The Bid-Ask Spread (part 2) - Steemit Crypto Academy - S4W3 - homework post for @awesononso

QUESTION 1

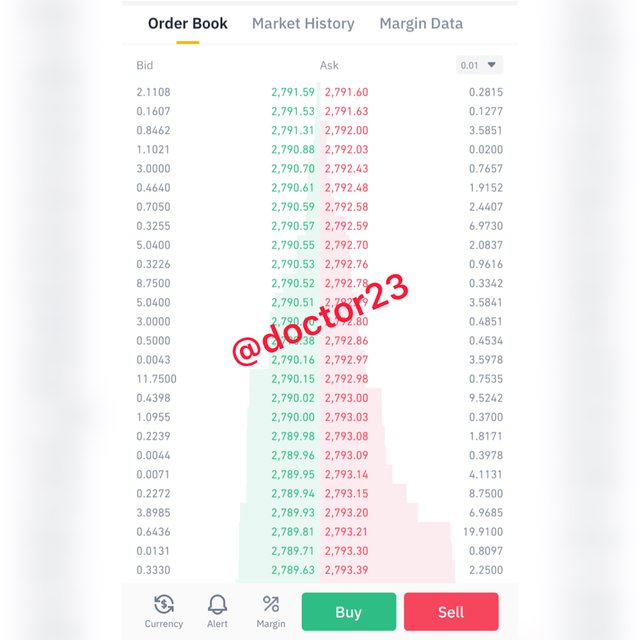

Define the order book and explain its components with screenshots from binance

The Order Book

In simple terms, an order book is known to be a list of trades which could be electronical or manual which exchanges use in recording market interest in specific security and financial instrument as well.

Talking about real time, the order book works on the real time, that is the order book is updated in real time as it known to be an important indicator in the market depth.

Doing now to identification, the order book identifies the buyers and sellers in the various exxhanges. In terms of usage, the order book is used by traders to help in making decisions through the measurement of market sentiment at any given time. This is noted as the order book gives a clear imdication is the market is dominated by the bulls or the bears.

Components of an Order Book

The order book is made up of the buyers and sellers side, the bid and ask, the prices, the total and the visual demonstration.

The Buyers and Seller’s Side

The buyers and sellers side shows the two major participants in the market which are the buyer and the seller

The Bid and Ask

The bid and ask is used in replacing the buyers and sellers side. The buyers bid for a certain number of shares which is done at a particular price while the sells ask for a specific price for the shares.

Prices

The prices is where we have a record of the value of interest of the buyers and the sellers side.

Total

The total is known to be a cumulative amount of the specific security or asset sold from different prices.

Visual Demonstration

For the visual demonstration, we have a table consisting of prices and total amounts from the buyers and the sellers side.

QUESTION 2

Who are market makers and market takers

Market Makers and Market takers

Market Makers

Market makers are referred to the individuals that actively quotes two sided markets in a particular asset, while providing bid and ask alongside with the market size of each.

So the market maker is known to be an individual or a member firm as well of an exchange who buys and sells assets on its own account. The market maker is known to provide depth and liquidity in the market as well as profiting from the bid=ask spread.

The market makers have an advantage that they are compensated for the risk of holding assets. This is because the assets or security value might decline in the purchase and sale to another buyer.

Market Takers

The market takers are noted to need liquidity as well as immediacy in ensuring reasonable price existence each time they want to enter a trade as well as closing a existing position.

Market takers actually turn over over positions far less frequently when compared with market makers. With this, market takers are less concerned about trading cost.

QUESTION 3

What is a market order and a limit order

Market order and Limit order

Market Order

The market order is known to be the most frequently used type of order, the market order is an order, in which place to sell or buy an asset at the current market available price

The market order ensures an execution although it does ensures an execution. The market order is said to be generally appropriate in relation to the thinking if the asset price is priced right.

Limit Order

With the limit order, we buy or sell a particular asset with a restriction on the minimum price to be received as well the maximum price to be paid. With this we we see an order filled at a specific limit price or we could say better.

Also, with the limit order, we do not have total assurance of the execution of the order.

QUESTION 4

Explain how market makers and market takers relate with the two order types and liquidity in a market.

