Yield Farming - Yearn Finance - Steemit Crypto Academy - S5W3 - Homework Post for @imagen

Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @imagen that talking about Yield Farming - Yearn Finance. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Describe the differences between Staking and Yield Farming

Staking is a Proof of Stake (PoS) consensus algorithm that runs on a blockchain network in the cryptocurrency mining process. The staking process can be carried out by investors by donating and locking assets on the network. This process involves validators working in the validation process and creating blocks on the network. This aims to get a reward in the form of assets that are locked within a certain period of time. The more assets that are staked, the more prizes investors will get. This feature shows the contribution of investors to the network to strengthen the network while earning profits. Staking can be used by investors to increase asset investment in the long term and have a positive impact on the cryptocurrency ecosystem.

Yield Farming is one of the ways that investors can use to earn passive income by contributing to certain platforms. The yield farming process can be done by investors by donating and locking assets on the network within a certain period of time. Here investors act as liquidity providers in the liquidity pool of certain cryptocurrency assets where there are other borrowers connected to the platform that will use the asset. This is aimed at obtaining rewards in the form of locked assets or adding other assets with a compound interest mechanism based on APY. Yield farming can be used by investors to increase asset investment in the long term and have a positive impact on the cryptocurrency ecosystem.

| Staking | Yield Farming |

|---|---|

| Staking uses the Proof of Stake (PoS) consensus algorithm in the validation process and creates blocks on the network | Yield agriculture uses Automated Market Maker technology in a compound interest mechanism based on APY |

| The staking process rewards investors for contributions in the block validation process on the network | The yield farming process rewards investors for being a provider of liquidity in the network |

| The APY rate is 15% and this leaves investors with a meager reward | The APY rate can reach up to 100% and this makes investors get great rewards |

Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options)

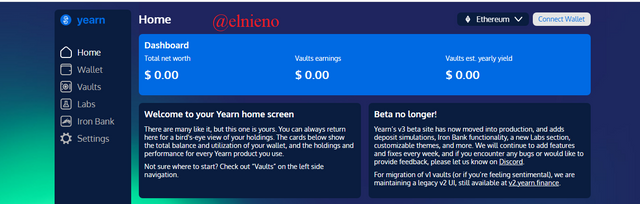

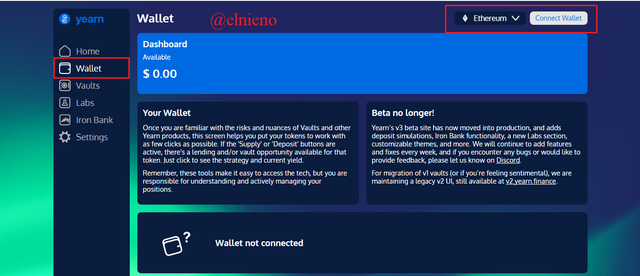

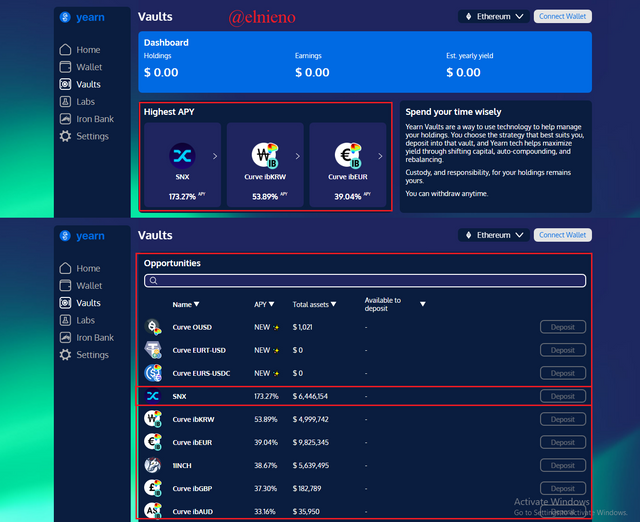

Here I visit the Yearn Finance website to explore the functionality and features of the platform. On the main page, you can see various features available on the platform such as Wallet, Vaults, Labs, Iron Bank and Settings. This is a feature that you can use to access the platform according to your needs. Here there is also a dashboard panel that shows the number of assets you have and you can manage at any time.

