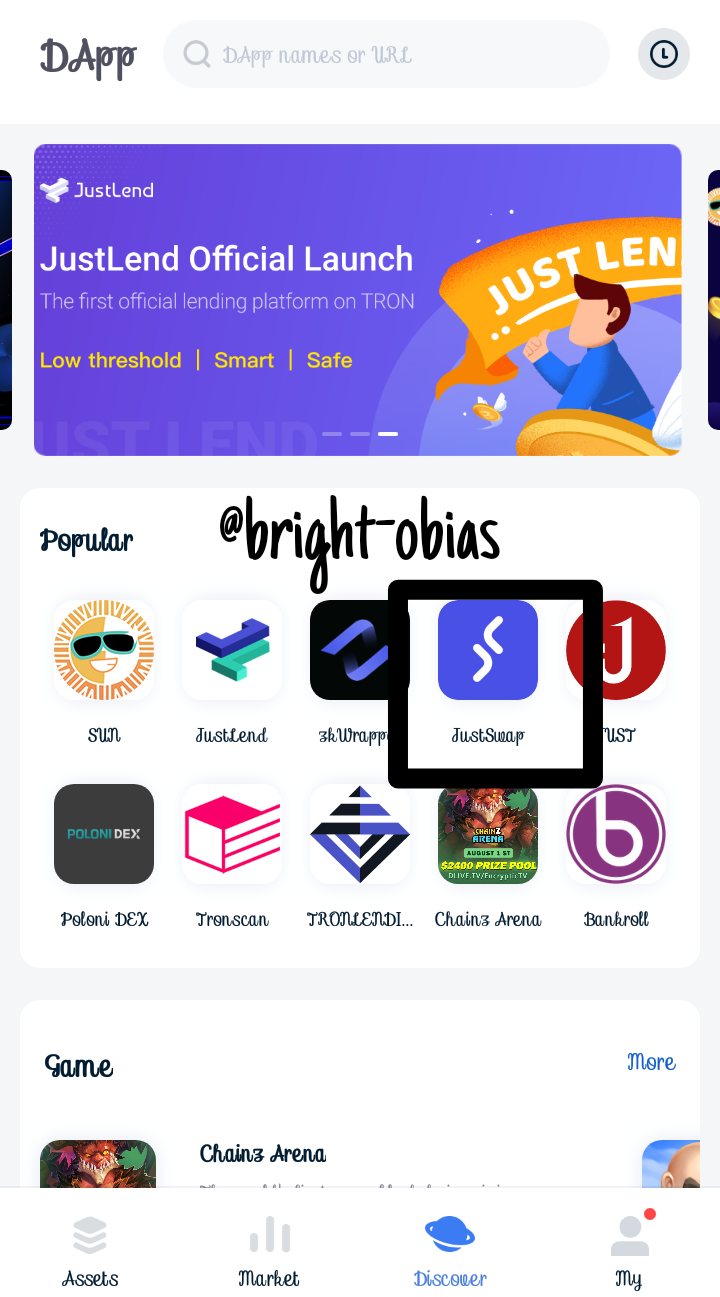

On the next page, I clicked on justswap

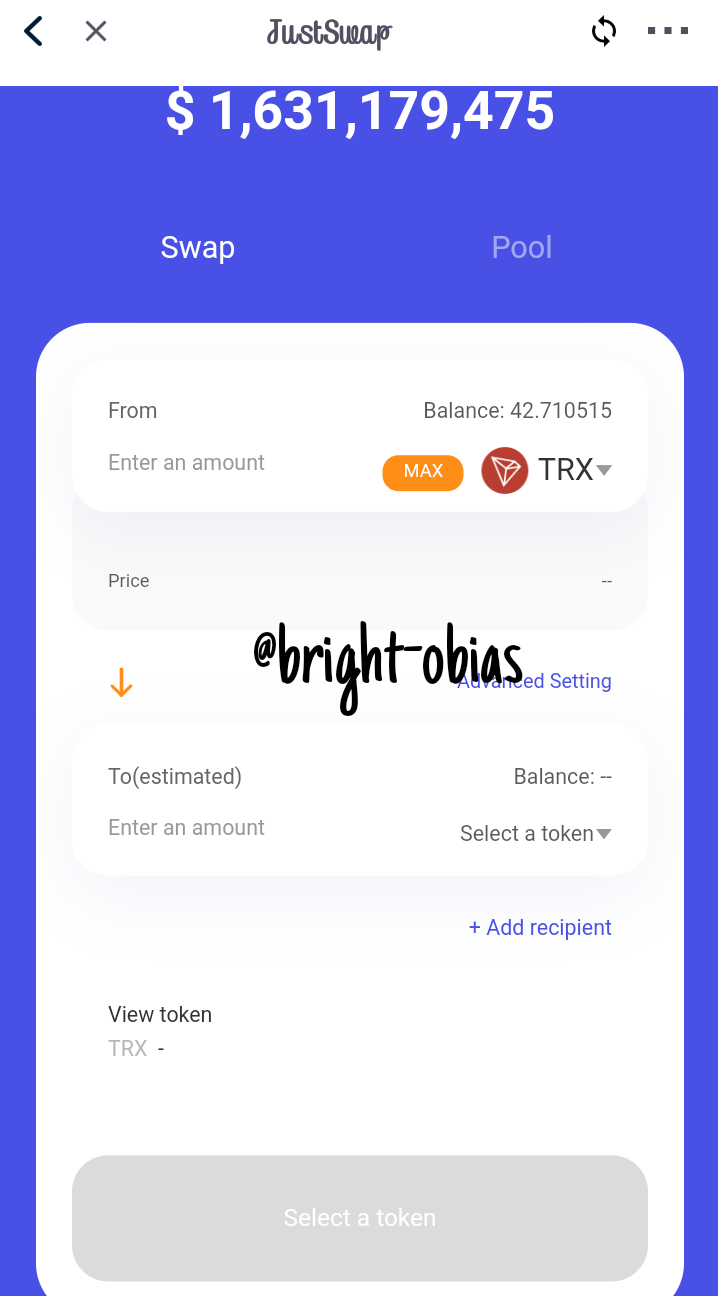

- on the next page that pops up, i am asked to input the token i want to swap as well as amount.