The Market Makers and Market Takers with the two types of order types and liquidiy in a market

The market makets normally populates the order book with limit orders as explained above. This orders are placed above or below the market prices. With this, we see a lot limit orders which are being open by market makers with this we can say there is liquidity in the market.

Now going to the aspect of the market takers, as explained above, we see the market takers to come into play when they take their market orders. This market orders normally are supposed to match the open limit order and which are filled. With this, we see the market takers accepting the prices of the market makers which will be accepted as the price of the market makers which takes up the liquidity provided.

QUESTION 5

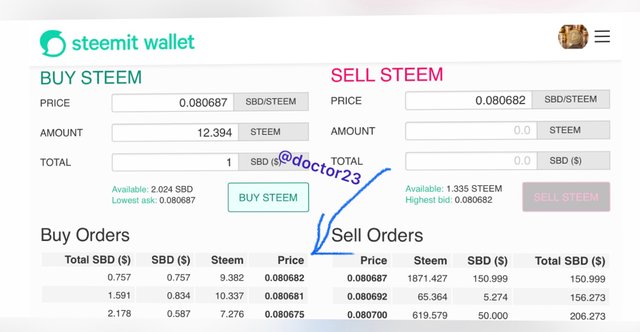

place an order of at least 1sbd for steem on the steemit market place by

a) Accepting the lowest ask. Was it instant? Why?

b) Changing the lowest ask. Explain what happens

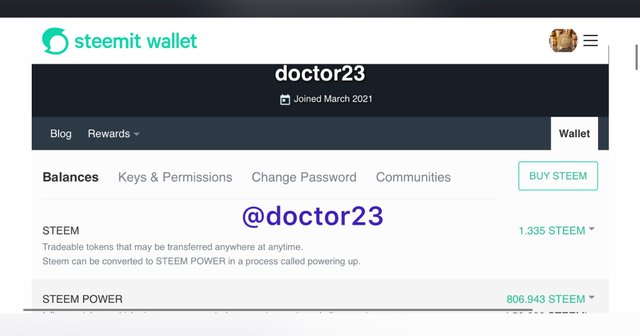

Order for at least 1sbd to steem

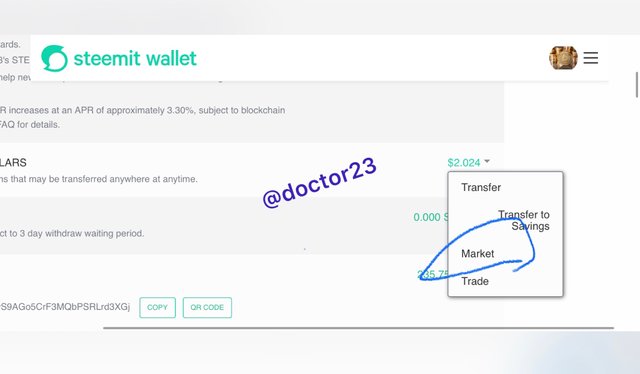

We begin by logging into the steemit wallet and signing in with the private active key. We then click on the drop down arrow on the SBD section and taking markets.

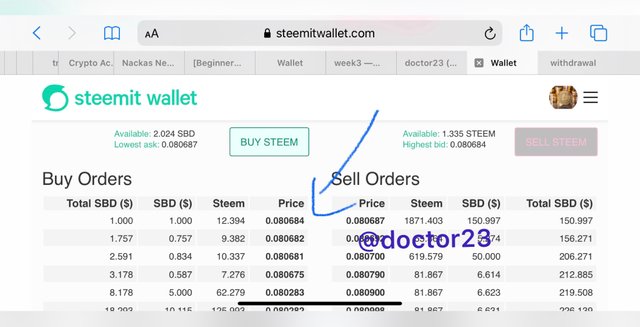

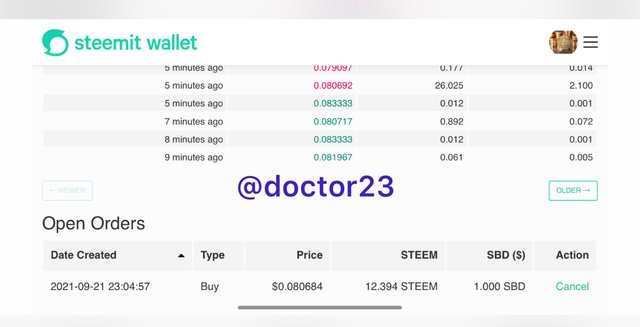

a) Accepting the lowest ask.