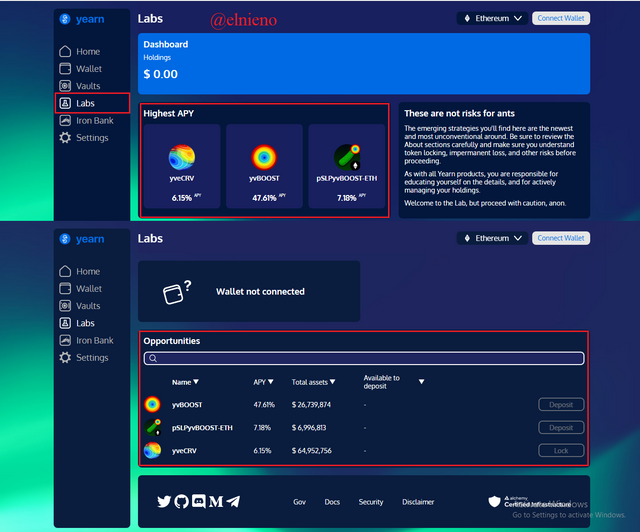

Furthermore, the Labs feature serves to provide data and information related to assets on the platform. This feature shows the asset that has the highest APY value. This feature also provides input and suggestions for users to understand the procedure for locking tokens, situations when there is a temporary loss and the risks that may occur.

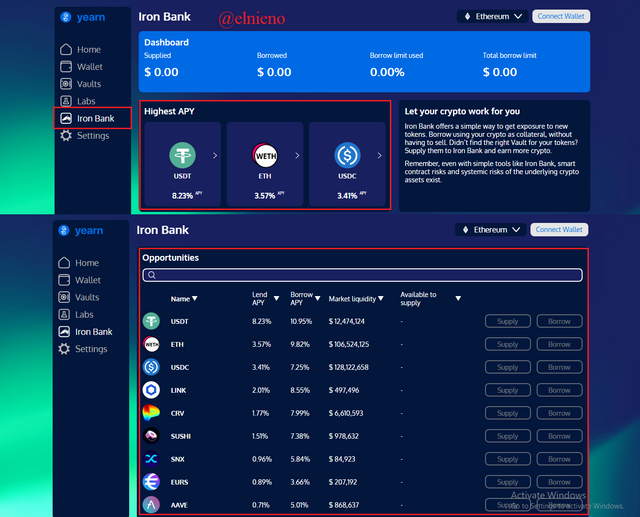

Furthermore, the Iron Bank feature serves to give you access to get new tokens on the platform. This feature shows the asset that has the highest APY value. This feature is an alternative that users can take advantage of to get rewards and increase asset investment by using assets owned as loans without having to sell these assets although this still carries risks.

Furthermore, the Wallet feature serves to store assets connected to the platform. This feature has a dashboard panel that shows the assets you have. This is a feature that plays an important role because this is the initial stage you have to do where you can manage these assets later. To run it you must connect the wallet by selecting Connect Wallet.

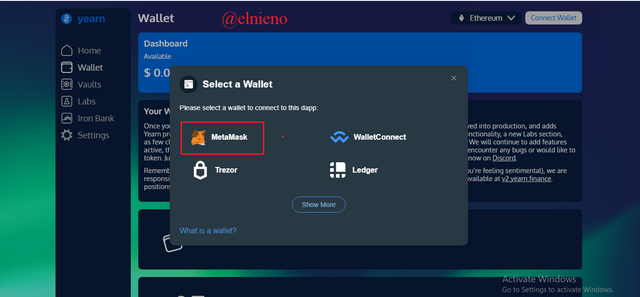

Furthermore, I was able to select several wallet options provided by the platform such as Metamask, Trezor, Ledger and WalletConnect. Here I choose the Metamask wallet.

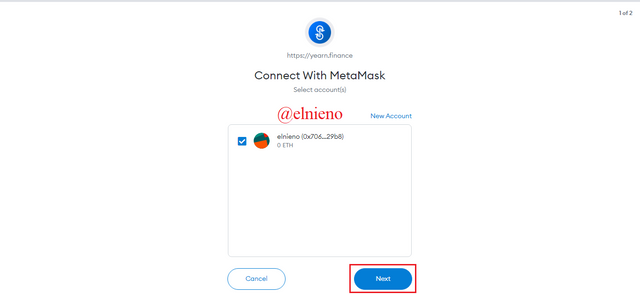

Furthermore, I opened the Metamask wallet to link it to Yearn Finance. I selected my account and clicked Next.

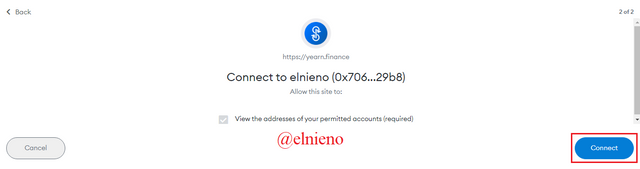

Furthermore, I clicked Connect and my Metamask wallet will be connected to the Yearn Finance platform.