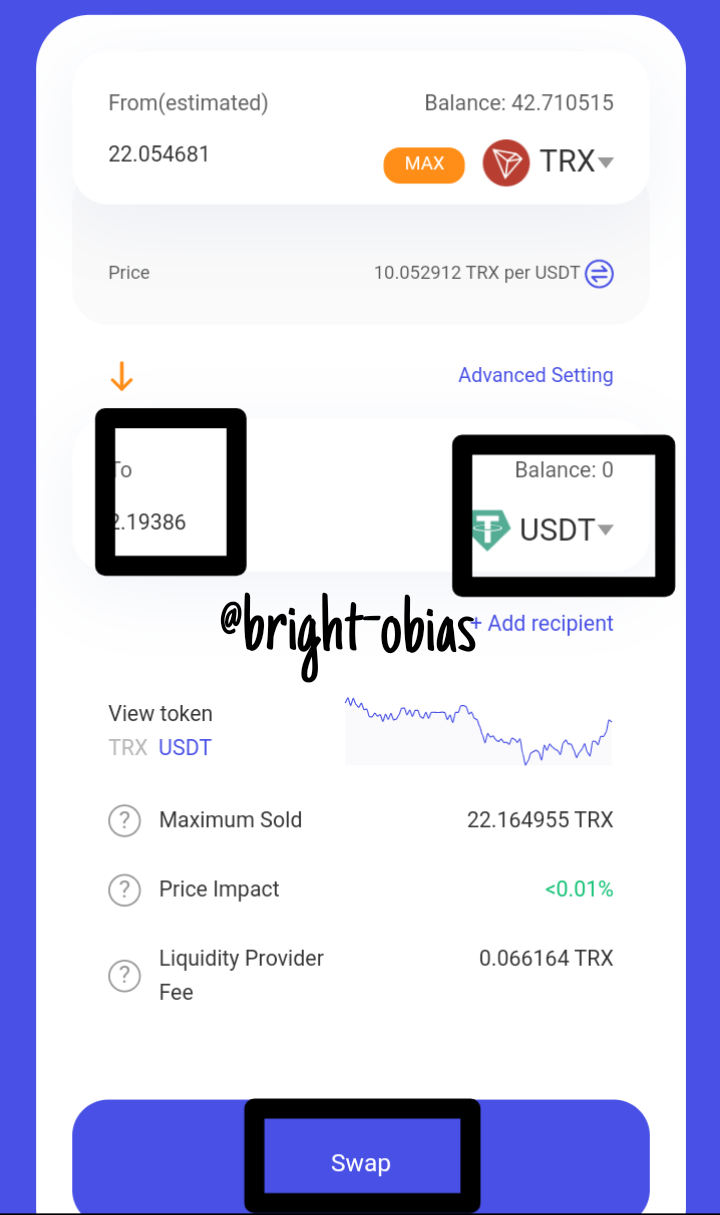

- I input amount and the token I am swapping

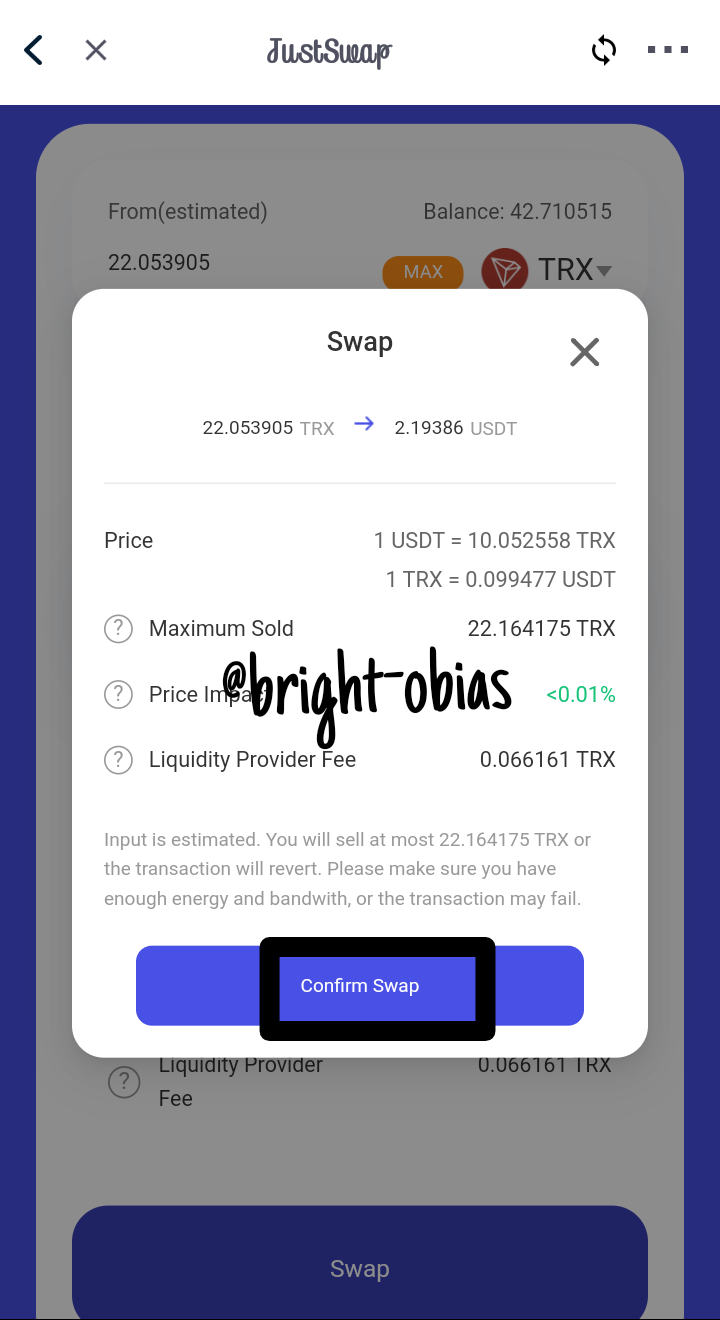