The lowest ask price is as shown below. And 2.3sbd will be equall to 23 steem.

The order was fulfilled immediately. And this was solely because it was actually the market price at the time of taking the trade.

Now changing the order below the market price, the trade did not execute instantly.

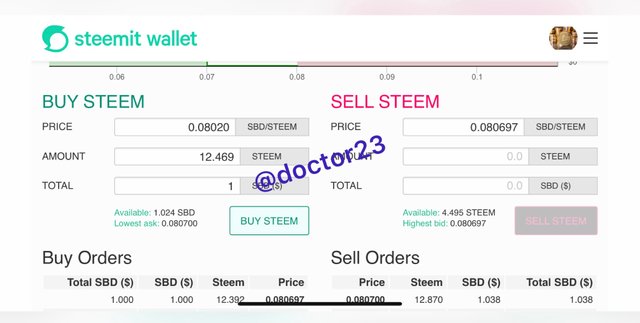

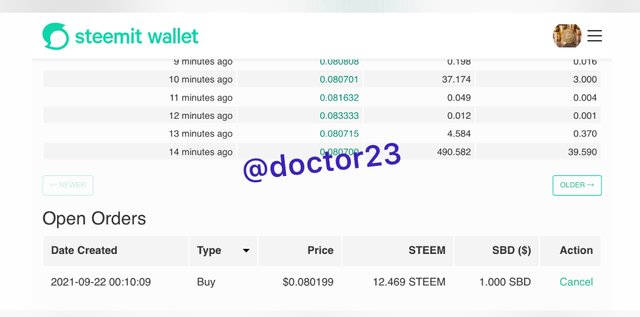

b) Changing the lowest ask.

I will be changing the current market price to a lower price which is 0.0802 which will now act as a buy limit price.

The order was not fulfilled immediately, took close to an hour for it to be executed. This is because the price change acted as buy limit, and prices had to actually touch this level before being executed.