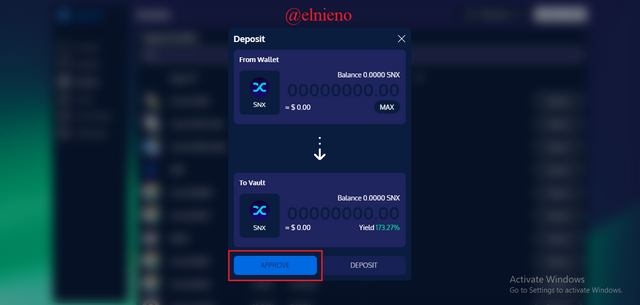

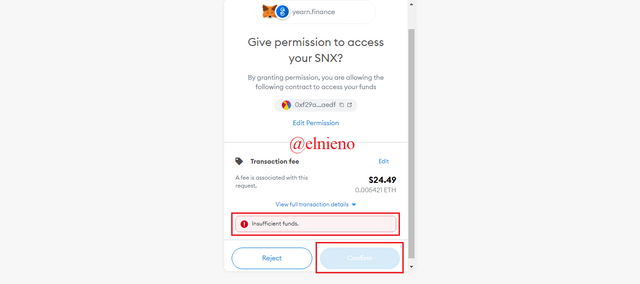

Furthermore, the Vaults feature serves to manage the assets you own on the platform. This feature shows the asset that has the highest APY value. This feature is a technology that allows you to take full control of assets and to increase investments by depositing in vaults, transferring capital, combining assets and managing them back on the platform. Furthermore, I try to deposit assets by selecting SNX and clicked Deposit.

Furthermore, I confirmed to deposit SNX assets from Metamask wallet to Vaults on the platform by clicking Approve.

Furthermore, I opened the Metamask wallet to confirm the deposit by granting access permission. All transaction details are available but I can't make a deposit because I don't own the funds or assets.

What is Collateralization in Yield Farming

Yield farming as a way to get a loan certainly requires collateral as one of the conditions that must be met. Collateral on yield farming must be higher than the amount of assets borrowed on the platform. This aims to avoid liquidation that may occur because high volatility can occur at certain times. Each platform regulates the yield farming system and process with different rules. Each platform shows the index of collateral to its users or borrowers to access loans. In this case, most platforms require larger collateral to reduce the risk so the borrower will not lose.

In this case, the function of the collateral is very influential in the lending process on yield farming. Like the real world, collateral serves to protect assets if something unexpected happens. Here collateral serves to reduce and avoid the risk of liquidation that may occur. This will prevent the borrower from losing assets if high volatility occurs. Each platform will set a collateral value above the threshold to provide convenience for each party involved in the cryptocurrency ecosystem.

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token?

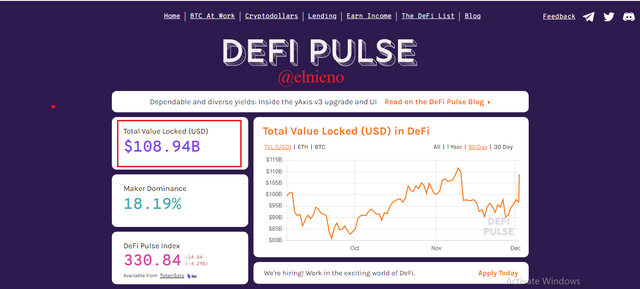

Here I visit the DeFiPulse website to find all the information about the DeFi ecosystem such as TVL values and charts, Maker Dominance and DeFi Pulse Index. On the main page I found the information regarding the TVL which has a value of $108.94B. The picture is as follows :

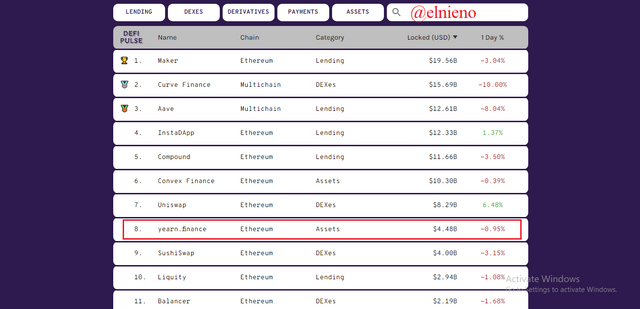

To get more information, I browse to the bottom of the page. On the next page, I found the information regarding Yearn Finance which is ranked 8th on the list and has a TVL value of $4.482B. The picture is as follows :

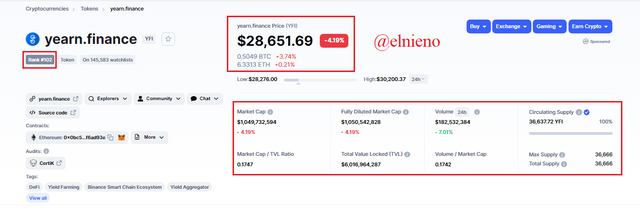

Next I visited the CoinMarketCap website to find all the information regarding the YFI token on the cryptocurrency market. YFI is ranked 102th on the crypto market list. The price of the YFI is $28.651.69. Market cap is $1.049.732.594. Market Cap / TVL Ratio is 0.1747. Total Value Locked (TVL) is $6.016.964287. Volume is $182.532.384. Circulating supply is 36.637.72 YFI. The picture is as follows :

Is the YFI Token Overvalued or Undervalued?

