[Trading with Linear Regression Indicator]- Crypto Academy /S5W5-Homework Post for kouba01

1. Discuss your understanding of the principle of linear regression and its use as a trading indicator and show how it is calculated?

2. Show how to add the indicator to the graph, How to configure the linear regression indicator and is it advisable to change its default settings? (Screenshot required)

3. How does this indicator allow us to highlight the direction of a trend and identify any signs of a change in the trend itself? (Screenshot required)

4. Based on the use of price crossing strategy with the indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

5. Explain how the moving average indicator helps strengthen the signals determined by the linear regression indicator. (screenshot required)

6. Do you see the effectiveness of using the linear regression indicator in the style of CFD trading? Show the main differences between this indicator and the TSF indicator (screenshot required)

7. List the advantages and disadvantages of the linear regression indicator:

8. Conclusion:

1. Discuss your understanding of the principle of linear regression and its use as a trading indicator and show how it is calculated?

The linear regression Indicator (LRI) spots the end value of the LRI line which specify the where the price would be in future period. For example, a 20 period LRI will equal the end value of a LRI line that completes 20 bars. The interpretation of the LRI is similar to the moving average even it does have an advantage when comparing to a moving average.

LRI indicator can be of great value, because It first identify where the market is crucial, then we will be able to precisely know if we are in a downtrend phase or in an uptrend phase. With this information, it helps to make better trading decisions. I could notice that the linear regression indicator is based on a channel, where the high and low points will be the extremes of the line that makes up the mean of the price. This is about being able to identify supports and resistances through these extremes that are highlighted in the price.

Calculation

To obtain the calculation of LRI we have to look at a straight line which has several points above and below them to determine the calculation according to the squared distance of all the points that go in the straight line. But for the use of trading, the points will make precisely the closings and maximums of the price according to the period with which the indicator is being used; a period of 14 sessions is regularly used.

Each point in the LRI is the end-point of an n-period LR Trendline.

Image created by me in MS powerpoint

Y = Closing Prices

a = (([y – b]x) / n)

b = (n[(xy]) - ([x]) ([t]) / (n[x²] - ([x])²)

x = Current time period

n = Number of periods selected

2. Show how to add the indicator to the graph, How to configure the linear regression indicator and is it advisable to change its default settings?

First log into Tradingview.com. Then after selecting charts I selected the SHIB/USD.

After adding the indicator to the chart I will now change the settings. To change the settings first I click settings of the indicator. As you can see the default period is 14.

Now I will change the setting of the indicator.

I consider that if we are newbies using this indicator we should leave it according to its predetermined period, because we do not want to make mistakes due to lack of knowledge, but I will be observing a little the period of 20 that the teacher was mentioning in his class to have how it changes of according to the period of 14 that comes by default.

3. How does this indicator allow us to highlight the direction of a trend and identify any signs of a change in the trend itself?

For me to better understand a trend with this indicator it will be to visualize where the price is hovering around the moving line of the linear regression indicator, implying that if the price is above the moving line I can consider that it is in an upward phase and if it is below in a bearish phase. But this depend on the period of time that we determine to place in the indicator, since the indicator will be changing according to the average number of candles that we are placing. In this way I can say that the Moving Line of the indicator will be equilibrium.

If we see the SHIB / USD chart we can find upward trends, where it can be identified with the linear regression indicator, where I was placing a period of 14. Well, we can see in both points that the price is making highs above the moving line of the linear regression indicator, which for me would be a great bullish phase signal.

We are also going to notice the same thing but now in a downtrend, when the price begins to cross above the moving line of the linear regression indicator, indicating the exhaustion of the downtrend because the sellers can no longer continue to lower the price and pass from being a descending line to an ascending moving line confirming the reversal of the price that also begins to have a direction above the moving line that would be a sign of a clear change in trend.

4. Based on the use of price crossing strategy with the indicator, how can one predict whether the trend will be bullish or bearish

we are going to be looking for a touch of the price on the moving line of the linear regression indicator, where the teacher explained to us what is called cutting this signal when the price crosses through above or below the line indicating a bearish signal or a bullish signal.

But it is important to know that the candle that manages to have that touch by cutting above giving a bullish signal, the price of the candle has to end up closing above the previous level, so we can predict that the signal is strong and in the same way we must expect that when the candle crosses below the moving line it should end up closing below the previous level.