- I click on confirm swap

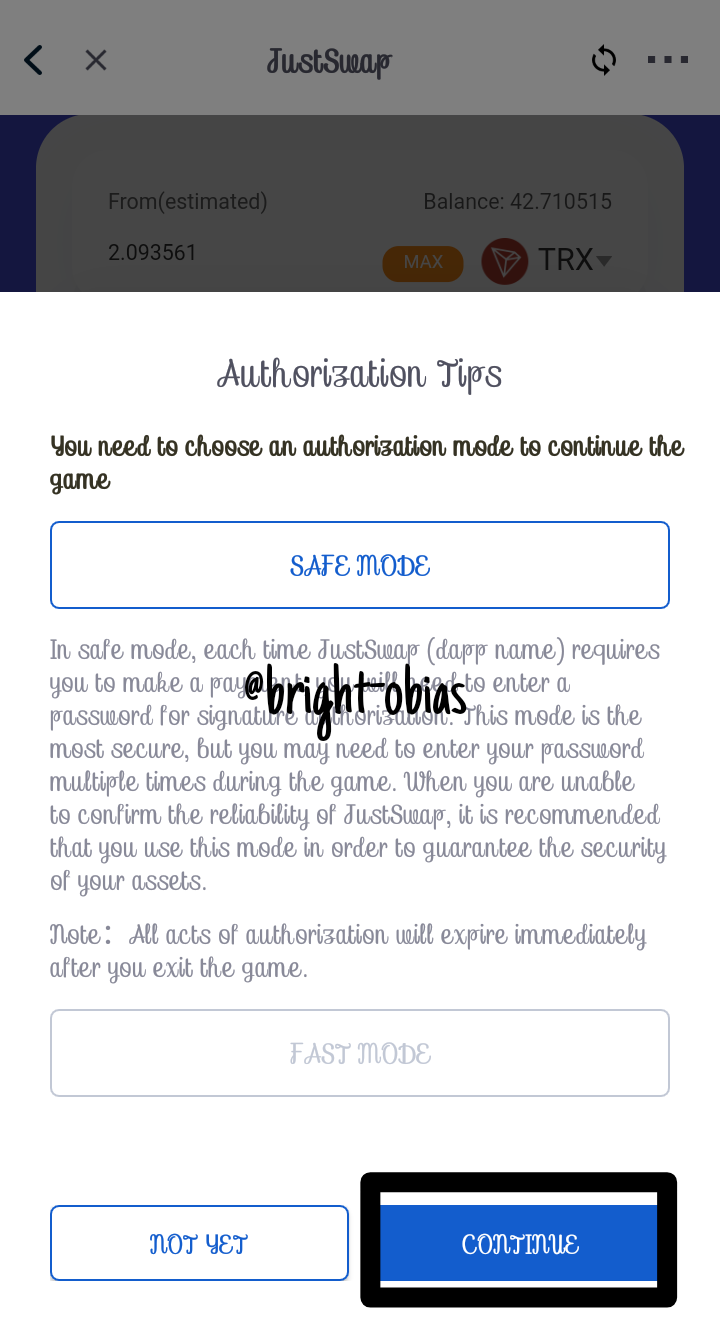

- I click on continue