QUESTION 6

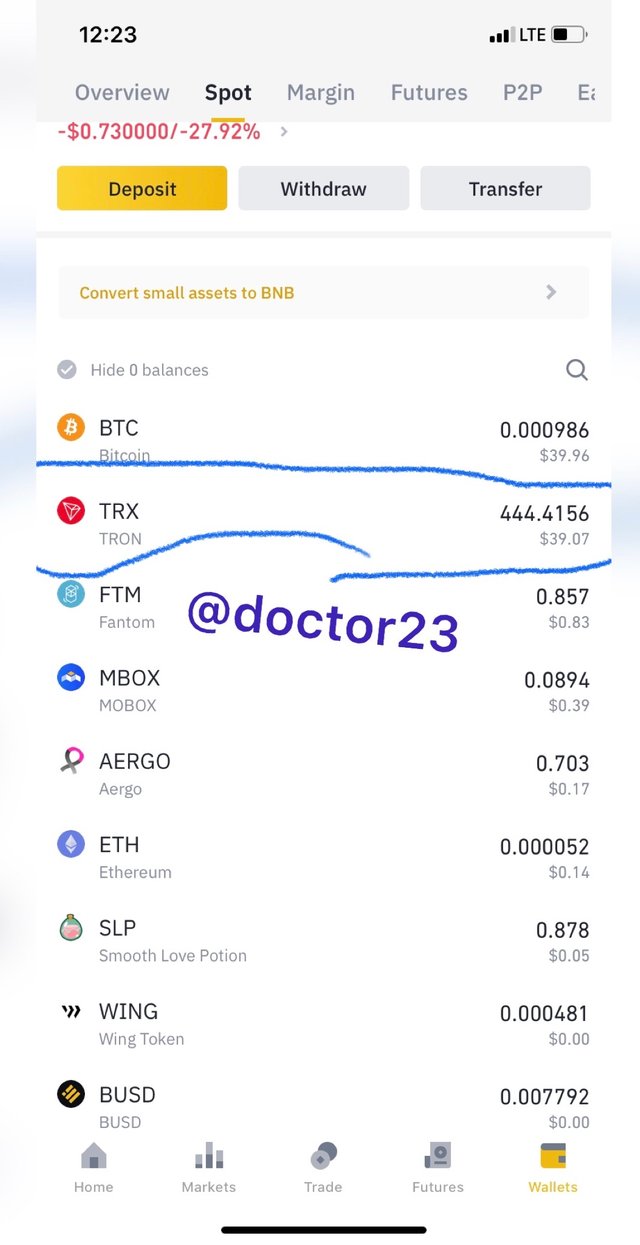

Place a trx/usdt buy limit order on the binance exchange for at least $15 . explain your steps and explain the impact of your order in the market.

Trade on trx/usdt using Buy Limit

Step 1

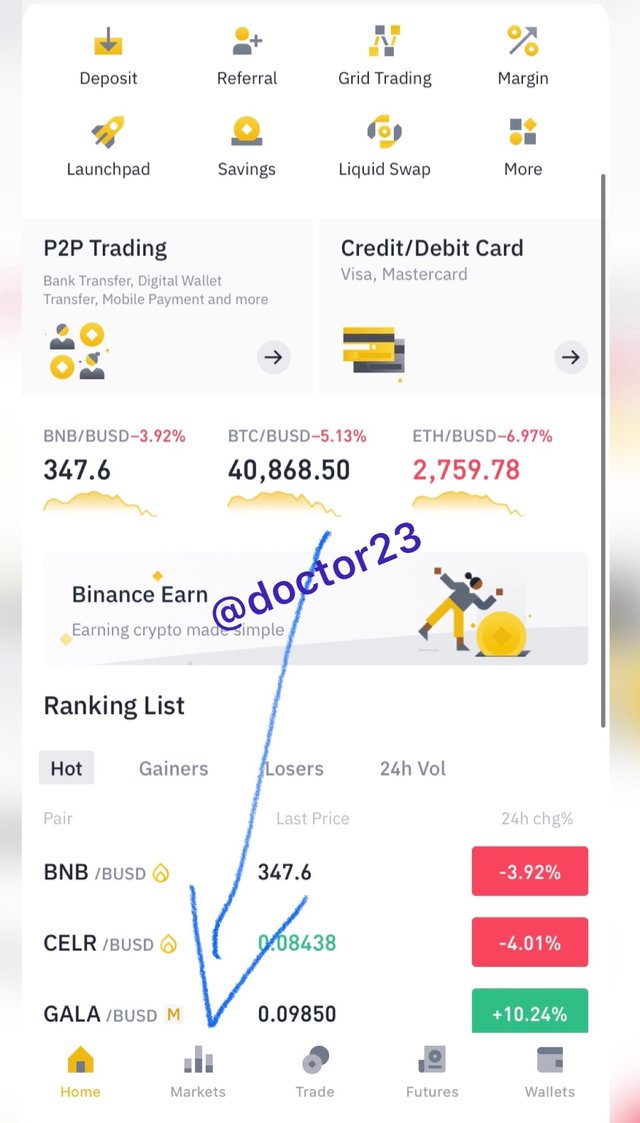

We begin by logging into the Binance Exchange, and take markets.