5. Explain how the moving average indicator helps strengthen the signals determined by the linear regression indicator.

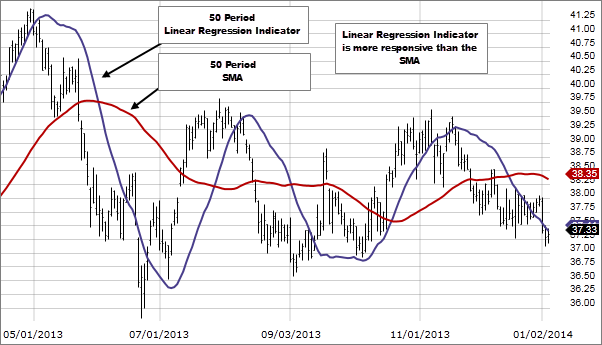

It can be seen that the linear regression indicator is very similar to a moving average as I said in the first question, since it can be read in the market in the same way where we seek to identify the trend of the asset and how to find reversals of the trend in a very similar way. But the moving line of the linear regression indicator has a higher correlation with the price tracking, so it could give more optimal signals as well as false signals and to confirm these signals a moving average can be placed.

6. Do you see the effectiveness of using the linear regression indicator in the style of CFD trading? Show the main differences between this indicator and the TSF indicator

If you see great effectiveness of the linear regression indicator with respect to CFD operations, although in this trading method it is based more on contracts where a trader seeks a lot of short-term profits, in the world of crypto currencies this indicator works perfectly because It gives the same information according to how to follow the direction of the price and thus a trader can also take advantage of having identified the trend in the market and take a buy or sell operation using the linear regression indicator.

The TSF indicator has a great resemblance to a moving average. Observing that when the price moves above the moving line it will be a bullish signal and when it moves below the moving line it will be a bearish signal.

7. List the advantages and disadvantages of the linear regression indicator

| ADVANTAGES | DISADVANTAGES |

|---|---|

| It is a very easy indicator to read in a technical analysis | The linear regression indicator is a to detect price direction and trends not so much to get trading signals |

| It is an Indicator that very well identifies the trends of a crypto asset | It cannot be used alone because there may be false signals and it is best to have more confirmations |

| It is an Indicator that has a lot of correlation with the price because it has a line that smooths the movement, therefore it reacts faster in the market unlike other moving averages. | In times of high volatility the linear regression indicator will not be very effective |

| You can identify the exhaustion of a trend with the linear regression indicator. | |

| You can get price reversal signals with the linear regression indicator. |

Conclusion

We have been able to talk about the Linear Regression indicator which helps us to better follow the price trend, detect it and also visualize when an asset reversal is coming. Although its calculation is very complex since in theory we see that everything can be very confusing, in its practical use it is a little simpler taking into account that it has great similarity with a moving average and we will also be using it in the same way.

.png)

https://steemit.com/hive-172186/@saeed0010/7awv2w-achievement-3-task-content-etiquette-by-saeed0010

Plz verify my post

https://steemit.com/hive-172186/@alis12/achievement1-introduce-my-self-by-alis12-18-12-2021.

Verifiy plz.

My Humble request to you @dilchamo please verify my post 5.

Thank you advance i am very tired.

https://steemit.com/hive-172186/@alihasnain8/6s3sjo-achievement-5-task-2-by-alihasnain8-or-or-review-steemscan-com

Kindly verify my achievement 5 Task 2.

https://steemit.com/hive-172186/@sameer07/achievement-5-task-2-or-reviewing-steemscan-or-by-sameer07

Buenos días profesora, gusto en saludarla. Felicidades por tan excelente trabajo.

Paso a dejarle mi tarea 8 la cual vence el día de mañana y no ha sido calificada ni curada

Porfavor: https://steemit.com/hive-108451/@soylola3091/curso-para-principiantes-de-la-temporada-4-de-steemit-crypto-academy-tarea-8-aplicaciones-descentralizadas-dapps-tarea-de

Please ma'am, help verify my post so i can move onto the next

https://steemit.com/hive-172186/@raybaby/achievement-5-task-2-review-of-the-steem-scan-web-page

https://steemit.com/hive-172186/@adil2/achievement3-task-content-etiquette-by-adil2

Plz verify my post mam

https://steemit.com/hive-172186/@faroqe99/achievement2-basic-security-by-faroqe99

Plz verify my post

https://steemit.com/hive-172186/@mehrbanfaiz/achievement4-markdowns-by-mehrbanfaiz