)

)

- I confirm swap

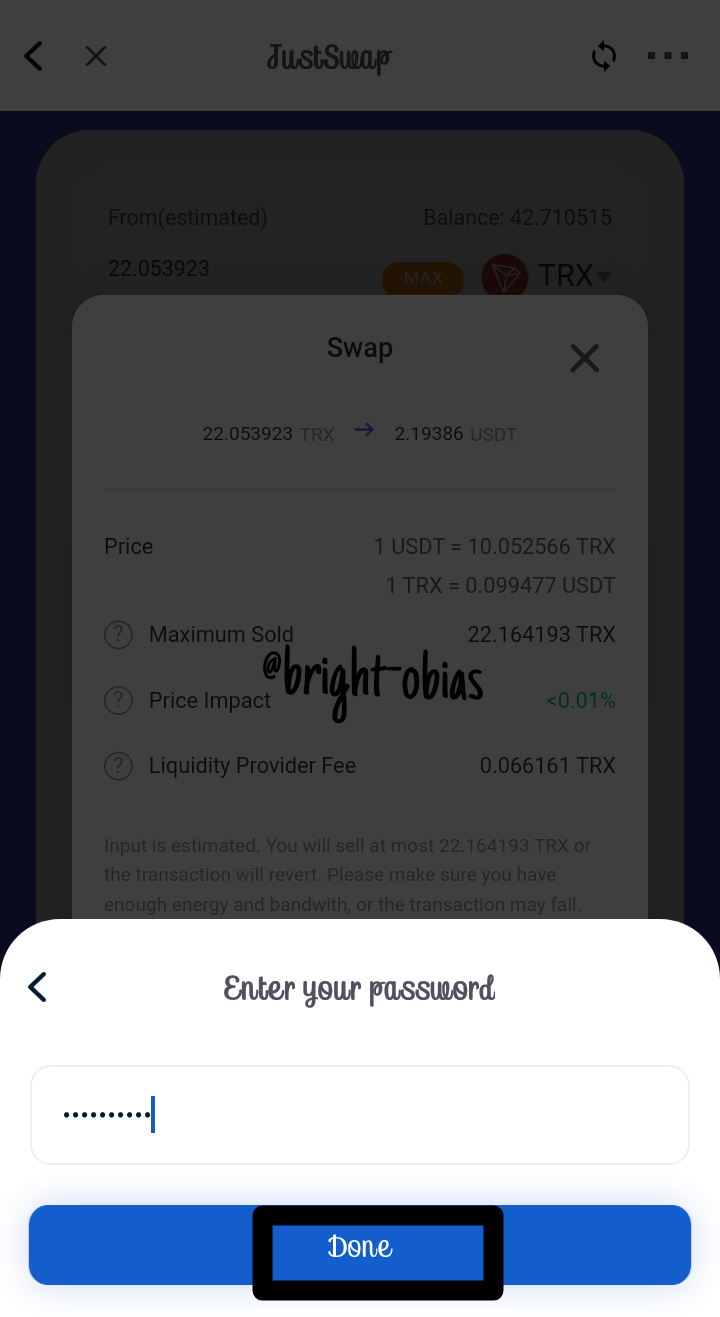

- I input my password and click on done.