Step 2

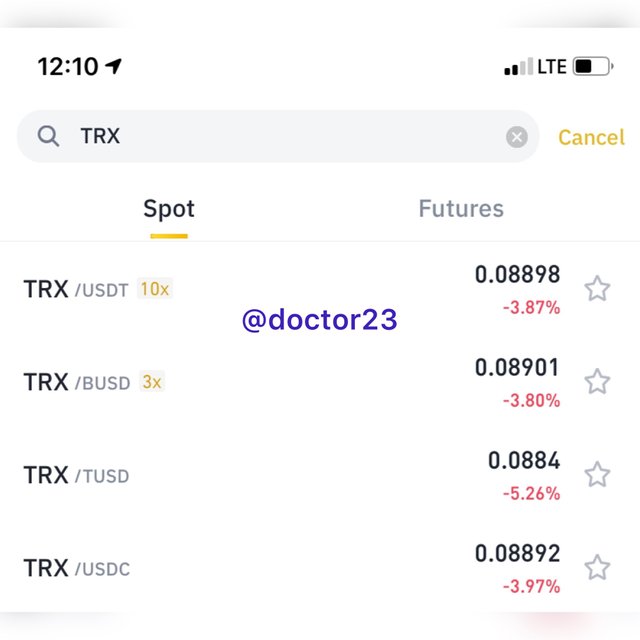

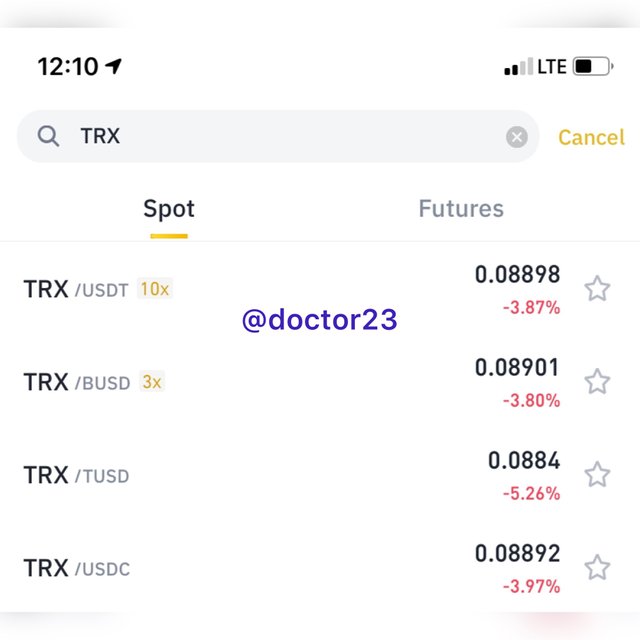

We then search the trx/usdt crypto.