Based on the data above, the Market Cap / TVL Ratio of YFI tokens is 0.1747. This shows the token value is below one so it can be called Undervalued. This statement is based on evidence of data and information available in the DeFi market and ecosystem. Yield farming by using YFI tokens shows that these tokens are increasingly being relied upon to generate passive income in the long or short term.

In this case, the Yearn Finance project also has an important role in providing investors with access to continue managing YFI assets and increasing their adoption in the DeFi ecosystem. This platform is very useful for investors who are going to do yield farming to increase their asset investment. The use of YFI tokens in various sectors will also make the tokens grow and have good quality. Undervalued YFI tokens will have a positive impact on the DeFi ecosystem and the cryptocurrency world.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality?

Based on the chart above, I analyzed the BTC/USD market from August 1, 2021 to December 2, 2021. The BTC/USD market showed a price movement of 41.58%. This shows that BTC investment is very suitable for investors because it can bring profits in the long or short term. Investment in BTC assets has great potential to increase and develop investment in the future.

Based on the chart above, I analyzed the YFI/USD market from August 1, 2021 to December 2, 2021. The YFI/USD market showed a price movement of -9.17%. This shows that YFI's investment is currently experiencing a slight loss. But this is a common thing in the world of cryptocurrencies where price volatility always occurs in the market. I believe that investing in YFI assets has great potential to increase and develop investment in the future. This is evidenced by the highest price ever reached by YFI some time ago and maybe it will happen again in the future.

BTC Investment = $500 × 41.58% = $207.9 + $500 = $707.9

YFI Investment = $500 × -9.17% = $-45.85 + $500 = $454.15

Total Investment = $707.9 + $454.15 = $1162.05

Profit = $1162.05 - $1000 = $162.05

Based on the profit earned, here I will continue to add the amount of investment in BTC assets because it has provided a profit. The dominance and power of BTC assets in the market is one of the reasons to continue investing. However, for YFI's asset investment, I will hold the asset until YFI's price movement shows an increase and can provide profits even though now YFI's investment is experiencing a slight loss. Every investment has a risk so that investment management needs to be divided into several assets to maximize profits and minimize losses.

What are the Risks of Yield Farming

Lost Investment

Yield Farming requires strategy and a good understanding of governance and all involved in the yield farming process. Investors can experience lost investment if they are not careful and make the wrong decisions. The risk of losing investment may occur if investors take actions that are not in accordance with procedures.Impairment Loss

Yield farming allows investors to experience an impairment loss when a significant decline in asset prices occurs. This will cause the compound interest rate to decrease and the asset value to be lower than the initial investment value. The risk of impairment loss will make investors suffer losses in a short time.Liquidation

Yield farming has collateral that the borrower must fulfill in the borrowing process. Collateral can be liquidated if the market experiences high volatility so that it is unable to cover the amount of the loan taken. The risk of liquidation can be avoided by borrowers with collateral that is higher than the loan value.Possible Hacks

Yield farms that run on the DeFi platform have smart contracts that may be hacked by irresponsible parties. Some DeFi Projects are of good quality but some are still under development. A system that has low security allows hacking or system errors to occur. The risk of hacking that may occur can make investors lose all assets.

Conclusion

In the cryptocurrency world, all investors can rely on Staking and Yield Farming to earn rewards by donating and locking assets on the network. This is a way and strategy to increase asset investment in the long or short term. Yearn Finance is a platform that investors can use to manage assets. YFI tokens have good potential in the future because the DeFi ecosystem continues to grow and all projects have good functionality and quality. Various information about TVL can be found by investors to analyze DeFi tokens and projects that can be used as investment assets.

Yield Farming is also inseparable from the risks it has during the process carried out by investors. Every investor may suffer losses if something untoward happens in the cryptocurrency market. One of the factors that can reduce this risk is to rely on collateral that is regulated by each platform. Until now, there are various ways and access that investors can do to continue investing so that it shows the development of the digital finance is getting better. Yield Farming will have a positive impact in various sectors where many parties are involved and contribute to the development of the cryptocurrency world.