)

)

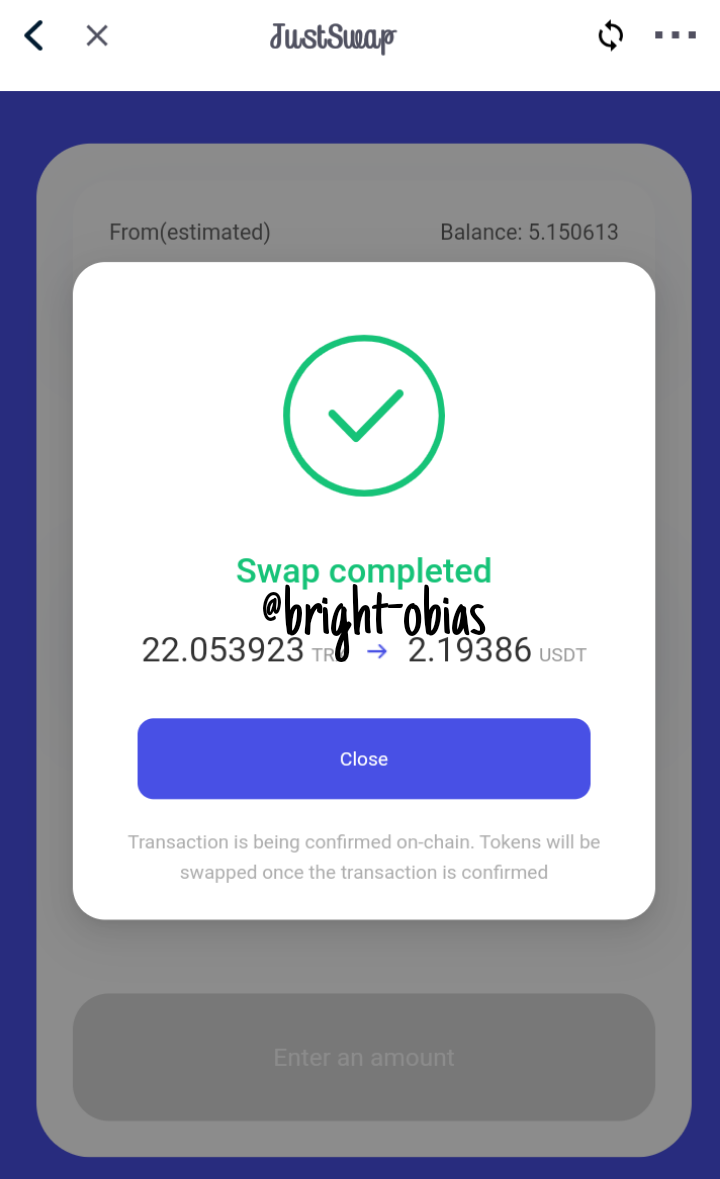

- Swapping process is completed

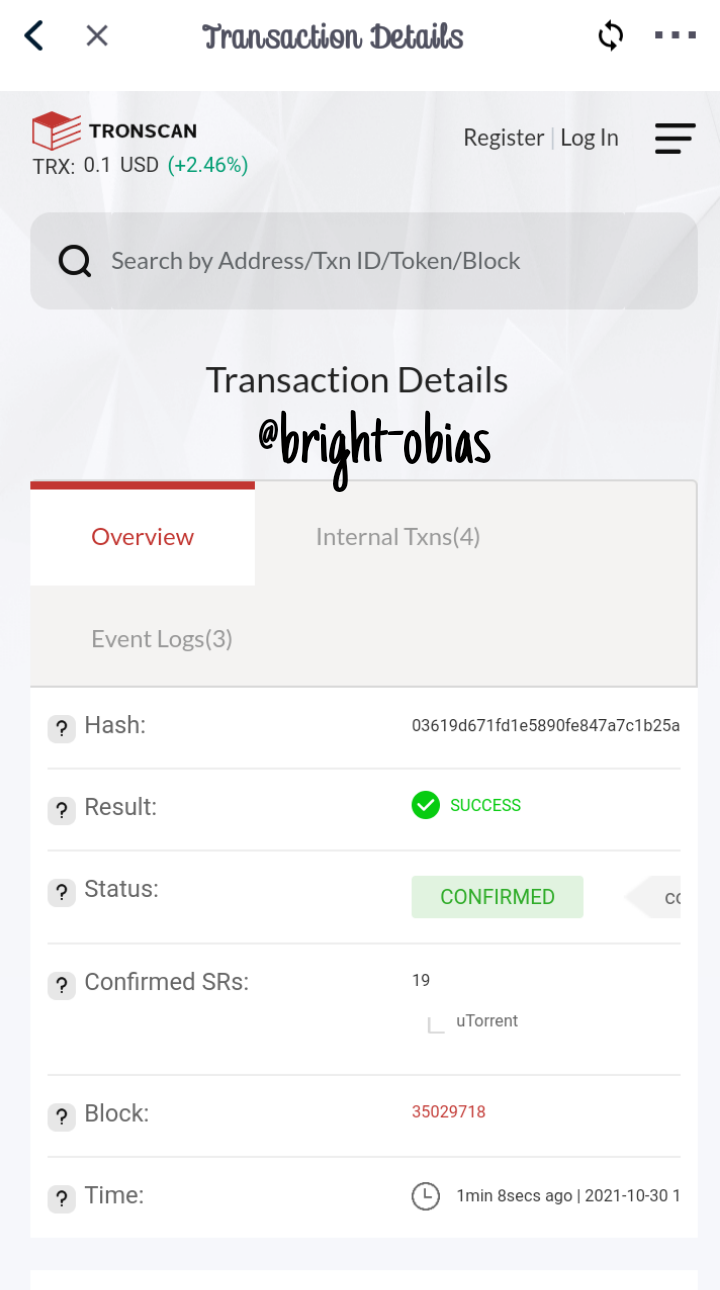

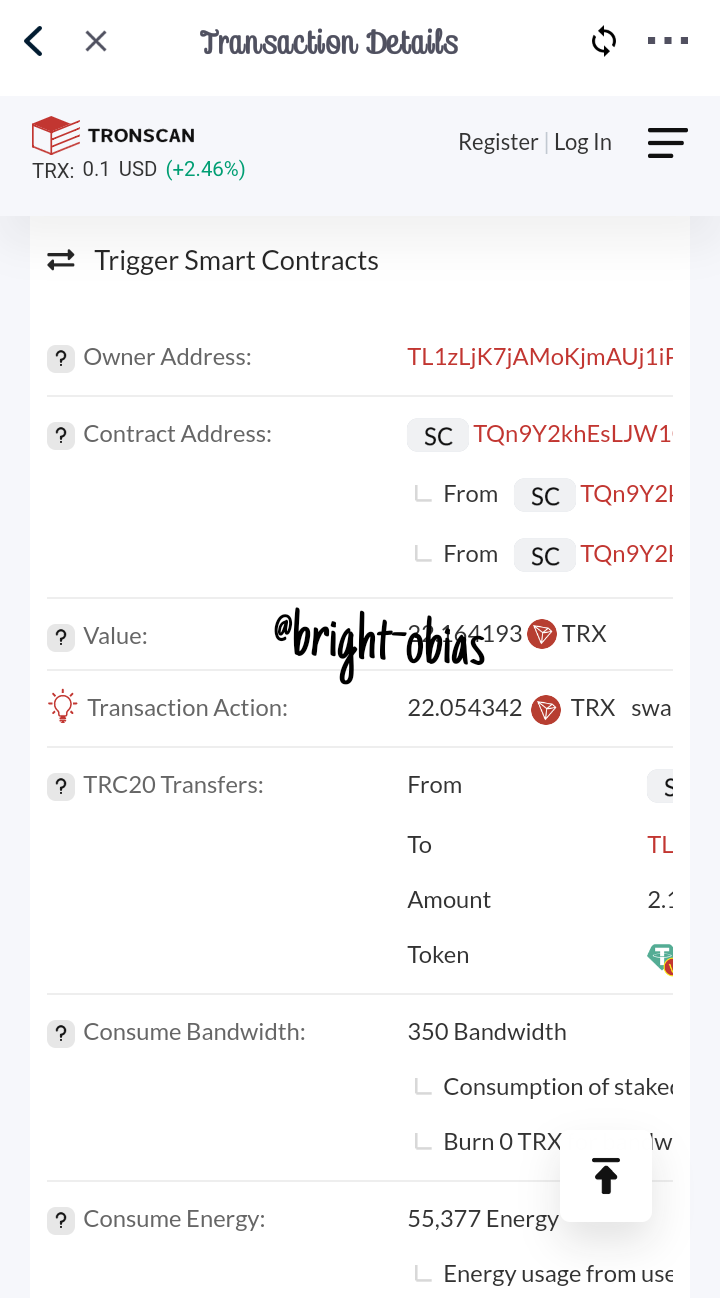

- Below is the transaction details

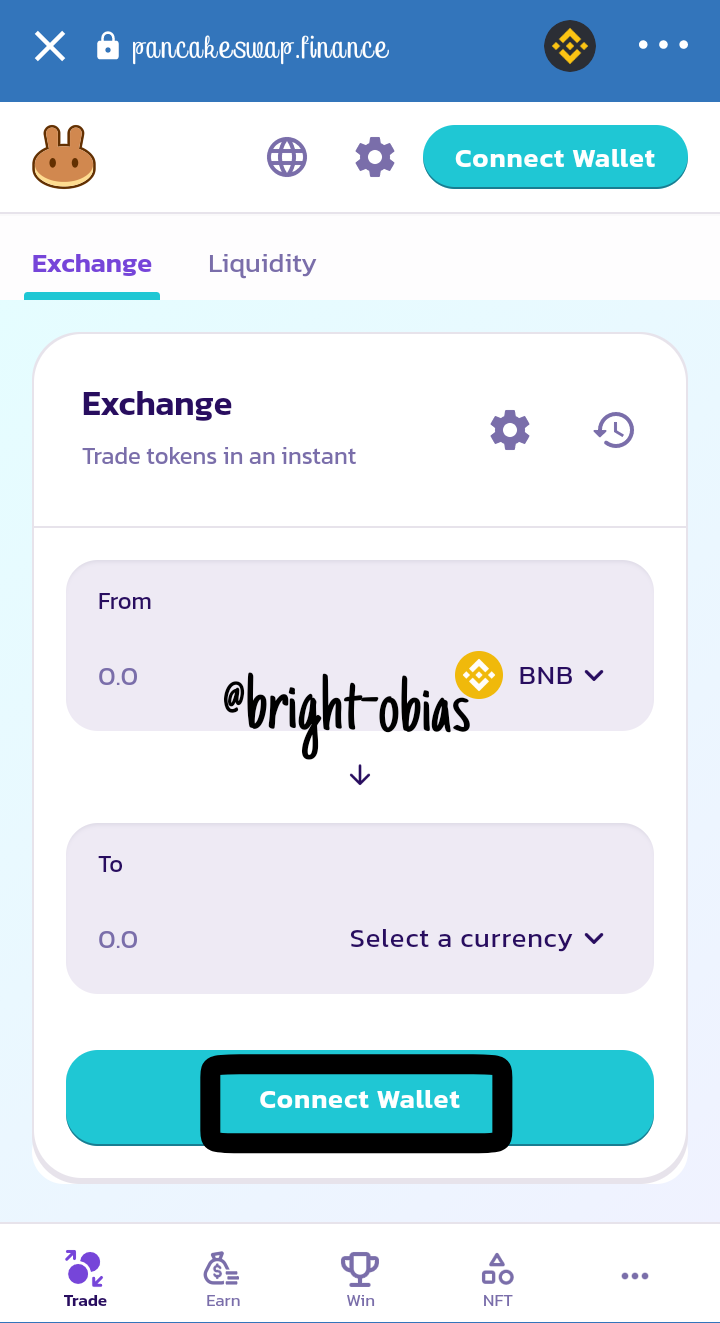

swapping using pancakeswap

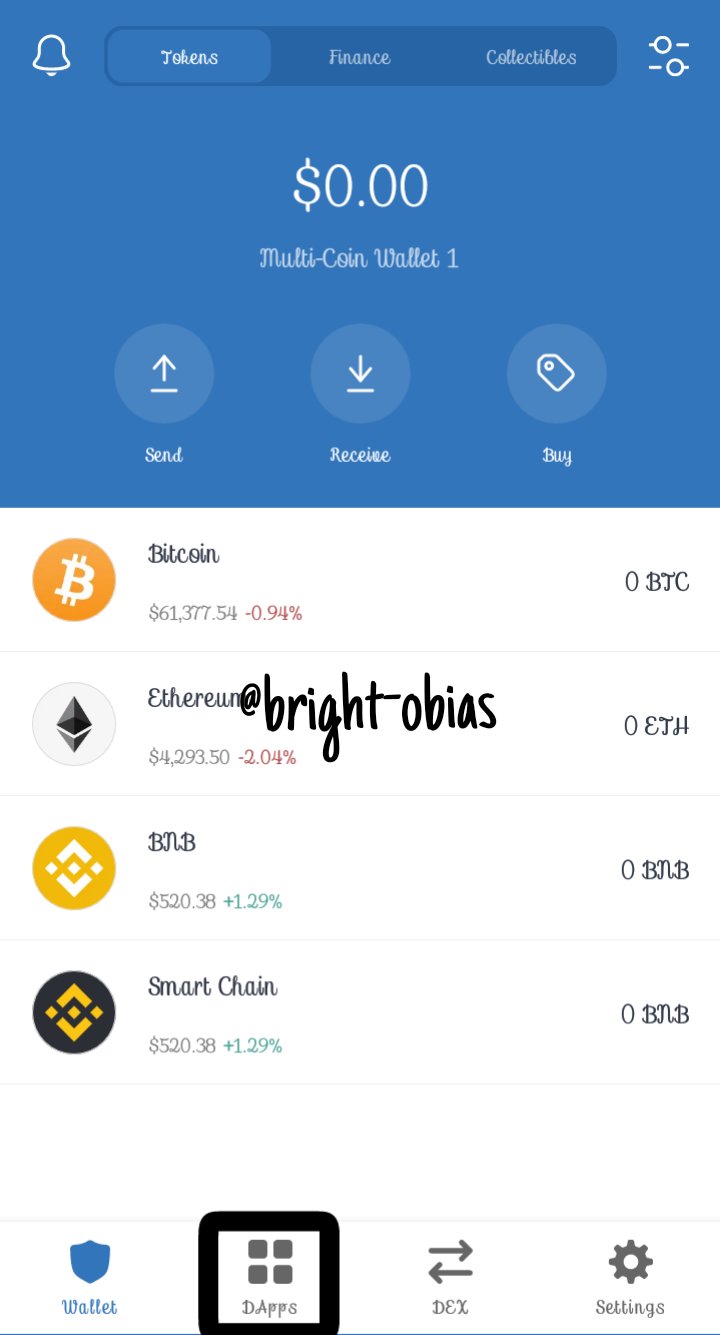

- on the homepage, I clicked on DApps using my trust wallet.