Step 3

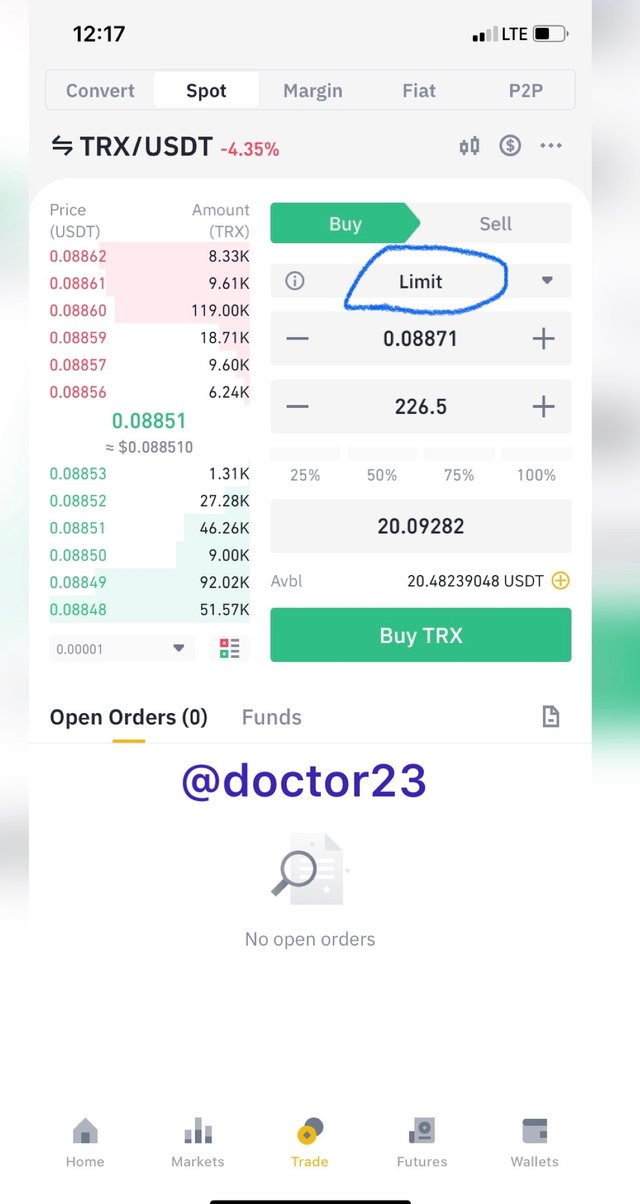

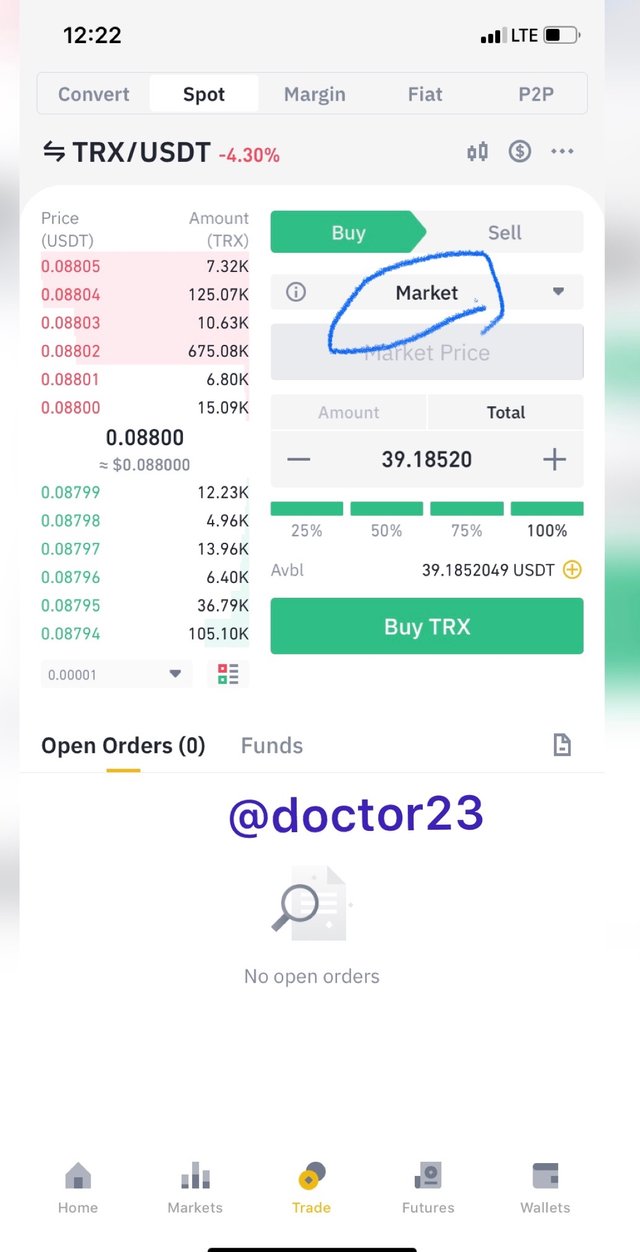

I then select the trx/usdt and click on buy. On the buy I select limit

Impact of Order

With the limit order, my order was placed at a price lower than the market price; meaning I have bought the trx at a relatively cheaper price. Also, my order is not likely to must be executed as I have added to the liquidity provided on the trx/usdt

QUESTION 7

Place a trx/usdt buy market order on the binance exchange for at least $15, explain your steps and explain the impact of your order in the marke.

Trade on trx/usdt using Market Order

Step 1

We begin by logging into the Binance Exchange, and take markets.

Step 2

We then search the trx/usdt crypto.