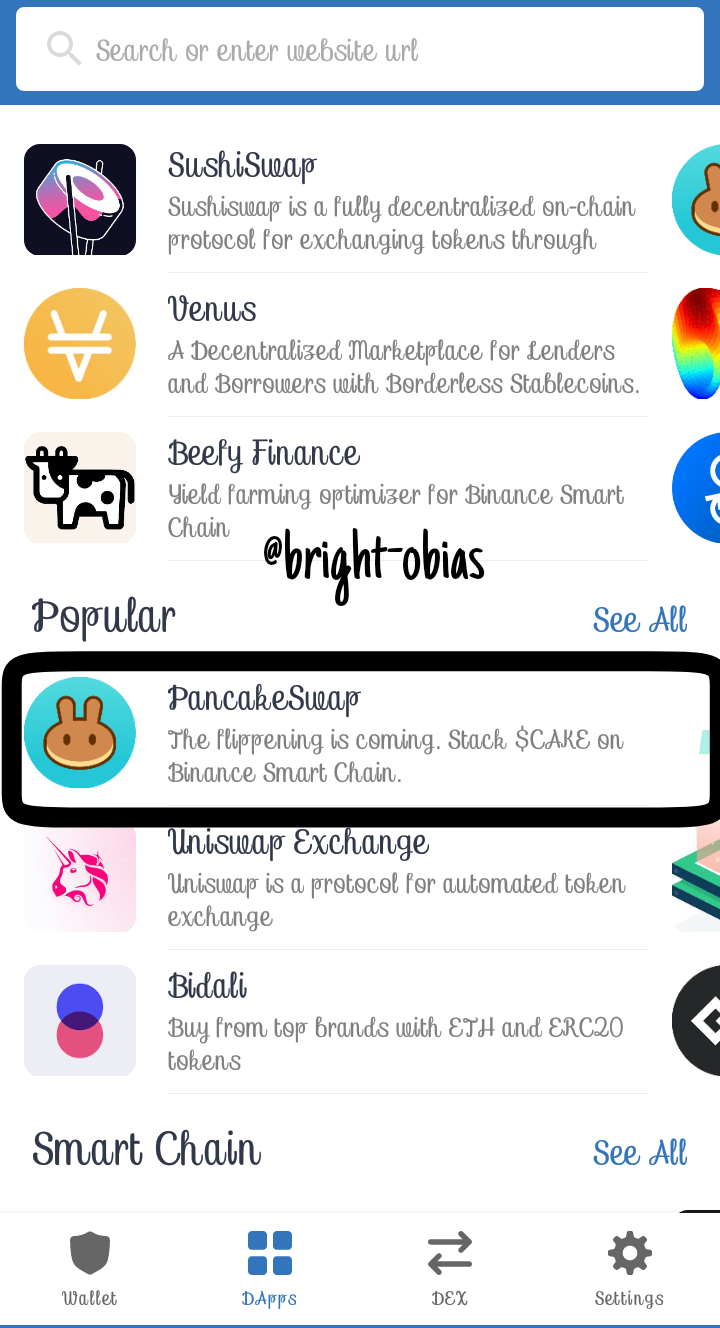

- I selected pancakeswap on the next page

- I click on connect to wallet

- I choose trust wallet

- Next page pops up where i am supposed to input the token i want to swap as well as the amount.

- After inputting amount and token, click on confirm swap.

- next click on Approve and then the transaction will be submitted.

unable to complete transactions as a result of lack of funds.

Conclusion

Every individual wants total control over their funds. Decentralized platforms have the main aim of providing liquidity constantly, reduction in low transaction fees, as well as complete elimination of third parties. Special thanks to @reminiscence01 for the wonderful lecture.

https://steemit.com/hive-172186/@alihassnain1/achievement2-task-basic-security-by-alihassnain1

Plz verify my post

Hello @bright-obias , I’m glad you participated in the 8th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This is an important benefit of DeFi products. Allowing users to earn passive income on their asset instead of holding them in their wallet.

Recommendation / Feedback:

Thank you for your research on DeFi products.