Step 3

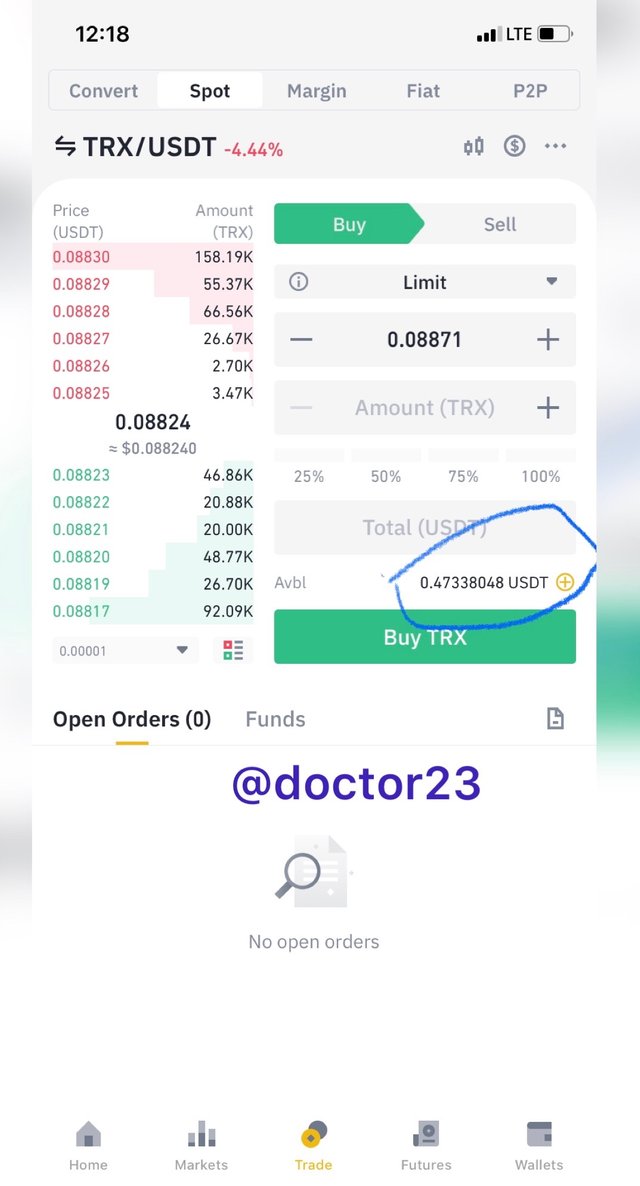

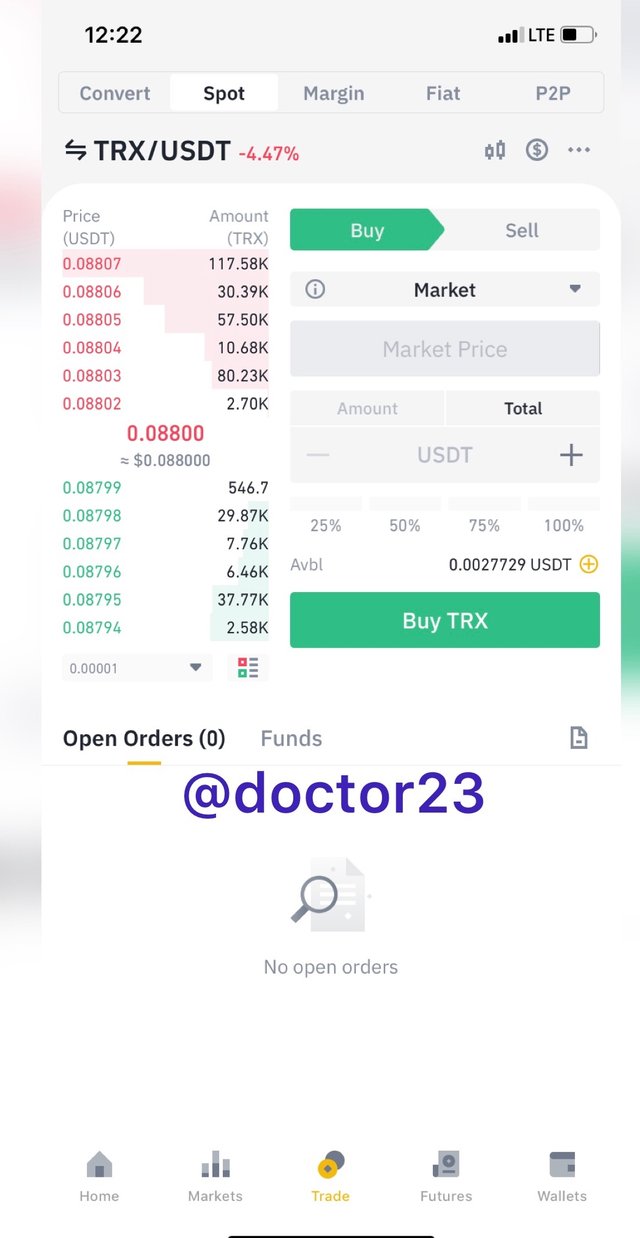

I then select the trx/usdt and click on buy. On the buy I select Market

Impact of Order

With the market order, it reduced the amount of liquidity which was provided by market makers. And also the other was executed instantly.

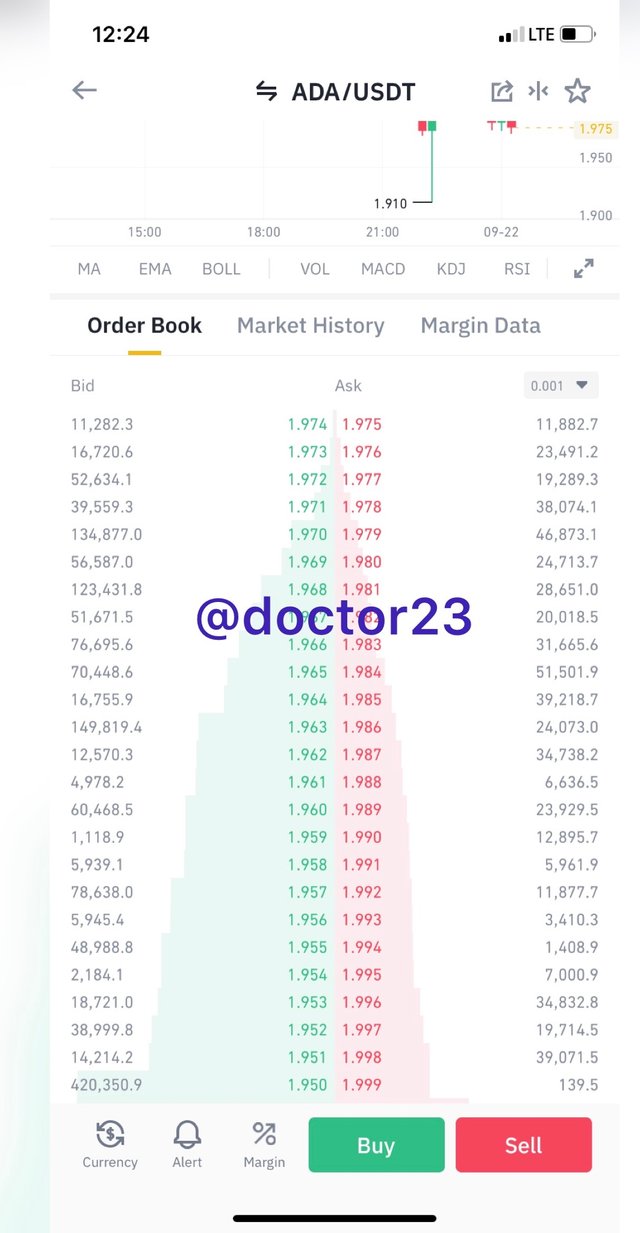

QUESTION 8

Take a screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices

a) Calculate the bid-ask

b) Calculate the mid-market price.

calculating bid-ask spread and mid-market price

a) bid-ask spread

Bid price = 1.975

Ask price = 1.974

Bid-Ask spread = ask price – bid price

1.975 - 1.974

= 0.001

b) Mid-market price

Bid price + Ask price / 2

1.975 + 1.974 / 2

= 1.9745

Conclusion

So far, we have seen the usage of the market makers and the market takers in market and how they affect the liquidity level in relation to trade entry based on market order and limit order. We have seen all this through exchange books. Going to the fact of performing real trades on the market order and limit order we have understood practically the partaking on liquidity levels through limit order.

You've got a free upvote from witness fuli.

Peace & Love!

Hello @doctor23,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should improve on how you answer question. Your work is not very clear.

I noticed that your work contained a lot of paraphrased content from other sites. I advise that you always be as original as possible.

Your answer to question 2 needs a lot of work.

You should always backup your screenshots with proper explanations.

Thanks again as we anticipate your participation in the next class.